Rover: Exercising Caution Despite Growth

Summary

- Rover is an industry leader in the pet services sector, with a high-quality business model.

- Strengths and opportunities for Rover include resilient consumer pet services spending, expansion of service offerings and pet types, strategic collaborations, and acceleration of international business.

- Potential weaknesses and threats include the impact of macroeconomic factors on leisure travel, uncertainty around return-to-office trends, intensifying competitive landscape, and volatility and limited liquidity of Rover shares.

- Rover's current valuation suggests a slight overvaluation, which may reflect high investor expectations.

GlobalP

The Rover Group (NASDAQ:ROVR) presents an enticing opportunity for investors seeking exposure to a growing pet services industry. The company's appeal stems from its clear leadership in an industry ripe for digital disruption, coupled with robust trends like surging pet ownership and the humanization of pets. With almost ten times more market cap than its closest competitor, Wag! (PET), and a path to long-term revenue growth of 20-25%; Rover's investment case warrants further examination.

Company Overview

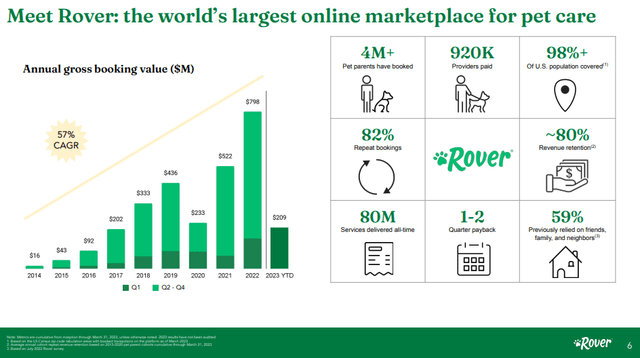

Rover is the leading pet services online marketplace in North America and Europe. Founded in 2011, the Seattle-based company went public via SPAC in 2021 and has created an extensive network that facilitates pet owners to connect with pet care providers for both daytime and overnight services. The company offers various services, including dog walking, in-home pet sitting, doggy daycare, and drop-in visits. Rover has facilitated over 80 million pet service transactions, involving more than 4 million pet owners and over 900,000 pet care providers.

ROVR May 2023 Investor Presentation

Financial Overview

Rover's financials resemble a fast-growing software company. The company boasts high gross margins exceeding 70%, signifying the potential for scalability. Additionally, the company demonstrated its operating leverage by achieving adjusted EBITDA profitability in 2021.

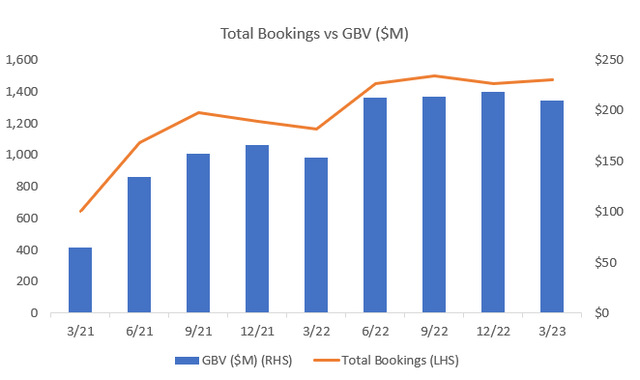

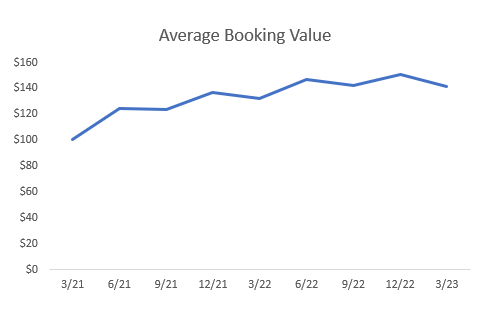

Rover's revenue primarily originates from service fees collected on bookings from pet parents and care providers, with current take rates set at 23% and 12%, respectively. The Gross Booking Value (GBV), representing the total dollar value of bookings made on Rover's platform, is a crucial indicator of the company's performance and growth. A higher GBV indicates more value transacted through the platform, which generally translates into higher revenue (after accounting for any cancellations). An increase in the number of bookings or the average booking value will lead to a higher GBV. From 2021 to 2022, the total booking volume grew by 32%, while the ABV saw a boost of 15%. The influx of bookings is usually most prominent in the third quarter corresponding with the summer vacation months, and the fourth quarter commonly reaches the highest GBV due to holiday travel. The growth in ABV can be attributed to the increased demand for overnight services, which charge a higher average ABV than their daytime services.

Company Reports Company Reports

Rover's marketing strategy has been exceptionally effective, as evidenced by the substantial decrease in marketing expenses as a percentage of revenues, which dropped from 82% in 2018 to 21% in 2022. This positive trajectory is attributable primarily to Rover's growing brand popularity and strong network effect, leading to 60% of bookings being organic word-of-mouth referrals. The diversity of Rover's customer demographics, spanning various age groups and income brackets, further amplifies its market reach and scalability.

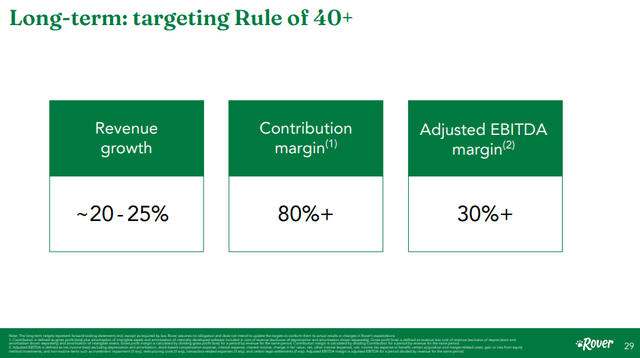

Even as the company expands its core business, Rover discovers multiple growth levers, promising further domestic and international expansion. These growth opportunities, paired with the robustness of Rover's marketplace model, are expected to drive long-term revenue growth in the range of 20-25%.

Rover's operational efficiency and financial discipline are evident in its projected marketing spend, which, despite being the company's most significant expense, is targeted to represent only 18%-25% of revenue in the long term. Furthermore, the company aims to achieve an Adjusted EBITDA margin exceeding 30%, demonstrating that they're exceeding the "rule of 40%". These financial targets outlined at Rover's analyst day in May 2023 reinforce the company's commitment to delivering sustained, profitable growth.

ROVR May 2023 Investor Presentation

In summary, Rover's robust financial outlook, marked by high gross margins, efficient marketing strategy, and strong revenue growth potential, presents a compelling case for its continued success in the expanding pet services industry.

Strengths and Opportunities

There are crucial elements that strengthen Rover's investment case and could have a positive impact on future share prices.

- Resilient consumer pet services spending: Despite economic downturns, pet-related spending has shown impressive resilience, with the industry growing 17% during the 2008 recession. Robust leisure travel trends in summer and winter of 2023 could further boost Rover's near-term financial performance.

- Expansion of service offerings and pet types: Rover is anticipated to expand its business by introducing new services and increasing its pet portfolio beyond dogs. Evidence of this is seen in their rapidly growing cat bookings, which make up 15% of all bookings and grew 13% YoY.

- Strategic collaborations: Rover has formed strategic partnerships with large companies such as Petco and Walmart, providing direct accessibility to Rover's services on their websites. These collaborations can significantly enhance Rover's brand visibility and take rate.

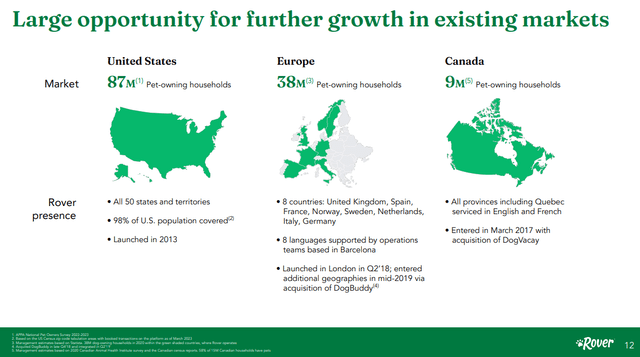

- Acceleration of international business: While Rover already has a presence in Canada, the UK, and several Western European countries, there is a clear ambition for further international expansion. Prospective regions include Belgium, Ireland, Denmark, Austria, Switzerland, and Poland. This global outreach could contribute significantly to revenue growth in the coming years.

ROVR May 2023 Investor Presentation

Weaknesses and Threats

Investors should consider these risk factors before making investment decisions.

- Impact of Macroeconomic Factors on Leisure Travel: Rover's bookings are tied to the trend in leisure travel. If macroeconomic conditions negatively affect consumer spending on such activities, this could harm Rover's booking growth.

- Uncertainty Around Return-to-Office Trends: The proportion of employees resuming office work amid ongoing COVID-19 variants is still being determined and could fluctuate in the short term. This poses a risk to Rover's daytime services like dog walking, which might see reduced demand if the work-from-home trend continues to be prevalent.

- Intensifying Competitive Landscape: Wag!, a direct rival has the potential to strengthen its market presence and steal market share from the substantial $95B U.S. pet market. Additionally, there's a risk of broader pet platforms, such as Chewy (CHWY), intensifying their efforts in the services segment, which could increase competition.

- Volatility and Limited Liquidity of Rover Shares: Rover, which went public via a SPAC in 2021, has seen its shares experience significant volatility, with current trading levels around 50% lower than the initial SPAC price. The liquidity of Rover's trading is limited, with a market capitalization of around $800 million and an average daily trading volume of less than $2 million.

Valuation

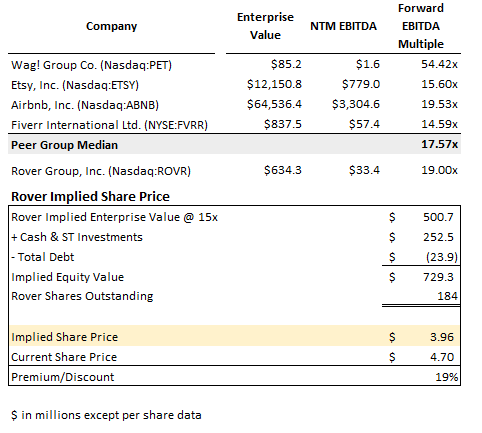

One reasonable way to determine the intrinsic value of Rover is to use the forward EBITDA multiple. This approach seems suitable, given that Rover became profitable in 2021. The next step is finding the appropriate peer group, which is challenging since their most direct peer, Wag!, is unprofitable and operates on a much smaller scale.

When seeking comparable businesses to Rover's online marketplace, I tried to identify companies with operational similarities. Despite belonging to different sectors, the companies chosen for comparison are Airbnb (ABNB), Etsy (ETSY), and Fiverr (FVRR). These companies share pivotal characteristics with Rover, making them ideal comparable companies.

First, all these companies operate two-sided marketplaces, like Rover, which connects pet parents with pet care providers. Secondly, these companies supply bases are unique and not interchangeable, mirroring Rover's supply base structure. In Rover's case, each pet care provider possesses distinctive attributes vital to pet parents, such as specific skills, experience, or proximity, making them non-substitutable. This distinctiveness parallels the unique offerings seen in Airbnb's hosts, Etsy's crafters, and Fiverr's freelancers.

I applied a 15x multiple to Rovers NTM EBITDA and reached an implied share price of $3.96. Rover trades at 19x forward EBITDA, but a modest discount is warranted due to its smaller scale and less proven profitability. Rover's shares trade at a slight premium relative to the peer group's median.

Capital IQ

Conclusion

Given these considerations, my current recommendation for Rover's shares is a "hold". While the company exhibits robust financials and high growth potential, the current share price has factored in much of this positive outlook. Investors could benefit from waiting for the next quarter's earnings for further clarity on financial performance and growth trends before making a definitive investment decision.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.