Landstar System: Moving Ahead With Increased Efficiency And Sustainability

Summary

- Landstar System maintains stabilized costs and expenses to offset the decrease in revenues.

- Its financial positioning reflects high sustainability levels.

- Investment returns are ample, given the consistent ordinary and special dividend distribution.

- The stock price keeps increasing, but the potential overvaluation limits the upside potential.

grandriver

Given the elevated prices and interest rates, capital-intensive companies have a higher risk exposure. The freight and logistics industry is no exception. With the cooler aggregate demand recently, they must strategize to balance their growth and viability. That's exactly what Landstar System, Inc. (NASDAQ:LSTR) is doing now. The current market landscape is unfavorable for its business. Pricing pressures were some challenges impacting its production volume. Even so, it capitalized on its operational efficiency to stabilize returns. It stayed viable with well-managed margins despite its contraction. Moreover, it maintains an impeccable financial positioning as one of its foundations. It remains the cornerstone of its sustainable operations and capital returns. Consequently, the stock price remains increasing, showing solid returns relative to company earnings. Yet, it has already exceeded the intrinsic value, limiting upside potential.

Company Performance

Trucking and less-than-truckload (LTL) service providers operate in a highly cyclical market today. With the softer demand and elevated prices, they face pricing and cost pressures. Landstar System, Inc. sees the same pattern as its growth potential is challenged. Even a company of its size did not avert the disruptive impact of macroeconomic volatility. Yet, it exudes durability with its stable and well-managed operations.

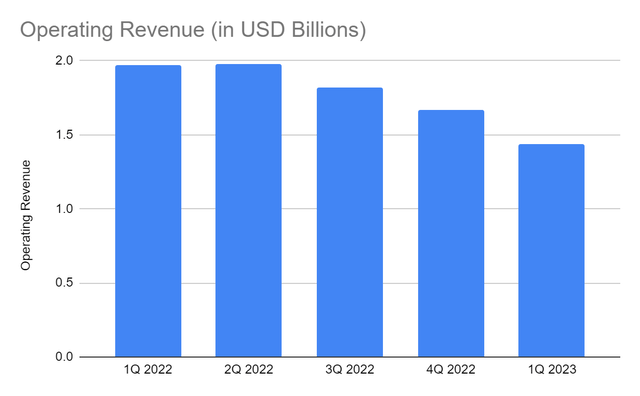

Landstar System started the year with lower results. Its operating revenues landed at $1.44 billion, a 27% year-over-year decrease. While it appeared typical for a logistics company in a high-inflation environment, the double-digit decrease was still high. Inflationary pressures were the primary challenge it faced last quarter. The combination of higher prices and recessionary fears made it difficult for LSTR to execute its plans. Also, it coincided with the clearing supply chains, making the industry capacity available to the market. As such, LSTR faced tighter competition, especially with smaller peers. It led to tighter pricing flexibility and limited demand. It also had to contract since load volume decreased by 14%. The decrease was visible in most of its services. All had a double-digit decrease except the LTL segment. It may be due to the flexibility of LTLs. They travel faster at a shorter distance.

Operating Revenue (MarketWatch)

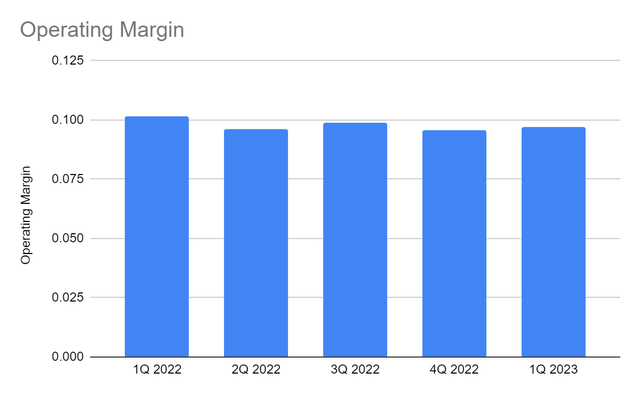

Despite this, the core strength of the company was its enhanced operational efficiency. Its efficient asset management allowed it to stabilize its operating capacity. Its operating costs dropped by 27%, offsetting the decrease in revenues. We can attribute it primarily to its purchased transportation, which decreased from $1.55 billion to $1.1 billion. It was consistent with the decrease in agent's commissions from $150 million to $126 million. Both reflected the lower production volume of the company, which was logical to counter the lower demand and higher prices. The contraction of the operations helped LSTR optimize its lower capacity. Meanwhile, the operating expense increased but was almost flat at only 1.5%. Selling, general, and administrative expenses mainly comprised it. Even better, the company's operating leverage doubled to 4%. It showed improved variable cost management. The operations became more scalable since the contraction cushioned the impact of lower revenues through decreased operating costs. Unsurprisingly, the operating margin remained stable at 9.8%. It was lower than in 1Q 2022 with 10%, but it was the highest since 2Q 2022. It was also a rebound from 4Q 2022, showing that LSTR has successfully adjusted to higher prices and lower demand.

Operating Margin (MarketWatch)

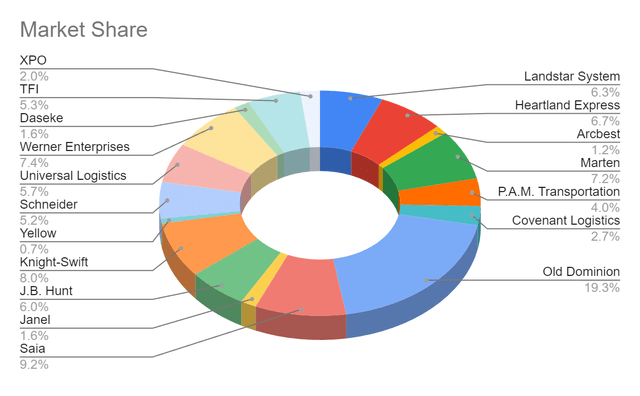

Relative to its close peers, its market share decreased from 9.2% to 6.4%. It should not be surprising, given its high revenue decrease. It was way lower than the market average of 1.5%. Despite this, its impeccable efficiency helped it go head-to-head with many of its competitors. Its operating margin remained higher than the market average of 7.4%. We must also note that the market proved the impact of inflation. Its peers like Yellow (YELL), Schneider (SNDR), J.B. Hunt (JBHT), Knight-Swift (KNX), and Universal Logistics (ULH) had decreased revenues.

Current Operating Margin (MarketWatch)

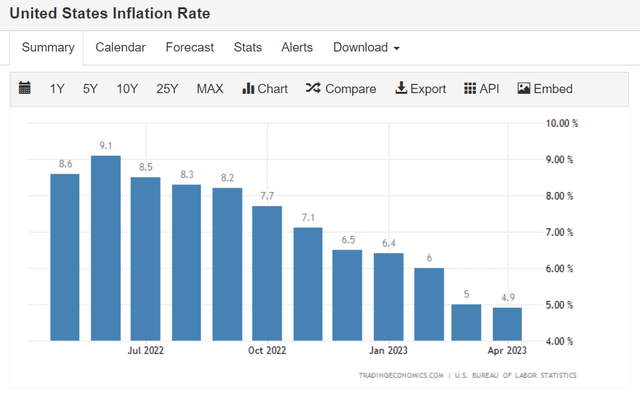

This year, Landstar System may face the same challenges. Prices remain elevated than pre-pandemic levels. Meanwhile, interest rate hikes persist, reaching 5%. But the relaxing inflation and gasoline prices may help stabilize its operations. We will discuss these further in the following section.

How Landstar System May Stay Solid This Year

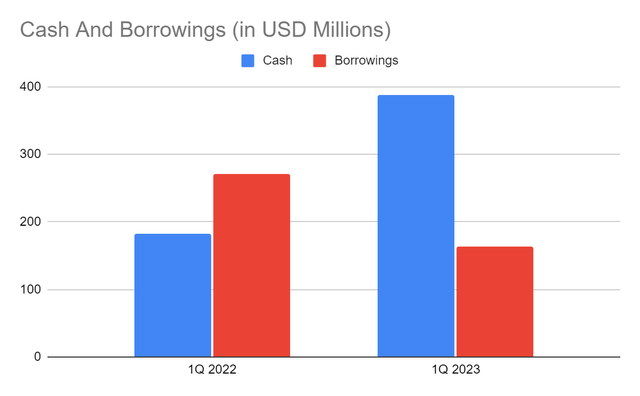

The elevated price became a challenge for Landstar System, Inc. in recent quarters. Yet, it was able to cushion the blow through its prudent asset management. But right now, interest rate hikes are the primary challenge for the company. For four consecutive quarters, it rose by 75 bps until rates exceeded 4%. The consolation is that interest rate hikes appear to have slowed down at 25 bps in the two most recent meetings. Also, LSTR seems to be deleveraging, given the 40% reduction in borrowing levels. Most importantly, borrowings are surprisingly low despite being capital-intensive. With that, the company can manage borrowings and interest expenses despite interest rate increases.

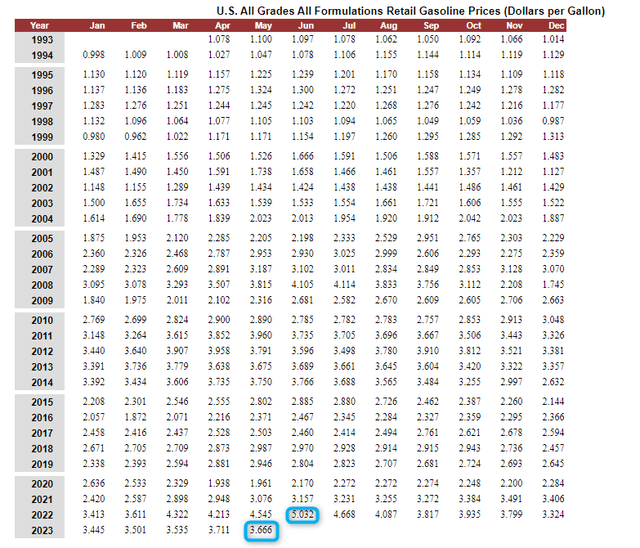

Moreover, inflation has relaxed at 4.9%, a 46% drop from the 9.1% peak in 2022. Indeed, The Fed succeeded in stabilizing inflation through its tight monetary policy. If the downward trend continues, interest rates may remain flat at their current rate. Even better, it may improve the pricing flexibility of the company. It may be easier today since gasoline prices are now $3.666 per gallon, 27% lower than the $5.032 peak in 2022. Hence, truck, van, and LTL trips may become less expensive. LSTR may also enhance its efficiency and increase margins through well-maintained costs and expenses.

US Inflation (Trading Economics) Gasoline Prices (US Energy Information Administration)

But what makes Landstar System, Inc. a force to reckon with is its excellent financial positioning. It has adequate and increasing cash reserves of $388.16, 114% higher than in 1Q 2022. They are also high enough to cover all its borrowings in a single payment. The company has high liquidity levels, given the negative Net Debt. Its EBITDA can also cover borrowings, so it may not need to use cash to cover them. The zero cash burn shows the company can sustain its operating capacity and even expand while paying capital returns through dividends and share repurchases. We can confirm it in the Cash Flow Statement of the company. The Cash Flow From Operations is higher than in 1Q 2022 and stayed above $100 million. These are more than enough to cover CapEx. Its FCF/Sales Ratio doubled from 4.6% to 9.2%. LSTR was able to convert a larger portion of revenues into cash last quarter. The company maintained the balance between viability and sustainability.

Cash And Equivalents And Borrowings (MarketWatch)

Stock Price Assessment

The stock price of Landstar System, Inc. has increased substantially over the years. There were some corrections in the past year, but the rebound was high. At $187.08, the stock price is 30% higher than last year's value. Indeed, the stock price uptrend has become more enticing. But investors may have to watch the upward trend first relative to the intrinsic value of the company. We can assess it with the TBV Ratio, given the current TBVPS and PTBV Ratio of 24.88 and 7.53x. If we use the current TBVPS and the average PTBV Ratio of 7x, the target price will be $174.07. In contrast, the EV/EBITDA Model shows that the stock price is still fairly valued, but the upside potential is limited. It gives a target price of ($6.52 B EV - (-$0.22 B Net Debt))/35,933,000 shares = $187.47.

On the other hand, Landstar System, Inc. is a secure dividend stock with increasing payouts. It only has yields of 0.64%, lower than the S&P 400 and NASDAQ average of 1.55% and 1.53%. But if we include the special dividends in the computation, yields will be higher at 1.72%. These are also well-covered, given the Dividend Payout Ratio of 14%. Investment returns are even higher if we compare the cumulative EPS to the average stock price change since 2019. The cumulative EPS reached $34.6 while the average stock price change was $45.4. So for every $1 EPS, the stock price increased by $1.31, giving 131% price returns. To assess the stock price better, we will use the DCF Model.

FCFF $335,112,000

Cash $388,154,000

Borrowings $164,080,000

Perpetual Growth Rate 4.4%

WACC 9.8%

Common Shares Outstanding 35,933,000

Stock Price $187.08

Derived Value $178.98

The derived value adheres to the supposition of a potential overvaluation. There may be a 5% downside in the next 12-18 months. And while it remains a solid stock, it is not yet offered at a discount.

Bottom Line

Landstar System, Inc. may have been negatively affected by price pressures and softer demand. But its operational efficiency helped it counter the impact of lower revenues. Its scalable operations with enhanced variable cost management stabilized margins. Even better, it has a well-grounded financial positioning with high cash reserves and low borrowing levels. So, it is highly sustainable despite being capital-intensive. Investment returns are also enticing, given the consistently increasing dividends and high price returns. The only thing that may hinder an investor from buying shares now is its potential overvaluation. It is a solid stock, but the price is high relative to its intrinsic value. Investors must wait for a better entry point before buying shares. The recommendation, for now, is that Landstar System, Inc. is a hold.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.