Gold: Are We In A Recession?

Summary

- Economists have been predicting a recession in the United States, but the economy has remained resilient, defying expectations.

- A recession is defined as a significant decline in economic activity spread across the economy that lasts for more than a few months.

- The Federal Reserve's aggressive interest rate hikes aimed at combating inflation have raised concerns about a potential recession.

- The majority of top economists do not believe the U.S. is currently in a recession.

- Looking ahead, economists still anticipate a recession in the second half of the year.

- This idea was discussed in more depth with members of my private investing community, Mean Reversion Trading. Learn More »

CreativaImages/iStock via Getty Images

Fundamentals

Economists have been predicting a recession in the United States, but the economy has remained resilient, defying expectations. While there is a 61% chance of a mild slide this year according to experts, the question remains: Are we currently in a recession?

A recession is defined as a significant decline in economic activity spread across the economy that lasts for more than a few months. It is determined by indicators such as employment, consumer spending, retail sales, and industrial production. The National Bureau of Economic Research (NBER) typically announces the beginning and end of a recession months after they have occurred.

Although GDP declined in the first two quarters of 2022, much of the drop was attributed to changes in trade and business inventories, which do not reflect the underlying health of the economy. The Federal Reserve's aggressive interest rate hikes aimed at combating inflation have raised concerns about a potential recession.

However, there are factors that suggest the U.S. is not currently in a recession. During the pandemic, households accumulated significant savings, and federal stimulus checks provided additional support. While consumption has fluctuated, it has shown signs of growth, and consumers still have pent-up demand for various activities. Both households and businesses have low debt levels, alleviating some financial burdens.

The majority of top economists do not believe the U.S. is currently in a recession. Consumer spending has remained strong, employment has stayed robust, and the economy has not contracted. GDP growth in the first quarter was 1.3%, and projections suggest a 1% growth rate in the current quarter.

Looking ahead, economists still anticipate a recession in the second half of the year. They expect the impact of high interest rates and reduced lending by banks to be more significant. An inverted yield curve, where short-term bonds have higher yields than long-term bonds, has historically been a reliable indicator of an impending recession.

In summary, while the U.S. economy has shown resilience and is not currently in a recession, there are concerns and expectations of a potential downturn in the coming months based on various economic indicators and factors.

Gold Monthly Standard Deviation

On the Jun 02, 2023 GOLD: Monthly Standard Deviation report, it recommended that if you are short, to take profits 1959 - 1921. The weekly low last week was 1955.20, closing at 1975.7 and activating a buy trigger for the rest of the month. The monthly target is 2011, unless it closes below 1959 for the rest of June.

Let's take a look at the Mean Reversion signals for next week and see if we can identify some short term trading opportunities.

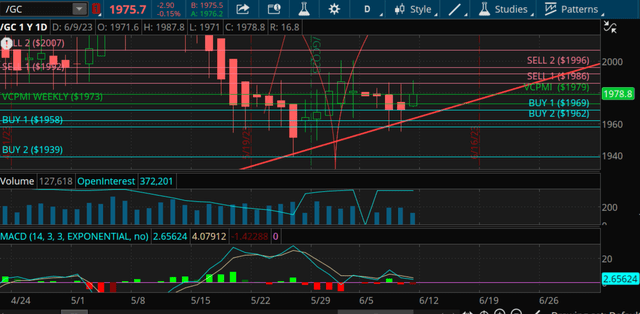

Gold: Weekly Standard Deviation Report

Jun. 10, 2023 12:30 PM ET

Summary

- The weekly trend momentum of 2006 is bearish.

- The weekly VC PMI of 1973 is a bullish price momentum.

- A close below 1973 stop, negates this bullishness neutral.

- If short, take profits 1968 - 1939. If long, take profits 1992 - 2007.

- Next cycle due date is 6.15.23.

Weekly Trend Momentum

The gold futures contract closed at 1977, indicating a notable market movement. The market's closing below the 9-day Simple Moving Average (SMA) of 2006 confirms the current weekly trend momentum is bearish. This suggests a downward trend in the short term.

However, it is important to note that if the market closes above the 9 SMA, it would negate the bearish short-term trend and shift the weekly trend momentum to a neutral stance. Traders should closely monitor future market movements to identify any potential reversals in trend.

Weekly Price Momentum:

The Weekly Price Momentum Indicator indicates that the market closed above the VC Weekly Price Momentum Indicator at 1973. This confirms the bullish price momentum for the week. Traders and investors should take this into consideration when assessing the market.

A close below the VC PMI would negate the bullish short-term trend and indicate a shift towards a more neutral stance in terms of price momentum. It is crucial to closely observe the market's behavior for further insights.

Weekly Price Indicator and Strategy:

The following strategies are recommended based on the weekly price indicator:

For traders in short positions, it is advisable to take profits in the range of 1968 - 1939. These levels represent potential support areas where prices may reverse or experience a correction.

Traders who are in long positions should consider taking profits in the range of 1992 - 2007 as the market reaches the Sell 1 and 2 levels. These levels indicate potential resistance areas where prices may encounter selling pressure.

Additionally, traders with long positions should set a stop loss at the 1939 level. This Stop Close Only and Good Till Cancelled order can help manage risk effectively.

Cycle Analysis:

The next cycle due date is anticipated on 6.15.23. Cycle analysis provides insights into market behavior and potential turning points. Traders and investors should take this date into account when making trading decisions as it may impact market dynamics.

Remember to consider these factors and adapt your strategies accordingly to make informed trading decisions.

Disclaimer: The information in the Market Commentaries was obtained from sources believed to be reliable, but we do not guarantee its accuracy. Neither the information nor any opinion expressed herein constitutes a solicitation of the purchase or sale of any futures or options contracts. It is for educational purposes only.

To learn more about how the VC PMI works and receive weekly reports on the E-mini, gold and silver, check out our Marketplace service, Mean Reversion Trading.

This article was written by

Unlock Your Trading Potential with the Equity Management Academy! Are you ready to take your trading skills to the next level? Look no further than the Equity Management Academy (EMA2trade.com). Our mission is simple: to empower traders of all levels with the knowledge and tools needed to achieve financial success. Led by renowned CEO Patrick MontesDeOca, with over 30 years of trading experience, we are dedicated to transforming your trading journey. At the heart of our Academy is the revolutionary Variable Changing Price Momentum Indicator (VC PMI), a fully automated proprietary trading program. This cutting-edge algorithm is designed to provide clear, precise entry and exit points across a wide range of markets. Say goodbye to guesswork and hello to data-driven decision-making! As a member of the Equity Management Academy, you'll have exclusive access to real-time trades placed by our expert analysts and traders. Witness their expertise in action as they leverage the power of the VC PMI to generate profitable recommendations. Our Chief Technical Analyst will guide you through advanced trading courses, delivering hours of instructional streaming videos. Gain the skills to identify trading opportunities, effectively manage risk, and grow your portfolio using automated trading intelligence. But that's not all! Institutional traders, hedgers, and experienced traders can supercharge their strategies with our VC PMI-based marketing reports. Receive comprehensive insights, including precise entry and exit points, to navigate various markets with confidence and precision. Our founder, Patrick MontesDeOca, is not only a trader and system developer but also an esteemed educator, author, and coach. His expertise shines through in the Seeking Alpha reports he authors, where he shares his analysis based on the VC PMI. Don't let your trading potential go untapped. Join the Equity Management Academy today and unlock a world of opportunities. Visit EMA2trade.com and embark on your path to financial success! Best regards, The Equity Management Academy Team

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GDX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.