U.S. Household Wealth Rose $3tn In The First Quarter

Summary

- A strong performance by equity markets lifted household wealth, helping to offset declines in real estate and cash, checking, and time savings deposits.

- With wealth $35tn higher than before, the pandemic households continue to have a strong platform to withstand intensifying economic headwinds, offering hope that any recession will be short and shallow.

- We remain hopeful that a likely 2023 recession will be modest and short-lived assuming a swift easing of monetary policy from the Federal Reserve.

stu99

By James Knightley, Chief International Economist

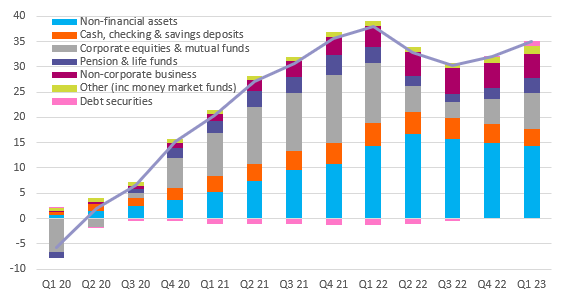

Wealth increase led by equity market gains

The value of assets held by US households increased by $3.05tn in the first three months of the year, taking the total assets held by the household sector to $168.5tn. Liabilities rose just $23bn to $19.6tn, leaving net household worth at $148.8tn. Rising equity markets were the main factor leading to the increase, but holdings of debt securities increased by $893bn. These factors more than offset the $617bn drop in household wealth in real estate and the $415bn decline in cash, checking, and time savings deposits held by US households.

Household wealth is $35tn higher than before the pandemic struck

Macrobond, ING

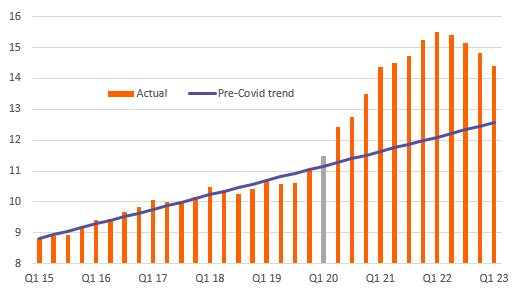

Excess savings are dropping

We have to remember that March saw the collapse of Silicon Valley Bank (OTCPK:SIVBQ) and Signature Bank (OTCPK:SBNY) with deposit flight hitting many of the small and regional banking groups. We have subsequently seen this situation stabilize although some money that would typically be left in banks has been switched to money market funds. Nonetheless, we do appear to be seeing much of the excess saving built up during the pandemic via stimulus payments and extended and uprated unemployment benefits being eroded - it is now "only" around 1.8tn above where we would expect it to be based on long-run trends. This is especially the case now that households have an apparent appetite to spend, particularly on services.

Cash, checking and time savings deposits are reverting to trend ($tn)

Macrobond, ING

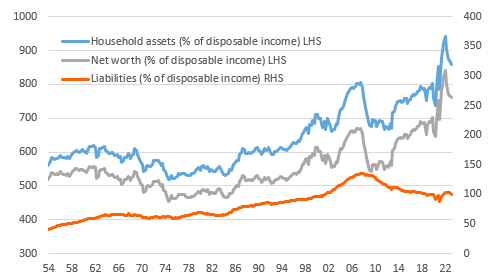

Household balance sheets are in a good position to help limit the downside of a recession

After the most rapid and aggressive period of interest rate hikes seen in over 40 years plus the tightening of lending conditions currently being experienced in the US, recession fears are mounting. Households will play a huge role in how prolonged and deep any downturn will be given consumer spending accounts for more than two-thirds of economic activity in the United States.

Household assets and liabilities as a proportion of disposable income

Macrobond, ING

Household assets are 860% of disposable income while liabilities are 'just" 100% of disposable income. While this is down on the peak seen in 1Q 2022 and there are questions over wealth concentration, this is a much better position than any previous recessionary environment and means that the consumer sector should be better able to withstand intensifying economic headwinds. Consequently, we remain hopeful that a likely 2023 recession will be modest and short-lived assuming a swift easing of monetary policy from the Federal Reserve.

Content Disclaimer:

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation, or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal, or tax advice, or an offer or solicitation to purchase or sell any financial instrument. Read more.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by