Okta: Macro Weakness Is Offsetting Sales Transformation

Summary

- Auth0 integration and sales force issues are improving, contributing to a rapid improvement in margins.

- Okta's Identity Governance and Privileged Access Management solutions could support growth going forward and support the company's competitive position.

- Okta's stock is reasonably priced given the quality of the company, but cloud spend will likely need to pick up before the stock moves higher.

BlackJack3D

Okta (NASDAQ:OKTA) is a leading supplier of identity and access solutions for the cloud. The stock has had a difficult time over the past few years though, due to sales force issues that were largely driven by the integration of Auth0. These problems appear to be resolved, although the success of the acquisition is unclear. The macro environment continues to weigh on the company's performance, but the introduction of IGA and PAM solutions should support growth and the company's competitive position.

Market

Okta has noted that the macro environment remains challenging, and deteriorated further between Q4 and Q1. This weakness is broad-based, with the business facing difficulties across regions and SMB and enterprise customers. This appears to be manifesting primarily in the acquisition of new customers, as growth is currently weighted towards upsells versus new business. Deal sizes are also smaller on average and customers are requesting shorter contracts.

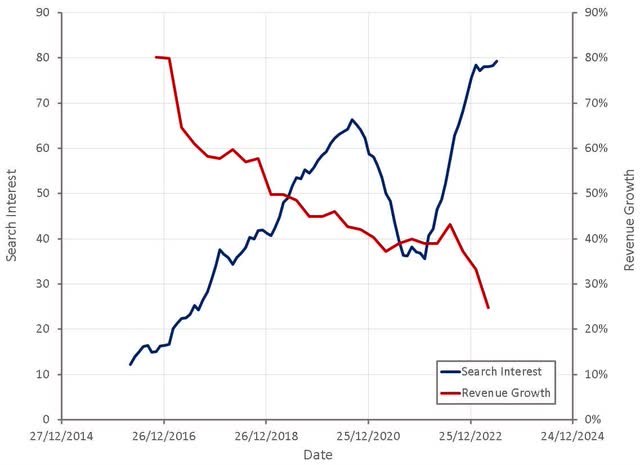

There have also been suggestions that as a premium product Okta has been facing pricing pressure. Okta's management team has stated that wins have remained strong though, with consistent unit pricing. Given the nature of Okta's products it is unlikely that customers will base purchase decisions primarily on price.

Figure 1: "Okta Pricing" Search Interest (source: Created by author using data from Google Trends and Okta)

Okta

Okta's Auth0 integration problems, and issues with the sales force, appear to be improving. Attrition in Okta’s go-to-market team is now at its lowest level in 2 years. Some of this may just be related to the weak labor market for enterprise software sales though. The number of fully ramped sales people is also approaching more normal levels, which is contributing to an improvement in productivity, and the number of sales reps closing Customer Identity Cloud deals is increasing.

With some of these issues now behind Okta, focus is likely to shift back to the strength of the company’s product portfolio and the long-term identity cloud vision. A large part of this involves the introduction of Identity Governance and Privileged Access Management solutions, which have been lacking in the past.

Okta Identity Governance has been on the market for some time now and Okta is reportedly pleased with its adoption. In the past 6 months, hundreds of organizations have purchased OIG, which Okta believes is validation of its integrated cloud-based approach to identity. Okta currently has around 18,000 customers though, so it is early days. OIG is gaining traction amongst some larger organizations, in addition to the mid-enterprise customers that Okta has primarily been targeting. It is also being adopted alongside other governance solutions, and in some cases is replacing other solutions.

Customer spending on OIG is typically around one third of total Workforce Identity Cloud spend, demonstrating that OIG could be a significant opportunity if adoption accelerates.

Okta’s PAM solution recently had a beta release, and general availability is expected by the end of the year. PAM products have been somewhat siloed in the past, whereas Okta’s solution will provide the same capabilities across resources, with a focus on the cloud. Okta wants to extend its access management and identity governance capabilities to privileged resources, which management hopes will accelerate adoption.

Okta also continues to introduce new products and features for its core products. Okta recently introduced advanced phishing resistance to FastPass. FastPass is a phishing-resistant passwordless authentication service that minimizes friction for end-users. Advanced Phishing Resistance ensures that authentication requests come from the correct server, rendering stolen keys useless.

Okta's Identity Engine is also gaining traction with customers, with over 40% of Okta’s workforce customers now on OIE. OIE provides a set of building blocks that customers can utilize to build customized solutions. Okta is also introducing self-service OIE upgrades, which allow customers to automate upgrades.

Security Center, a dashboard that delivers real-time insights into potential attacks, is now generally available. It helps customers optimize their security posture based on insights from Okta Customer Identity Cloud. It provides visibility of authentication events, potential security incidents, and threat response efficacy.

Financial Analysis

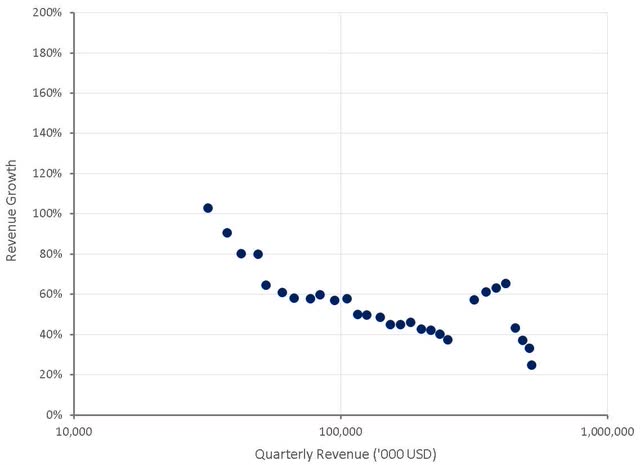

Revenue growth in the first quarter of FY2024 was roughly 25%. While growth has deteriorated significantly over the past 12 months, some of this is due to lapping the Auth0 acquisition, as well as sales force issues and a weak macro environment.

With some of these issues now in the past, and new products gaining traction in the market, revenue growth could stabilize, even in the face of market headwinds. Revenue growth is expected to be around 18% in the second quarter of FY2024, and 17-18% for the full financial year. While this only represents a modest deceleration from current levels, management has stated that this guidance assumes the macro environment gets worse.

Figure 2: Okta Revenue Growth (source" Created by author using data from Okta)

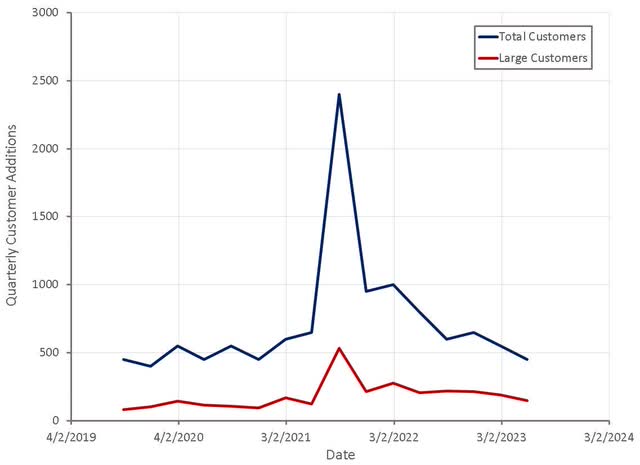

Customer growth has become an issue for Okta over the past few quarters, which is believed to be a result of the macro environment. Unsurprisingly, growth in larger customers has been strong relative to SMBs. For example, customers with over 1 million USD ACV increased by 40% YoY.

Figure 3: Okta Quarterly Customer Additions (source: Created by author using data from Okta)

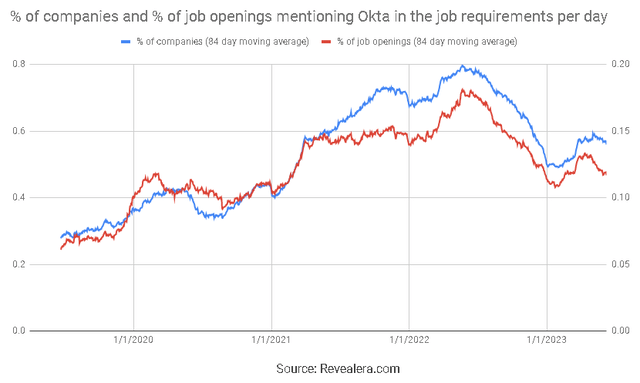

The number of job openings mentioning Okta in the job requirements had shown some strength at the start of the year, but is now falling off again. This could indicate that customer growth will continue to be a problem going forward.

Figure 4: Job Openings Mentioning Okta in the Job Requirements (source: Revealera.com)

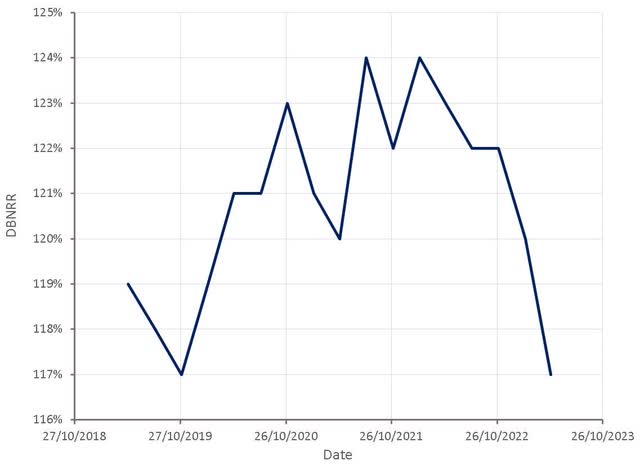

Okta’s net retention rate has also been moving lower, which has been attributed to a decline in upsell rates. Customers are not expanding seats as much as in the past, and the customer base is also more mature. These trends are expected to continue going forward. This primarily appears to be a macro problem as Okta’s gross retention rates have been consistently in the mid-90% range. Some of this macro weakness is being offset by strong growth in the cross-selling of products though.

Okta bases its DBNRR calculation on ACV on a YoY basis. This, coupled with the fact it has dropped sharply over the past 2 quarters, means Okta's DBNRR is likely to continue dropping sharply in the next 2 quarters, particularly if ACV expansion from existing customers continues to decelerate.

Figure 5: Okta Dollar-Based Net Retention Rate (source: Created by author using data from Okta)

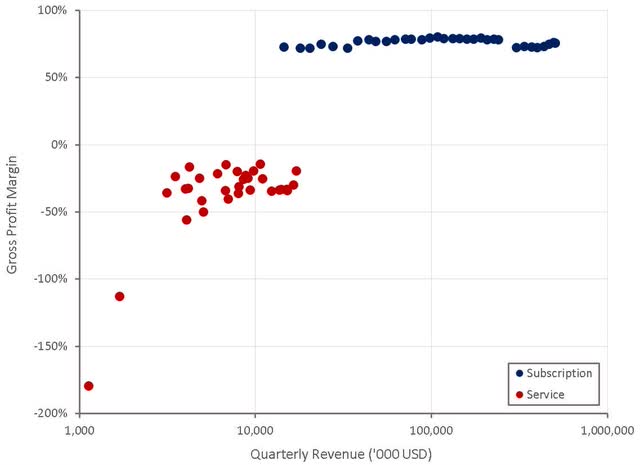

Okta's gross profit margins have increased over the past few quarters, returning to a more normal range after declining substantially on the back of the Auth0 acquisition.

Figure 6: Okta Gross Profit Margins (source: Created by author using data from Okta)

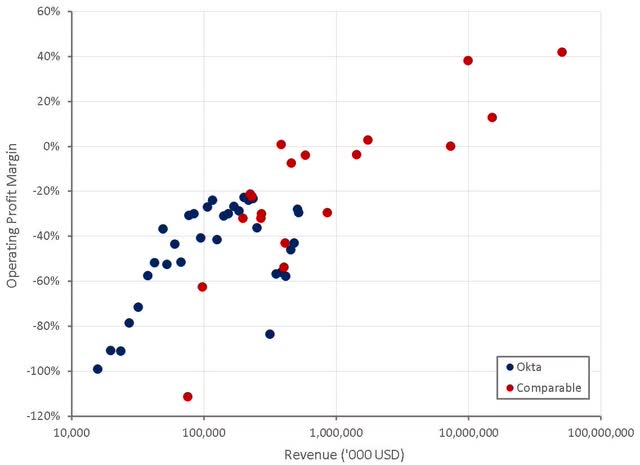

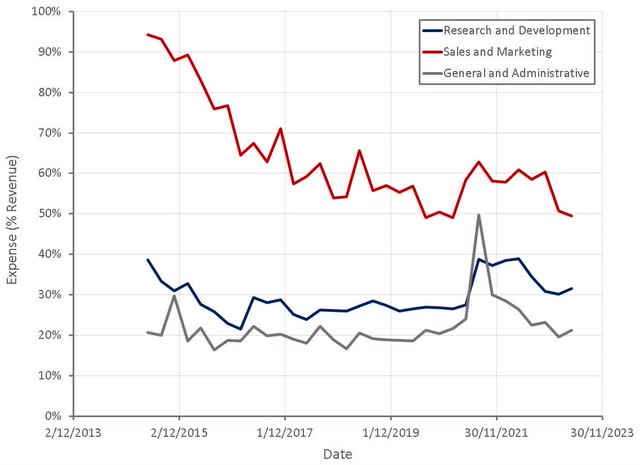

Operating expenses have been a far larger issue for Okta than gross profit margins though. Okta has generally been a reasonably efficient organization in the past, but operating losses blew out after the Auth0 acquisition. With SBC beginning to normalize and sales force issues being resolved, margins are improving rapidly.

Figure 7: Okta Operating Profit Margins (source: Created by author using data from company reports)

Okta laid off around 5% of its workforce in the first quarter, contributing to a 14 million USD restructuring cash outlay. This was attributed to over hiring in a weak macro environment, and should help to bring Okta's operating expenses back into line with its revenues.

SBC has also been a problem for Okta, a problem that management has been trying to address. The company appears to be targeting annual dilution in the 2-3% range, although dilution is currently sitting a little bit above this range.

Figure 8: Okta Operating Expenses (source: Created by author using data from Okta)

Valuation

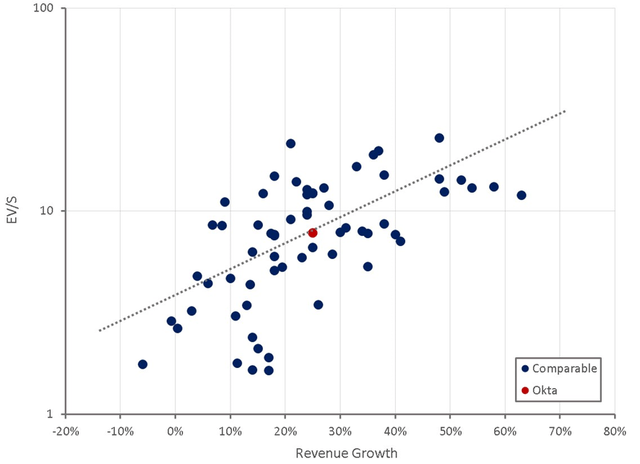

A lot of Okta's recent problems have now been resolved, which has supported the stock's rebound off the 2022 lows. Despite the move higher, Okta's stock is still reasonably priced given the quality of the company, but cloud spend will likely need to pickup before the stock moves higher.

Customer adoption of Okta's IGA and PAM products, in addition to cross-selling the CIAM solution, should help support growth going forward. The ultimate success of these new products remains unclear though.

Figure 9: Okta Relative Valuation (source: Created by author using data from Seeking Alpha)

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.