Kinnate Biopharma: Trading Below Cash Value

Summary

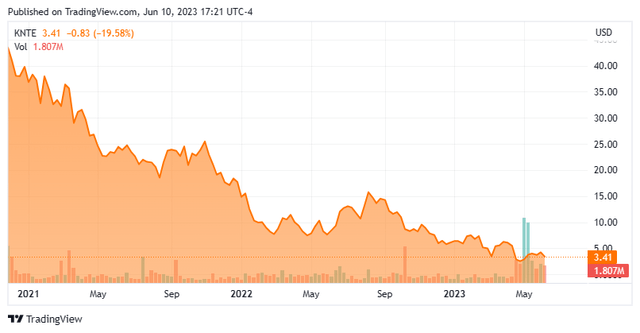

- Shares of precision oncology concern Kinnate Biopharma Inc. (KNTE) have crashed 93% from their all-time high as long overdue data from a Phase 1 study failed to impress.

- The company is advancing a couple of early-stage compounds but has hit some bumps in the road since coming public.

- Trading at a ~$70 million discount to cash, the recent buying by two beneficial owners merited a deeper dive.

- A full investment analysis follows in the paragraphs below.

- Looking for a helping hand in the market? Members of The Busted IPO Forum get exclusive ideas and guidance to navigate any climate. Learn More »

vdvornyk

The employed are punished by having to do what they do not love. The self-employed are punished by the opposite.”― Mokokoma Mokhonoana

Today, we take a deeper look at a small developmental name that is deep in Busted IPO territory. It popped up on the radar as the shares sell for less than the net cash on the company's balance sheet and there has been some recent purchases by a couple of the equity's beneficial owners. A full analysis/recommendation follows below.

Company Overview:

Kinnate Biopharma Inc. (NASDAQ:KNTE) is a San Francisco based early-clinical stage precision oncology concern focused on the development of kinase inhibitors to treat genomically defined cancers. The company has two programs undergoing Phase 1 study and two additional that should enter the clinic over the next 13 months. Kinnate was founded in 2018 and went public in December 2020, raising net proceeds of $256.7 million at $20 a share. Its stock trades just $3.50 a share, translating to a market cap of $160 million.

March 2023 Company Presentation

Approach

The company’s approach to its discovery and development efforts is to target oncology indications that meet one of the following three criteria: (1) cancers that are a result of gene mutations (oncogenic drivers) and have no currently available targeted therapy; (2) oncogenic driven cancers that have intrinsic resistance to currently available treatments; and (3) cancers that develop resistance to currently available treatments during the course of therapy. Management believes that this discovery engine ‘filter’ paired with its biomarker-driven method of drug development increases the probability of clinical success while reducing the cost of drug development.

March 2023 Company Presentation

Pipeline

From this approach it has entered two programs into the clinic.

March 2023 Company Presentation

Exarafenib. Kinnate’s lead asset is exarafenib, an orally administered and reversible Rapidly Accelerated Fibrosarcoma [RAF] inhibitor for the treatment of patients with solid tumors, with an initial focus on lung cancer and melanoma. The three approved solid cancer therapies – Novartis’ (NVS) Tafinlar (dabrafenib), Roche’s (OTCQX:RHHBY) Zelboraf (vemurafenib), and Pfizer’s (PFE) Braftovi (encorafenib) – target only B-RAF [BRAF] kinase Class I alterations. Owing to structural differences of BRAF Class II and Class III alterations, the approved therapies have the potential to trigger paradoxical activation, leading to cancer in previously normal tissue in these solid cancer BRAF subtypes.

March 2023 Company Presentation

By contrast, exarafenib is a pan-RAF inhibitor, with the ability to also target BRAF Class II and Class III (as well as neuroblastoma ras viral oncogene homolog, or NRAS) alterations, providing it potential to be approved as a first-line therapy. BRAF alterations occur in approximately 6% of all cancers, including non-small cell lung cancer, melanoma, as well as colorectal, ovarian, thyroid, prostate, and breast cancers. BRAF II and III mutations are believed to occur in 2.1% of all cancers, or ~35% of all BRAF-related cancers.

March 2023 Company Presentation

To test its hypothesis, Kinnate initiated an open-label, two-part Phase 1 study encompassing 115 pretreated patients with advanced or metastatic solid tumors driven by specific BRAF alterations in 2H21, with expectations of providing initial monotherapy data in 3Q22. In January 2022, Kinnate added NRAS-mutant melanoma patients to the trial to evaluate exarafenib as both a monotherapy and in combination with Pfizer’s MEK inhibitor Mektovi (binimetinib). After first delaying the release of monotherapy trial data until 4Q22 in April 2022, Kinnate then further extended the trial update timeline to 1H23 – citing Covid-related delays – in October 2022.

March 2023 Company Presentation

When the data finally arrived at the American Association for Cancer Research 2023 Annual Meeting in April, the market yawned. Of the 49 evaluable patients for efficacy covering five dose cohorts (twice a day for 28-day cycles), there were six partial responses [PR]. The most encouraging news was that the response rate at the most likely recommended dosage (300mg bid) was 33% (1/3) in BRAF Class II cancers and 29% (2/7) in NRAS cancers. Over the total evaluable population, mean duration of therapy was 7.0 months in the partial responders (n=6) and 4.0 months for those with stable disease (n=22). Across the 300mg cohort, there were four PRs in 22 evaluable patients (18%). Exarafenib was well-tolerated, with only two of the 60 patients evaluable for safety discontinuing therapy due to treatment-related adverse events.

Although demonstrating decent efficacy in Class II and NRAS cancers, especially in light of the fact that median pretreatments in the patient population was three, the sample size of good news was too small to elicit any positive market reaction. Owing to slow trial progression versus initial expectations and the somewhat shallow results when they finally arrived, Kinnate’s stock – whose first trade was double the IPO pricing at $40 a share and quickly reached an all-time high of $48.75 a few trading sessions thereafter – is now off 93% from its late-2020 peak.

Next updates from this trial include expansion dose selection for the advanced NRAS mutant melanoma patients in 2H23 and additional monotherapy data in 1H24. Based on early returns, recruitment for Class II melanoma and lung cancer patients is being emphasized, whereas as recruitment for Class III candidates has been deemphasized. Class II and NRAS patients total ~55,000 in the U.S., EU4, Japan, and China.

March 2023 Company Presentation

Exarafenib is not the only pan-RAF inhibitor in the clinic. Fore Biotherapeutics (FORE) (Phase 2), whose candidate targets BRAF Class I and II alterations, as well as Roche (Phase 2) and Erasca (ERAS) (Phase 1) – both of which are advancing assets that inhibit the mitogen-activated protein kinase (MAPK) pathway, along which BRAF alterations operate – provide the current clinical competition to exarafenib.

KIN-3248. Kinnate’s other clinical program is KIN-3248, a fibroblast growth factor receptor (FGFR) 2/3 inhibitor for the treatment of intrahepatic cholangiocarcinoma [ICC], a cancer of the bile ducts in the liver, and urothelial carcinoma (UC), a cancer of the bladder lining. FGFRs are a gene family of receptor tyrosine kinases with four signaling members (FGFR1 – FGFR4), of which FGFR2 alterations are known oncogenic drivers in ICC while FGFR3 alterations influence UC. KIN-3248 targets both FGFR2 and FGFR3. Somewhat similar to the BRAF story, there are currently three approved FGFR inhibitors: Johnson & Johnson’s (JNJ) Balversa (erdafitinib) for UC; Incyte’s (INCY) Pemazyre (pemigatinib) for ICC; and Taiho Oncology’s Lytgobi (futibatinib) for ICC. However, the vast majority of responses from these therapies are typically partial with relatively short median duration of responses (five to nine months) as patients develop FGFR mutations leading to treatment resistance.

March 2023 Company Presentation

Kinnate’s answer is KIN-3248, which is designed to target the specific FGFR 2/3 alterations that drive resistance. It is currently undergoing evaluation in a two-part (dose escalation and dose expansion) Phase 1 study in patients harboring FGFR2 or FGFR3 alterations. Part A, which began dosing in 2Q22, will escalate to a recommended Phase 2 dose (RP2D) in 45 patients covering solid cancers. Once the RP2D has been established, it will be employed in Part B, where it will be assessed in 75 participants covering three cohorts (ICC, UC, and other solid cancers). Initial data from Part A is expected in 2H23.

March 2023 Company Presentation

Balance Sheet & Analyst Commentary:

To fund these endeavors, Kinnate held cash and investments totaling $31.3 million at the end of the first quarter, which includes $25.7 million set aside for a Chinese venture – more on that below – providing it a relatively short cash runway into mid-2024.

After the initial readout of exarafenib, four of the five Street analysts following the company lowered price targets, but four of the five still carry buy or outperform ratings against one hold by Wedbush, who downgraded the stock in November 2022. Price objectives are wide-ranging, from $5 to $30, with a median of $25.

With shares of KNTE plunging below $3 after the exarafenib data, two of Kinnate’s beneficial owners used it as a buying opportunity. Foresite Capital, with two board members, purchased 1.78 million shares at $2.80 on May 8, 2023, while Orbimed Advisors, represented on Kinnate’s board by Carl Gordon, acquired 1.46 million additional shares at an average price of $2.80 on May 4th and 5th.

Verdict:

These purchases are curious in light of the fact that Orbimed, Foresite, and Kinnate had formed a Chinese JV back in May 2021 with the idea of advancing clinical programs in that geography. In February 2023, Kinnate bought out its partners in the venture for a total consideration of $24.0 million, including cash of $9.1 million and 2.2 million shares of KNTE, ostensibly to have greater control over development in greater China. In light of the market’s reaction to the exarafenib data, a would-be investor would not be criticized for concluding that Orbimed and Foresite had lost confidence in exarafenib (and possibly Kinnate) and were looking to claw back what they could. In fact, the $24 million price tag was less than the $35 million initially raised for the JV. However, their recent beneficial owner purchases suggest otherwise.

March 2023 Company Presentation

That said, Kinnate faces a significant uphill battle. With ever-increasing clinical expenses that truncate its cash runway to 18 to 24 months, Kinnate may be compelled to raise extremely dilutive capital to continue operations past early 2025. Putting the situation into perspective, the company saw a cash outflow from operations of $89.0 million in FY22, which, according to the company’s cash runway forecast, appears likely to ramp up in FY23.

That can all change is Kinnate pulls a rabbit out of its hat in the form of great initial data from KIN-3248 in 2H23. Potentially market moving exarafenib data would arrive too late (in 1H24). Kinnate does have a $150 million ATM facility, but if employed, would only serve to pressure the thinly traded stock. Although trading at a significant discount to cash with a market cap of $160 million, it is challenging to recommend this name as it is in short supply of two things it desperately needs: more robust exarafenib data and a longer cash runway. The CEO should consider another exarafenib update in 1H23 to provide heft to the promising initial BRAF Class II and NRAS data. Since that is currently not in the cards, investment is not recommended.

When the past is your enemy, all you have is the present.”― Danielle Steel, Malice

Author's note: I present and update my best small-cap Busted IPO stock ideas only to subscribers of my exclusive marketplace, The Busted IPO Forum. Try a free 2-week trial today by clicking on our logo below!

This article was written by

The Busted IPO Forum founded by Bret Jensen, is a hypothetical $200K portfolio built of stocks that have been public for 18 months to five years that are significantly under their offering price. Many times after the initial analyst hyperbole has died and lockups have expired, these same companies can be had for .30 to .50 cents on the dollar from when the shares went public. As lucrative as this niche has been for my portfolio over the years, a service or newsletter has not existed that covered this segment of the market -- until now! The goal in creating the Busted IPO Forum is to build a portfolio of 15-20 small cap and mid cap busted IPOs which consistently outperform the Russell 2000 over time. As of 07/02/2021 our model portfolio has generated an overall return of 73.84% substantially above the 52.37% gain from the Russell 2000 over the same time frame.

• • •

Specializing in profiling high beta sectors, Bret Jensen founded and also manages The Biotech Forum, The Insiders Forum, and the Busted IPO Forum model portfolios. Finding “gems” in the biotech and small-cap stock sectors, these highly volatile spaces proven hugely successful have empowered Bret Jensen's own investing portfolio.

• • •

Learn more about Bret Jensen's Marketplace offerings:

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.