Is Adobe's AI Rally Justified?

Summary

- The AI rally has driven up the value of technology companies, with Adobe benefiting from a 50% increase since its Figma acquisition.

- Investors should consider the impact of AI on productivity, costs, and competition in the market, as well as Adobe's ability to maintain its moat.

- Despite appearing cheap compared to its historical valuation, Adobe's stock is still expensive, and I retain my hold rating due to uncertainties surrounding AI's impact on the company.

bennymarty

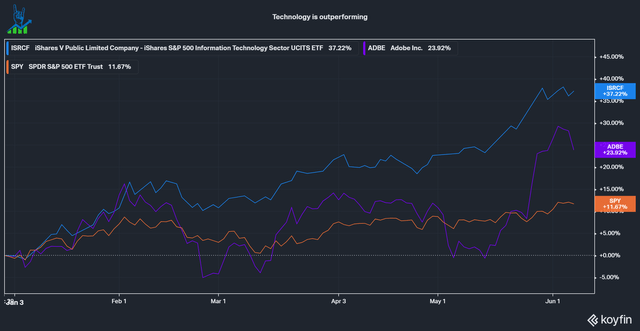

Since OpenAI introduced ChatGPT to the world in late 2022, the market has been in an AI craze. The market is bidding up technology companies like crazy, with the S&P 500 Information Technology Sector index up 37% yearly. The S&P 500, in comparison, is up just 11% and most other sectors are trailing behind. One of the beneficiaries has been Adobe (NASDAQ:ADBE). The company rallied over 50% from its bottom after the Figma acquisition last September. Let's talk about this AI rally and if it makes sense.

Technology factor is outperforming (Koyfin)

Looking forward

In January I published an article about why I sold out of Adobe. Since then, the stock has been up 27%. AI did not play a part in the discussion back then and my main reasons for selling were the following:

- assessing moats is hard, especially in fast-moving technology markets

- management without significant skin in the game might not act in the interest of shareholders

- be more critical about buyback strategies, especially combined with high stock-based compensation

The first point is even more relevant now than when I sold. AI has been the driving story for the last few months. Especially generative AI has been making headlines. One of Adobe's most notable business lines is the creative cloud, used by most professionals in photo editing, film editing and other creative tasks. The past months saw incredible improvements in the quality of large language models like Dall-E.

Adobe was fast to release its generative image AI, Sensei. Features like image fill and cutting out unwanted elements offer incredible value to consumers. The big question is if this added value will also show up in increased operating metrics or just in retaining customers against a new wave of competitors. We've seen hundreds of AI start-ups come out in quick succession targeting all different areas. The question emerges if there is a moat in AI or if it will get commoditized away.

In my opinion, these are the three questions investors need to ask themselves:

- Will AI make people more productive and reduce average seats per company or will the added productivity enable more hired professionals and increase seats?

- Will AI increase costs for Adobe and can they pass on those costs forward?

- Will new competitors emerge?

Productivity

So far, it seems that generative AI solutions like Sensei enable a significant increase in productivity. If history is a guide, then this will push companies to add more employees. After all, construction companies didn't shrink just because you now need one person in an Excavator instead of 10 people with shovels. Another angle could be people who aren't professionals but can now leverage AI software to do the tasks they used to outsource, for example designing a logo via Fiverr (FVRR). I could see select companies shrinking their creative departments, but I doubt it will negatively affect the total seats for Adobe.

Costs

SemiAnalysis estimated that Chat GPT queries are around 40% more expensive than normal search queries. Generative AI could negatively affect the profitability of the search business of Alphabet (GOOG) (GOOGL), according to their estimation in February. I expect a similar situation in AI-enhanced software. Large computational power is required to run these models and could negatively impact margins. Luckily Adobe has strong margins at 34% EBIT and can stomach it. In the past, Adobe managed well to increase subscription prices with new updates and I expect these new capabilities will make it easy to show pricing power.

Competitive landscape

I think it is pretty evident that new competitors are entering the market. AI is the latest craze and companies are trying to grab market share left and right. Many competitors will be funded by VC or PE funds that won't be able to sink money into customer acquisition endlessly. I expect that it could be challenging for many of these start-ups to scale revenue effectively and that we could see a race to the bottom. Adobe should be protected from this via its large subscription base and ability to package many services into one product.

Still trading at a premium

We'll use Historical Multiples and an Inverse DCF Model to value Adobe.

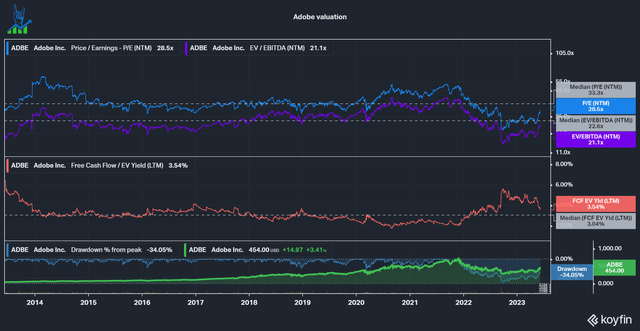

Below we can see that Adobe is historically cheap compared to its ten-year median valuation. We should remember that this was during a phase of rapid growth in earnings due to the switch and scaling of the SaaS strategy. Adobe was a costly stock.

Adobe Valuation multiples (Koyfin)

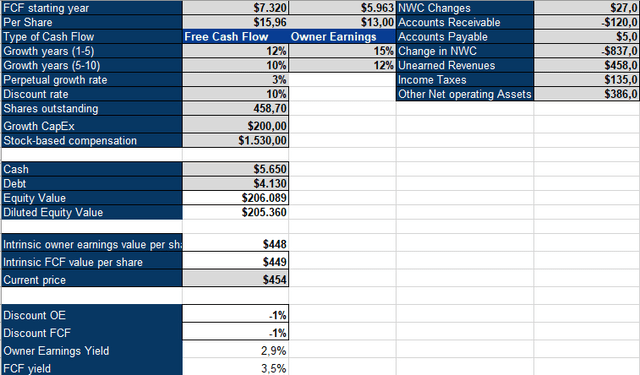

If we look at an inverse DCF using Free Cash Flow and Owner Earnings (defined as Free Cash Flow + Growth CapEx - Stock based compensation +/- NWC Changes), we can see that Adobe needs to grow Free Cash Flow by over 10% for a decade. If we adjust it to Owner Earnings, we require 15% for the next five years, followed by 12% growth for five years. This is mainly due to the sizeable stock-based compensation expense the company has. Analysts expect earnings (which we can roughly equal to Free Cash Flows) to grow by ~13% for the next three years. After that, only one analyst provides estimates ranging from around 9-11% growth through 2032. This is lower than the required growth in Owner Earnings, so even though it looks cheap compared to its past, the stock still is expensive.

Adobe Inverse DCF Model (Authors Model)

Adobe remains a hold

I believe the current AI rally is a bit overblown. AI can accelerate growth, but it can also accelerate costs. Overall it could go either way; I am not confident that Adobe will be an AI winner. The consumer certainly will win in this technological revolution, but it is uncertain which way Adobe will swing. Given the demanding valuation, I remain at a Hold rating for the stock.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is not financial advise.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.