XT: Everyone Has To Chase AI

Summary

- XT has a fair bit of AI exposure, through semiconductor and software companies, that has been driving its returns ahead of a typically weighted US index.

- We think that longer-term, the AI hype is overdone and generative AI won't make quite the dislocating impact that some expect.

- Still, everyone is going to chase it, because all businesses need to pay the premium for the AI business option.

- Not to minimise how important generative AI might be, but a lot of the current demand we suspect is business option premium paying. Careful to not get caught up.

- Looking for a helping hand in the market? Members of The Value Lab get exclusive ideas and guidance to navigate any climate. Learn More »

sankai

The iShares Exponential Technologies ETF (NASDAQ:XT) contains exposures that have been moved by the recent hype for generative AI, which has increased demand for computing solutions to power them. In our coverage, we are indeed seeing investment in developing generative AI across industries. While they are going to have a meaningful impact, and while certain players will see outsized gains, we think that there is maybe a little bit too much hype for certain companies that do move the XT, specifically on the semi front and Nvidia (NVDA). Markets have a tendency to extrapolate hype like this too far in the future, where many companies are upfronting expenditure on this stuff in order to establish business options. Best to stay away or to at least be more selective within the AI space.

XT Breakdown

The espoused mandate of XT is to allocate into exponential technologies. While that encapsulates several things, as far as the AI boom is concerned, the exposures that matter are in cloud services and in hardware to power the development and deployment of generative AI, which spurred by the release to the public of ChatGPT, has become an object of intense publicity.

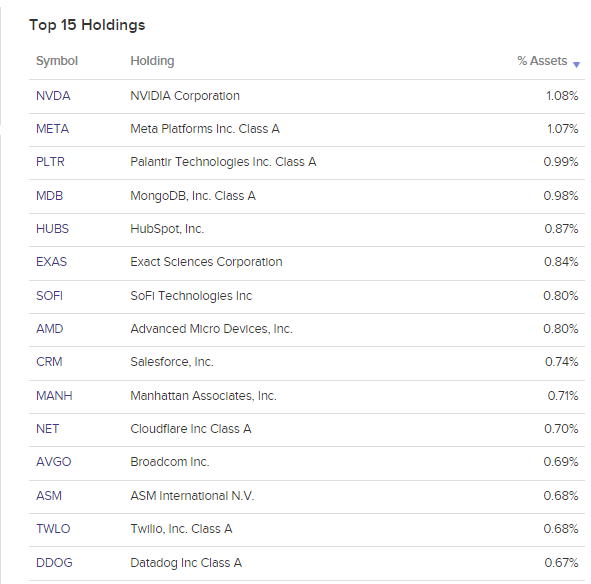

Holdings (ETFDB.com)

The effects of generative AI on some industries have already been tangible. Nvidia, which produces GPUs that some use for powering the training of AIs, has seen a massive spike in orders, showing that companies are scrambling to get their own generative AIs going. To deploy the models, and in some case to also train them, cloud providers are going to be needed to, which is where the hype followed by the disappointment in C3.ai (AI) comes in.

Thoughts

Here are our concerns: while Nvidia is a small part of the portfolio of XT, which is broad and diversified, markets seem to already be misjudging things that spells concerns about how sensible current tech prices actually are. NLP libraries to prepare data for feeding into NLP models are typically CPU intensive, not really GPU intensive. The training is much more suited for GPUs than CPUs, but also much more suited for TPUs (an Alphabet (GOOG) (GOOGL) thing) than GPUs, and we further believe that GSI Technologies (GSIT) will bring to market a chip that beats a lot of them for a lot of model structures, especially sparse models like in NLP among other things.

Moreover, there are more fundamental considerations that have us leaning on the massive growth in revenues being a blip, not to be extrapolated as far as the repricing on already extended tech valuations implies. When something like generative AI, which does indeed have the potential to be disruptive, hits the market, everyone needs to chase it because if they don't and it turns out to be revolutionary to their industry, they are doomed. People are paying an upfront premium for the business option to deploy AI meaningfully in their businesses, but that demand only continues if they all also exercise it. The premium is also likely to be pretty expensive since everyone is getting in on it at once, and we've already had pretty tight markets for GPUs these last couple of years, despite a momentary sign of a glut.

There is a lot of value in generative AI. We think that it pays even bigger now given the tight labour market and wage inflation. Meta (META) is looking to change things up in how they generate copy for ads; music labels may be considering the possibility of creating AI generated songs, where at least the voices of artists they record are AI generated into compositions. There are going to be revolutionary effects, but there are also going to be a lot of places where AI will not be as useful as people hope.

Thanks to our global coverage we've ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it's for you.

This article was written by

Formerly Bocconi's Valkyrie Trading Society, seeks to provide a consistent and honest voice through this blog and our Marketplace Service, the Value Lab, with a focus on high conviction and obscure developed market ideas.

DISCLOSURE: All of our articles and communications, including on the Value Lab, are only opinions and should not be treated as investment advice. We are not investment advisors. Consult an investment professional and take care to do your own due diligence.

DISCLOSURE: Some of Valkyrie's former and/or current members also have contributed individually or through shared accounts on Seeking Alpha. Currently: Guney Kaya contributes on his own now, and members have contributed on Mare Evidence Lab.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GSIT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.