Sea Limited: Attractive Entry Point With Margin Of Safety

Summary

- Sea Limited's stock has declined 24% partly due to Garena's revenue and bookings dropping, but Shopee and SeaMoney still have a long pathway for growth.

- Shopee faces competition from TikTok in Southeast Asia, but its investment in logistics capabilities provides an advantage in customer experience and cost efficiencies.

- We saw a slight uptick in the NPL ratio. But the company is focusing on improving the quality of its loan book as well as diversifying its funding source.

- Sea Limited's current valuation provides an attractive entry point, with a fair value estimate of $88 per share, implying a 38% upside potential.

kokkai

Recap

In our article titled “Sea Limited: Ample Room for Growth, But Competition Is Here to Stay,” we wrote that huge, under-penetrated e-commerce markets in Southeast Asia and Latin America would drive Sea’s (NYSE:SE) top-line growth. Additionally, SeaMoney also has a long pathway for growth, as a large portion of the population remains underbanked or unbanked. However, while the industry is heading toward profitability, competition is here to stay. In our view, the acceptable buying price is between $62 and $66 per share, providing a comfortable margin of safety.

Since we published our article, the stock has declined 24% from $79 per share to $64 per share. Shares once touched $57 per share after the 1Q23 EPS GAAP had come in below expectations at $0.15, thus pushing down the shares by 17%. But are the 1Q23 results as bad as they appear?

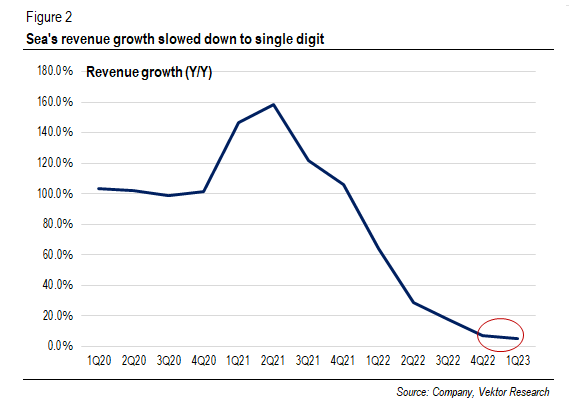

Beaten-Down Gaming Business Dragged Down Sea’s Revenue Growth

In 1Q23, Sea’s revenue only grew 5% (Y/Y) to $3 billion, marking a second consecutive single-digit growth rate. This was largely because Garena’s revenue and bookings were down 53% (Y/Y) and 44% (Y/Y), respectively.

Sea's revenue growth (Company, Vektor Research)

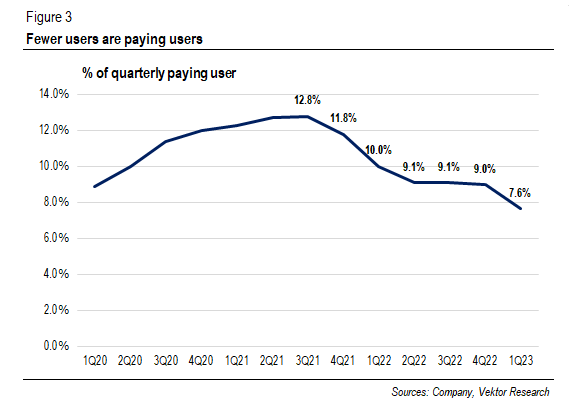

Indeed, quarterly active users were up, ending a two-consecutive quarterly decline. Sea’s management said that Free Fire’s monthly active users achieved “a new peak” in April and that it would “monitor closely” the trend. Moreover, the company is launching new third-party published games, namely Undawn and Black Cloud Mobile. Even so, less than 8% of the active users were paying users in 1Q23, down from the latest peak of 13%.

Quarterly paying users as a % of quarterly active users (Company, Vektor Research)

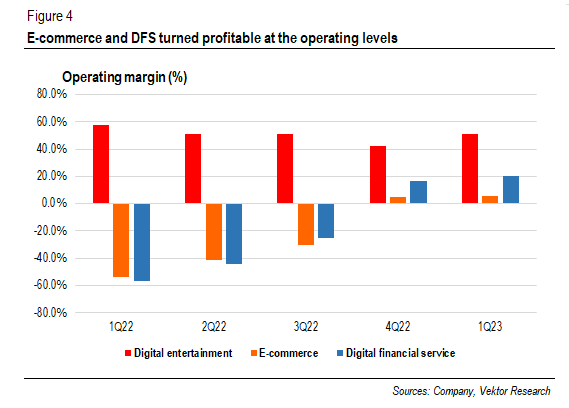

Further, Sea’s operating margin shrank from 10% in 4Q22 to 4% in 1Q23. This is mainly because Garena, which produces over 50% operating margin, made up a smaller portion of Sea’s EBIT. Shopee and Sea Money’s operating margins actually expanded to 5.6% and 20.5%, respectively. Another plus point is that the company reported a positive free cash flow during the quarter. Free cash flow margin was 17% in the quarter.

Segments' operating margin (Comapny, Vektor Research)

Competition is Tougher in the E-commerce Market, But Investment in Logistics Makes a Difference

On the contrary, Shopee’s revenue grew 36% (Y/Y), and core marketplace revenue increased 54% (Y/Y). As we mentioned in our last article, the e-commerce market size is huge and remains under-penetrated, providing a long pathway for growth. Additionally, being a profitable business remains the company's focus. In Brazil, where Shopee has only been in its fourth year of operations, contribution margin loss improved to $0.34 from $1.52 a year earlier.

Nevertheless, competition from TikTok in Southeast Asia is getting tougher. According to Singapore-based Cube Asia, 51% of TikTok Shop consumers in Indonesia, Thailand, and the Philippines spent less on Shopee, as cited in CNBC. Besides already having a large user base, TikTok is offering discounts to new users as we are writing this article.

When asked about competition from TikTok, the management said that the strategy is to “remain very nimble and flexible.” Please note what the management said during the last earnings call:

As I shared, both for our long-term goals of expanding the profitable TAM and build strengthening our competitive, and also in the near-term to respond to market dynamics within each market, so again, we're not particularly worried about the margin. I think it's more about how we build a healthy long-term ecosystem that will maximize the long-term profitable growth of our business.

Our take is that aggressive moves from TikTok are likely to force established e-commerce players, including Shopee, to do more promotions and discounts to defend market share. However, just as we have seen in the past few years, promotions come at the expense of financials, and at some point, promotions will be fewer and thus the industry will be more rational.

Instead, while competition from new players is basically unavoidable, existing e-commerce players have been focusing on improving their logistics capabilities. This should cut down delivery time and costs, as the company is enhancing customer experience and improving cost efficiencies. Sea’s management said that 95% of its customer base in Indonesia has been covered by the company’s delivery services, and that the company has been expanding its first and last-mile hubs in Brazil.

Another example is that GoTo, an Indonesia e-commerce company, consolidated Tokopedia’s fulfillment unit and Gojek’s same-day delivery service under GoTo Logistics. "Enhanced batching and routing capabilities" allow the company to provide the next-day delivery service at 30% lower costs than other third-party providers, GoTo management said.

We believe that logistics capabilities differentiate more established players from newer players. As we are writing, TikTok Shop only has a standard shipping option (in our area), while Shopee provides various delivery options, such as same-day, next-day, or regular delivery services. In our view, TikTok is likely to continue taking market share at least in the near term. But Sea plays a long-term game by investing in its infrastructure, thus building a sustainable, profitable business. As we wrote in the last article:

We believe the industry is becoming more rational, with profitability becoming the number one priority. This also triggers customers to increasingly look beyond price and prefer a better customer experience, in our view.

A Slight Uptick in NPL, But Unlikely to be An Alarming Sign

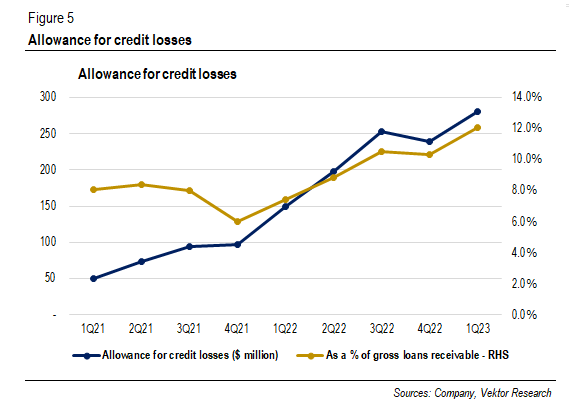

Revenue from digital financial services increased 75% (Y/Y), driven by credit business. Loans receivable remained at ~$2 billion because Sea had third-party financial institutions to fund a significant portion of its loan book. Yet, allowance for credit losses was up to $281 million from $239 million, although loans receivable was relatively flat.

The management said this was because “products have expanded in terms of the features and tenure and types of loans we offer.” However, we found that allowance for credit losses as a percentage of gross loans receivable has gone north in the past few quarters. An increase or decrease in allowance typically depends on the discretion of a company’s management.

Sea's allowance for credit losses as a % of gross loan book (Company, Vektor Research)

Sea’s management argued that this was caused by more variety of product “features, tenure, and types of loans” and that NPL remained “very stable and low.” However, we notice that NPL of more than 90 days went up from “less than 2%” to “around 2%.” Before Sea shortened the loan write-off period, the ratio was “less than 4%” in 3Q22 and would have increased to “about 5%” in 4Q22 without the change.

Nevertheless, the loan book is unlikely to grow significantly, as Sea pivoted to focus on improving the quality of its loan book and now is looking to “diversify offerings and funding sources.” Thus, we do not see such a slight uptick in the NPL ratio as an alarming sign.

Overall, our thesis is playing out as expected: Shopee and SeaMoney have a long pathway for growth. Further, the lower revenue contribution from Garena means that the decline will have less impact on Sea’s revenue growth as we move forward. Digital entertainment used to make up about 50% of Sea’s revenue. Now, it is 18%. Therefore, does the stock provide an attractive entry point?

Valuation

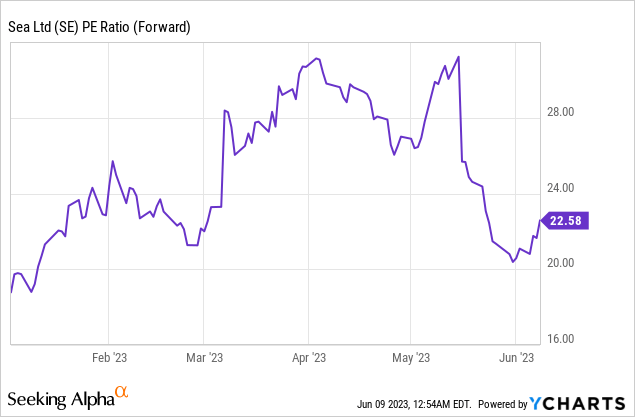

Sea trades at 23x its forward earnings. We believe that the acceptable buying price is between $62 per share and $66 per share, which provides a comfortable margin of safety. The last time the stock traded at ~$60, the market was more conservative on Sea’s future earnings. Additionally, Sea was losing money at the time. Now, it is a cash-generating business.

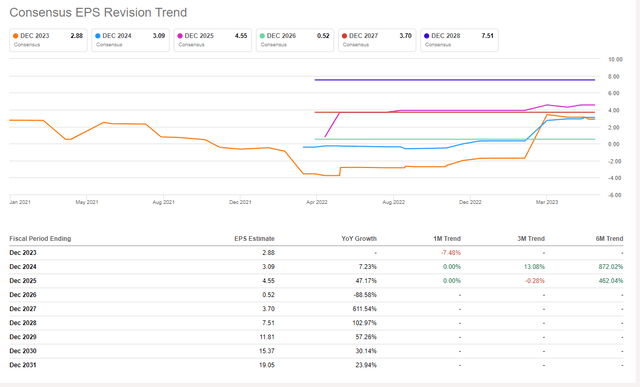

Consensus EPS revision (Seeking Alpha)

But what about Sea’s growth outlook? Despite Garena’s soft results, we still believe that Shopee and SeaMoney have a long pathway for growth. While Shopee is facing tougher competition from TikTok—likely to last at least in the near term—we see that Shopee has an advantage in logistics capabilities in an environment where customers increasingly look beyond price. This will help Sea build a sustainable, profitable business. In SeaMoney, we saw a slight uptick in the NPL ratio. But the company is focusing on improving its loan book quality, while at the same time diversifying its funding source.

Thus, we believe that it makes a lot of sense to buy Sea at the current valuation. Our fair value estimate is $88 per share, which implies a 38% upside potential. If you have any thoughts, please do not hesitate to comment below.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is not an investment recommendation. Please do you own due diligence.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.