Iron Mountain: Learning From Our Mounting Mistakes

Summary

- IRM remains a buy despite the impressive rally thus far, attributed to the attractive upside potential to our price target of $71.45.

- Assuming a Fed pause ahead, we may see its interest expenses moderate, potentially boosting its profitability and dividend payout per share to $2.51.

- Combined with the IRM management's optimistically raised FY2023 outlook, we remain confident about its ability to sustain excellent dividends, despite the uncertain macroeconomics.

- Meanwhile, if the IRM stock does not break out of $55, bottom-fishing investors may consider waiting for a retracement to $50 for an improved margin of safety.

golubovy/iStock via Getty Images

The IRM Investment Thesis Has Been Robust, Afterall

Author's Historical Rating on IRM

We have been very wrong about Iron Mountain Incorporated (NYSE:IRM) indeed, as evidenced by our mistaken hold rating in October 2022, when the stock is very cheap (in hindsight, of course).

IRM Total Returns Since October 2022, Including Dividends

Through this blunder, we have missed out on IRM's impressive stock return of +26.37% over the past few months, against SPY at +15.12%. Otherwise, a total return of +29.31% including dividends, against the SPY at +19.09%.

It appears that the company continues to outperform expectations as well, with the accelerating Storage Rental Revenue of $810M (+5.1% QoQ/ +7.8% YoY), easily negating the deceleration in the Service Revenue to $504M (-1.1% QoQ/ +1.4% YoY) in the latest quarter.

Notably, these numbers are much improved compared to IRM's FQ1'22 Storage Rental Revenue cadence of +6% YoY, though moderated against the Service Revenue of +32.8% YoY.

Either way, the result remains net positive for the company for now, with total revenues of $1.31B (+2.7% QoQ/ +5.2% YoY) and AFFO of $284M (inline QoQ/ +7.4% YoY). The latter has allowed it to sustain a dividend payout of $0.6185 per share quarterly, triggering an annualized dividend yield of 4.38% based on the current share prices, and a payout ratio of 63.7% based on the latest quarter's AFFO per share of $0.97.

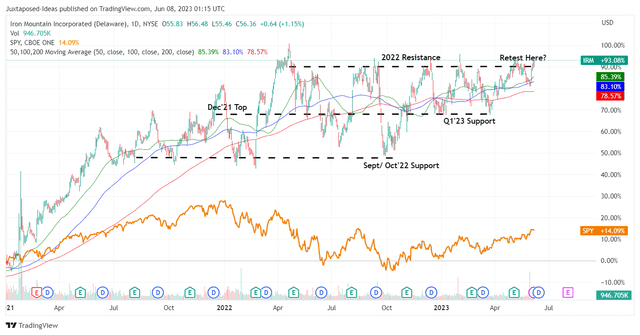

IRM 2Y Stock Price

These numbers are impressive indeed, with the decline in IRM's yield from the 4Y average of 6.58% only attributed to the rising stock prices by +93.08% since early 2021, compared to the SPY at +14.09% at the same time. The excellent combination of decent yields and high growth must have been greatly welcomed by its long-term shareholders.

The durability of the company's demand is also demonstrated by the raised FY2023 guidance, with revenues of $5.55B (+8.8% YoY) and AFFO per share of $3.95 (+3.9% YoY) at the midpoint, despite the peak recessionary fears.

These numbers imply the safety of its dividends, with IRM still boasting robust customer retention at 98% and over 50% in physical records retention for the past few years.

Naturally, there are risks to the company's execution, due to the rising interest rate environment. For example, it recorded a higher annualized interest expense of $548.8M (+12.4% YoY) and a growing weighted average interest rate of 5.3% (+0.2 points QoQ/ +0.9 YoY) by the latest quarter, on top of the expanding long-term debts of $10.93B (+3.5% QoQ/ +7.7% YoY).

Then again, depending on the Fed's action at the upcoming meeting, with only 34.4% of market analysts projecting a 25 basis point hike, we may see IRM's interest expenses peak at current levels and moderate from henceforth.

Assuming a similar 63.7% in payout ratio, it is not overly speculative to project a raised dividend payout to $2.51 annually or $0.629 quarterly by the end of 2023, suggesting an excellent +1.6% increase, similar to its historical cadence.

Those numbers also imply an improved forward yield of 4.45%, both a win for IRM's long-term shareholders, while allowing the company to achieve its long-term "target AFFO payout ratio of low to mid-60."

So, Is IRM Stock A Buy, Sell, Or Hold?

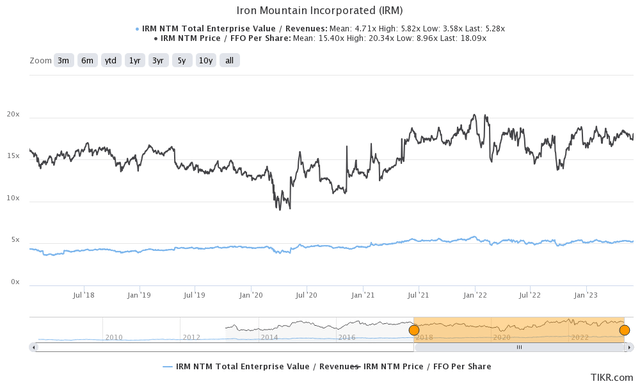

IRM 5Y EV/Revenue and Price/ FFO Per Share

Therefore, it is unsurprising to see the same optimism baked in IRM's valuations, at NTM EV/ Revenues of 5.28x and NTM Price/ AFFO Per Share of 18.09x, against its 5Y mean of 4.71x and 15.40x, or 1Y mean of 5.16x and 13.64x.

Based on the management's optimistic FY2023 guidance of AFFO per share of $3.95 and NTM Price/ AFFO Per Share of 18.09x, we are still seeing a relatively attractive upside potential of +26.7% to our price target of $71.45.

As a result, we are cautiously rerating IRM as a Buy here, with the caveat that investors size the portfolio appropriately. With the stock already recording an impressive rally of +12.11% YTD, compared to the SPY at +12.01%, it remains to be seen if it may break out of the previous 2022 resistance levels.

Otherwise, bottom-fishing investors may consider waiting a little longer for a further retracement to the Q1'23 support levels of $50 for an improved margin of safety.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.