FTAI Aviation Preferred, 9% Yield, High Future Reset Rate

Summary

- FTAIN currently yields ~9%, and has a high future reset rate.

- FTAI's preferred dividend coverage is strong, at 5.58X in Q1 '23.

- FTAI had good Q1 '23 earnings.

- This idea was discussed in more depth with members of my private investing community, Hidden Dividend Stocks Plus. Learn More »

aapsky

The HDS+ portfolio holds the FTAI Aviation Ltd. 8.25% RED PFD C (NASDAQ:FTAIN) preferred shares.

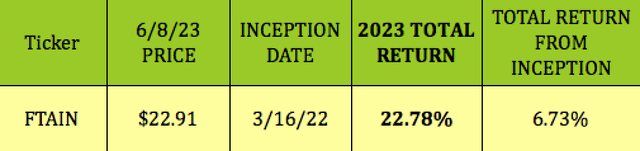

The market has favored FTAIN in 2023, giving it a 22.78% total return, vs. ~12% for the S&P 500 Index (SP500). The majority of FTAIN's 2023 return has been its 17.50% price rise; it has also paid $2.58/share in distributions since its inception.

Company Profile:

FTAI Aviation Ltd. (FTAI) owns and acquires infrastructure and related equipment for the transportation of goods and people in Africa, Asia, Europe, North America, and South America.

It formerly operated as Fortress Transportation & Infrastructure Investors LLC through 2 main segments: Aviation Leasing, and Infrastructure. The Aviation Leasing segment leases aircraft and aircraft engines. The company was founded in 2011 and is headquartered in New York, New York.

As of August 1, 2022, Fortress announced it would spin off its infrastructure assets into a new company, FTAI Infrastructure Inc. (FIP), and it retained its Aviation Leasing operations under the FTAI ticker as of 11 November 2022. As noted below, shareholders will receive a 1099, not a K-1.

Earnings:

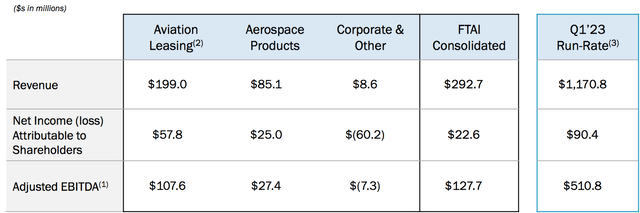

FTAI's revenue approached $300M in Q1 '23, with $108.7M in Asset Sales for 15% NBV gain of $16.5M (3 Engines & 22 Aircraft / Airframes).

Net Income was $22.6M, vs. a $186M loss in Q1 '22, which was adversely affected by Russia's invasion of Ukraine. Adjusted EBITDA was $128M, vs. $45M in Q1 '22. FTAI's Interest expenses improved by 11% in Q1 '23, falling to ~$39M.

Full year 2022 revenue was up 93%, while Adjusted EBITDA grew 76%, to $428M. Interest expenses improved by 42% in 2022, declining to $137M.

Segments:

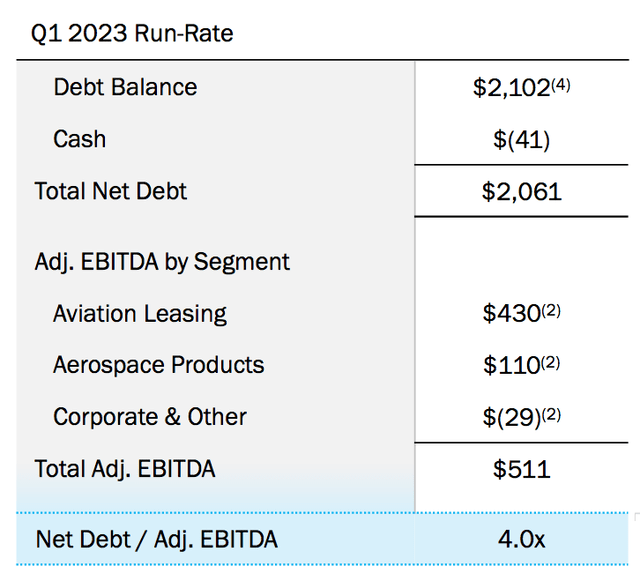

The Aviation Leasing segment contributed ~84% of segment Adjusted EBITDA in Q1 '23, with $107.6M, while the Aerospace segment kicked in $27.4M. FTAI's Q1 '23 consolidated Adjusted EBITDA run-rate was ~$511M.

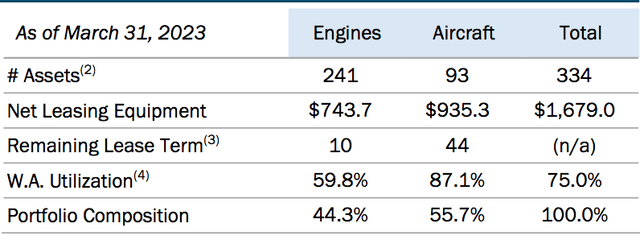

The Aircraft Leasing segment's assets were comprised of ~56% in Aircraft and 44% in Aircraft Engines, as of 3/31/23. The weighted average utilization of 75% is heavily weighted toward the Aircraft assets, which have an average of 44 months remaining on their leases, vs. 10 months for Engines.

Management expects Aviation Leasing to generate EBITDA of $350 to $400M in 2023, excluding gains on asset sales. There are additional asset sales expected in Q2 '23 and in Q3-4. They expect gains on asset sales of ~$25M/quarter, or $100M for full year 2023.

They also expect the Aerospace segment to generate ~$20 to $30M in quarterly EBITDA, with ~$100M plus for full year 2023.

Preferred Dividends:

The FTAIN shares are cumulative, meaning that FTAI must pay preferred shareholders for any unpaid dividends BEFORE paying a common dividend. FTAI pays a $.30 common dividend quarterly, having decreased it from $.33 in Q4 '22.

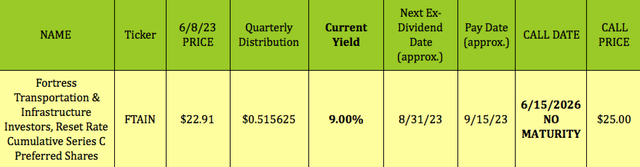

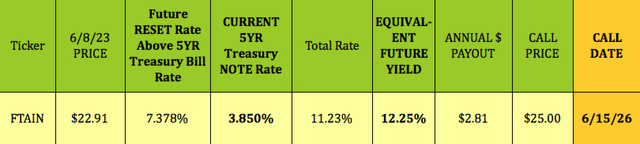

At its 6/8/23 closing price of $22.91, FTAIN yields 9.00%. It should go ex-dividend next on ~8/31/23, with a ~ 9/15/23 pay date.

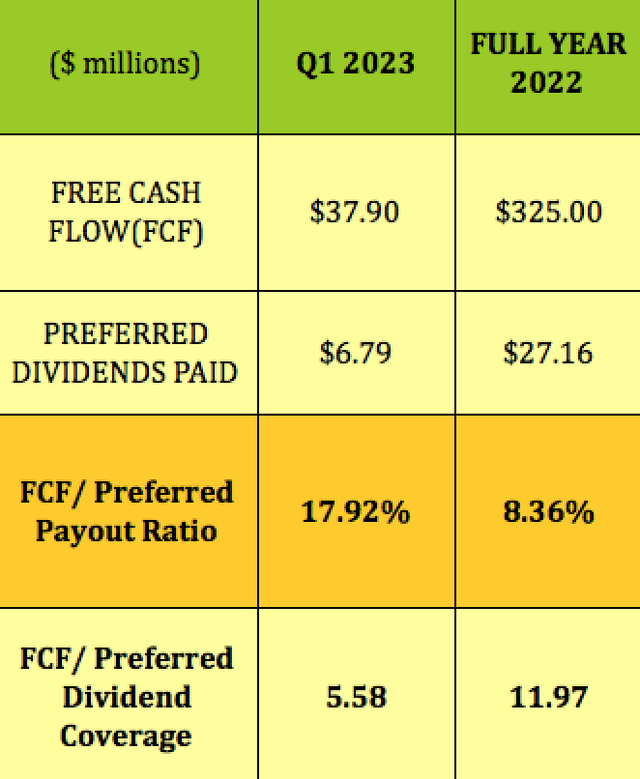

On a Free Cash Flow, FCF, basis, the Q1 '23 Preferred Dividend payout ratio was a conservative 17.92%, vs. an extremely low 8.36% for full year 2022.

Flipping the ratio numbers gives FTAI a Preferred Coverage ratio of 5.58 for Q1 '23, lower than 11.97X for full year 2022, but still strong.

Future Higher Rate:

In addition to its attractive coupon rate, the key feature of FTAIN is its reset rate, which is based upon the 5 year T-Bill rate.

FTAIN's future reset rate will be 7.378% above the 5 year T-Bill rate, which is currently 3.85%. The rate will reset every 5 years thereafter. FTAIN's reset rate period doesn't begin until 6/15/26.

At its current price of $22.91, new buyers would potentially have a future equivalent yield of 12.25% on FTAIN, if the 5 year T-Bill rate is ~3.85% when its 1st reset period starts on 6/15/26.

Taxes:

FTAI issues a 1099 at tax time for common and preferred distributions.

Profitability & Leverage:

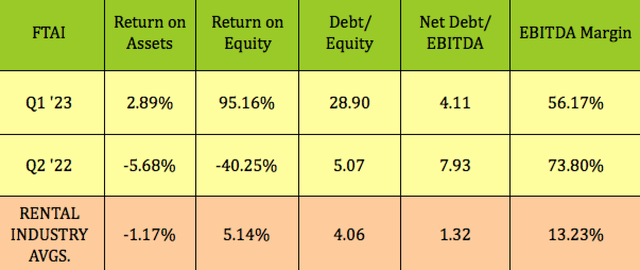

Due to the spinoff, the FTAI entity emerged with a much lower equity base, which is why its Debt/Equity leverage is so high. However, its Net Debt/EBITDA leverage improved dramatically, down to 4.11X, vs. 7.93 in Q2 '22. Management projects Q4 2023 Net Debt / Adj. EBITDA to decline to range of 3X – 4X.

ROA and ROE improved in Q1 '23, with both better than industry averages, while EBITDA Margin was lower, but still above average. Again, the low equity base caused a very high ROE figure.

Debt & Liquidity:

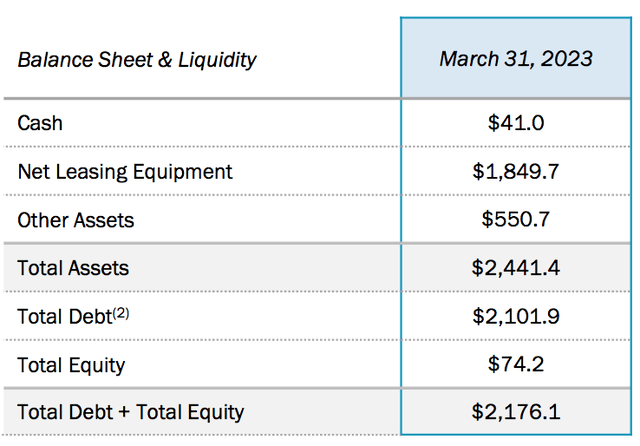

FTAI had $225M of its Corporate Revolver facility available, and $41M in cash as of March 31, 2023. It had Net Debt of $2.06B, as of 3/31/23, with leverage of ~4X for Net Debt/Annualized Adjusted EBITDA.

The Asset/Debt ratio was 1.16X, as of 3/31/23.

Parting Thoughts:

We rate FTAIN preferred as a BUY, up to $25.00.

With its very attractive current and potentially higher future yield, FTAIN should do well in 2023 and over the next few years.

Our Marketplace service, Hidden Dividend Stocks Plus, focuses on undercovered, undervalued income vehicles, and special high yield situations. Our portfolio's average yield is over 9%.

We scour the US and world markets to find solid income opportunities with dividend yields ranging from 5% to 10%-plus, backed by strong earnings.

We publish exclusive articles each week with investing ideas for the HDS+ site that you won't see anywhere else.

We offer a range of high yield income vehicles, many of which are still selling below their Net Asset and redemption values in 2023.

This article was written by

Robert Hauver, MBA, was VP of Finance for an industry-leading corporation for 18 years, and publishes SA articles under the name DoubleDividendStocks. TipRanks rates DoubleDividendStocks in the Top 25 of all financial bloggers, and Seeking Alpha rates us in the Top 5 of several categories, including Dividend Ideas, Basic Materials, and Utilities.

"Hidden Dividend Stocks Plus", a Seeking Alpha Marketplace service, which focuses on undercovered and undervalued income vehicles. HDS+ scours the world's markets to find solid income opportunities with dividend yields ranging from 5% to 10%-plus, backed by strong earnings.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of FTAIN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: This article was written for informational purposes only, and is not intended as personal investment advice. Please practice due diligence before investing in any investment vehicle mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.