USFR: Ready For Whatever Happens Next

Summary

- The Federal Reserve is expected to pause interest rate hikes at the next FOMC meeting.

- A rate pause could be bullish for risk assets, with equities performing well after the last rate hike if recession is avoided.

- Floating rate notes offer attractive risk-adjusted returns and are expected to perform well regardless of the Fed's decision.

Diy13

Perhaps the most impactful FOMC meeting of the year is expected next week when the Federal Reserve will announce if they are raising rates yet again. Many analysts expect the Fed to raise by another 25 basis points in June. Some believe the Fed may "skip" a raise in June but continue raising later in the year, a turn of events that is very uncommon. Others still believe that many more hikes are on deck and the Fed Funds rate is going to 6% and beyond.

It is our belief that the Fed is likely to pause at the next FOMC for the indefinite future. We wrote about our thesis in this article: That's It, Hikes Are Done And Rates Have Peaked At 5%. Currently the market agrees with us as the futures market is expecting a 74.8% probability that the Fed does not raise rates next week.

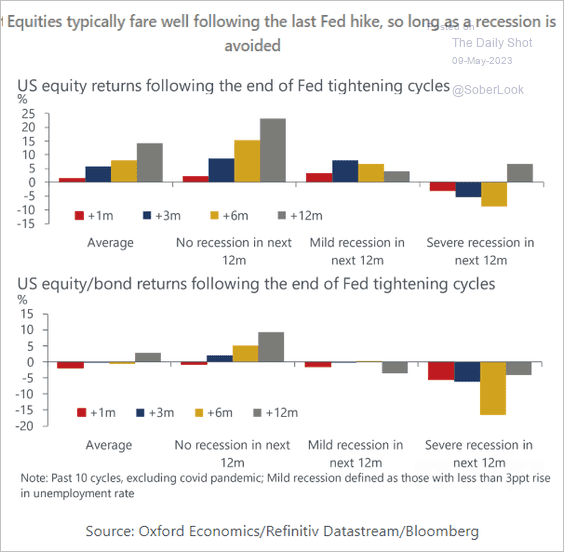

What does this mean for investors? A rate pause could be bullish for risk assets. Equities tend to perform well after the last rate hike, especially if recession is avoided. On average, equities have experienced positive returns over the 1 month, 3 month, 6 month, and 12 month time frame following the last hike. But when severe recession follows the last rate hike equities do not perform well, especially in relation to bonds.

The Daily Shot (used with permission)

For now, the macroeconomic data has us cautious. Our equity exposure remains underweight and we are overweight fixed income. In particular, we are overweight short duration fixed income, especially floating rate notes. The WisdomTree Floating Rate Treasury ETF (NYSEARCA:USFR) is an example of one of our positions. The potential rate pause, or not, does not change our investment thesis in this position. Regardless of the outcome, the risk adjusted returns continue to be superb.

Risk Adjusted Returns

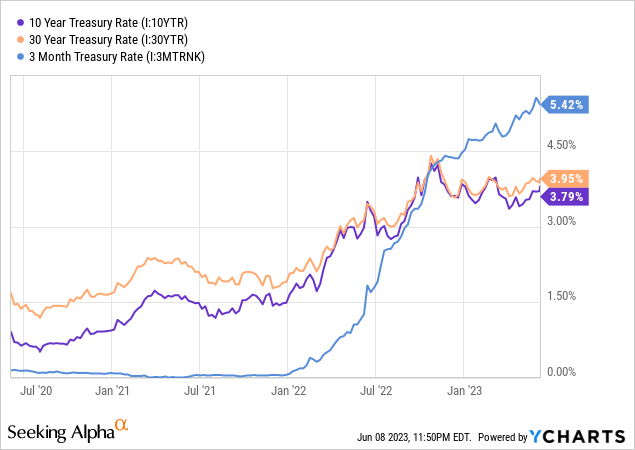

USFR invests in Treasury floating rate notes (FRNs). FRNs pay a monthly interest rate that is equal to the latest 3 month Treasury rate plus a spread. The latest 3 month T-bill rate is 5.378% and the current spread for new issuance is 0.169%. USFR has an average yield to maturity of 5.42% today.

Given that the fund is essentially unexposed to duration risk because it is a floating rate bond, the yield is very attractive on a risk-adjusted basis. In comparison, the 10 year Treasury is yielding 3.79% and the 30-year is yielding 3.95%.

If yields were to continue to rise from here, longer duration bonds like the 10 and 30 year would be vulnerable to loss of principal. Floating rates are not so vulnerable as USFR has an effective duration of 0.02. If rates were to fall, longer duration bonds can benefit from a rise in capital appreciation.

In the current situation we are unsure if the Fed will continue to raise or not. If they raise, floating rate notes will benefit by earning higher interest. If they pause, short term rates may fall minimally and the interest earned on floating rates will fall but the principal will be stable. FRNs earn over 1.5% more than long duration bonds for the moment which we find favorable.

Risk of Recession

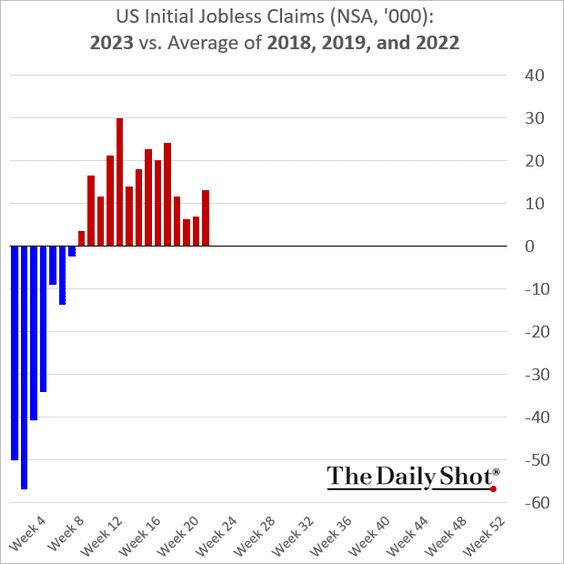

Contrary to many widely held views we do not believe that the risk of recession is negligible. The economic indicators that point towards significant recession continue to accumulate. Although the labor market continues to be tight with low unemployment at 3.7% and job openings of 10.1 million, the trend of employment is heading south. The direction of initial jobless claims is turning higher which we have been expecting for months based on leading indicators, including the National Association of Home Builders index and the rise in the percentage of banks tightening lending standards.

The Daily Shot (used with permission)

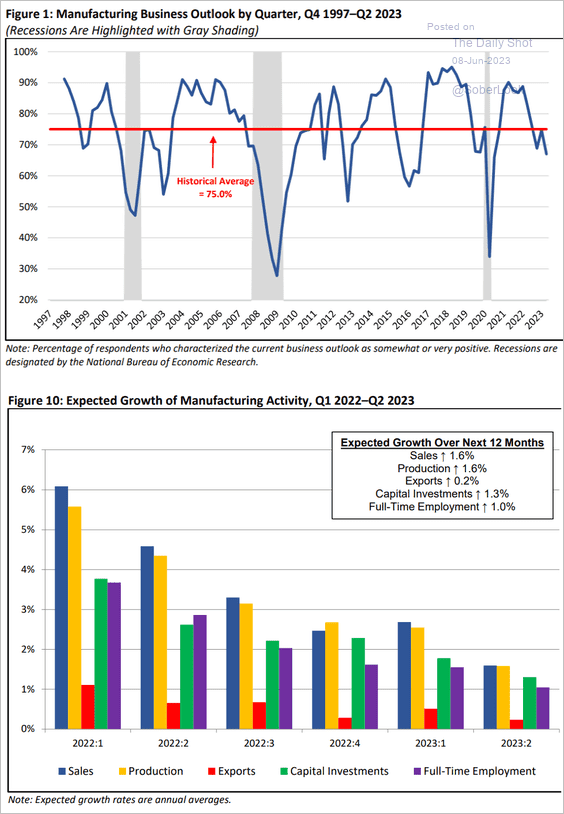

Services and manufacturing PMIs are turning down in the U.S. The manufacturing PMI is already in contraction territory and the services PMI is shortly behind. Manufacturing business outlook has fallen below its historical average, a common occurrence during recession.

The Daily Shot (used with permission)

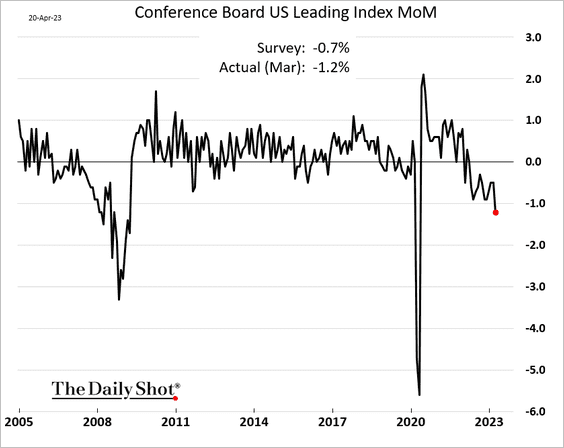

The Conference Board of US leading indicator index is negative MoM for the last 6 months. This trend and duration of negative readings commonly occur only during periods of significant recession.

The Daily Shot (used with permission)

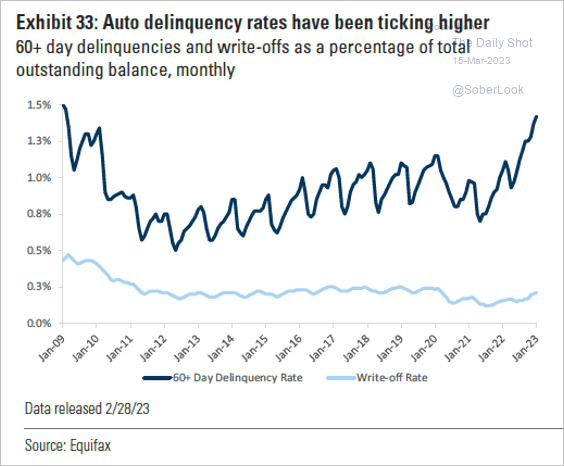

Auto delinquencies are rising in the U.S. This is a comprehensive indicator of overall consumer financial health as most households finance some or all of their vehicles and are reluctant to default on those loans resulting in embarrassing repossessions. The 60+ day delinquency rate is the highest since 2010, in the wake of the Great Recession.

The Daily Shot (used with permission)

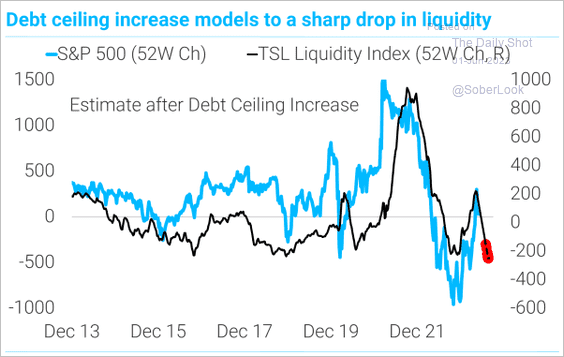

On top of the degrading economic data we now have the headwind of draining liquidity in the financial markets due to the restoration of the Treasury General Account now that the debt ceiling has been passed. It is possible that this drain of liquidity has already been priced into equity markets. It's also possible that the restoration of the TGA will result in massive issuance of T-bills which will bid rates higher as supply outpaces demand. If the former is false or the latter true we would expect FRNs to perform admirably in the months ahead.

The Daily Shot (used with permission)

Conclusion

During this part of the business cycle there is reason to be cautious on risk assets. Yields offered by fixed income are attractive and FRNs offer some of the highest yields because short term rates are currently higher than long term rates and FRNs add a spread on top. Until short term rates begin to decline, FRNs are expected to offer about the same or higher yields. If the Fed chooses to continue hiking rates FRNs will benefit from higher yields but essentially no rate risk. If the Fed chooses to pause hiking rates, equities may outperform for a while unless recession is underway. Overall, we like the risk-adjusted return on FRNs and hold an overweight position for the notes in our portfolio.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of USFR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The content in this article is for informational, educational, and entertainment purposes only. This content is not investment advice and individuals should conduct their own due diligence before investing. The author is not an investment advisor, is not registered as a financial advisor, and is not suggesting any investment recommendations. This article is not an investment research report but a reflection of the author’s opinion and own investment decisions based on the author’s best judgement at the time of writing and are subject to change without notice. The author does not provide personal or individualized investment advice or information tailored to the needs of any particular reader. Readers are responsible for their own investment decisions and should consult with their financial advisor before making any investment decisions. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Any projections, market outlooks, or estimates herein are forward looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. Any analysis presented is based on incomplete information, and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.