ARK Innovation: Reckless Allocation, Hard Downgrade To Sell

Summary

- We have reason to believe that the ARK Innovation ETF's year-to-date surge might soon revert.

- Catherine Wood has decided to add additional Coinbase stock to the fund's portfolio, buying the dip amid state pressure on the crypto industry.

- Most of the fund's primary holdings host unimpressive earnings and cash flow yields. Moreover, the ETF's risk premium is surging.

- Lastly, headline data suggests that a growth-conducive market has yet to fully occur.

- Looking for a helping hand in the market? Members of The Factor Investing Hub get exclusive ideas and guidance to navigate any climate. Learn More »

LumerB

ARK Invest's ARK Innovation ETF (NYSEARCA:ARKK) is up by more than 40% since the turn of the year and nearly 15% month-over-month amid a recovery of high beta (high-risk) stocks. Our previous article from February on ARK Innovation conveyed our belief that beta support will prevail, leading to an upside for growth-based assets like ARK Innovation. In today's article, we downgrade our outlook on high beta securities and ARK Innovation, in particular; here's why.

Explaining Beta Analysis And Measuring ARK's Beta Performance

A security's beta performance measures its sensitivity to the overall market. For example, a stock with a beta of 1.5 is 1.5 times as risky as the S&P 500. On top of that, the beta analysis goes a step further and measures a security's performance relative to various market segments, such as growth, value, momentum, market capitalization, and so forth. In essence, a beta analysis helps us understand how a given security is likely to perform in different market environments (for example, there are times when the market favors a certain investment segment over another).

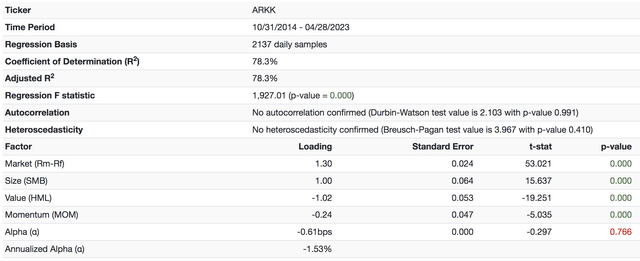

The diagram below presents a backtest of ARK Innovation's past performance. If you look under the subsections titled "factors" and "loading", you will notice that the ETF has a negative loading of 1.02% in a value-seeking environment. Theoretically, this means that the ETF tends to perform impressively in growth markets and poorly in value-seeking markets.

Regression of ARKK's Stock (Author in Portfolio Visualizer)

Now, with the prior being said, two things need to be established, which are 1) what constitutes a growth market, and 2) Are we set for a growth market?

To answer the prior, a growth market usually occurs at an early-stage interest rate pivot or when credit spreads are low. However, growth markets end when interest rates are on the up or when credit spreads widen.

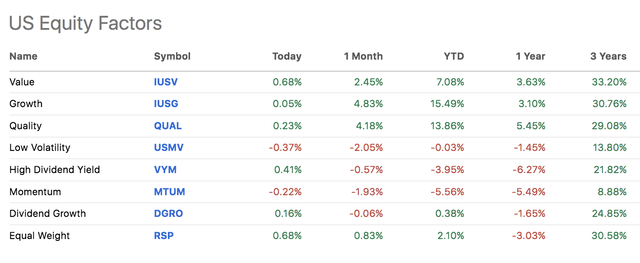

Based on market data, we are not yet in a growth market as interest rates are yet to reach a formal inflection point, and although they have calmed down, credit spreads are still relatively high. Even though growth stocks have performed stunningly since the turn of the year, so have value stocks and many other investment segments, suggesting that we have experienced a broad-based market recovery after last year's down market instead of a growth market environment.

U.S. Stock Segment Performance (Seeking Alpha)

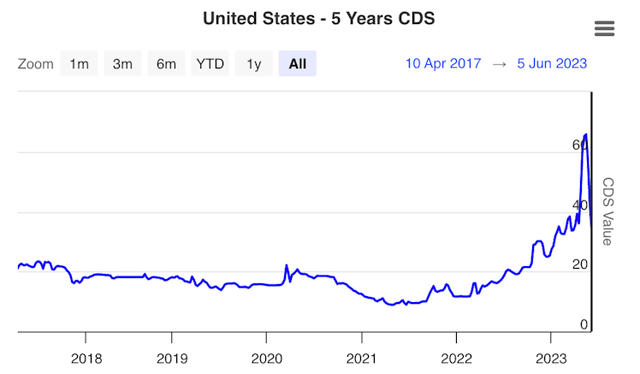

Looking ahead, a growth-centric market may likely occur before the year closes. However, based on macroeconomic data, CDS risk premiums are still too elevated for growth stocks to outperform the market. Although inflation has settled into a range, and rumors are emerging of a "Fed Pivot", these risk factors have yet to abate, which might halt the near-term performance of growth stocks.

CDS Premiums (worldgovernmentbonds.com)

To confine this section's research into a single sentence: The market likely experienced a technical bounce since the turn of the year, and quantitative data implies that a growth environment is yet to emerge, meaning that sustainable support to securities like ARK Innovation is unlikely.

Assessing ARK's Portfolio

A Few Qualitative Observations

ARK Innovation's product possesses approximately 30 securities, meaning the idiosyncratic risk of its underlying entities is moderately diversified. However, the ETF hosts a style drift (growth) and a thematic tilt (innovative companies).

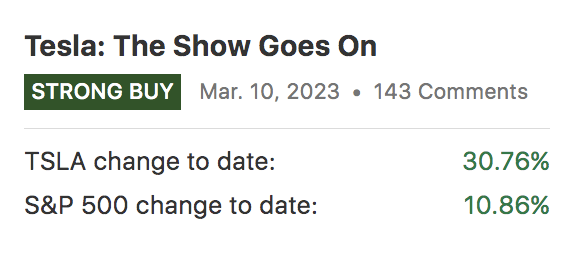

In our view, the ETF's sector tilt is nearly negligible, and the moderate security-specific risk embedded pertains to its substantial exposure to Tesla (TSLA). The fund's exposure to Tesla latter is a component that we support, as revealed by our recent bullish call on the stock.

Pearl Gray's Bullish Call on Tesla Stock (Seeking Alpha)

A major concern for us is ARK's exposure to the crypto space, as the firm's most recent financial disclosure conveys that 6.9% of its portfolio is exposed to blockchain and peer-to-peer solutions. In the meantime, it was revealed on Wednesday that Catherine Wood bought the dip on Coinbase (COIN), adding 400 000 shares to the fund's portfolio.

In our opinion, the fund's exposure to crypto is dangerous, given an industry-wide lawsuit barrage from the SEC, which has seen both Coinbase and Binance into a tizzy. Additionally, Wood's "buy the dip" endeavor is questionable, and one has to wonder whether Wood's decision will pay off.

Quantitative Features

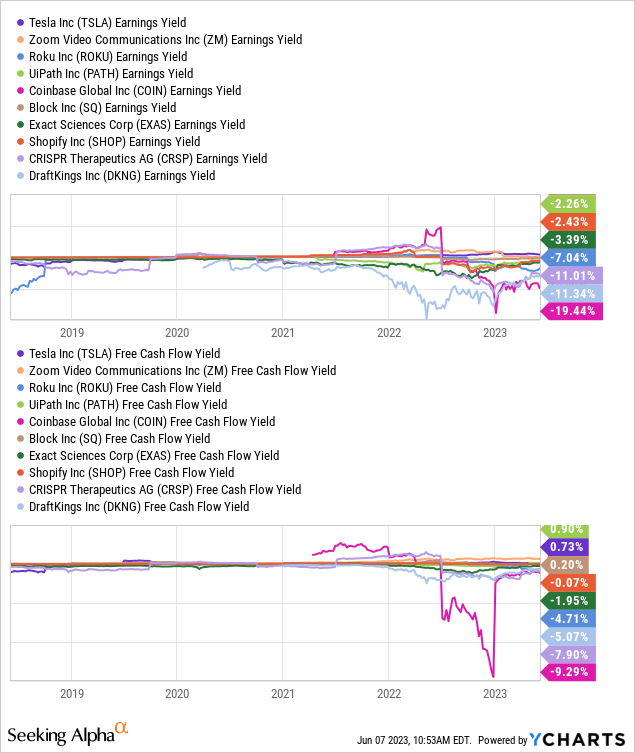

As things stand, corporate earnings are compressed across industries as severe supply-side inflation coupled with a cyclical economic decline has eroded many companies' income statements.

A look at ARK's portfolio spells serious trouble. As revealed in the panel data below, many of the fund's key holdings' earnings yields and cash flow yields are in negative territory. Therefore, we downgrade the ETF's fair value prospects from a corporate earnings viewpoint.

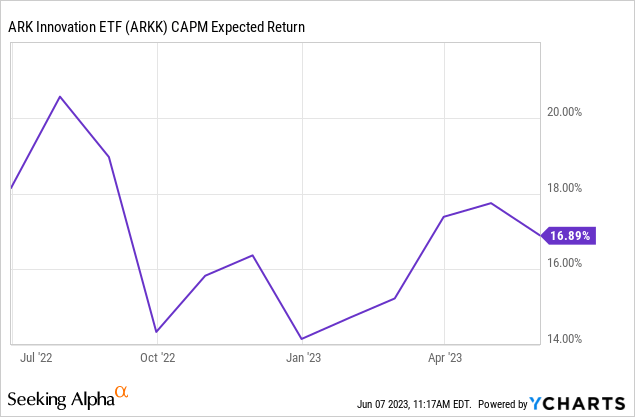

Furthermore, ARK Innovation's expected return (risk premium) has skyrocketed since January, which enhances our argument that the ETF's valuation is becoming increasingly compressed.

- Sidenote: A valuation usually consists of two components, namely corporate earnings and a risk premium.

Costs and Risk Attribution

In Ark's defense, its expense ratio of 0.75% is fairly low for an actively managed ETF with an elevated turnover ratio (the ETF trades frequently). Although nothing is disclosed in the fund's marketing material, we suspect that ARK maintains a respectable expense ratio by engaging in securities lending, which generates additional income for the fund, allowing it to charge less to shareholders.

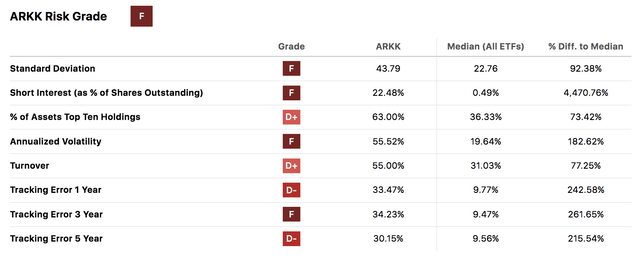

As previously mentioned, ARK's ETF is thematic and hosts a style drift with moderate security-specific risk. However, I wanted to elaborate on these features, as they are essential to understand before deciding on investing in (or shorting) this ETF.

ARK manages an unconstrained strategy, which is not bound to an index-tracking methodology. In addition, its thematic approach is novel and also does not follow an index tracking system. In essence, it is difficult to gauge the vehicle's risk versus return attributes.

Although many investors might disagree, we believe ARK follows a scattergun approach, buying whatever seems hot while ignoring basic portfolio management techniques. As such, it will not be a surprise if investors attach further risk to the ETF in the coming years, as its strategy is unclear.

Final Word

Our analysis shows that ARK Innovation is on shaky ground. A news post published by Seeking Alpha revealed that Pearl Gray was among the few to predict a capitulation of the ETF in 2022, and we see similar faultlines arising once more.

Looking for structured portfolio ideas? Members of The Factor Investing Hub receive access to advanced asset pricing models. Learn More >>>

This article was written by

Quantitative Fund & Research Firm with a Qualitative Overlay.

Coverage: Global Equities, Fixed Income, ETFs, and REITs.

Methods: Factor Analysis, Fundamental, Valuation, Street Gossip, and Common Sense.

Our work on Seeking Alpha consists of independent research and not financial advice.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.