MSCI: Why I'm Looking To Buy This Wealth Compounder

Summary

- In this article, I'm reassessing MSCI Inc. as a potential investment due to its potential for wealth compounding and dividend growth.

- The company has a great business model paving the way for strong long-term growth and rising margins at already elevated levels.

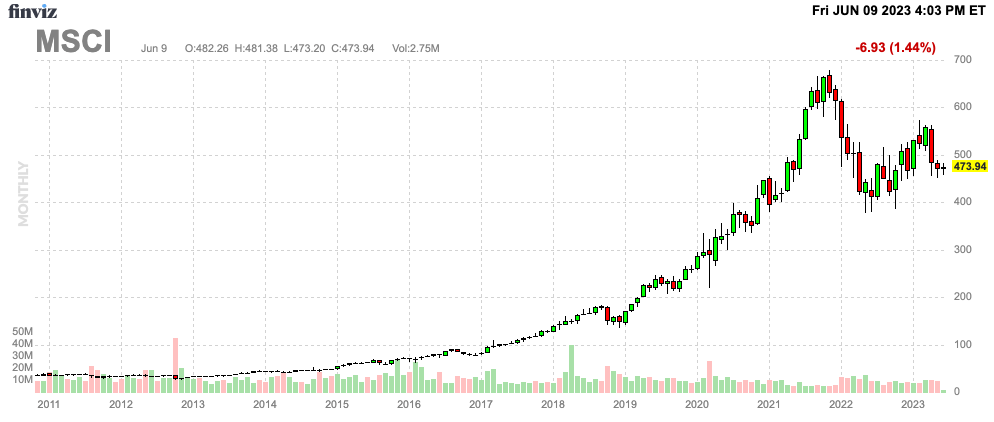

- MSCI shares are currently trading 30% below their all-time high, causing the price to come close to an attractive entry level.

Michael M. Santiago

Introduction

While I keep plenty of digital files of everything I do, I have a piece of paper next to my computer with a list of stocks that I'm watching for potential entries. One of the stocks on that list is MSCI Inc. (NYSE:MSCI), a stock I haven't discussed since April of last year.

The reason why I haven't covered it anymore or bought it is because of my focus on stocks that fall more into the value category. After all, my base case was above-average inflation for a prolonged basis.

It's also why MSCI shares are trading roughly 30% below their all-time high.

In this article, I'm re-assessing the stock, as I believe it's a terrific wealth compounder for investors that care about the growth in dividend growth.

So, let's get to it!

Why I Like MSCI's Business Model

I'm monitoring a lot of dividend investing groups on Facebook and Reddit. I do it to see what the masses are buying and interested in.

One thing I noticed is that a lot of investors buy MSCI-linked ETFs, which brought up a question: how can I benefit from that?

We can benefit from that by buying MSCI.

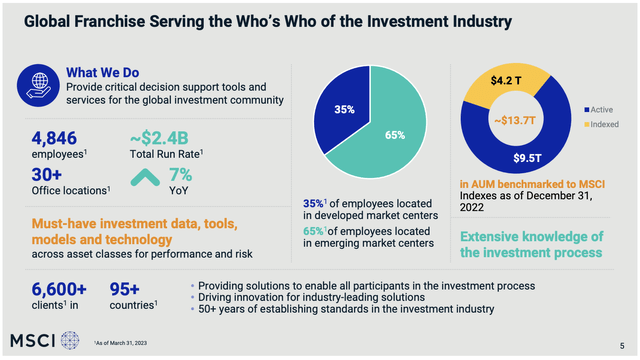

With a market cap of $38 billion, New York-based MSCI is one of the largest financial service companies in the world. The company officially operates in the financial data & stock exchanges industry, where it services more than 6,600 clients in almost 100 nations.

MSCI Inc.

Morgan Stanley Capital International (that's where the name comes from) makes most of its money in the Index segment, where it generated 58% of its 2022 revenues.

26% of its revenues were generated in the Analytics segment, followed by 10% in the Environmental, Social, Governance, and Climate segment ("ESG").

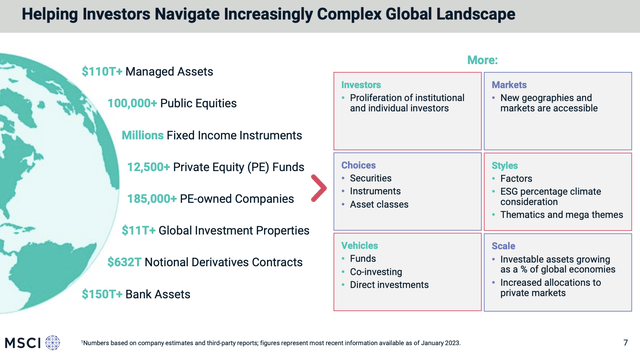

As these numbers show, the core of the MSCI business is its indexes, which serve as benchmarks for investors. These indexes cover equity, fixed income, and multi-asset class investments, essentially enabling clients to measure performance, allocate assets, and create investment products like ETFs.

MSCI Inc.

MSCI also provides portfolio analytics and risk management tools, helping clients assess factors such as exposure, performance attribution, and risk modeling.

When it comes to ESG, the company offers research and indexes that allow investors to incorporate sustainability considerations into their strategies. Additionally, MSCI provides real estate indexes for measuring the performance of real estate investment portfolios.

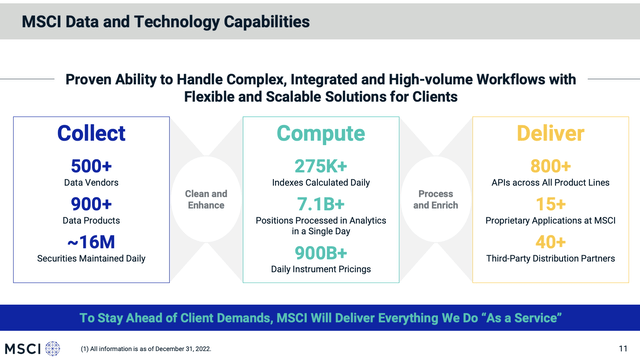

Furthermore, by leveraging advanced data analytics and technology, MSCI collects and processes large amounts of financial and non-financial data to deliver its products and services.

MSCI Inc.

It generates revenue through licensing agreements, where clients pay fees based on product usage and subscription scope.

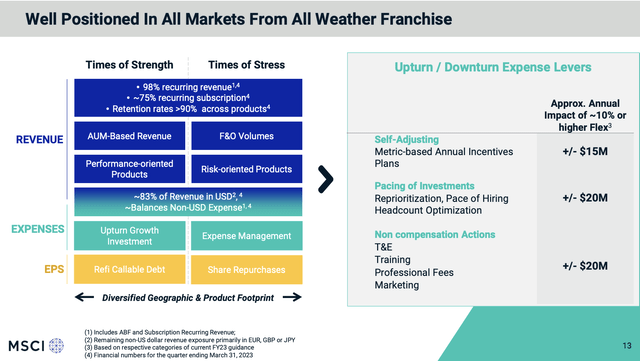

As the overview below shows, almost all of its revenues are recurring revenues. 75% are recurring subscription revenues. The company has a 90% retention rate, which helps tremendously to grow its business over time.

MSCI Inc.

With all of this in mind, I would make the case that MSCI has a relatively large moat. While financial services is a crowded industry with many high-profile players, they each serve a different niche. MSCI benefits from the index business and its ability to deliver related services.

Moreover, while I am highly skeptical when it comes to the ESG trend, I believe that MSCI is one of the best ways to benefit from that trend.

In addition to that, MSCI benefits from increasing demand for its services. An increasing number of retail traders have found out about the power of ETFs, digitalization is speeding up, and data collection and distribution are increasingly efficient and powerful.

Where's The Value For Shareholders?

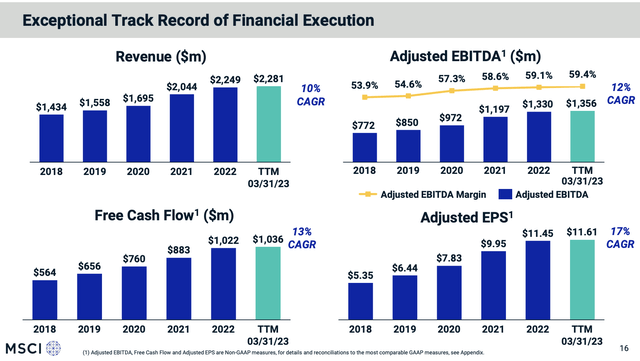

Thanks to the mix of offering the right products and services at the right time, MSCI has grown its top line by 10% per year since 2018.

Thanks to an adjusted EBITDA margin increase from 53.9% in 2018 to 59.4% in the last four quarters, the company was able to grow EBITDA by 12% per year.

MSCI Inc.

Note that the company continued its growth after 2021 when market euphoria peaked. Back then, everyone started to trade stocks, which was highly beneficial to MSCI. It's also why I started to get interested in the company, as I wondered how to make money from increasing data and ETF demand.

Free cash flow rose by 13% during this period.

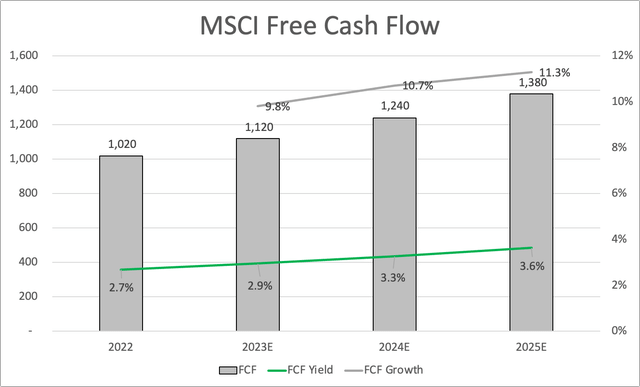

Even better, analysts expect free cash flow growth to accelerate in the years ahead. This year, free cash flow is expected to grow by 10%. That growth rate is expected to exceed 11% again in 2025.

Leo Nelissen

The implied free cash flow yield for 2024 is 3.3%, which is great news for shareholders for three (related) reasons.

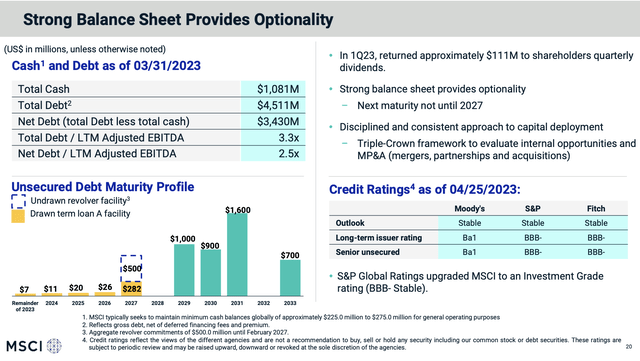

- Reason one is the company has a healthy balance sheet. It has a 2023E net leverage ratio of 2.1x EBITDA and a BBB- credit rating. Hence, it does not have to prioritize debtholders. Furthermore, the company has no major debt maturities until 2029, which buys the company a lot of time in the current high-rate environment.

MSCI Inc.

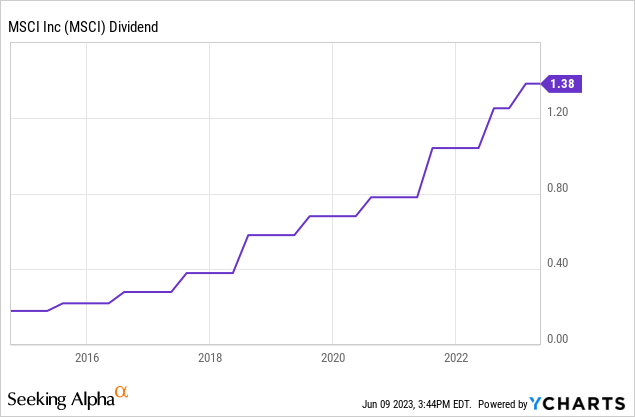

- Reason two is that MSCI has a fantastic dividend track record. Historically, the company has maintained a 40% payout ratio, which means that earnings growth translates to higher earnings. While the company's 1.2% yield isn't juicy, the company scores extremely high (I'm referring to its dividend scorecard) on safety and growth. Over the past five years, the dividend has been hiked by 28% per year - on average. On January 31, the board approved a 10.4% hike. These numbers make up for a low yield. Unless you're in need of high income from your investments, this low yield is no dealbreaker.

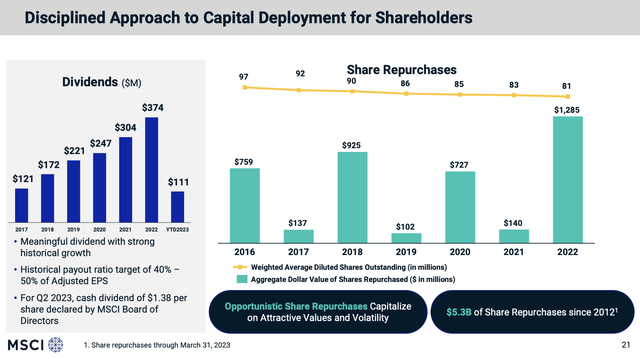

- Reason three is that excess cash is used to repurchase shares. The company uses opportunistic share repurchases to capitalize on attractive values and volatility. In other words, it only buys back shares when it believes that its company is undervalued. In 2021, it bought back shares worth $140 million. In 2022, buybacks were $1.3 billion. Between 2016 and 2022, the company bought back 16% of its shares at very favorable prices. This kind of management is great for long-term shareholder returns.

MSCI Inc.

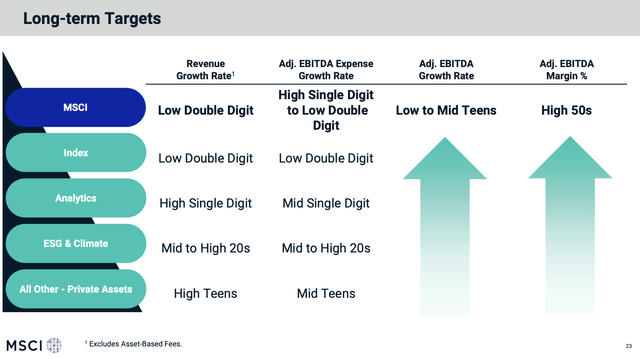

On a long-term basis, the company expects EBITDA growth to remain in the high single-digit to the low double-digit range. Margins are expected to remain in the high 50% range.

The fastest-growing segments are expected to be Analytics and ESG.

MSCI Inc.

With regard to the current challenging environment, the company is doing well. Despite facing challenges such as tighter client budgets and longer sales cycles, MSCI closed over $56 million in new recurring subscription sales in the first quarter, contributing to a total recurring subscription run-rate of $1.84 billion with 12% organic growth. I did not expect growth to be that high.

Furthermore, the company remains confident in the mission-critical nature of its data models, research, and tools. The sales pipeline and client engagement across products and regions are steady, with promising larger deals expected to be closed in the second quarter. Retention rates remain strong, reflecting investments made in products and client servicing capabilities.

Hence, I expect MSCI's resilience in tough times and its superior business model to provide outperformance in the future.

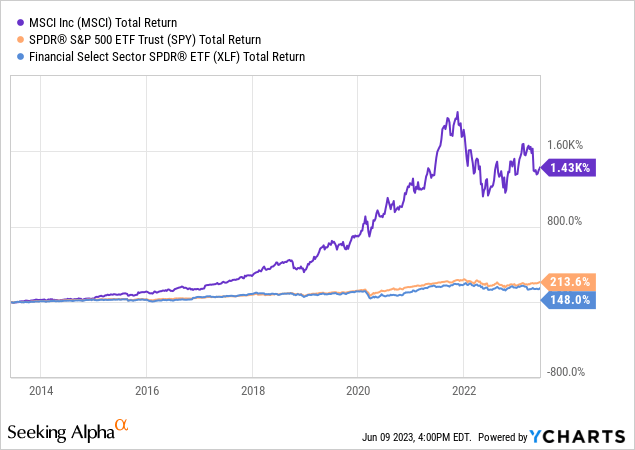

During the past ten years, MSCI shares have returned 30.8% per year. That number has come down to 24.9% over the past five years. Over the past three years, the company has returned 13.7%. Needless to say, the company has outperformed its peers and the market by a wide margin.

Portfolio Visualizer

While I do not believe that the company will continue to return 30% per year, I believe that double-digit long-term growth close to 15% is highly likely.

This brings me to the valuation.

Valuation

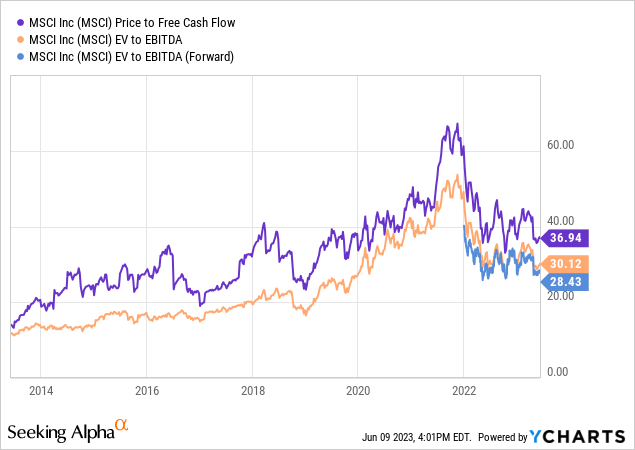

This is the part that's less great. MSCI is not cheap. The company is trading at 33x 2024E free cash flow, which is elevated, but back at pre-pandemic levels. The same goes for its forward EV/EBITDA multiple.

While I believe that a certain premium is warranted because of the company's high expected free cash flow growth and business model that benefits from secular growth, I'm not chasing the price at current levels.

Hence, I'm once again playing a dangerous game called waiting for better entry prices. As I believe that the Fed will have to keep rates higher for longer due to sticky inflation, I wouldn't bet against a deterioration in demand for financial services.

Hence, I believe that if my thesis turns out to be correct, I might get a shot at buying MSCI for close to $400. At that price, I would be willing to start adding MSCI shares to my portfolio, as I consider the company to be a great fit for my value-overweight portfolio.

FINVIZ

The current consensus price target is $550, which implies a 16% upside potential.

I agree with that. Hence, my bullish rating is a long-term rating. Please bear that in mind. It reflects the longer-term risk/reward, as I still expect some short to mid-term headwinds.

Takeaway

MSCI Inc. presents an attractive opportunity for investors seeking dividend growth and exposure to the financial data and stock exchange industry.

With its robust business model centered around indexes, analytics, and ESG offerings, MSCI has established a solid moat in a crowded market.

The company's consistent revenue growth, increasing free cash flow, and strong dividend track record make it an appealing choice for long-term shareholders.

Additionally, MSCI benefits from the rising demand for its services, driven by factors like the popularity of ETFs and digitalization trends.

While the current valuation is relatively high, patient investors may find better entry points in the future.

Overall, MSCI's resilience, superior business model, and potential for double-digit growth position it well for outperformance in the coming years.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.