LyondellBasell: Undervalued With An Appealing Dividend Yield

Summary

- LyondellBasell is a global chemical company with a strong balance sheet and efficient operating model, making it a good value choice for income and growth investors.

- LYB has a track record of consecutive annual dividend raises, currently yielding 5.5% at a 43.5% payout ratio, and has returned $3.5 billion in capital to shareholders over the past 12 months.

- The company is expanding its capabilities in its core business and circular solutions, with a forward PE of 9.2, and analysts expecting annual EPS growth in the 2024-2025 timeframe.

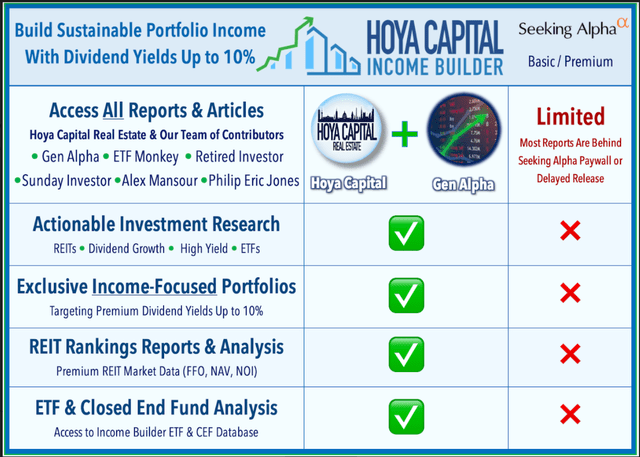

- Looking for a portfolio of ideas like this one? Members of Hoya Capital Income Builder get exclusive access to our subscriber-only portfolios. Learn More »

MarsBars

Dividend investing can be a great way for everyday retail investors to become wealthy by building their income streams one brick at a time. After all, Rome wasn’t built in day, and neither should a well-rounded investment portfolio be, either. As such, it’s important to diversify and pick the right companies with a track record growing their payouts.

Such appears to be the case with LyondellBasell (NYSE:LYB), which I last covered here back in December, when I remarked that it was on sale with a 6% yield. It appears that the market has agreed, as LYB has given investors a 12% total return since then, slightly surpassing the 11.9% return of the S&P 500 (SPY) after the latter’s AI-led rally.

LYB recently gave investors a decent dividend bump, and in this article, I discuss why it remains a good value choice for income and growth, so let’s get started.

Why LYB?

LyondellBasell is a global chemical company, with business segments that include olefins and polyolefins, and intermediates and derivatives, and oxyfuels and refining. It's what I would consider to be a 'GDP' company, as its products have wide-reaching uses that touches a wide range of consumer and industrial uses, and its health can be used as a barometer for the global economy. Over the trailing 12 months, LYB generated $47.5 billion in total revenue.

As with most industrial companies that achieve a certain size, LYB enjoys an economy of scale that makes it hard for new entrants to penetrate without a sizeable asset base already in place. This is reflected by LYB's impressive 12% return on invested capital over the trailing 12 months and its high 89% cash conversion, as calculated by taking net operating cash flow divided by EBITDA excluding LCM (lifecycle management) and impairment costs.

This was supported by steady demand for fuels, which continued to support strong oxyfuels and refining margins for LYB. Importantly, LYB's bread and butter olefins and polyolefins margins improved during the first quarter due to improving global demand and lower input costs.

The continued strong results have enabled LYB to return a sizeable $3.5 billion in capital to shareholders over the past 12 reported months. A part of this includes the dividend payouts, with LYB currently yielding a respectable 5.5% at a 43.5% payout ratio. The dividend was also recently raised by 5%, continuing LYB's track record of consecutive annual raises over the past 9 years.

The dividend is also backed by a strong BBB rated balance sheet, with $1.8 billion in cash and equivalents on hand and a low net debt to EBITDA ratio of just 1.7x, sitting well below the 3.0x level generally considered to be safe by ratings agencies.

Looking ahead, LYB has a number of ways to unlock value in its portfolio. This includes the leveraging of its scale and global hubs to secure recycled and renewable feedstocks to build out its low carbon and circular solutions business. It also includes the recent opening of the world's largest propylene oxide plant, which management highlighted the benefits of during the recent conference call:

Our plant doubles the scale of our prior plans, improves yields, increases product recovery and incorporates hundreds of design improvements that save energy, reduce emissions and lower costs.

The net result is that we believe propylene oxide from our PO/TBA technology has a lower carbon footprint relative to the most widely used PO technologies. And our cost of production is the lowest in the world. The new plant was producing on-spec products at rates of 70% or above within one month from start-up.

Lastly, LYB remains a good value play at the current price of $89 with a forward PE of 9.2. Analysts expect 10% to 13% annual EPS growth in the 2024 - 2025 timeframe, and have an average price target of $101, which comes to a potential 19% total return over the next 12 months including dividends.

Investor Takeaway

LyondellBasell has been a steady and reliable dividend payer over the years, and continued this with its most recent dividend raise. Its strong balance sheet and efficient operating model make it a valuable asset and good bellwether for the global economy. Meanwhile, it's expanding its capabilities in a meaningful way in its core business and in circular solutions. All of this combined with a reasonable valuation make it a good value choice for income and growth investors alike.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!

This article was written by

I'm a U.S. based financial writer with an MBA in Finance. I have over 14 years of investment experience, and generally focus on stocks that are more defensive in nature, with a medium to long-term horizon. My goal is to share useful and insightful knowledge and analysis with readers. Contributing author for Hoya Capital Income Builder.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.