Avista Corporation: Renewable Energy Transformation Expanding Cash Flow Capabilities

Summary

- Avista Corporation is a hold due to its large dividend, renewable energy strategy, and overvaluation based on DCF figures.

- AVA's adoption of renewable energy sources contributes to long-term financial stability and cash flow predictability.

- Avista faces operational, maintenance, and regulatory risks in its highly regulated industry.

deyanarobova

Avista Corporation (NYSE:AVA) has displayed consistent and long-term growth over the years. I believe that the company is currently a hold because although the company pays a solid dividend and is adopting renewable energy practices, the stock is currently overvalued assuming my DCF figures.

Business Overview

Avista Corporation is an electric and natural gas utility company that operates through two main segments: Avista Utilities and AEL&P.

Under the Avista Utilities segment, the company provides electric distribution and transmission services, as well as natural gas distribution services in certain regions of eastern Washington, northern Idaho, northeastern and southwestern Oregon. Additionally, Avista Utilities generates electricity in Washington, Idaho, Oregon, and Montana. This segment is also involved in the wholesale buying and selling of electricity and natural gas.

The AEL&P segment focuses on providing electric services specifically in the city and borough of Juneau, Alaska.

Avista Corporation generates electricity through a variety of sources including hydroelectric, thermal, and wind facilities. These power generation facilities contribute to the company's ability to meet the energy demands of its customers in a reliable and sustainable manner.

In addition to its core utility operations, Avista Corporation also engages in venture fund investments, real estate investments, and other investments. These additional activities provide the company with opportunities to diversify its revenue streams and explore potential growth areas beyond its traditional utility services.

Avista

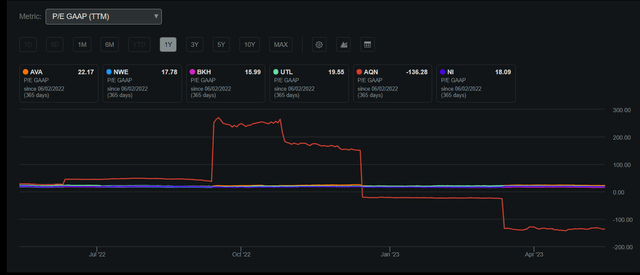

Avista Corporation, with a market capitalization of $3.15 billion, has experienced a 52-week high of $45.29 and a low of $35.72. Currently priced at $42.15, the stock is trading in proximity to its 200-day moving average of $41.37. However, with a price-to-earnings ratio GAAP of 22.17, Avista appears relatively expensive compared to its industry peers

Avista 1Y P/E GAAP Compared to Peers (Seeking Alpha)

Avista Corporation also offers a dividend yield of 4.43%, indicating a payout ratio of 96.36%. While this demonstrates Avista's dedication to providing returns to shareholders, it also suggests that a significant portion of the company's free cash flow is allocated to dividend payments. As a result, there may be limited available funds for other purposes, including maintaining the sustainability of the dividend and pursuing expansionary initiatives.

With Q1 2023 results missing expectations on the top and bottom lines with a $0.43 miss on earnings per share at $0.73 and a $25.23 million miss on revenue at $460.14 million showing a 2.5% Y/Y growth, the company is displaying underperformance in a time of moderate economic headwinds. With 2023 consolidated earnings guidance with a range of $2.27 to $2.47 per diluted share, I believe that this miss demonstrates the company's urgency to pivot to a long-term strategy that would provide consistency and security for investors due to the risky nature of its dividend.

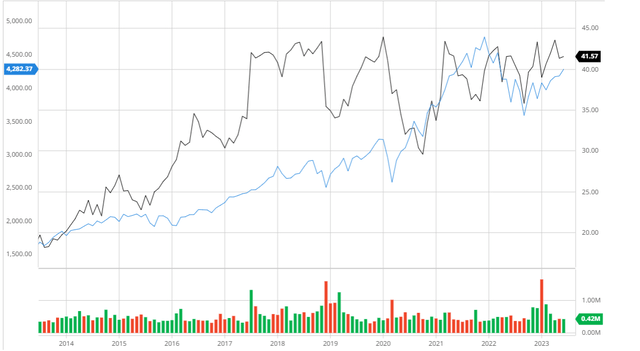

Outperforming the Broader Market

In the last decade, Avista has exhibited superior performance compared to the S&P 500 when considering dividend adjustments. This achievement highlights the company's capacity to enhance shareholder value by distributing dividends while simultaneously expanding its business operations.

Avista Compared to the S&P 500 10Y (Created by author using Bar Charts)

Renewable Energy Adoption Creating Cash Flow Stability

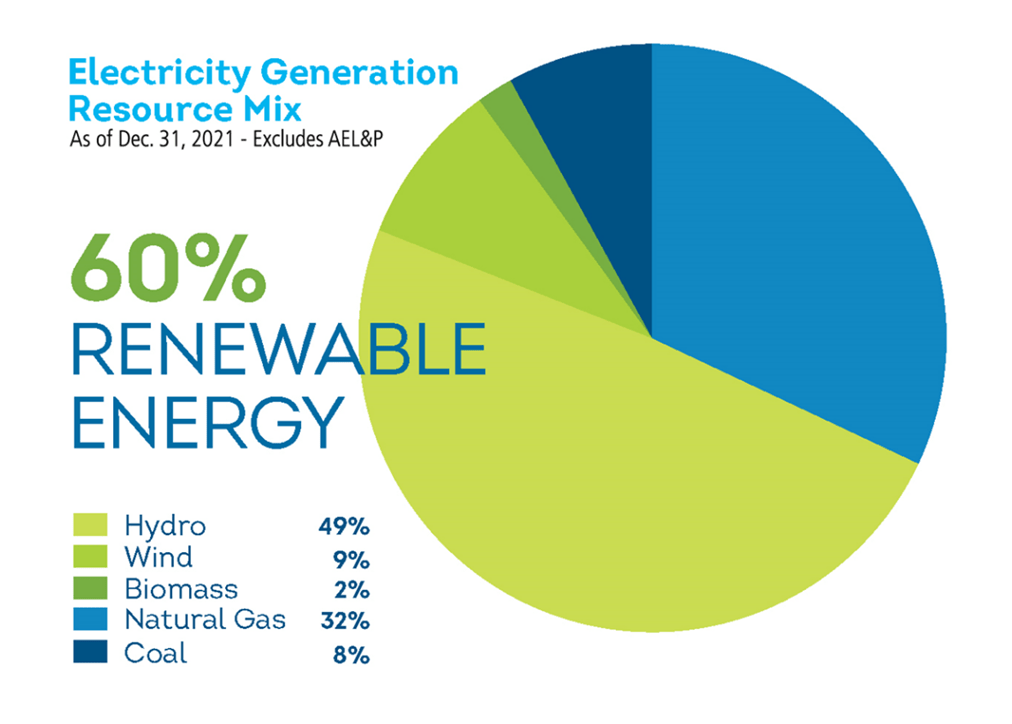

Avista Corp. has a clear renewable energy plan that strives to move away from dirty energy sources and toward ones that are more environmentally friendly. As part of its long-term financial and environmental aims, the corporation is dedicated to lowering its carbon footprint and supporting the generation of renewable energy.

The creation and acquisition of green energy projects is a crucial component of Avista's sustainable energy strategy. For instance, the corporation has made investments in wind farms including Washington State's Palouse Wind Project. The 58 megawatts of clean electricity produced by this plant can power thousands of homes. Avista diversifies its energy mix and lessens its dependency on fossil fuels by investing in wind energy. This helps the company maintain long-term financial stability and lowers its exposure to uncertain energy markets.

The use of renewable energy by Avista has a number of long-term financial advantages. First off, the corporation lessens its vulnerability to market instability and variations in fuel prices by diversifying the energy it produces with renewable sources. Because they often have fewer expenses for operation and extended asset lifespans, renewable energy projects give Avista steady and predictable cash flows.

Second, Avista's investment in green energy sources enables the company to seize market possibilities as the need for clean energy increases. Avista can grow its consumer base from customers who care about the environment. Long-term, this will result in superior financial performance, increased revenue, and client retention.

Furthermore, Avista's plan for renewable energy is in line with changing legal requirements and government incentives meant to encourage the use of clean energy. Avista can benefit from beneficial regulations, such as tax breaks and sustainable portfolio standards, by strategically pursuing renewable energy projects. These policies can offer financial benefits and assistance for the company's renewable energy activities.

Avista

Analyst Consensus

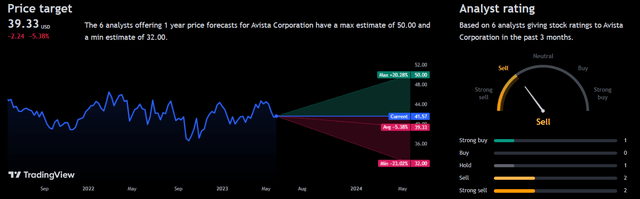

Avista is currently given a "sell" rating by analysts for the next 12 months. The average price target of $39.33 indicates a potential downside of 5.38% for the stock.

Valuation

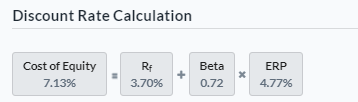

By utilizing the Capital Asset Pricing Model and considering a risk-free rate of 3.7%, which corresponds to the 10-year treasury yield, I have calculated the Cost of Equity for Avista. The results indicate a Cost of Equity of 7.13%, as shown below.

Created by author using Alpha Spread

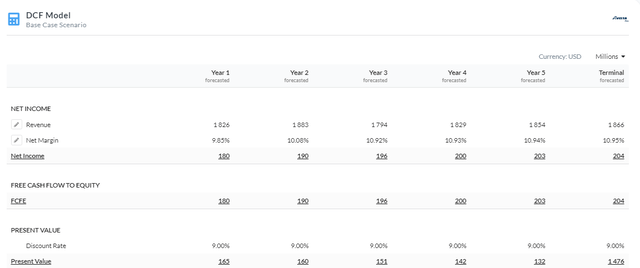

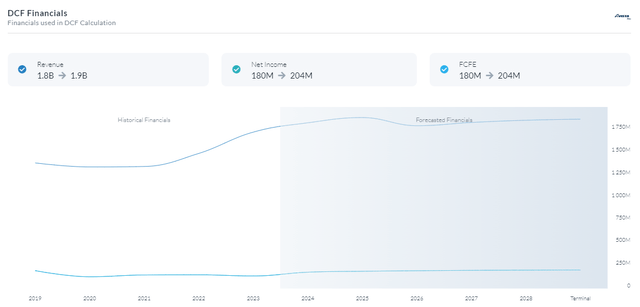

Based on an Equity Model DCF analysis using net income, Avista is found to be overvalued by 29% with a fair value estimate of around $29.37. This evaluation was conducted by applying a discount rate of 9% over a 5-year period. To accommodate factors like the high payout dividend and potential macroeconomic challenges, a risk premium of 1.87% was incorporated into the analysis. Furthermore, the projected expansion of Avista into renewable energy is expected to drive margin expansion through the consistent cash flows generated by this sector.

5Y Equity Model DCF Using Net Income (Created by author using Alpha Spread) Created by author using Alpha Spread Created by author using Alpha Spread

Risks & Upside Opportunities

Operational and Maintenance Risks: Avista's complex infrastructure and systems provide operational hazards. These dangers include things like equipment breakdowns, supply-chain disruptions, cybersecurity concerns, and mishaps that could result in service interruptions, safety problems, or increased expenses.

Regulatory and Legislative Risks: Since Avista operates in a highly regulated sector, any changes to the rules or laws could have a big effect on how profitable and successful it is. Rate, environmental, and energy policy decisions made by regulators may have an impact on Avista's costs and capacity to recoup investments.

Grid Modernization and Infrastructure Upgrades: Avista can take advantage of grid modernization programs to upgrade its infrastructure, boost operational effectiveness, and make it possible to integrate distributed energy resources as the energy industry experiences substantial technical developments. Smart grid, advanced metering, and automation technology investments can save costs, increase dependability, and improve customer services.

Programs for Energy Efficiency: Avista is able to improve and broaden its initiatives for customers to use less energy, pay less, and support sustainability. By luring environmentally conscientious clients, lowering demand during peak hours, and improving system effectiveness overall, these measures can provide value.

Conclusion

To summarize, I believe that Avista is currently a hold because even with a strong dividend and renewables expansion, the company's overvaluation demonstrates a price that should be revisited in the future.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.