Adobe: Buy The Bullish Momentum (Technical Analysis)

Summary

- Adobe's strategic move into AI for content creation has strengthened bullish sentiment surrounding the stock, with the introduction of AI-driven tools like Firefly and Sensei GenAI positioning the company at the forefront of a significant industry shift.

- Adobe's stock has demonstrated robust bullish momentum, surpassed crucial thresholds, and offered attractive investment opportunities in the face of corrective dips.

- Adobe's stock price has shattered the reverse triangle and is now poised for further gains, implying that any market corrections should be interpreted as prime buying opportunities for investors.

hapabapa

In an era rapidly advancing towards an AI-driven future, numerous companies are tactically aligning their strategies to harness the transformative potential of this technology. Among these is Adobe Inc. (NASDAQ:ADBE), a world-renowned provider of creative and multimedia software products. This article builds upon our previous discussion of Adobe's stock price technical analysis and offers a projection of its future trajectory. As Adobe takes the lead in integrating AI into content creation with its newly launched AI-powered tools, Firefly and Sensei GenAI, it has sparked a shift in investor sentiment. The resulting surge in the company's share price paints a picture of bullish optimism, further reinforced by positive reactions from market analysts and upward revisions of price targets. Nevertheless, this promising growth journey has potential risks and uncertainties, which warrant careful consideration.

Recent Growth in AI and Implications for Adobe

Adobe's venture into AI for content creation strongly bolsters a bullish view of its stock. The company's unveiling of new AI-driven tools, including the Firefly generative AI package and the Sensei GenAI service, are pioneering steps that directly respond to the industry's trajectory towards increased AI integration. The introduction of these tools into Adobe's suite positions the company as a frontrunner in the merging of AI and content creation, an area that is widely expected to experience significant disruption and growth from AI innovation. A price surge in Adobe's shares following the launch of these tools suggests investor recognition of this strategic move's potential to foster the company's long-term growth.

The bullish sentiment surrounding Adobe's stock is further amplified by the positive reaction of market analysts. Adobe's stock price has experienced a substantial upswing of over 40% from its February 2023 low point of $318.60, with forecasts indicating a likely continuation of this upward trend. The fact that these price hikes are directly attributed to Adobe's generative AI capabilities illustrates the strong expectation that AI will be a crucial driver for Adobe's future growth. This indicates a strong confidence in the company's strategic direction, likely stimulating continued investor interest and potentially driving Adobe's stock price upwards.

Given the likelihood of the creative industry being heavily disrupted by AI, Adobe's move to incorporate generative AI into its business model puts it at a strategic advantage. Not only does this position Adobe to benefit from the efficiencies and capabilities that AI can offer, but it also prepares the company to lead and shape this industry shift. Consequently, Adobe's approach is receiving a notable endorsement from its shareholders, signifying their substantial faith in the company's future. This confidence could potentially fuel a further increase in Adobe's stock value.

Adobe Surpasses Significant Threshold

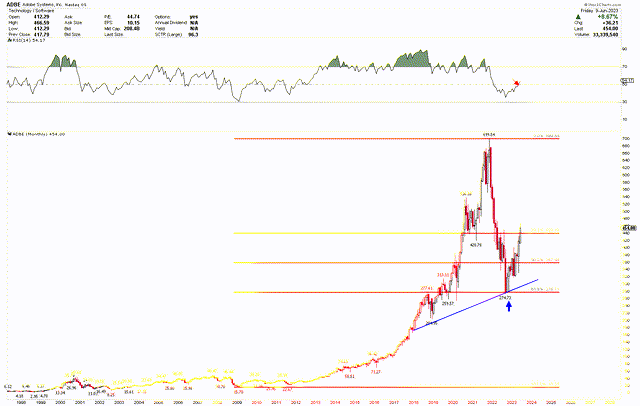

The following chart delineates the monthly trajectory of Adobe's stock price. It demonstrates the Fibonacci levels plotted from the low of $15.70 in 2009 to the high of $699.54 in 2021. The chart clearly shows that the price retracement from the 2021 high bottomed at the 61.8% Fibonacci level, after which the price began its ascent. This chart reveals that the price is currently breaching the 38.2% Fibonacci retracement level - a significant bullish indication. Furthermore, the blue line support, previously referenced, has solidly anchored at $274.73. Complementing this bullish outlook, the RSI is also puncturing the mid-level 50, further bolstering the bullish signal.

Adobe Monthly Chart (stockcharts.com)

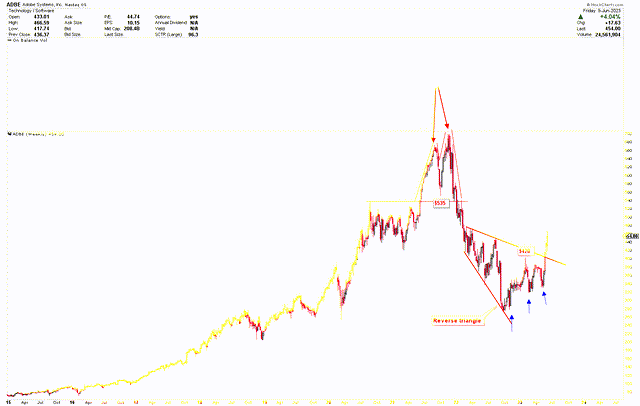

A similar pattern is discernible in Adobe's weekly chart displayed below. The chart delineates a double top formation during the last quarter of 2021 and the first quarter of 2022. Upon breaching these double tops, the price swiftly descended, carving out a reverse triangle—a pattern typically associated with the bullish sentiment. This reverse triangle is shaped around the crucial $420 level, as previously discussed. Notably, this key $420 level has been surpassed, with weekly candle closures above it and the price currently on an upward trajectory. The chart further depicts three support levels, indicated by blue arrows, marking the points from which the stock price embarked on its ascent. Adobe's significant resistance level is pinpointed at the $535 mark, aligning with the neckline of the head and shoulder patterns.

Adobe Weekly Charts (stockcharts.com)

Key Action for Investors

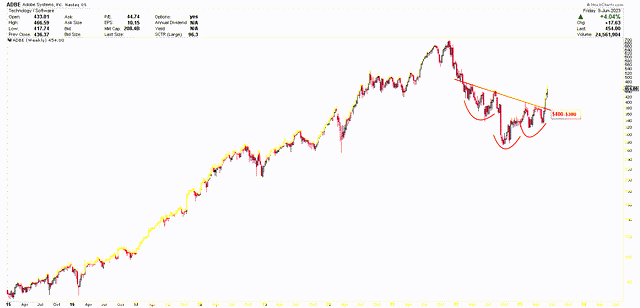

The price corrections observed in February and March 2023 were recognized as promising buying opportunities for investors, driven by the emergence of bullish price trends. Nevertheless, some investors might have missed this window. At present, Adobe's stock exhibits a robust bullish pattern - an inverted head and shoulders, which can be seen in the following weekly chart. As Adobe is currently challenging the $460 resistance level, any corrective dips should be interpreted as potential buying opportunities. The subsequent chart denotes the $380-$400 bracket as a crucial support area where the breakout occurred. Should Adobe's price experience a substantial decline toward this zone, investors should view it as a potentially lucrative point of entry.

Adobe Weekly Chart (stockcharts.com)

Risk Factors

The AI arena is highly competitive and rapidly evolving, which means Adobe must continuously innovate to maintain its frontrunner position. Any failure to do so could see the company losing ground to competitors, potentially impacting the stock price negatively. Furthermore, the incorporation of AI in content creation, while promising, is a relatively nascent field that carries inherent uncertainties. Market adoption rates, technological glitches, or regulatory issues could potentially hinder the anticipated growth in this area. Additionally, the stock's current bullish momentum, driven by positive investor sentiment, raises the risk of inflated expectations. Should future performance fall short of these heightened expectations, it could trigger a corrective phase in Adobe's stock price. Lastly, the firm's stock price has breached key resistance levels recently, entering into a potential overbought territory. This may increase the risk of price pullbacks, especially if the broader market conditions turn unfavorable. Moreover, the monthly candlestick for June has yet to settle above the 38.2% retracement level, calculated from the bullish surge from the 2009 low to the high of 2021. This retracement marker is positioned around $438.18, and unless Adobe registers a monthly close above this threshold, the price may continue to exhibit volatility before a substantial rally occurs.

Bottom Line

In conclusion, Adobe's strategic move into AI for content creation has strengthened the bullish sentiment surrounding the stock. With the introduction of AI-driven tools like Firefly and Sensei GenAI, the company is positioned to be at the forefront of a significant industry shift, potentially leading and shaping the future of AI-integrated content creation. Adobe's stock has demonstrated robust bullish momentum, surpassed crucial thresholds, and offered attractive investment opportunities in the face of corrective dips. However, it's also important to consider potential risk factors. The dynamic and competitive nature of the AI field requires Adobe to maintain consistent innovation to stay ahead. Moreover, Adobe has shattered the reverse triangle, sustaining its bullish momentum. The positive outlook is further reinforced by the bullish pattern evident in the inverted head and shoulders formation. It appears that any correction to the $380-$400 range should be regarded as a compelling buying opportunity for investors.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.