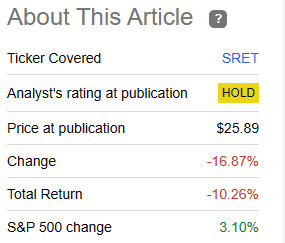

SRET Came Into 2023 Chasing Yields And Buying Mortgage REITs

Summary

- SRET came into 2023 chasing yields and buying mortgage REITs.

- And it is all out of mortgage REITs.

- So now, it is buying office REITs.

- No medals for predicting how this will end.

- Looking for a helping hand in the market? Members of Conservative Income Portfolio get exclusive ideas and guidance to navigate any climate. Learn More »

RichVintage

The Fund

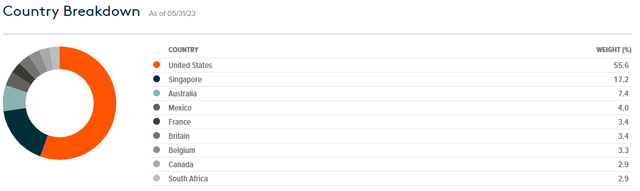

Global X SuperDividend REIT ETF (NASDAQ:SRET) pursues the performance of the Solactive Global SuperDividend REIT Index. By doing so it invests in 30 of the world's highest yielding securities. The ETF's most recent geographic allocation indicates where the gems currently reside.

The ETF's strategies involve investing at least 80% of its total assets in securities from the benchmark index. The minimum threshold for total assets held in REITs is also 80%. Now, the index does play gatekeeper and excludes historically volatile REITs. So SRET investors have that going for them, which is nice.

SRET generally tries to hold a security in approximately the same proportion as the benchmark, which is also known as the replication strategy. However, at times it applies the representative sampling method when replication becomes difficult due to facts such as costs and liquidity. Besides discerning between which security selection method to use, the ETF follows a passive investing approach and charges its investors 0.59% annually for it.

The Performance

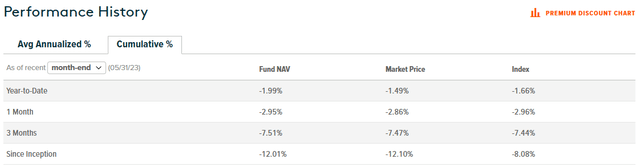

SRET's mission began in 2015 and performance wise it has been successful.

We are talking about its success in tracking its benchmark index.

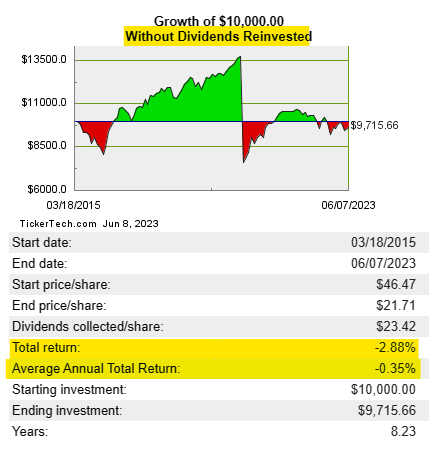

The index does not have any expenses, so the above underperformance by SRET is expected. This is not the kind of success the investors of this fund were probably looking for however. The above performance assumes reinvestment of dividends, whereas the typical income investors do not do that. The returns without reinvestments are in a similar boat, one that s[t]inks, albeit at a slower pace.

www.splithistory.com

Note: the cumulative returns from the ETF website presented above are to May 31, 2023. The price has appreciated about a dollar since then. That does not materially change the return trajectory or comparison between that graphic and the one shown above from splithistory.com.

Why has SRET not done so well over the years? We have been covering this ETF since 2020 and the underlying story for the underperformance has been the same two things, chasing yield and mortgage REITs. The influence of the latter is also apparent when we look at how closely SRET and iShares Mortgage Real Estate Capped ETF (REM) have moved in tandem over the years.

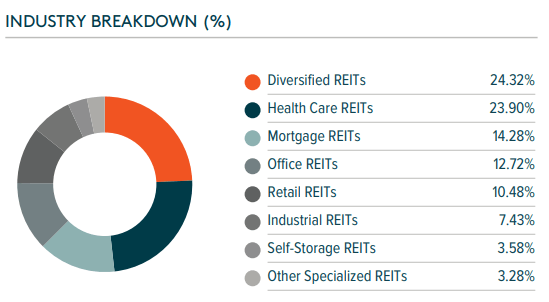

Which is why it warms our heart to see the most recent available allocation from April 30.

Factsheet

The ETF has held at least a third of its portfolio in Mortgage REITs each time we have covered it in the past. Until as recently as October 31, 2022, SRET held almost 39% of its portfolio in mortgage REITs, most of which have been sold for a loss and are out of the current holdings.

The 14% above is a welcome sight, but of course is a function of several mortgage REITs cutting their dividends and being evicted from the index and as a result the fund. We don't think they can buy any mortgage REITs as almost all have cut the dividend at some point. What is concerning now is increased exposure to the office sector from the sub 4% in the past. We may even see more churn in this allocation as a lot of REITs are cutting or suspending dividends. Clearly, following this index is not working as the ETF invariably buys high and sells low.

Distributions

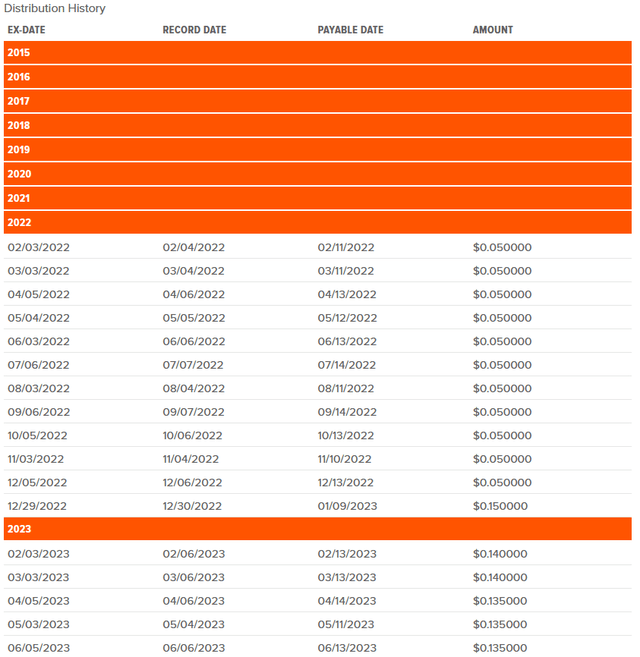

SRET distributes monthly and no the amount has not tripled since December 2022.

There was a 1:3 reverse split back in December, which accounts for this seeming increase. At the current price of $21.71, the fund yields around 7.5%.

Verdict

We have not been impressed in the last four outings and this time is no different. The performance gap with Vanguard Real Estate ETF (VNQ) remains about the same since our previous piece.

When we covered it last, we gave you a clear verdict on how bad things would get for you.

So if you go hunting in this area, armed with only the ability to exclude based on volatility, you will struggle to beat JPMorgan Chase (JPM)'s savings account interest rate of 0.01%.

Over time, you might find some brief periods of relative outperformance versus VNQ or even S&P 500 (SPY). But the whole structure of this fund is designed to elucidate the consequences of yield chasing and it is going to do a splendid job in that area.

Source: Chase That 0.01% Yield Instead

That was a good call.

Seeking Alpha

Considering that the fund still has the same methodology, is laden with mortgage REITs and office REITs, we would take a hard pass. The only reason you might want to buy one share of this ETF is to track exactly how blind yield chasing and running behind the biggest yields without due diligence performs over time. Outside that, we don't see this as a viable investment and it likely will perform even worse if we enter a recession.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Are you looking for Real Yields which reduce portfolio volatility? Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Give us a try and as a bonus check out our Fixed Income Portfolios.

Explore our method & why options may be right for your retirement goals.

This article was written by

Conservative Income Portfolio is designed for investors who want reliable income with the lowest volatility.

High Valuations have distorted the investing landscape and investors are poised for exceptionally low forward returns. Using cash secured puts and covered calls to harvest income off value income stocks is the best way forward. We "lock-in" high yields when volatility is high and capture multiple years of dividends in advance to reach the goal of producing 7-9% yields with the lowest volatility.

Preferred Stock Trader is Comanager of Conservative Income Portfolio and shares research and resources with author. He manages our fixed income side looking for opportunistic investments with 12% plus potential returns.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.