TOTL: Underperforms Passive Benchmark

Summary

- The SPDR DoubleLine Total Return Tactical ETF has underperformed its benchmark, the Bloomberg US Aggregate Bond Index, over its 8-year history.

- TOTL has a high expense ratio of 0.55% and a high portfolio turnover rate of 119% compared to the passive Vanguard Total Bond Market ETF.

- Investors should avoid TOTL due to its high costs and underperformance.

Gearstd

A few months ago, I wrote a cautious article on the DoubleLine Yield Opportunities Fund (DLY), noting that the DLY fund managed to underperform almost all fixed income asset classes despite it being managed by Jeffrey Gundlach, the supposed 'bond king'. To be honest, I had not looked into Mr. Gundlach's performance and have only heard about his investment 'prowess' from news articles like this one. The DLY fund's poor performance piqued my interest in reviewing DoubleLine funds as I come across them.

This article looks at the SPDR DoubleLine Total Return Tactical ETF (NYSEARCA:TOTL). The TOTL ETF gives the manager, DoubleLine, freedom to take tactical positions it feels will help the fund maximize returns.

Unfortunately, over the fund's 8 years of history, there is little evidence the TOTL ETF is able to outperform the passive benchmark. I would avoid this underperforming ETF from DoubleLine.

Fund Overview

The SPDR DoubleLine Total Return Tactical ETF seeks to maximize total return by combining traditional and alternative fixed income assets through active sector allocation and security selection. The TOTL ETF seeks to outperform its benchmark, the Bloomberg US Aggregate Bond Index, by exploiting mispricings in the markets.

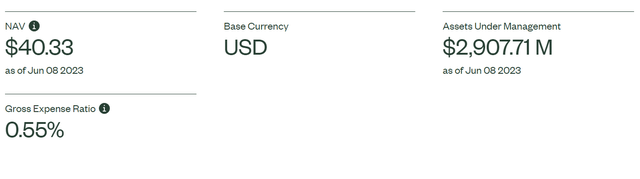

The TOTL ETF is a sizeable fund with $2.9 billion in asset and charges a 0.55% gross expense ratio, high relative to passive ETFs like the Vanguard Total Bond Market ETF (BND), which tracks the US Aggregate Bond Index and only charges a 0.03% expense ratio (Figure 1).

Figure 1 - Investors pay up for management by DoubleLine (ssga.com)

Portfolio Holdings

Figure 2 shows the overall portfolio characteristics of the TOTL ETF. The ETF holds almost 1,300 securities with option adjusted duration of 6.4 years. The portfolio also has an average yield to maturity of 5.9%.

Figure 2 - TOTL ETF portfolio characteristics (ssga.com)

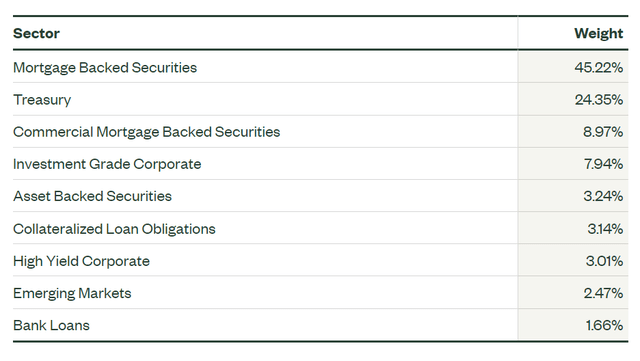

The TOTL ETF's sector allocation is shown in Figure 3. The ETF has 45% of its portfolio allocated to Mortgage Backed Securities ("MBS"), 24% in treasury securities, 9% in Commercial Mortgage Backed Securities ("CMBS"), 8% in Investment Grade Corporate bonds, and 3% in Asset Backed Securities ("ABS").

Figure 3 - TOTL sector allocation (ssga.com)

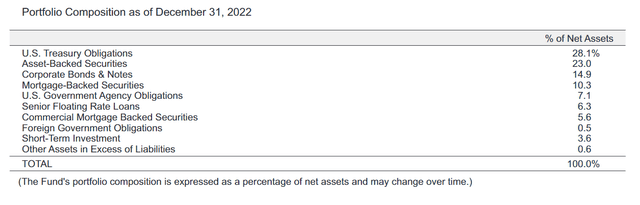

Investors should note that the TOTL ETF's sector allocation can change quite a bit over time. Figure 4 shows the sector allocation as of December 2022. Compared to December, the TOTL ETF is currently heavily overweight MBS, while its asset-backed allocation has been dramatically reduced.

Figure 4 - TOTL sector allocation as of December 2022 (TOTL semi-annual report)

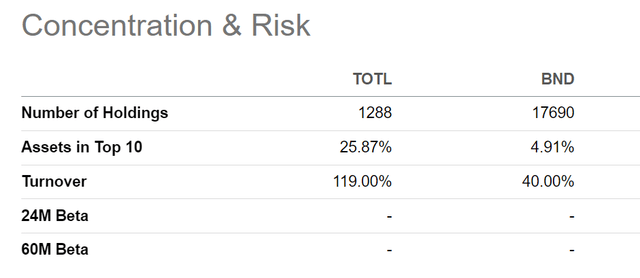

In fact, according to Seeking Alpha's data, the TOTL ETF's entire portfolio is turned over in less than a year, almost 3 times the portfolio turnover of the BND ETF (Figure 5).

Figure 5 - TOTL has a high 119% turnover rate (Seeking Alpha)

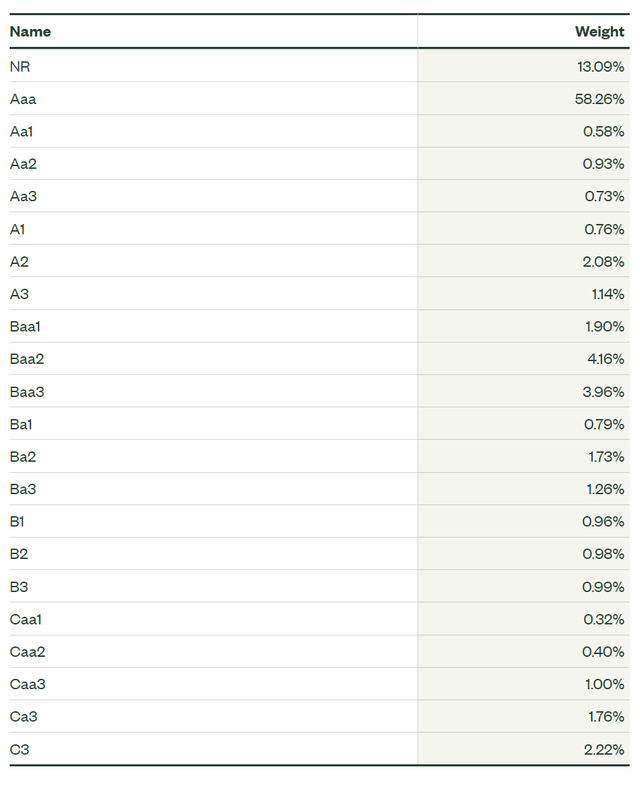

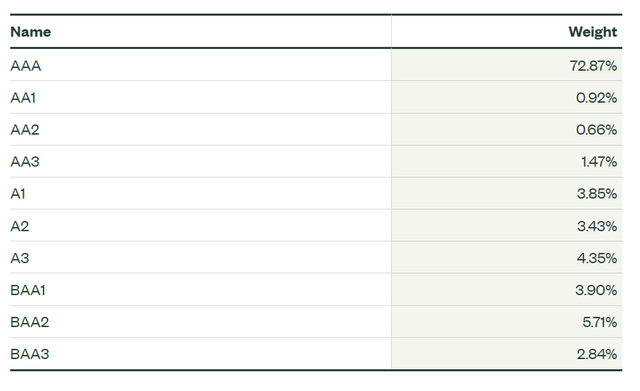

Figure 6 shows the TOTL ETF's credit quality allocation, while Figure 7 shows the credit quality allocation of the benchmark index. Compared to the benchmark, the TOTL ETF has notably allocated 13.1% to unrated securities, as well as 12.4% to non-investment grade securities.

Figure 6 - TOTL credit quality allocation (ssga.com) Figure 7 - Benchmark credit quality allocation (ssga.com)

Distribution & Yield

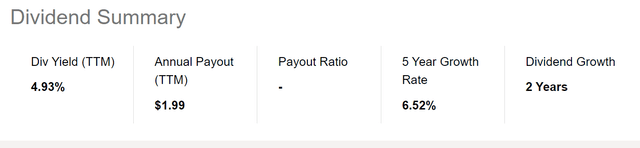

The TOTL ETF pays a monthly distribution with an attractively trailing 12 month distribution yield of 4.9% (Figure 8).

Figure 8 - TOTL pays trailing 12 month distribution yield of 4.9% (Seeking Alpha)

Based on the fund's most recent distribution of $0.1545 / share, the TOTL ETF has a forward yield of 4.6%.

Returns

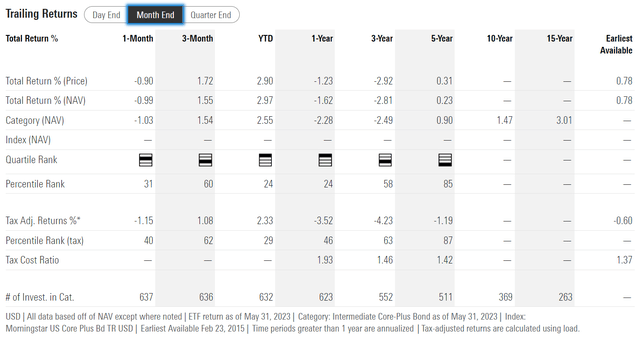

Figure 9 shows the historical returns of the TOTL ETF. Overall, the TOTL ETF has delivered mediocre returns, with 1/3/5Yr average annual returns of -1.6%/-2.8%/0.2% respectively.

Figure 9 - TOTL historical returns (morningstar.com)

In fact, compared to peers within the Morningstar category Intermediate Core Plus Bond, the TOTL ETF ranks a disappointing 3rd quartile on 3Yr average annual returns and 4th quartile on 5Yr average annual returns.

Another analysis we can perform is to compare the TOTL ETF against the passive ETF BND that tracks the reference benchmark. Recall that the TOTL ETF is trying to outperform the benchmark by capitalizing on the manager's skill in active sector allocation and security selection.

Figure 10 compares the BND ETF against the TOTL ETF using the time period March 2015 (TOTL inception date) to May 2023.

Figure 10 - TOTL vs. BND ETF comparison (Author created with Portfolio Visualizer)

Unfortunately, we can see that TOTL has done a poor job of outperforming its benchmark, as its CAGR returns since inception was 0.8%, trailing the benchmark's 0.9%. The TOTL ETF does have slightly lower volatility of 4.1% vs. BND at 4.8%, but overall, the BND ETF has better Sharpe and Sortino ratios vs. the TOTL ETF.

Conclusion

The SPDR DoubleLine Total Return Tactical ETF aims to outperform its benchmark, the US Bloomberg Aggregate Bond Index, by allowing the manager freedom to tilt the portfolio's sector and credit quality allocation, capitalizing on mispricings in the market.

Unfortunately, what we end up with is a high-cost ETF (0.55% gross expense ratio vs. 0.03% for the BND ETF) that churns its portfolio (119% turnover vs. 40%) and underperforms (0.8% CAGR returns vs. 0.9% for BND).

I would totally avoid the TOTL ETF.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.