Consumers Are Too Negative, And That's A Good Thing For Stocks

Summary

- Consumer sentiment remains low despite strong economic indicators, such as high employment and household wealth.

- Low sentiment typically precedes strong stock performance, creating opportunities for long-term investors.

- Long-term optimism is supported by the strength of the U.S. economy, technological advancements, and increasing productivity.

Eoneren/iStock via Getty Images

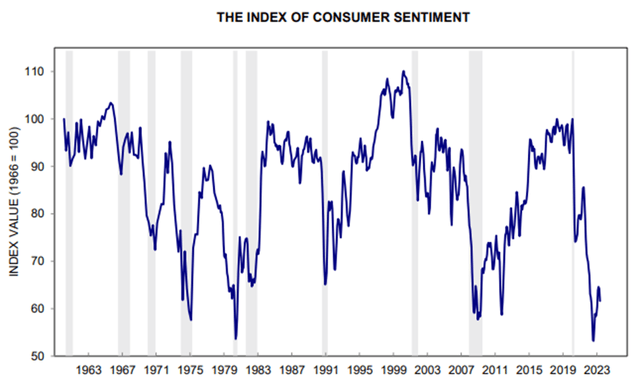

The University of Michigan has been tracking consumer sentiment for decades, reporting its estimate each month. The latest report available, for May 2023, shows an index value of 59.2. This represents a decline of 6.8% during the month but is well off the all-time low reached in June 2022. While the sentiment level appears to be trending higher over the last year, it is far below the average of about 85 over the last 50+ year period. Consumer sentiment at these levels is difficult to reconcile with economic reality and is likely causing many to be too pessimistic on the economy and financial markets.

Consumer Sentiment Index (University of Michigan)

Consumer Behavior Does Not Reflect Consumer Sentiment

What makes these low sentiment scores interesting is that, by most measures, the economy is performing well. Data for major economic indicators do not show any cause for concern at this point. I understand that ‘the absence of evidence is not evidence of absence’ when talking about economic conditions (or medical diagnoses), but it is difficult to find real data to support a bear case. Of course, this is subject to change, and change quickly, in the event of some unforeseen shock that derails macroeconomic conditions. A shock of this type could arise from known sources like tightening monetary policy, distress among regional banks, and geopolitical concerns, or from some currently unknown source.

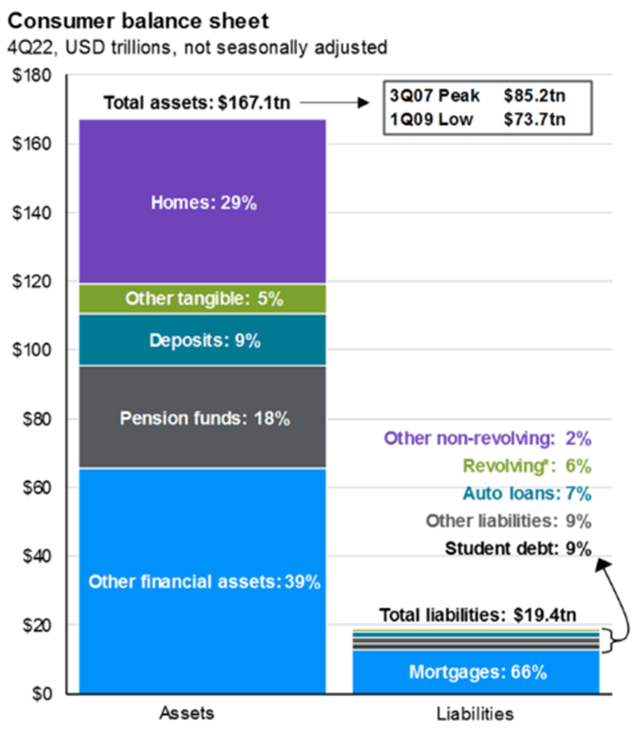

Consumer negativity seems unfounded as consumer finances are strong and employment remains high. Household wealth is near all-time highs driven by rising housing and stock market values. Mortgage debt remains the largest contributor to household debt but is not a cause for concern. Most mortgages in the U.S. were taken out at lower interest rates than what’s available today and most properties have appreciated in value, increasing home equity.

Consumer Balance Sheet (JP Morgan)

Despite how they feel, consumers are behaving very differently from how they are responding to sentiment surveys. Consumer spending grew by 6.7% in April year-over-year, well above the 4.5% average over the last 20 years.

Consumer Spending Growth (FRED)

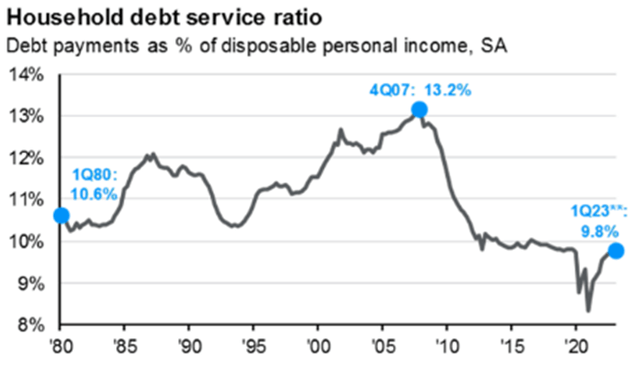

Debt service, while trending higher, remains far below the long run average and is nowhere near the peak measured on the eve of the Global Financial Crisis in 2007. Although this ratio is likely to trend toward the long run average, it will stay manageable as long as the labor market remains strong.

Household Debt Service Ratio (JP Morgan)

Lower Inflation, More Jobs

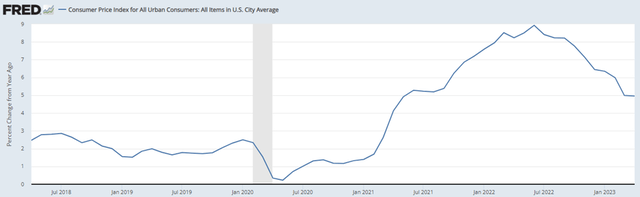

Inflation has been steadily falling since it peaked at about 9% in June of last year. Surprising to many is that this has been achieved without having a materially negative impact on the labor market. Although the phrase “soft landing” isn’t mentioned in the financial press as frequently as it once was, the strong labor market and consumer spending occurring at the same time as rising interest rates and falling inflation might warrant the label.

CPI (FRED)

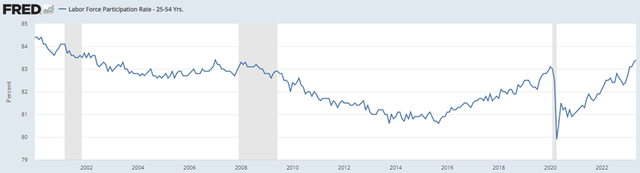

Employment remains strong. As long as people have jobs they spend money. And more people than ever are working. The “nobody wants to work” perspective is nonsense. Unemployment remains near 50-year lows while the labor force participation rate for those aged 25-54 years is at its highest in more than 15 years, since before the GFC.

Labor Force Participation Rate: Ages 24-54 Years (FRED)

Pessimism Creates Opportunity

Why is sentiment suffering? There are many potential reasons driven by individual circumstances, but for long-term investors the reasons don’t really matter. In fact, U.S stocks typically outperform long-term averages following troughs in consumer sentiment readings. Put another way, consumer negativity typically precedes strong stock performance.

The chart below from JPMorgan (JPM) illustrates the path of consumer sentiment over the last 50+ years. We can see the June 2022 trough with a reading of 50 and what appears to be another potential trough forming with the May reading the lowest since September of last year.

Recessions are marked by gray vertical bars on the chart. Historically, most major troughs have coincided with recession or occurred near the end of a recession. With current readings near 50-year lows, the question is where was/is the recession? Some will point to the brief slowdown last year, but that wasn’t officially determined to be a recession. So, this would be the first time on record that consumer sentiment spikes lower to this degree without a recession.

Consumer Sentiment and S&P 500 Returns (JP Morgan)

Position for Long-Term Prosperity

Despite falling consumer sentiment and rampant negativity in the media, there are many reasons to be optimistic beyond the traditional economic measures mentioned above. The surge in the development and adoption of AI, investment in reshoring and onshoring for U.S.-based businesses (in part supported by Federal programs), and better than expected corporate earnings reports in the last quarter. While Capex flatlined during the first quarter, I think it is reasonable to expect this to pick up as companies increase spending on AI-related efforts and on tech in general.

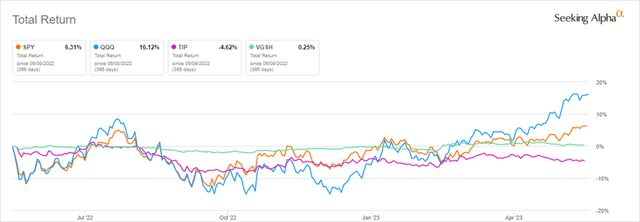

The evidence and history discussed above makes a strong bull case for long-term investors, particularly in the U.S. Investors that are overly conservative or holding too much cash should consider moving off the sidelines and back into large-cap U.S. stocks. I suggest adding to positions tracking the S&P 500 as I am doing with the SPDR S&P 500 Trust ETF (SPY). Given the potential surge in spending and value created within tech, I am also adding to my NASDAQ 100 exposure using the Invesco QQQ ETF (QQQ). The cash for those investments came from trimming my iShares TIPS Bond ETF (TIP) and Vanguard Short-Term Treasury ETF (VGSH) positions. While earning 4-6% yields with minimal risk is attractive, the upside potential in equities far outweighs this, especially for patient investors.

The 1-year chart below shows that stocks started to break away from TIPS and short-term Treasuries in April, a move that is aligned with the long-term trend of equity outperformance.

1-Year Total Return: SPY versus QQQ versus TIP versus VGSH (Seeking Alpha)

Final Thoughts

While there might be cause for short-term caution, that is outweighed by the many reasons for long-term optimism. The current strength and dynamism of the U.S. economy in conjunction with accelerating development in technology creating increased productivity and wealth are powerful reasons to remain bullish long-term. Sure, there will be bumps along the way, there always are, but that is not a reason to bet against our economy, growth, and prosperity. The negative attitude held by many on the state of the economy is largely unfounded and creates opportunities for those with a long-term investment horizon. My opinions expressed here are based on data that is open, observable, and objective. Feelings should play a minimal role in making investment allocation decisions.

Thank you for reading. I look forward to seeing your feedback and comments below.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SPY QQQ TIP VGSH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.