REET And Higher Global Interest Rates: What Investors Need To Know

Summary

- Interest rates have risen across the globe.

- As rates rise, demand for real estate decreases, due to higher mortgage rates, and as other investments start to offer competitive yields and returns.

- REET is a global REIT ETF, and has been negatively impacted by these trends.

- This idea was discussed in more depth with members of my private investing community, CEF/ETF Income Laboratory. Learn More »

imaginima

Author's note: This article was released to CEF/ETF Income Laboratory members on May 16th.

Increasing Federal Reserve intervention and rising treasury rates imperil real estate prices. Investor demand for real estate was sky-high when rates were at zero, due to cheap mortgages, and due to a relative dearth of profitable investment opportunities. Demand has weakened as rates rise, as fewer investors can finance real estate purchases with +6.5% mortgage rates, and fewer want to do so with t-bills yielding +5.0%. As investor demand shifts, real estate prices are stagnating, with most industry professionals expecting price cuts in the coming months.

In my opinion, and as explained here, the above issues are incredibly important for U.S. real estate properties, REITs, and REIT funds. Thought to write a quick article looking at these issues for global REITs, to try and gauge their importance for these securities.

From what I've seen, global interest rates are a bit lower than in the U.S., but so are global real estate rental or cap yields. So, global real estate seems to be in a similar precarious situation to U.S. real estate. As such, global real estate does not seem like a compelling investment opportunity right now, at least not compared to other asset classes. The iShares Global REIT ETF (NYSEARCA:REET) invests in global REITs, suffers from these issues and risks, and so I would not be investing in the fund at the present time.

Real Estate Prices and Cap Rates

A quick look at some real estate metrics before looking at REET itself. I have a longer analysis of these here.

Cap rates are an important real estate metric, measuring a property's expected profitability or yield. Cap rates are equal to net operating income, or NOI, over market value. For most real estate properties and REITs, operating income is mostly rent.

As an example, a property worth $10 million generating $0.3 million in NOI would have a cap rate of 3.0%. Property owners should expect around 3.0% in cash-flows from a property with these characteristics, equivalent to its cap rate.

Cap rates determine real estate expected profits, and so are key to real estate demand and prices. High cap rates means strong expected profits and strong investor demand, and vice versa.

Cap rates are similar, although not identical, to other valuation and yield metrics, and can be compared. A property with a 20.0% cap rate has much higher expected profits than a bond with a 5.0% interest rate, for instance.

Spreads between cap rates and other interest rates are important for real estate demand and prices. Real estate investors might forego properties with 5.0% cap rates if bonds yield 10.0%, probably not properties with 20.0% cap rates.

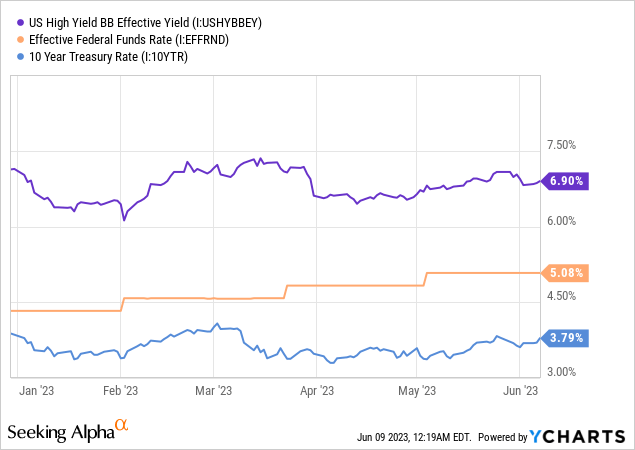

As is common knowledge, interest rates have risen across the board since early 2022. The Federal Funds rate is around 5.0% higher, high-yield corporate bonds yield around 3.0% more than 10Y treasuries, while benchmark 10Y treasury yields have risen by about 1.5%.

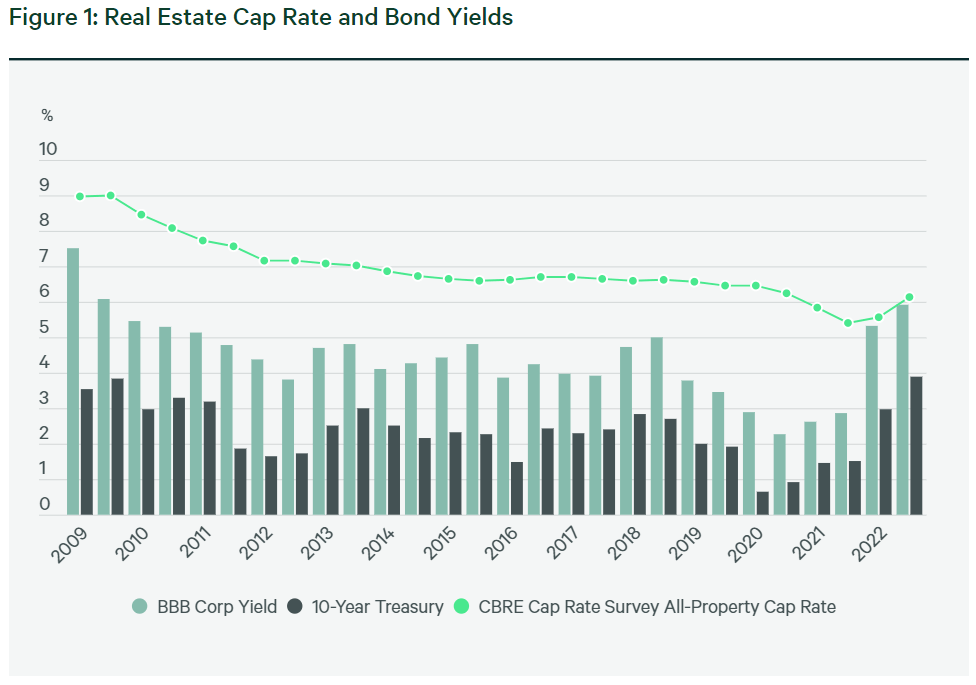

Cap rates have risen too, but much less.

CBRE

The above has caused real estate demand to decrease: not a ton of demand for real estate with 6.1% cap rates when t-bills yield +5.0%. The risk-return profile is simply not all that compelling: real estate yields marginally more than a treasury bill, but it is a much riskier, more operationally complex asset class. High-yield bonds yield +6.9% as well, and those offer a simpler, higher-yielding alternative to real estate too.

As real estate investor demand decreases, so do prices, with housing down around 3.0%, as are broader commercial real estate properties. The outlook for the rest of the year is negative, if not terribly bleak. These are very negative developments for U.S. real estate investors and owners, including most REITs and REIT funds.

Now, the above is true for U.S. real estate properties, but what about international or global real estate? Let's have a look at these asset classes.

Global Real Estate Cap Rates and Prices

Some, perhaps most, REITs report cap rates, and those that don't generally provide more than enough information to estimate these. REIT funds, on the other hand, rarely, if ever, report cap rates, but one can sometimes estimate these with publicly available information.

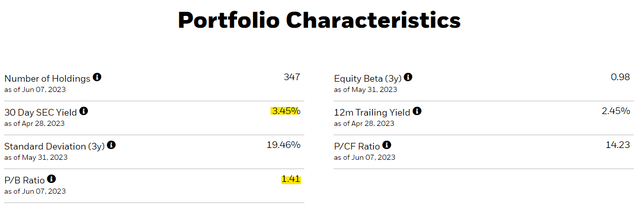

Cap rates are equal to net operating income over market value. SEC yields are equal to a fund's net investment income per share over its share price. For REIT funds, net investment income is functionally equivalent to underlying REIT dividends. For REITs, dividends track income, as REITs are required, by law, to distribute most of their income to shareholders as dividends. So, SEC yields are roughly equal to net operating income over share price. PB ratios are equal to share price over book value, so you simply multiply a fund's SEC yield and its PB ratio to get to an estimated cap rate (in all honesty, I used a rule of three here).

Although the process above seems a bit convoluted, and it is very rough, the logic is sound, and it does seem to work. I did the math for the iShares Core U.S. REIT ETF (USRT), and arrived at a cap rate of 6.5%, versus 6.1% for the U.S. real estate industry. The gap is likely due to the fact that the 6.1% figure is older, and cap rates have been increasing for months. Doing the math for REET, I arrive at an estimated cap rate of 4.8%.

REET's lower cap rate is almost entirely due to lower real estate cap rates in some developed foreign markets. The reasons for that are both financial and economic.

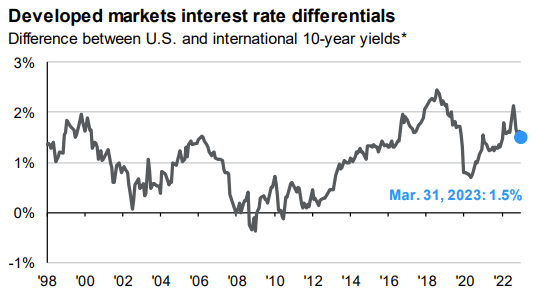

Looking at financial markets, long-term rates are consistently higher in the U.S. compared to Japan and some European countries. Rates are sometimes higher than in other Anglophone countries, too, but less consistently so. As per J.P. Morgan, U.S. long-term rates are about 1.5% higher than average right now.

JPMorgan Guide to the Markets

As rates are lower in international markets, foreign real estate investors are sometimes willing to invest in properties with rock-bottom yields. Japanese investors might buy Tokyo real estate at 2.4% cap rates, considering the alternative is 10Y bonds yielding 0.4%. As rates are higher in the U.S., investors are much less willing to invest in real estate properties with rock-bottom cap rates. Local investors will overwhelmingly choose t-bills yielding +5.5% over properties with 2.4% cap rates.

Long-term rates are lower in international markets for economic and demographic reasons too. Japan, for instance, has been stuck with extremely low interest rates since the early 90s, Europe since the late 2000s. Sluggish economic growth since has caused rates to remain low as well: central banks won't hike until economic growth picks up, which might be never for some of these economies. Aging populations and high savings rates have a similar impact. Interest rates need to be low to entice the older Japanese and European populations into greater consumption.

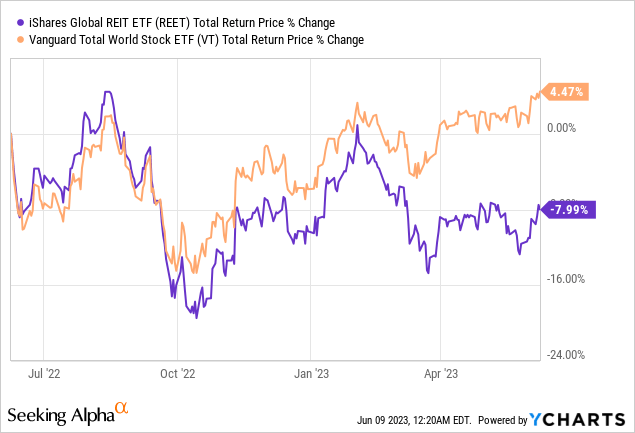

In any case, it seems that global real estate properties are also sporting very low cap rates. Potential profits are low, and potential losses quite high, if investors continue to shift towards safer and / or higher-yielding asset classes. Global REITs have underperformed global stocks for over a year now, and underperformance could very well continue.

Conclusion

Global real estate properties sport uncompetitive cap rates. Low cap rates imply weak potential profits, and high potential losses. REET is a global REIT ETF, and so suffers from these same issues. As such, I would not be investing in the fund at the present time.

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

This article was written by

Juan has previously worked as a fixed income trader, financial analyst, operations analyst, and economics professor in Canada and Colombia. He has hands-on experience analyzing, trading, and negotiating fixed-income securities, including bonds, money markets, and interbank trade financing, across markets and currencies. He focuses on dividend, bond, and income funds, with a strong focus on ETFs, and enjoys researching strategies for income investors to increase their returns while lowering risk.

---------------------------------------------------------------------------------------------------------------

I provide my work regularly to CEF/ETF Income Laboratory with articles that have an exclusivity period, this is noted in such articles. CEF/ETF Income Laboratory is a Marketplace Service provided by Stanford Chemist, right here on Seeking Alpha.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.