Braze Q1 2024 Earnings: Great Performance But Unjustified Upside

Summary

- Braze shares spiked after Q1 2024 financial results exceeded analysts' expectations for revenue and adjusted earnings per share.

- The company's revenue has grown significantly, but profitability and cash flows have suffered, with net losses increasing.

- Despite a bright future, Braze's current valuation makes it look overpriced, and the required growth to justify it may be unrealistic.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

Images By Tang Ming Tung

Shares of Braze (NASDAQ:BRZE) spiked on Friday, June 9th, after management reported financial results for the first quarter of the company's 2024 fiscal year. Although the company continues to generate significant net losses, it did manage to exceed analysts' expectations on both its top and bottom lines. Revenue in particular has been growing at a rather impressive pace. It makes sense for investors to become more optimistic after seeing performance like this. But when you really step back and put the company in perspective, shares look very expensive at this time and are unlikely to achieve a significant upside moving forward.

An introduction to Braze

With a market capitalization of $3.82 billion, Braze is a fairly small business. Most investors probably don't know much, if anything, about the firm. So a brief overview sounds appropriate to me. Founded in 2011, the company has grown to become what it considers a leading comprehensive customer engagement platform that “powers customer-centric interactions between consumers and brands.” If this sounds vague, that's okay, because it is. We can dig in a bit deeper.

At the core of the company is what it calls the Braze Platform. This platform offers a suite of solutions for businesses that are trying to engage existing customers and increase transactions. It does this by giving firms the ability to cross channel message users, send in app messages, send e-mail, and more, to their customers. In addition to this kind of functionality, the platform provides customers with data and analytics, helps to orchestrate messaging campaigns, and more. It does this for customers across a variety of industries. For the financial services sector, for instance, it helps to boost mobile app adoption and lifetime value by utilizing data-driven marketing.

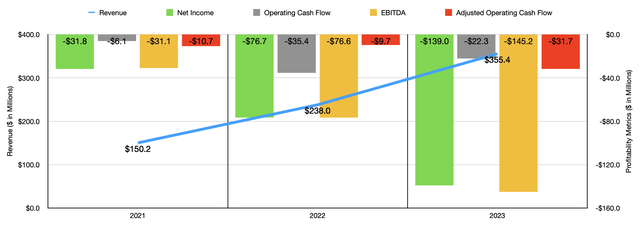

Over the past three years, management has done really good when it comes to revenue growth. Sales went from $150.2 million during the 2021 fiscal year to $355.4 million in the 2023 fiscal year. But to do this, the firm had to enable interactions with a significant number of users. From the 1,770 customers that had in January 2023, the company enabled interactions with 4.8 billion monthly active users. And in the 2023 fiscal year alone, it processed over 13 trillion consumer generated data points on its platform and its customers sent about 2.2 trillion messages to their customers on it over that same window of time.

Unfortunately, this is where the good news ends. Even as revenue increased nicely, profits and cash flows have suffered. The firm went from generating a net loss of $31.8 million in 2021 between that loss of $139 million in 2023. The other profitability metrics for the company also worsened during this time. This can all be seen in the chart above. Particularly painful was EBITDA, a metric that went from negative $31.1 million to negative $145.2 million over the same time period.

Investors are happy

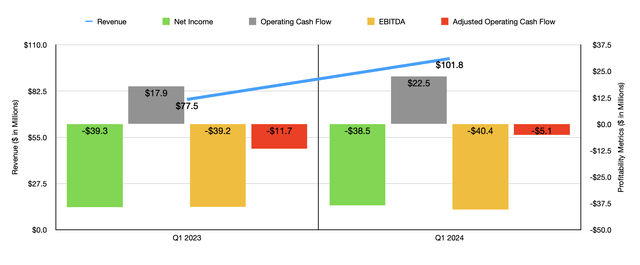

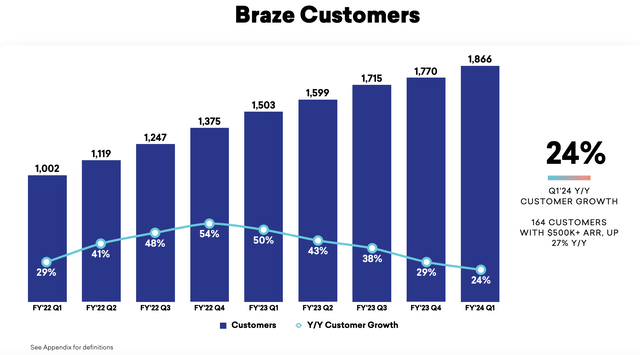

On June 8th, after the market closed, the management team at Braze announced financial results covering the first quarter of the company's 2024 fiscal year. Revenue for that time came in at $101.8 million. That represented a sizable increase over the $77.5 million generated one year earlier. And it was also $2.8 million above what analysts anticipated. This surge in revenue was driven largely by a 33.4% pop in subscription revenue. Almost half of the subscription revenue increase was driven by growth from existing customers as those customers used more of what the company has to offer. 51% of the 33.4% increase, however, came from new customers. At the end of the most recent quarter, the company boasted 1,866 customers, up from the 1,503 that it reported one year earlier. This jump in customer account helped to bring the monthly active users for the company up to 5.1 billion in April of this year.

On the bottom line, the picture was rather mixed. The firm actually generated a net loss of $0.40 per share. While this was $0.01 per share lower than what analysts anticipated, the adjusted earnings per share of $0.13 exceeded expectations by $0.05 per share. The loss per share the company reported translated to an overall net loss for the quarter of $38.5 million. That's actually a slight improvement over the $39.3 million loss reported one year earlier. Most other profitability metrics also improved during this time. Operating cash flow grew from $17.9 million to $22.5 million. Even if we adjust for changes in working capital, we would see this number improve from negative $11.7 million to negative $5.1 million. The only profitability metric that worsened during this time was EBITDA. This actually went from $39.2 million in the red to $40.4 million in the red.

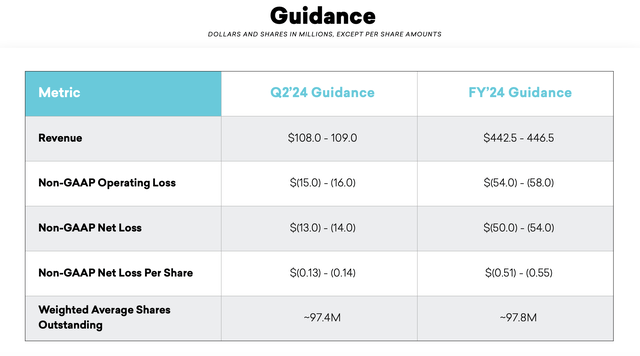

In addition to exceeding expectations on the top and bottom lines, the latter admittedly on an adjusted basis, the company also revised higher its expectations for the 2024 fiscal year in its entirety. Previously, management was forecasting revenue for the year of between $433 million and $438 million. That number has now been revised higher to between $442.5 million and $446.5 million. The adjusted loss per share was previously forecasted at between $0.55 and $0.59. Now, however, it should come in between $0.51 per share and $0.55 per share. At the midpoint, this would imply a net loss for the company of $51.8 million. That would mark a significant improvement over the $139 million loss generated in the 2023 fiscal year.

I can understand why this might make investors enthusiastic. In the long run, I suspect the company would do just fine. It has no debt on its books and boasts $507.4 million in cash. And given how pricey the stock is, it can continue to issue shares in order to raise even more cash. I have no doubt that the picture for the company will eventually turn quite positive. However, I do think that shares are drastically overpriced. In truth, you can't really value a company that has negative earnings and cash flows and that has assets that are probably worth less than book value. But you can see what kind of profitability would be needed in order for the company to be fairly valued or undervalued, and then see if that kind of outcome is reasonable in the foreseeable future.

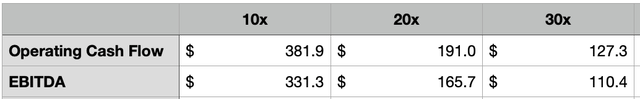

In the table above, you can see three different scenarios. The first one calculates what kind of operating cash flow the company would need to generate in order to trade at a price to operating cash flow multiple of ten. It also calculates the amount of EBITDA the company would need to generate in order to trade at an EV to EBITDA multiple of 10. The second scenario bumps both of these up to 20, while the third pushes it to 30. It's really difficult to imagine shares trading much above that point. As you can see from the calculations, the company would need to be very profitable to satisfy these scenarios. Yes, revenue is growing nicely and profitability has improved. But consider even the most extreme example. If we take midpoint guidance for the 2024 fiscal year and assume that the company will continue to grow at a 20% rate for the next five years, that would take revenue up to $1.11 billion. At that point, you would still need an EBITDA margin of 10% for the company to be fairly valued. That's a long time to wait for what would probably be a very aggressive valuation.

Takeaway

In analyzing Braze, I came to really appreciate the services that it offers. I think it is a fascinating company that has a bright future. But this doesn't mean that I think the company is attractively priced. Shares look very expensive at this moment and I believe that, in order to justify its valuation, the amount of growth that it will have to see on both its top and bottom lines from here on out is unrealistic. Given these factors, I've decided to rate the company a soft ‘sell’ at this time.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.