Bucking The Trend: Why SMID Caps Are Poised For A Comeback

Summary

- Small- and mid-cap stocks (SMID caps) have underperformed large-caps and the broad US equity market recently, but their current valuation is becoming increasingly attractive.

- Historically, SMID caps have outperformed large-cap stocks during economic recovery phases, with average annualized returns of 26%.

- With valuations at 20-year lows relative to large-caps, now may be a good opportunity for investors to allocate to SMID caps in anticipation of a potential economic recovery.

primeimages

Originally posted on June 06, 2023

The recent performance of small- and mid-cap stocks, often referred to as "SMID caps”, and why they might be poised for a comeback has become a topic of interest among investors. SMID cap equities, which have traditionally been seen as more volatile and riskier than their large-cap counterparts, have recently underperformed both large-caps and the broad US equity market. This is mostly due to the uncertainty surrounding an economic slowdown and the looming threat of a recession that typically has a greater impact on the performance of smaller companies.

However, taking a closer look, we find that the current valuation of these smaller-cap stocks is becoming increasingly attractive relative to large-caps. This combined with an economic recovery phase possibly on the horizon, where smaller-caps have historically outperformed, supports the case that now may be a good opportunity for investors to allocate to this area of the market.

Performance Leading into a Recession

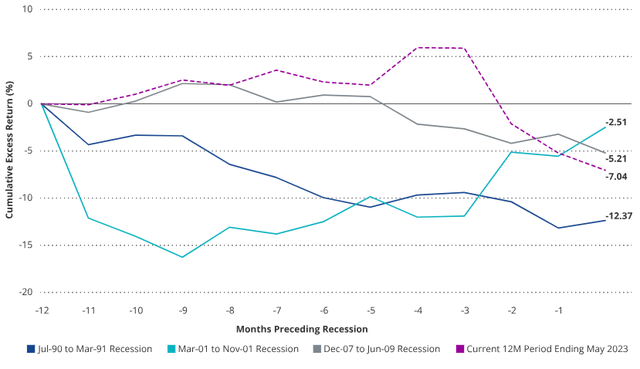

Historically, small- and mid-cap stocks have shown a tendency to underperform large-cap stocks in the period leading up to a recession. This is primarily due to their higher risk profile and greater sensitivity to economic conditions. As uncertainty increases and economic indicators point towards a slowdown, investors often shift their portfolios towards more stable, large-cap companies, which are generally considered safer during turbulent times.

For example, small- and mid-caps, represented by the Russell 2500 Index, have underperformed the S&P 500 during the 12 months preceding recent recessions. On average, the SMID caps underperformed by nearly 700 basis points during these periods. This underperformance of smaller companies can be attributed to their higher volatility and the fact that they are often more exposed to domestic economic conditions. While we are not officially in a recession today, smaller companies have been punished as if we are heading in that direction. As of the end of May, SMID caps have underperformed the S&P 500 by about 700 basis points over the last year.

SMID Cap Underperformance Preceding Recessions

Source: Morningstar. SMID Cap Stocks represented by the Russell 2500 Index. Cumulative Excess performance relative to the S&P 500 Index. Past performance is no guarantee of future results. See disclaimers and descriptions at the end of this presentation. See disclaimers and descriptions at bottom of page.

Dominate Performance Following Recessions

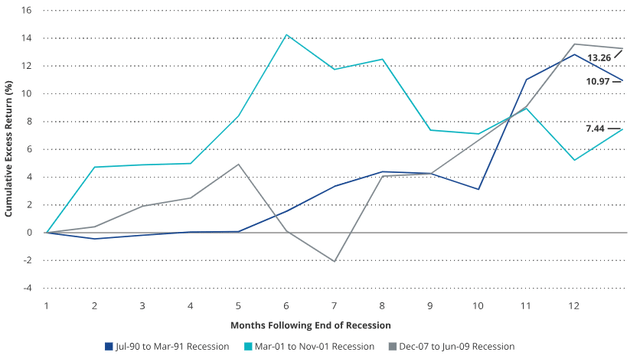

While small- and mid-cap stocks often bear the brunt of a recession, they also tend to bounce back strongly during the recovery phase. Historically, smaller companies have outperformed their larger counterparts 83% of the time in recoveries and saw average annualized returns of 26% during the recovery phase.1 This is because smaller companies tend to benefit more from fiscal stimulus measures and are often more leveraged to the domestic economy, which usually recovers before the global economy. They are also generally more agile and can adapt more quickly to changing economic conditions.

This outperformance of smaller companies during the recovery phase can also be observed by looking at recent recession cycles. On average, the SMID cap Russell 2500 Index outperformed the S&P 500 by roughly 1000 basis points in the 12 months following the end of recent recessions. Furthermore, data shows that this outperformance extends beyond just the first year. Increasing to five-year post-recession periods, the average annualized return for smaller-cap companies was 14.5% compared to an annualized return of about 12% for large-caps.2

SMID Cap Excess Return over S&P 500 Post Recent Recessions

Source: Morningstar. SMID Cap Stocks represented by the Russell 2500 Index. Cumulative Excess performance relative to the S&P 500 Index. Past performance is no guarantee of future results. See disclaimers and descriptions at the end of this presentation. See disclaimers and descriptions at bottom of page.

The Current Opportunity – Decade Low Valuations Ahead of a Possible Recovery

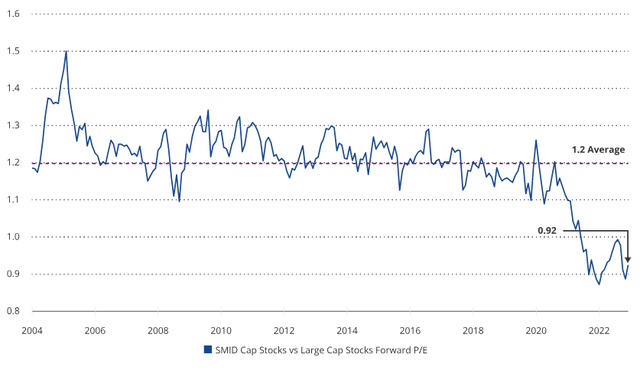

Given the recent underperformance of smaller market-cap US equities and the looming threat of an economic slowdown, it might seem counterintuitive to consider allocating to small-caps. However, it's important to remember that markets are forward-looking, and much of the anticipated economic slowdown may already be priced into this segment of the market.

Currently, valuations for SMID cap companies look extremely attractive relative to large-caps, the most attractive in decades actually. As of the end of April, the forward price-to-earnings (P/E) ratio for SMID cap companies are now at 20-year lows relative to large caps. This relative undervaluation could provide a good entry point for investors considering an allocation to smaller cap companies. While the threat of an economic slowdown or recession is still present, the potential upside of these already beaten down stocks in a recovery could be worth the risks.

SMID Cap Forward P/E Relative to Large Cap Forward P/E

January 2004 – April 2023

Source: Bloomberg. SMID Cap Stocks represented by the Russell 2500 Index. Large Cap Stocks represented by the S&P 500 Index. Past performance is no guarantee of future results. See disclaimers and descriptions at the end of this presentation. See disclaimers and descriptions at bottom of page.

The VanEck Morningstar SMID Moat ETF

While the uncertainty of an economic slowdown and possible recession has led to the underperformance of small- and mid-cap US equities recently, their current decade low valuation relative to large-caps and historical outperformance in economic recoveries presents a potentially attractive opportunity for investors.

Given the current economic climate, it may now be an opportune time to consider diversifying your portfolio with SMID cap equities. As we continue to navigate an economic slowdown, or potential recession, and the subsequent recovery, SMID caps may offer a compelling investment opportunity for those looking to capitalize on their historical potential for outperformance on the back side of economic turbulence.

For investors looking to gain exposure to smaller-cap equities, the VanEck Morningstar SMID Moat ETF (SMOT) could be an attractive option. SMOT seeks to track the Morningstar® US Small-Mid Cap Moat Focus IndexSM, which leverages Morningstar’s forward-looking, rigorous research process, driven by over 100 analysts globally. The Index applies much of the same core index methodology principles as Morningstar’s flagship Wide Moat Focus Index, but to a universe of small- and mid-cap companies. The Index targets SMID cap companies with long-term competitive advantages, known as moats, and attractive valuations.

| Important Disclosures Source for all data unless otherwise noted: Morningstar. 1 Source: Merrill, Bank of America; Small-caps represented by the Russell 2000 Index. Large-caps represented by S&P 500. Data based on the BofA Global Research U.S. Regime Indicator. Based on data from 1970 to November 2022. 2 Source: Allspring; the Kenneth French Data Library, Center for Research in Security Prices (CRSP), and National Bureau of Economic Research (NBER). Fair value estimate: the Morningstar analyst's estimate of what a stock is worth. Price/Fair Value: ratio of a stock's trading price to its fair value estimate. This is not an offer to buy or sell, or a recommendation to buy or sell any of the securities/financial instruments mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third party data. The information herein represents the opinion of the author(s), but not necessarily those of VanEck or its employees. Holdings will vary for the SMOT ETF and its corresponding Index. For a complete list of holdings in the ETF, please click here: SMOT - VanEck Morningstar SMID Moat ETF - Holdings. An investor cannot invest directly in an index. Returns reflect past performance and do not guarantee future results. Results reflect the reinvestment of dividends and capital gains, if any. Certain indices may take into account withholding taxes. Index returns do not represent Fund returns. The Index does not charge management fees or brokerage expenses, nor does the Index lend securities, and no revenues from securities lending were added to the performance shown. The Morningstar® US Small-Mid Cap Moat Focus IndexSM was created and is maintained by Morningstar, Inc. Morningstar, Inc. does not sponsor, endorse, issue, sell, or promote the VanEck Morningstar SMID Moat ETF and bears no liability with respect to the ETF or any security. Morningstar® is a registered trademark of Morningstar, Inc. Morningstar® US Small-Mid Cap Moat Focus IndexSM is a service mark of Morningstar, Inc. The Morningstar moat-driven indexes represent various regional exposures and consist of companies identified as having sustainable, competitive advantages and whose stocks are attractively priced, according to Morningstar. The Morningstar® US Small-Mid Cap Moat Focus IndexSM is intended to track the overall performance of small- and mid-cap companies with sustainable competitive advantages and attractive valuations according to Morningstar's equity research team. Russell 2500 Index represents small- and mid-cap US companies. The S&P 500 Index consists of 500 widely held common stocks representing larger-cap US companies. Morningstar Wide Moat Focus Index consists of companies identified as having sustainable, competitive advantages and whose stocks are attractively priced, according to Morningstar. An investment in the VanEck Morningstar SMID Moat ETF (SMOT) may be subject to risks which include, among others, equity securities, small- and medium-capitalization companies, consumer discretionary sector, financials sector, health care sector, industrials sector, information technology sector, market, operational, index tracking, authorized participant concentration, new fund, absence of prior active market, trading issues, passive management, fund shares trading, premium/discount and liquidity of fund shares, non-diversified, and concentration risks, all of which may adversely affect the Fund. Small- and medium-capitalization companies may be subject to elevated risks. An investment in the VanEck Morningstar Wide Moat ETF (MOAT) may be subject to risks which include, among others, risks related to investing in equity securities, consumer discretionary sector, health care sector, industrials sector, information technology sector, financials sector, medium-capitalization companies, market, operational, high portfolio turnover, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount risk and liquidity of fund shares, non-diversification and index-related concentration risks, all of which may adversely affect the Fund. Medium-capitalization companies may be subject to elevated risks. Investing involves substantial risk and high volatility, including possible loss of principal. An investor should consider the investment objective, risks, charges and expenses of a Fund carefully before investing. To obtain a prospectus and summary prospectus, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing. © Van Eck Securities Corporation, Distributor, a wholly owned subsidiary of Van Eck Associates Corporation. |

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by