Buy The SPDR S&P 600 Small Cap Value ETF For The Long-Term

Summary

- The SPDR S&P 600 Small Cap Value ETF is well-positioned for long-term out-performance.

- The Fama and French Small Cap Value premium shows 4.8% out-performance by small cap value from 1926 to present.

- P/E and P/S for Large-Cap Growth have grown to absurd levels.

- Small-Cap Value stocks are valued lower than their 10-year average.

- The gap between Large-Cap Growth and Small-Cap value is the widest since 2002.

chaofann

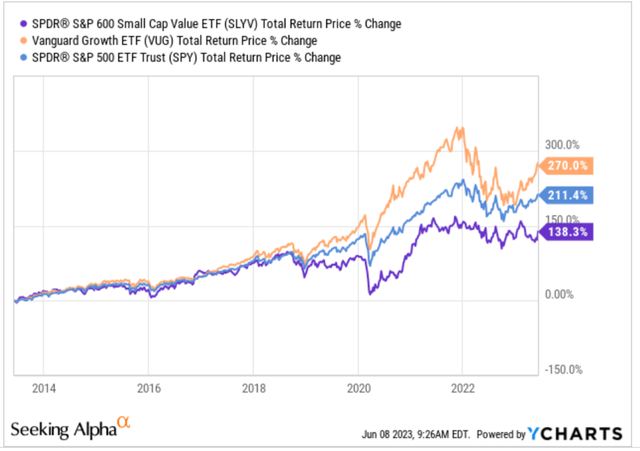

The SPDR® S&P 600 Small Cap Value ETF (NYSEARCA:SLYV) is a top pick as a long-term holding and the time may never be better to buy. This ETF has experienced underperformance recently when compared to Large Cap Growth, as shown here with the Vanguard Growth ETF (VUG). This difference is due to the rotation of investors' preference from small cap value stocks to big tech amid the pandemic and recovery. The performance of larger tech stocks like Amazon (AMZN), Microsoft (MSFT), Nvidia (NVDA), and Apple (AAPL) has been a primary driver. However, the situation could change as the economy turns, interest rates remain elevated, and smaller companies begin to show growth and stable profitability.

Small Cap Value vs Others (ycharts)

Small-cap companies have the potential for better growth than their large-cap counterparts, but this growth potential comes with more perceived risk among investors. As the economic cycle changes, investors could once again turn towards small-caps value stocks as a source of higher investment returns. I believe the time for small caps to return to favorability is overdue, thus ensuring better performance of SPDR® S&P 600 Small Cap Value ETF sometime in the future in my view.

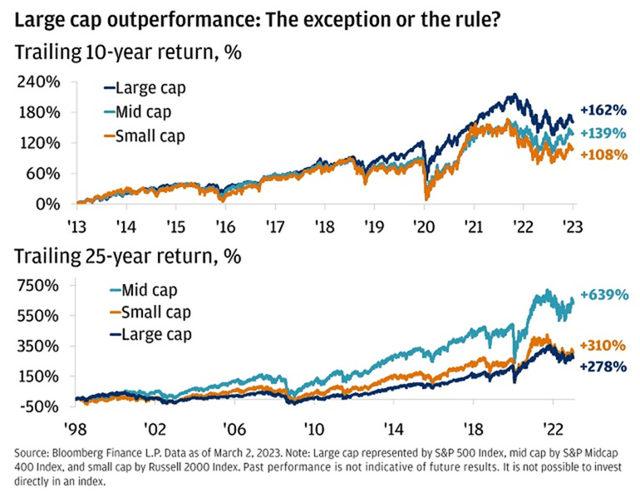

Borrowing a pic from a prior piece, and a J.P. Morgan assessment of the market, small and mid-cap stocks have outperformed large caps when looking at a 25-year time horizon. Only in the past ten years, large caps have outperformed.

10 and 25 Year Comparisons (JP Morgan)

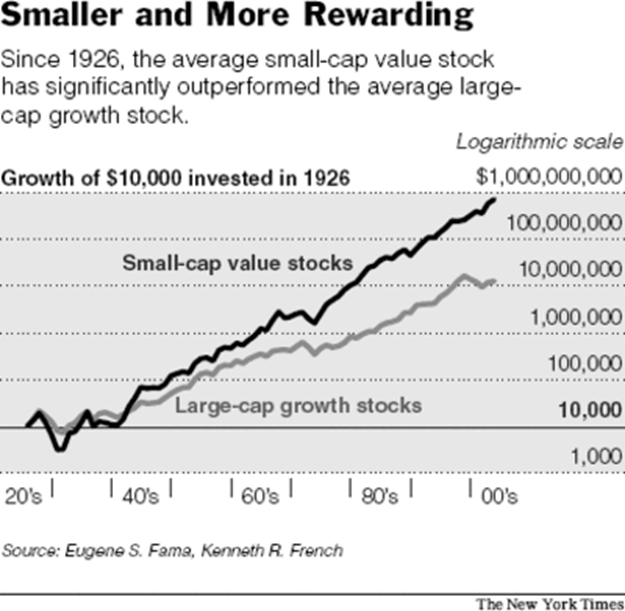

Not only that, according to a study by Fama and French, small-cap value stocks have outperformed large cap stocks by an average of 4.8% per year from 1926 to 2017. This can be attributed to the fact that smaller firms have more room for growth and are often undervalued compared to their larger counterparts, and value tends to outperform growth over the long term.

Known as the Fama and French Small Cap Value premium, this is a phenomenon in finance in which was first identified by Eugene Fama and Kenneth French in the 1990s and they later won the Nobel Prize in Economics in 2013 for their work in developing asset pricing models and identifying this value premium. Under the efficient markets hypothesis, some investors would argue that the premium is thought to exist because smaller firms have higher risks and therefore require a higher expected return to compensate investors for that risk.

Fama and French 1926 to present (Interactive Advisors)

Nevertheless, the outperformance of small-cap value versus large cap growth is not something you should ignore. Historical results speak for themselves.

What’s driving large cap stocks’ recent outperformance vs small caps?

Let’s look at the PE ratios of Microsoft, Apple, Nvidia, and Amazon for a clue. Each of them trades at 33.52, 29.77, 48.19, and a 77.57 PE multiple. These valuations are important because these stocks sometimes make up more than a third of large cap equity ETFs. For example, these four stocks are 34.33% of the Vanguard Growth Index Fund ETF Shares. You will see further below that many times small cap equities don’t command the same premium valuation, but also the price investors have been willing to pay for these large cap growth stocks has expanded over the past decade.

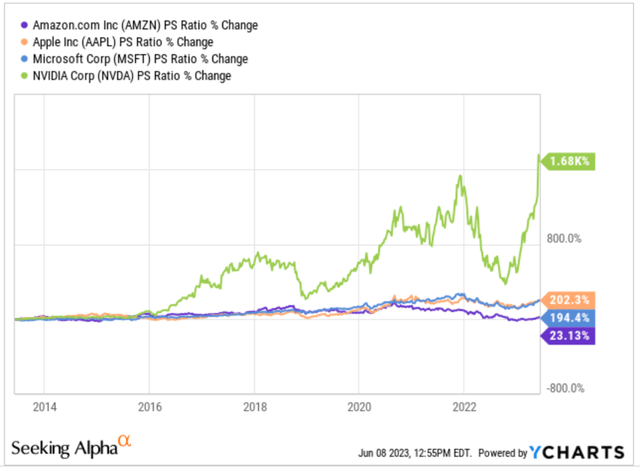

As seen below, the PS ratios for Microsoft, Amazon, Nvidia and Apple has expanded by about 23% to 1680%, meaning investors are willing to pay up to 16 times as much for these stocks what they paid 10 years ago. Frankly, the premium paid for large-cap growth stocks has grown to absurd levels in my opinion.

Large Cap P/S Expansion (ycharts)

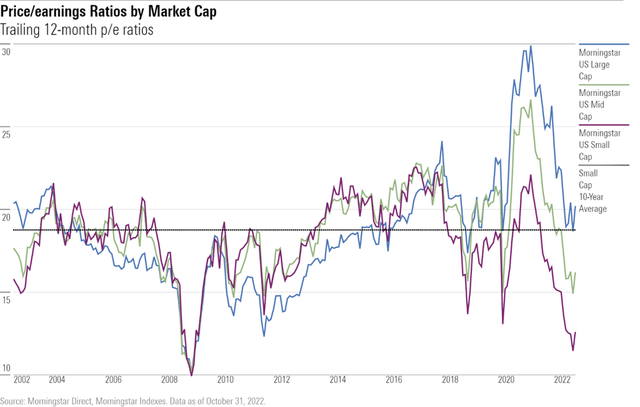

Meanwhile, valuations on small caps are showing a tremendous opportunity. Not only are small-caps significantly underpriced compared to mid and large-cap equities, they are also trading at a discount to the 10-year average for small-caps. On their own, they are undervalued, even without comparing to other investing styles.

Small Caps are Cheap! (Morningstar)

“The trailing 12-month price/earnings ratio for the Morningstar US Small Cap Index—a collection of the smallest 7% of U.S. stocks, each with current market caps of no more than $18.7 million—currently lies at 12.6, while the large-cap index’s price/earnings ratio is 20.2. A gap this wide between large- and small-cap valuations hasn’t been seen since 2002.”- Morningstar

Now is arguably the best time to buy small-cap value in 20 years!

Top Ten Holdings

These top ten holdings make up just 8.15% of the total ETF holdings. The fund is very well diversified. Looking at each of these companies will help an investor understand how the fund is allocated across business sectors. At this moment, the top industries held are Consumer Cyclical (19.13%), Industrials (16.71%), Financials (15.28%), Real Estate (13.23%), and Technology (10.59%).

Meritage Homes Corp (MTH) is a US-based homebuilder founded in 1985. With operations in 9 states, the company specializes in building premium single-family homes. Meritage Homes has a focus on energy-efficiency and quality. The company is known for its commitment to green building strategies, receiving multiple awards for its sustainable practices. The PE ratio for this company is a very low 8.54 and the company is expected to grow revenue by 5.68% next year.

Insight Enterprises Inc (NSIT) is a global provider of technology solutions to businesses and governments. With operations in over 20 nations, Insight delivers a wide range of solutions to help clients achieve their digital transformation goals. These include consulting, technology solutions, cloud services, software licensing, managed and support services. The PE ratio for this company is 14.31, which is fairly low, and the company is expected to grow revenue by 4.21% next year.

Radian Group (RDN) Inc is a leading provider of mortgage services, including risk management, mortgage insurance, appraisal and valuation, title and closing, and home warranty services. Founded in 1977, the company is headquartered in Philadelphia and operates nationwide. The PE ratio for this company is a respectable 8.34, but the company is not expected to grow revenue next year. This is partly the result of the housing recession driven by higher interest rates. Radian has consistently carried a low PE for the past decade and never seems to break out of the value mold, but has performed well over that same period.

John Bean Technologies Corp (JBT) is a top company for distribution of equipment and services for the food and beverage industry. With a global presence in over 100 countries, John Bean Technologies Corp serves a range of customers, including food processors, equipment manufacturers, and retailers. The company is committed to sustainability, safety, and efficiency. The PE ratio for this company is 23.15 and that makes it an odd stock to include in this value ETF. They appear to be going through some divestiture activity that could be skewing some valuation metrics. The company is expected to grow revenue by 8.65% next year, giving the stock decent growth prospects.

Essential Properties Realty Trust Inc (EPRT) is a real estate investment trust that manages single-tenant properties across the U.S. The company focuses on businesses with stable demand such as convenience stores, restaurants, and dollar stores. As a REIT, it aims to provide attractive returns to investors through consistent cash flow and potential capital appreciation. Due to the structure, it is best to view the dividend yield and growth rate for proper valuation. The current dividend yield is 4.41% and the forward-looking growth rate is 9.05%. Both appear to be indicators of strong value.

Viasat Inc. (VSAT) is a global telecommunications company that provides high-speed internet services and secure networking solutions. Their satellite internet technology provides service to over 590,000 internet subscribers, while their cybersecurity and data encryption solutions help protect critical government infrastructure and sensitive information. The PE ratio for this company is off the charts, but the price to book ratio is only 0.91 and the company is expected to grow revenue by a whopping 24.37% next year. This may be both a growth and value proposition.

Group 1 Automotive Inc (GPI) has over 185 dealerships and 240 franchises across the United States, United Kingdom, and Brazil, the company sells a variety of new and used vehicles, as well as offering repair and maintenance services. The PE ratio for this company is 5.96, a very low ratio, and the company is expected to grow revenue by 7.98% next year. The possibility of a recession and higher interest rates have likely lead to this stock being undervalued.

Tri Pointe Homes (TPH) Inc is a U.S.-based homebuilder known for their exceptional quality, innovative designs, and energy-efficient features. The company operates in seven states, including California, Texas, and Colorado. The PE ratio for this company is 10.15 and the company is not expecting to grow revenue in the next year. This is another firm who is seeing the rapid increase in interest rates hit the bottom line and lower valuation.

Itron Inc (ITRI) is a firm that provides solutions to tackle energy and water resource management challenges. This firm serves customers in more than 100 countries across the globe. With a commitment to innovation and sustainability, the firm is well positioned to have an impact on the future of energy and water management. The PE ratio for this company is a 49.56 and the company is expected to grow revenue by just 3.42% next year. With revenue that historically declined since 2019, it’s unclear initially how this firm fits into the value mold, but it is uniquely positioned.

Avista Corp (AVA) provides natural gas and electricity services to over 400,000 customers in eastern Washington, northern Idaho, and parts of Oregon. These operations include several renewable energy projects, including wind and solar power. The company's mission is to provide safe, reliable energy services. The PE ratio for this company is 18 and the company is expected to grow revenue by 6.37% next year. The company currently pays out 95% of earnings as a dividend.

Companies like these above make up the rest of the SPDR® S&P 600 Small Cap Value ETF. Many of them have strong prospects for growth and profitability.

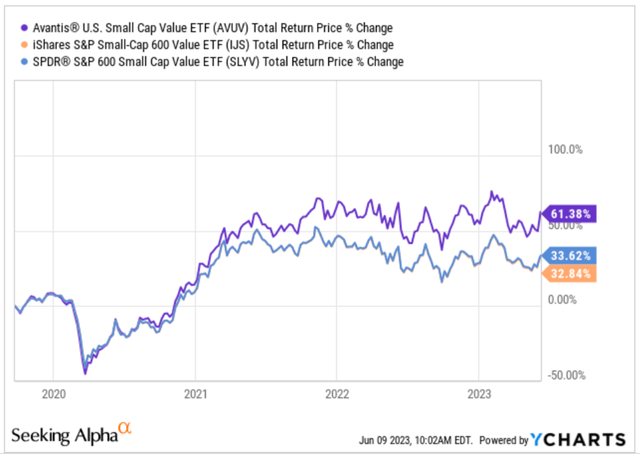

Other Small Cap Value ETF Alternatives

Investors looking at small cap value can also consider iShares S&P Small-Cap 600 Value ETF (IJS) and Avantis® U.S. Small Cap Value ETF (AVUV). Both take a small cap value approach to investing, but one is actively managed and the other is passively managed like SPDR® S&P 600 Small Cap Value ETF.

Small Cap Value ETF Performance (ycharts)

The iShares S&P Small-Cap 600 Value ETF shares many of the top ten holdings with SPDR® S&P 600 Small Cap Value ETF and has a similar dividend and expense ratio. This fund is also passively managed, meaning that the managers don’t pick the winners and losers. They broadly diversify and try to keep expenses low.

Avantis® U.S. Small Cap Value ETF (AVUV) is actively managed ETF and charges a bit more for active management. It’s an interesting choice. Since inception in 2019, Avantis® U.S. Small Cap Value ETF has outperformed the index on a total return basis. Keep in mind this is a short period of time and actively managed funds don’t always beat passively managed funds, but this one may be worth a look.

Conclusion

I believe investing in the SPDR® S&P 600 Small Cap Value ETF is a prudent decision for anyone seeking to diversify their portfolio with small-cap value stocks with great potential for strong growth and profitability. With a low expense ratio, broad exposure to small-cap value equities, and a solid track record of performing well, SLYV offers a dependable investment opportunity for long-term investment growth.

- Small-cap value stocks have outperformed large cap stocks by an average of 4.8% per year from 1926 to 2017.

- Small-cap value stocks are trading at a discount to the 10-year average.

- The gap between large- and small-cap valuations hasn’t been seen since 2002.

Adding SLYV to your investment portfolio is a great way to gain exposure to small cap value and possibly profit from an area of the market that in the past has been proven to provide outperformance at a time when nobody really expects it.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.