Leatt Is On The Path To Recovery (Rating Upgrade)

Summary

- The company booked revenues of $13.1 million for Q1 2023, which is above the level from two years ago.

- Leatt is optimistic about sales in Q2 2023, and I think that EBITDA for 2023 could surpass $10 million.

- The EV is below $55 million, and I think that the company is starting to look cheap based on fundamentals.

- Microcap Review members get exclusive access to our real-world portfolio. See all our investments here »

Andreas Balg

Introduction

I've written three articles on SA about U.S. motorcycle safety gear company Leatt Corporation (OTCQB:LEAT), the latest of which was in January when I said that the coming months could be underwhelming from a financial point of view.

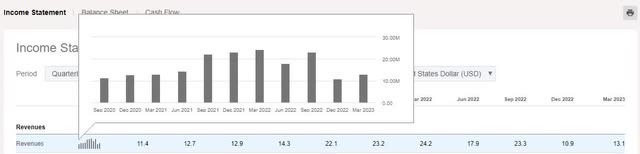

Well, revenues slumped by 53% year-on-year to $10.9 million in Q4 2022 as COVID-19-related supply chain issues and moderating consumer demand resulted in overstocked inventory across the company's brands by distributors and dealers. However, the overstocking issues seem to be alleviating as Q1 2023 revenues came in at $13.1 million and the company booked a $1.02 million net income for the period. While these results are much weaker compared to Q1 2022, it's worth noting that the latter was the best quarter in the company's history and that revenues are now close to 2021 levels. In addition, cash and cash equivalents increased to $11.4 million in Q1 2023 and the stock is trading near its 52-week low. The market valuation of Leatt has declined by over 40% since my previous article and considering that financial results are improving, I'm upgrading my rating on the stock to speculative buy. Let's review.

Overview of the Q1 2023 financial results

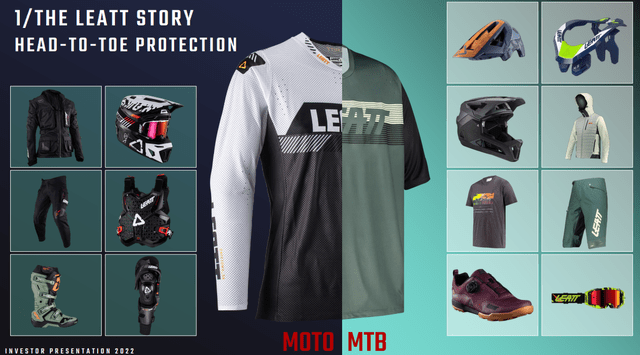

In case you're not familiar with Leatt, here's a short description of the business. The company is involved in the design and sale of motorcycle safety gear and its portfolio includes body armor products, neck braces, helmets, and guards among others for riders of motorcycles, bicycles, snowmobiles, and ATVs. Leatt is perhaps best known for the Leatt-Brace, an injection-molded neck protection system for off-road moto riders. The company owns the exclusive global manufacturing, distribution, sale, and use rights while the patent is owned by its Chairman, Dr. Christopher Leatt. However, the Leatt-Brace currently accounts for less than 10% of Leatt's sales.

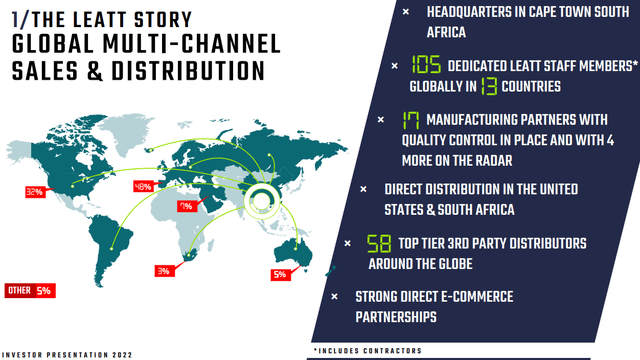

The products are predominately manufactured in China, although the company has been saying for over a year now that it's building manufacturing capacity in Thailand and Bangladesh (see page 12 here and page 13 here). It's unclear when this new production capacity is set to come online. Leatt has a total of 17 manufacturing partners and over 50 third-party distributors worldwide, and the USA and Europe account for over two-thirds of its sales.

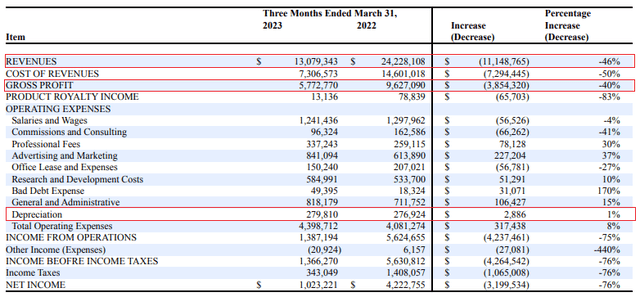

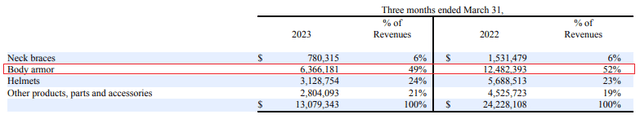

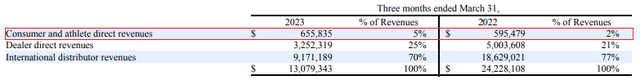

Turning our attention to Q1 2023 financial results, revenues decreased by 46% to $13.1 million while EBITDA slumped by 71.8% to $1.67 million. Sales went down significantly across all product segments, with the worst-performing segment being body armor as there was a 76% decrease in the volume of motorcycle boots sold. On a positive note, the gross profit margin grew to 44.1% from 39.7% a year earlier thanks to an improvement in global and domestic shipping and logistics costs. In addition, consumer and athlete direct revenues rose by 10.1%.

Overall, I think the Q1 2023 financial performance of Leatt was decent considering Q1 2022 was the best quarter in its history as customers boosted inventory levels amid rising demand and supply chain issues following the end of COVID-19 lockdowns across Europe and North America. The Q1 2023 revenues were 1.4% higher than Q1 2021 levels, and it seems that there could be further improvement in the coming quarters as Leatt mentioned in its financials that industry-wide stocking dynamics are still affecting distributor and dealer ordering levels (see page 15 here).

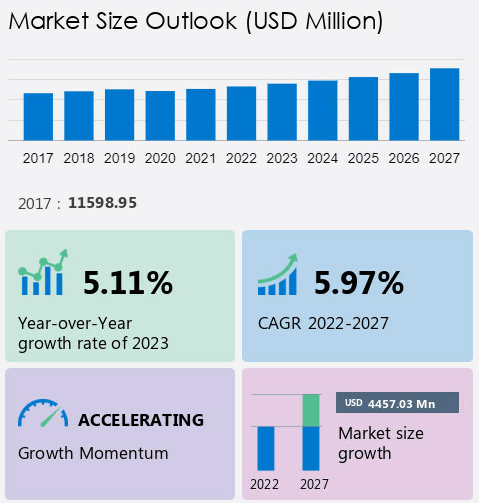

Looking at the profitability levels of Leatt, EBITDA in Q1 2023 was 44.2% lower compared to two years earlier while net income was down 50.3% as salaries and wages, R&D, G&A, and advertising and marketing expenses remained elevated. It seems that Leatt is reluctant to downsize its business despite falling sales and the reason for this is optimism about Q2 2023. CEO Sean Macdonald said during the Q1 2023 results release that the spring riding season would boost consumer participation in outdoor activities, which would in turn stimulate growth. Looking at the future, I'm cautiously optimistic here as it appears that the global protective motorbike riding gear market is growing slowly except for APAC. According to a recent study by Technavio, the global protective motorbike riding gear market is forecast to expand at a compound annual growth rate (CAGR) of 5.97% between 2022 and 2027, but 81% of that growth will come from APAC.

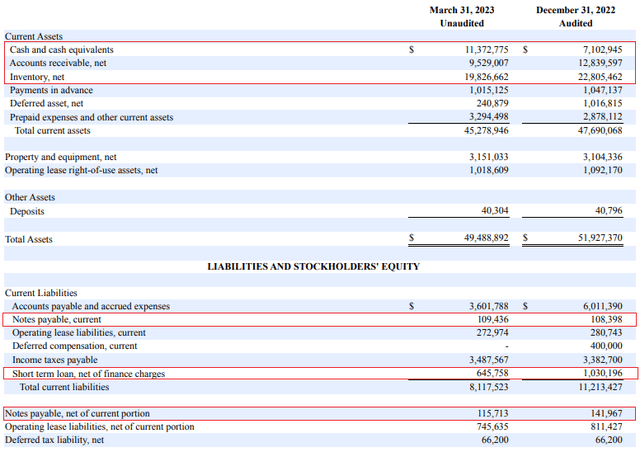

Technavio

Turning our attention to the balance sheet, cash and cash equivalents rose by $4.3 million quarter on quarter to $11.4 million at the end of March as accounts receivable and inventories decreased by $3.3 million and $2.8 million, respectively. The net cash provided by operating activities in Q1 2023 stood at $5.3 million and considering Leatt doesn't have any major capital expenses planned for the next 12 months (see page 18 here), the cash position should remain above $10 million over the course of 2023. As you can see from the table below, Leatt has an asset-light business model, and inventories and cash and cash equivalents account for the bulk of the asset base. In my view, the balance sheet is solid as the company had a net cash position of $10.5 million as of March 2023.

Leatt has an enterprise value (EV) of $54.9 million as of the time of writing and is trading at an annualized EBITDA of 8.2x. With management optimistic about Q2 sales and the global protective motorbike riding gear market growing at a decent pace, I think that EBITDA for the full year could grow above the $10 million level once again. This would put the EV/EBITDA ratio below 5.5x.

Looking at the risks for the bull case, I think there are three major ones. First, it's possible that Leatt is overly optimistic about sales in Q2 2023, and EBITDA and net income get squeezed by the higher cost base compared to two years ago. Second, the protective motorbike riding gear market in Europe and North America could be stagnant over the coming years, making it challenging to boost sales back to 2022 levels anytime soon. Third, this is a thinly traded stock, with a daily trading volume rarely exceeding 5,000 shares. There could be significant share price volatility, and it could be challenging to exit a large position.

Investor takeaway

In my view, Leatt booked decent Q1 2023 financial results, and it seems that sales are likely to continue to improve over the coming months. I think that EBITDA for 2023 could surpass $10 million and with the EV down below $55 million, the company is starting to look undervalued based on fundamentals. Yet, there are several major risks here, which is why I rate the stock as a speculative buy.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you like this article, consider joining Microcap Review. I post my portfolio and shortlist there, and you can also find exclusive ideas from our community of investors. I like to focus on undervalued companies that the market is ignoring, like an island of misfit toys.

This article was written by

I have been investing in stocks since 2007. I have no preference for sectors or countries - I'm as comfortable owning a part of a cement miner in Peru as holding shares in a wheat farming firm in Bulgaria. If it's a value stock - great. If the dividend or share buyback yield is high - even better.

- Disclosure: I am not a financial adviser. All articles are my opinion - they are not suggestions to buy or sell any securities. Perform your own due diligence and consult a financial professional before trading.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not a financial adviser. All articles are my opinion - they are not suggestions to buy or sell any securities. Perform your own due diligence and consult a financial professional before trading.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.