Ares Management: Credit Competency Makes It A Sector Standout

Summary

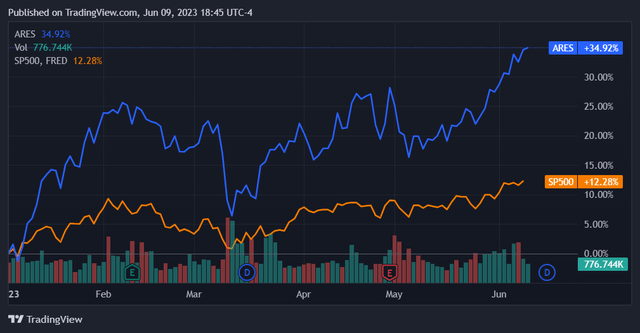

- Ares Management Corporation has been the best-performing private asset manager (private equity/private credit) this year, with its stock returning 34.9% return YTD - well beyond any of its peers.

- Ares relative fundamentals undergird this recent performance, with a good growth profile, profitability, and return metrics.

- It is also a company with a distinguished competency in private credit investment, something that appears opportune in the current high-rate context.

- Despite this, it is worth noting that the company is distinctly exposed to market-wide credit phenomena and is trading at a relatively expensive valuation, with near-term performance already priced in.

- Nonetheless I think the full picture here amounts to a buy over a long-term investment horizon.

Mikhail Leonov

Overview

Ares Management Corporation (NYSE:ARES) has been the best-performing private asset manager (private equity/private credit) this year, posting share price returns of 34.92% year to date. This price return has exceeded the major indices and is also well beyond that of its peers. While some of its competitors have seen appreciation of roughly half of Ares’ price return this year, namely KKR (NYSE:KKR), Apollo (NYSE:APO), and Blackstone (NYSE:BX), none have come close to Ares’ price return year-to-date.

Interestingly, appreciation in Ares’ shares has accelerated after its latest quarterly results even though it missed consensus expectations against both the top and bottom line.

This means that the market has continued to price optimistic future expectations into this stock even though it underperformed. The immediate catalyst here could very well have been the firm’s continued traction in increasing AUM as well as strong buy-ins for its latest funds. Details around this were outlined on its latest earnings call.

Given the outperformance here I think it’s worth looking into how Ares has been able to distinguish itself as well as its financials relative to its peer group. This article will identify what’s driving the stock’s outperformance and determine whether it’s set to continue in the near to medium term.

Relative Financials

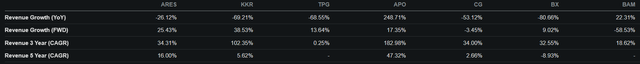

Starting with revenue growth, we can first note the wide variance in growth performance and expectations across the publicly-traded alternative asset managers. This is the natural result of volatility inherent in the complex private equity and private credit investment businesses; there is a very wide range of returns and return timeframes playing out across a myriad of investment vehicles. Furthermore, investment returns can be estimated but rarely perfectly predicted in advance, creating additional inherent variability in the business model. This high-variance distribution makes concepts such as the average and the median less important as they are not particularly indicative of the overall distribution. This leaves us to consider every firm on its own merits as well as its relative sector rank across each metric as a method of comparison.

- Year over year growth rates range from -80.86% to 248.71% | Range: 329.57%

- One year forward growth rates range from -58.53% to 38.53% | Range: 97.06%

- Three year compound annual growth rates range from 0.25% to 182.98% | Range: 182.73%

Here, Ares is in the top 3 firms sector-wide across these three revenue growth metrics. While it doesn’t take the cake on either a trailing or forward basis, it is well into the better half of the sector in terms of its growth profile. In general Ares had a smaller decline in revenues y/y and has better forward prospects than its peer group overall. While this is likely not the entirety of what’s making the stock stand out this year, we can certainly consider it as having a good relative growth profile.

ARES | KKR | TPG | APO | CG | BX | BAM | |

Y/Y Growth | -26.12% | -69.21% | -68.55% | 248.71% | -53.12% | -80.86% | 22.31% |

Rank | 3 | 6 | 5 | 1 | 4 | 7 | 2 |

ARES | KKR | TPG | APO | CG | BX | BAM | |

1 Yr FWD | 25.43% | 38.53% | 13.64% | 17.35% | -3.45% | 9.02% | -58.53% |

Rank | 2 | 1 | 4 | 3 | 6 | 5 | 7 |

ARES | KKR | TPG | APO | CG | BX | BAM | |

3 Yr FWD CAGR | 34.31% | 102.35% | 0.25% | 182.98% | 34.00% | 32.55% | 18.62% |

Rank | 3 | 2 | 7 | 1 | 4 | 5 | 6 |

Data Source: Seeking Alpha

Looking over to profitability we see a similarly variable picture emerge. Ares is only 4th in the sector as to both gross and net margins. Importantly, it is profitable.

ARES | KKR | TPG | APO | CG | BX | BAM | |

Gross Margin | 41.52% | 31.06% | 22.38% | 5.55% | 54.75% | 105.19% | 78.86% |

Rank | 4 | 5 | 6 | 7 | 3 | 1 | 2 |

ARES | KKR | TPG | APO | CG | BX | BAM | |

Net Margin | 6.84% | -8.27% | 5.93% | -11.79% | 20.29% | 14.48% | 53.06% |

Rank | 4 | 6 | 5 | 7 | 2 | 3 | 1 |

Data Source: Seeking Alpha

Of course, for financial businesses such as these we also need to understand what kind of returns they’re getting on their capital. ROE will tell us each company’s return based on its total equity, while ROA will tell us each company’s return on its equity as well as its leverage. Ares is the third best in the sector for its returns on equity and fourth for its return on assets.

ARES | KKR | TPG | APO | CG | BX | BAM | |

Return on Equity | 10.81% | -3.52% | -5.71% | -11.31% | 12.38% | 3.34% | 19.57% |

Rank | 3 | 5 | 6 | 7 | 2 | 4 | 1 |

ARES | KKR | TPG | APO | CG | BX | BAM | |

Return on Assets | 2.87% | 0.06% | 0.95% | -1.98% | 5.56% | 7.84% | 8.48% |

Rank | 4 | 6 | 5 | 7 | 3 | 2 | 1 |

Data Source: Seeking Alpha

The difference between these two return metrics is also an important consideration because it illustrates each firm’s marginal gain in return from solely equity capitalization to equity + debt capitalization. This quantifies the marginal return at each company’s level of leverage and tells us whether this leverage is being used efficiently or not. Here, Ares is 6th (2nd to last) in the sector. It appears the company has a fairly high degree of capital utilization and makes it work.

ARES | KKR | TPG | APO | CG | BX | BAM | |

ROA/ROE Diff. | -7.94% | 3.58% | 6.66% | 9.33% | -6.82% | 4.50% | -11.09% |

Rank | 6 | 4 | 2 | 1 | 5 | 3 | 7 |

Data Source: Seeking Alpha

Just as with its growth profile, Ares’ profitability overall ends up being in the better half of the sector, with a particularly good return on equity. This appears to be being done through a controlled, yet significant, utilization of leverage (debt financing), something we can determine in more detail from its balance sheet.

Through Ares’ balance sheet we can see that it does indeed make use of relatively high levels of leverage: the firm’s debt to equity ratio is by far the highest in the space. At 296.15%, Ares has close to $3 of leverage for every $1 of equity. The second most leveraged firm, Carlyle Group (CG), only has $1.3 of leverage for every $1 of equity. Ares is in its own class when it comes to leverage. It operates in an aggressive fashion, something which is further evidenced by its current ratio of 0.53 – by far the lowest in the space.

Overall these financials tell the story of a company that knows how to use leverage to generate returns. Ares is distinctly capital-intensive in its operations and has a distinguished core competency in private credit, an area on which it has focused since its inception. This is readily illustrated by its most recent, heavily oversubscribed, direct lending fund.

Through this core competency it makes sense that the company is readily able to convert debt that it takes on into higher-return debt vehicles that it provides. Higher rates have also driven up yields across all fixed income and private credit, creating an expanded opportunity set for Ares. All of this indicates that the firm’s nature as a credit specialist has provided it with a superior market position in the present context, with the stock price reflecting that.

Valuation and Risks

As a highly leveraged entity managing a complex set of credit risks, Ares is distinctly exposed to market-wide credit phenomena of the type that we saw in 2008. While there are a range of mechanisms that have since been put in place to prevent such things from happening again, it is not entirely impossible. Every so often, a black swan appears. If credit quality deteriorates across multiple sectors at the same time, I would think Ares could be in for some trouble. Broad credit stress and an environment in which we see increasing correlations amongst credit instruments would be a significant cause for concern when it comes to this company.

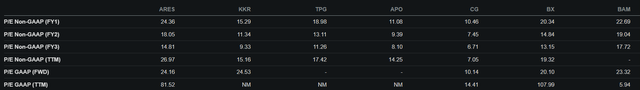

With that being said we can evaluate Ares’ valuation relative to its peers. On a one year forward non-GAAP P/E basis, Ares is already the most expensive stock of the bunch. At current estimates, this changes in the subsequent two years and sees Ares trading at a relative P/E discount to Brookfield. Overall this is not particularly indicative, and all we can readily conclude is that Ares is indeed trading at a premium within its sector, roughly in line with the other well-regarded players. The avenue for the bull case here is that the stock’s P/E is set to be less than 20 as soon as next year. This brings it somewhat out of ‘growth stock’ territory and could present an attractive valuation for those that believe all will go according to plan. Indeed, Ares is not priced particularly far into the future and would hit financial sector median P/E (9.15, forward) in roughly 5 years at expected growth rates. This means that a scenario of continuing high growth beyond that time is not yet priced in.

Conclusion

While there are material risks here, as well as an expensive valuation, I am going to call this stock a buy. Ares appears to have a top end credit business that should be able to do particularly well throughout current high rate environment as well as just fine thereafter. Its relative financial profile as well as the continued interest in its investment products add to this and ultimately make me optimistic for its trajectory. I think Ares Management is a good buy on a long-term investment horizon of 5-10 years.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.