The Dark Side Of Mortgage REITs

Summary

- Mortgage REITs lure a lot of investors with their 10%+ dividend yields.

- But these high yields come with significant risks.

- Over time, mREITs have earned very poor returns for their shareholders, and I explain why.

- High Yield Landlord members get exclusive access to our real-world portfolio. See all our investments here »

JuSun

Over the past few months, I have published many articles making the case for investing in real estate investment trusts aka REITs.

To make it short:

- Their valuations are today the lowest in many years.

- Their balance sheets are the strongest ever.

- Rents keep growing at a solid pace in most property sectors due to the high inflation.

- Private equity players like Blackstone (BX) are buying REITs left and right.

- We think that they enjoy significant upside potential as interest rates return to lower levels.

- And you earn a high dividend yield while you wait.

Therefore, I believe that REITs offer some of the best risk-to-reward prospects in today’s market. In many cases, they are priced at large discounts to the fair value of the properties they own for no good reason.

But that’s not true for every REIT.

The REIT world is vast and versatile with 100s of companies globally and not all of them are worth buying even at today’s discounted prices.

Lately, I have received a lot of questions about mortgage REITs aka mREITs specifically, and I wanted to write this quick follow-up article to clarify that I don’t share the same optimism towards them.

Unlike Equity REITs (VNQ) aka eREITs that own properties, Mortgage REITs (MORT) invest in property debt, loans, and securities. As such, they are closer to banks than real estate investments in that they are really lenders, not landlords.

They are today heavily discounted and commonly offer 10%+ dividend yields, and that’s attracting the interest of many individual investors.

I think they may make attractive trading vehicles at today’s valuations, depending on your views of interest rates and spreads, but if you have a long-time horizon and aren’t interested in trading, then you would probably be better off sticking to traditional equity REITs.

Here are 5 reasons why:

Reason #1: mREITs' Horrible Track Record

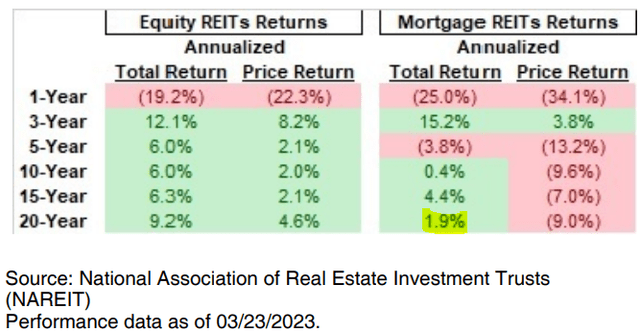

Firstly, let me start by showing you just how poorly mREITs have done in the long run. As a group, they have been a “value trap” – returning just 1.9% annually over the past 20 years:

In comparison, equity REITs, those that own actual properties, have earned nearly 10% annual returns over this same time period.

That’s a huge difference and I think that it can be explained by reasons 2, 3, and 4:

Reason #2: Bad Business Models

You don’t just earn such poor results as a group by accident.

It strongly hints that something might be wrong with the business models of mREITs, and I think that this is the case.

The main issue of mREITs is that they are really just a spread business. They borrow at rate x and attempt to earn a spread by lending at rate y.

But the problem is that interest rates and spreads can be extremely unpredictable, and as such, most mREIT business models aren’t built on solid foundations.

Their entire businesses can go from earning great returns to suffering large losses in just a few quarters based on macro factors that are mostly out of their control.

Making matters worse is the fact that they are heavily leveraged, which we discuss below:

Reason #3: Excessive Leverage

In the introduction of the article, I noted that REIT balance sheets are today the strongest ever. This is the case with equity REITs. Their average loan-to-value is just 30%, most of that debt has a fixed rate, and debt maturities are long and well-staggered. That’s very conservative and it explains why most equity REITs are doing just fine today.

But mREITs are generally a lot more aggressive in their approach to leverage.

Since their underlying investments are generally safer (loans or securities), they will use a lot more leverage, often 2-3x their equity, to earn attractive returns. To give you an example, Blackstone Mortgage Trust (BXMT) has a 67% debt ratio – which is way more than what a typical equity REIT would ever use.

High leverage may lead to high returns when things are going well, but you then risk losing it all when things go south, and that’s why many of these mREITs have such poor track records.

They are using high leverage and their businesses rely on unpredictable factors, causing them to go through boom-and-bust cycles.

Why not use less leverage? Reason #4 may explain why:

Reason #4: Significant Conflicts of Interest

Not all, but many mREITs are poorly managed and suffer significant conflicts of interest.

Today, most equity REITs are internally managed, which means that the management is hired as employees of the REIT. This is today the preferred management structure because it does a better job of aligning interests between the manager and shareholders. The managers earn salaries that are largely based on some key performance indicators and the managers are solely focused on this one REIT.

But a lot of mREITs are externally managed, which means that the management is outsourced to an outside asset management firm like Blackstone, Starwood, or KKR (KKR).

This leads to greater conflicts of interest because the manager will typically earn fees that are based on the volume of assets under management and some incentive fees based on performance above a certain hurdle.

The issues with such fee structures are that: (1) it will incentivize the manager to grow the size of the REIT as much as possible since this will lead to higher management fees. This means that the manager will be motivated to make a lot of equity raises – often at the detriment of shareholders. (2) Secondly, the manager will also want a piece of the performance in the form of incentive fees, which are typically only earned if they hit a certain hurdle. To get there, they will then take on a lot of leverage, which will allow the managers to get incentive fees during the good years, but they don’t share the downside when losses occur.

Their risk-to-reward is asymmetric, and their interests aren’t well aligned with shareholders.

Reason #5: Questionable Risk-to-Reward

It feels like mREIT investors are always just one black swan away from getting their multi-year returns wiped out, and this is why I think that their risk-to-reward is often questionable.

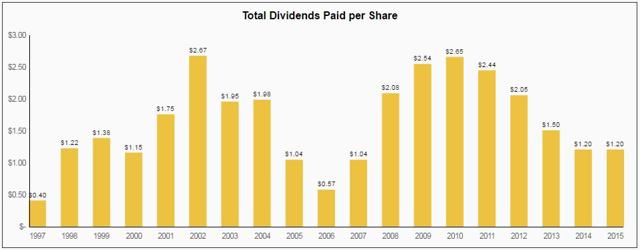

Their businesses rely too heavily on unpredictable factors like interest rates and spreads, they take on too much leverage, and the management is often conflicted. Just look at the dividend track record of a blue-chip mREIT like Annaly Capital Management (NLY):

Annaly Capital Management

The business model is just too unpredictable.

Valuations are today discounted, and so I am bullish on the near-term prospects of most mREITs, but I don’t share the same optimism about their long-term prospects in most cases.

Closing Note: eREITs > mREITs – With Some Exceptions

Generally speaking, I believe that investors would be better off focusing on eREITs, despite their lower dividend yields.

eREITs are conservatively financed real estate investments that typically enjoy consistent cash flow and steadier growth prospects.

mREITs, on the other hand, are aggressively financed loan and securities investments that go through boom and bust cycles that are the result of unpredictable macro factors, excessive leverage, and conflicted management.

There are, of course, exceptions. We also own a few mREITs at High Yield Landlord, but don’t make the mistake of putting too much of your capital into these vehicles.

If you want full access to our Portfolio and all our current Top Picks, feel free to join us at High Yield Landlord for a 2-week free trial

We are the largest and best-rated real estate investor community on Seeking Alpha with 2,500+ members on board and a perfect 5/5 rating from 500+ reviews:

You won't be charged a penny during the free trial, so you have nothing to lose and everything to gain.

Start Your 2-Week Free Trial Today!

This article was written by

Jussi Askola is a former private equity real estate investor with experience working for a +$250 million investment firm in Dallas, Texas; and performing property acquisition in Germany. Today, he is the author of "High Yield Landlord” - the #1 ranked real estate service on Seeking Alpha. Join us for a 2-week free trial and get access to all my highest conviction investment ideas. Click here to learn more!

Jussi is also the President of Leonberg Capital - a value-oriented investment boutique specializing in mispriced real estate securities often trading at high discounts to NAV and excessive yields. In addition to having passed all CFA exams, Jussi holds a BSc in Real Estate Finance from University Nürtingen-Geislingen (Germany) and a BSc in Property Management from University of South Wales (UK). He has authored award-winning academic papers on REIT investing, been featured on numerous financial media outlets, has over 50,000 followers on SeekingAlpha, and built relationships with many top REIT executives.

DISCLAIMER: Jussi Askola is not a Registered Investment Advisor or Financial Planner. The information in his articles and his comments on SeekingAlpha.com or elsewhere is provided for information purposes only. Do your own research or seek the advice of a qualified professional. You are responsible for your own investment decisions. High Yield Landlord is managed by Leonberg Capital.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of KKR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.