Big Tech Strikes Back

Summary

- The 2023 stock market rally is driven by AI speculation and Big Tech giants, with the MAAMG group (Meta, Apple, Amazon, Microsoft, and Google) reaching a combined valuation of approximately $10 trillion.

- Citigroup's lead strategist Dirk Willer and the bank's asset allocation team have upgraded US tech shares to overweight, expecting the AI-driven rally to continue.

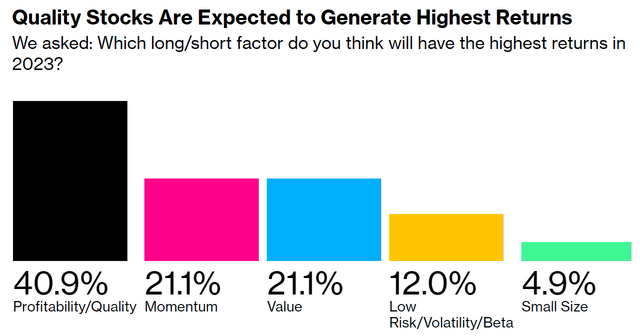

- A Bloomberg MLIV Pulse survey found that 34.3% of respondents expect equities to outperform other asset classes over the next 12 months, with 41% believing that investing in quality stocks focused on profitability will yield the highest returns.

pressureUA

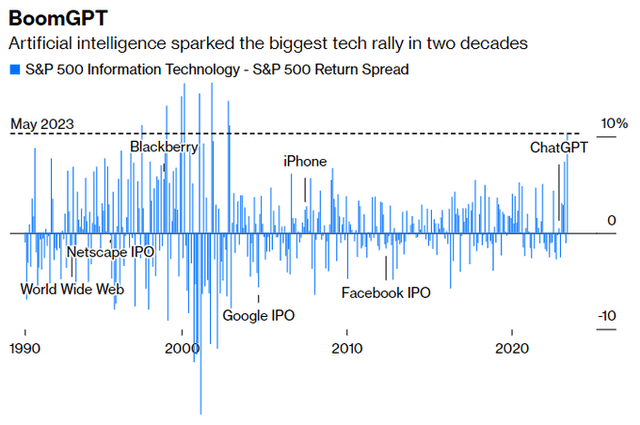

2022 was a tough year for BigTech and long duration/ growth assets, and stocks in general, with the Nasdaq 100 (NDX) (QQQ) closing about 33% lower YoY. But in 2023, the technology giants' shares have rebounded with such vengeance, that the rally is hard to ignore. In fact, following the ChatGPT/ AI mania, the S&P 500 Information Technology vs. S&P 500 spread widened the most in 20 year.

Bloomberg

With that frame of reference, Nvidia (NVDA) CEO has previously compared the advent of AI to the "iPhone moment" (emphasis added):

"This is the iPhone moment of artificial intelligence ... this is the time when all those ideas within mobile computing and all that, it all came together in a product that everyone kinda [says], I see it, I see it ...

... What OpenAI has done, what the team over there has done, genuinely, one of the greatest thing that has ever been done for computing.

However, reflecting on the verdict of the market, the AI mania compares more to the early innings of a "Dot.com moment", implying that there is still more juice in the 2023 rally.

All The Power Is Currently In Big Tech

The most recent stock market rally is carried by AI speculation. And AI speculation is carried by the big tech giants: In their Q1 earnings call with analysts and investors, Alphabet (GOOG) (GOOGL) has mentioned the AI keyword 50 times, Meta (META) 49 times, Microsoft (MSFT) 46 times, and Nvidia managed to sneak in 77 mentions.

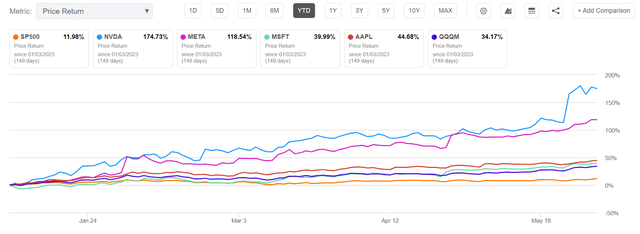

The thesis is also very well reflected in the share price performance of BigTech over the past few months: YTD, shares of NVDA, META, MSFT and AAPL are up close to 175%, 120% 40% and 45% respectively, outperforming the S&P 500 by a factor of x4 - x15.

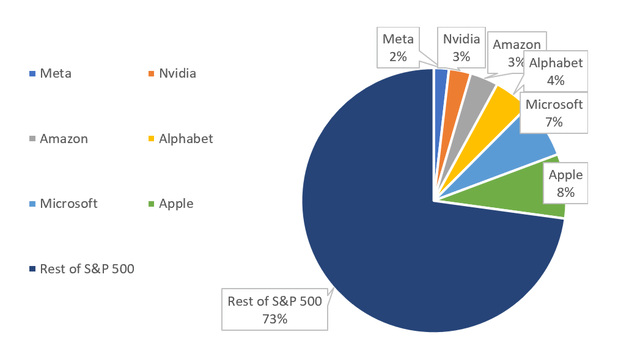

With that frame of reference, the MAAMG group, consisting of the major Tech giants including Meta, Apple (AAPL), Amazon (AMZN), Microsoft and Google, now claim a combined valuation of approximately $10 trillion, accounting for ~27 of the entire S&P 500 index - the highest market cap concentration ever. Notably, Apple and Microsoft alone now account for close to 15% of the S&P 500.

In context of arguing that all the power is in BigTech, there is one final observation that I would like to highlight: According to Refinitiv data, the US stock market has actually been in a downward trend, excluding BigTech's share price appreciation. The S&P 500 Equal Weighted index, which gives equal importance to each stock, has decreased by 0.35 percent since January. In contrast, the 'standard' benchmark S&P 500, where companies with larger market capitalizations have a greater influence, has gained 9.5 percent. The percentage of S&P 500 constituents that are outperforming the index on a trailing 60-day period is currently at about 12%, the lowest point since at least 1993.

The Tech Rally Is Expected To Continue

Citigroup lead strategist Dirk Willer and the bank's asset allocation team have adjusted their bet on US stocks, upgrading NAM equities to neutral, and U.S. tech shares to overweight. This decision has been argued through several factors: Firstly, they anticipate the Federal Reserve's rate hikes to come to an end, which would boost the appeal of long duration assets. Secondly, they highlight the resilience of the American economy when compared to China and Europe. And thirdly, they specifically emphasize the influence of AI on US equities, as the market has a substantial exposure to tech mega-cap companies, which would likely drive further price appreciation as expectations for AI build (emphasis added):

While price moves for AI-related stocks have clearly been extreme, especially at a time when monetized-use cases are still in the future, and with barriers to entry not overly high, we would still expect that it is too early to fade the moves before AI has even developed far enough to be able to disappoint expectations

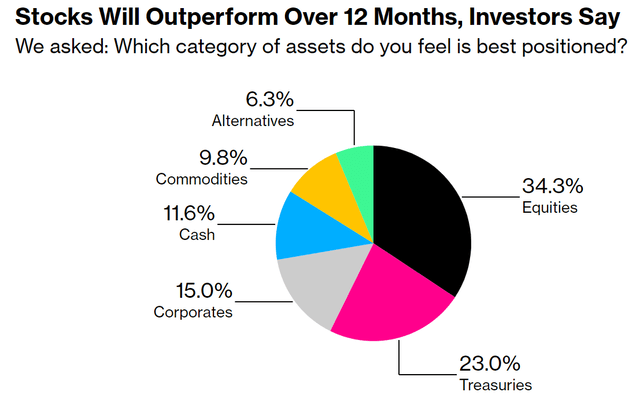

In the recent MLIV Pulse survey conducted by Bloomberg, which is a survey conducted on a weekly basis by Bloomberg's Markets Live team, targeting Bloomberg News readers through the terminal and online platforms, it was found that out of 492 participants, 34.3% expect equities to outperform other asset classes over the next 12 months.

Bloomberg MLIV Pulse survey May 22-26 with 492 respondents

In addition, 41% of participants held the belief that investing in quality stocks with a focus on profitability would yield the highest returns this year, as quality emerged as the superior factor for capital allocation, followed by momentum (21.1%). Needless to say, 'Quality' and 'Momentum' favor the BigTech giants such as Apple, Microsoft and Nvidia.

Bloomberg MLIV Pulse survey May 22-26 with 492 respondents

Conclusion

On May 22nd, I argued that the S&P 500 (SP500) rally will likely gain steam, defying the doom scenarios. Today I reiterate my bullish thesis, as I expect AI considerations to overshadow macro negativity. And in any case, the AI mania is also supported by fundamentals. Investors should consider Nvidia's bumper outlook for FY 2024 -- provoking a close to 100% EPS consensus upward revision for the current fiscal year.

Earnings are also ticking up, although to a lesser extent, for other BigTech companies such as MSFT...

... and META.

In my personal view, I anticipate the Nasdaq 100 index reaching a level of 16,000 by the end of the year. This prediction suggests a reasonable, growth-skewed price-to-earnings (P/E) multiple of x25 for the forward fiscal year 2024. To capitalize on this outlook, I am doubling down on my bullish 105/115% moneyness call spread bet on the S&P 500, with a similar bet on the Nasdaq 100. The 105/115% call spreads with December 10th expiration date have the potential for a ~4:1 payoff if the Nasdaq 100 benchmark closes at or above $16,000

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SPY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.