Representative Image

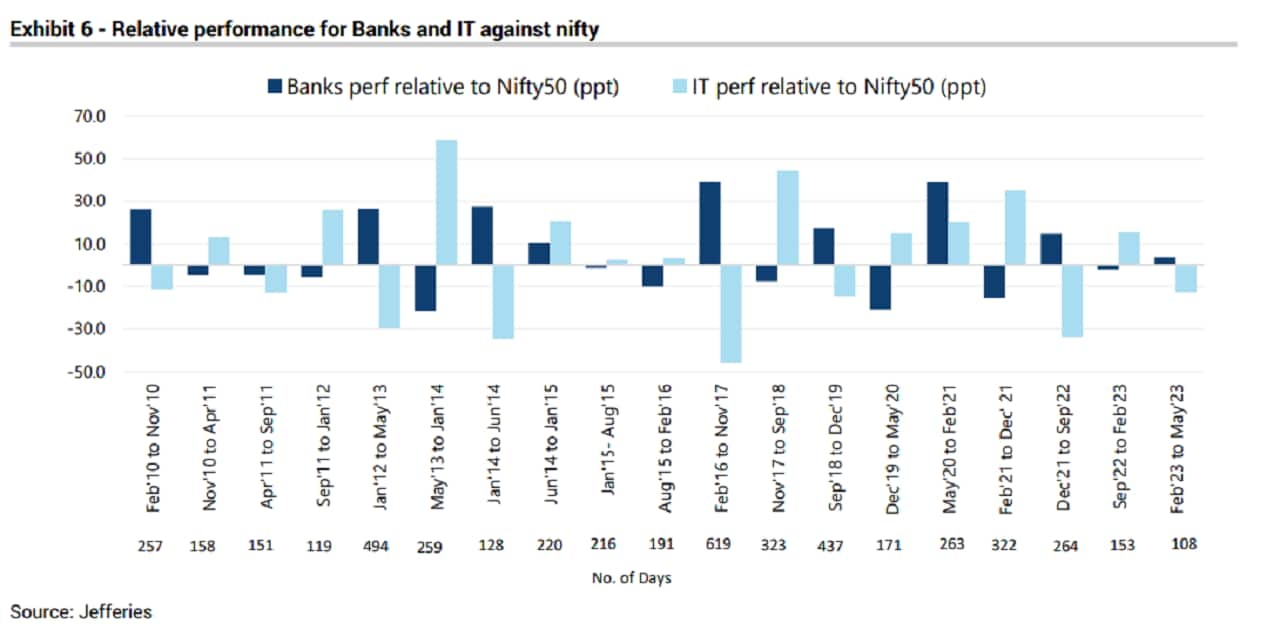

Brokerage firm Jefferies has chosen banking over information technology (IT) as it analysed the prospects of the two heavyweight sectors in the Nifty 50. The financials and IT sectors together account for 50 percent of the Nifty 50 and are key for any India portfolio. Data from the past 14 years also reveals that the two sectors are often contradictory, moving in opposite directions 70 percent of the time.

Jefferies explains that the fundamental reason behind the contrasting trend is that banks tend to outperform during times of favourable macro conditions like stable/strong rupee, falling yields and strong growth, while IT tends to shine during times of distress with rising inflation and a weakening rupee.

While Jefferies did point out that over the long run, banks and IT have outperformed the Nifty 50 by a similar margin, it also emphasised the substantial periods of outperformance and underperformance that both sectors moved in and out of.

Periods of divergent performances from the two sectors also tend to last for around three quarters on average, as highlighted by Jefferies. Digging deeper into that idea, the broking firm believes we are currently in the midst of one such divergent phase. At the current juncture, macros for India are in a comfort zone, with a stable rupee on a year-to-date basis and an easing of the current account deficit.

On that account, Jefferies chose to be 'overweight' on banks while it gave an 'underweight' call for the IT pack. "We would be sellers into the recent IT rally," the broking firm stated in its report.

Banking stands strong

The banking sector has performed strongly in FY23 with system-wide loan growth at 16 percent, posting a multi-year high, analysts at the firm noted. Benign asset quality coupled with the Reserve Bank of India's (RBI) decision to pause rate hikes has helped banks to increase their net interest margin (NIM), a crucial metric to assess the health of a bank.

The outlook for the sector is strong with public sector loan growth poised to grow at 12-14 percent. That for the private sector, on the other hand, is expected to be at 18-20 percent, largely aided by the government's outlay of Rs.1.97 lakh crore for production-linked incentive (PLI) scheme across 14 sectors to boost manufacturing.

To top it all, reasonable valuations despite touching new highs make the banking sector a lucrative buy for Jefferies. For context, the Nifty Bank index has gained over 25 percent in the past year, sharply outperforming the Nifty 50's near-13 percent uptick.

Wobbly IT

Demand for IT outsourcing has weakened substantially with several major players in the industry posting flat or declining revenue figures. The report also mentions that a mid-single-digit growth is expected for the IT pack in FY24 along with a pause in new employee headcounts. According to Jefferies, valuations for IT stocks are still above historical averages despite their weak outlook, which prompted it to go 'underweight' on the sector.

"We believe March was the first quarter of misses for some IT majors and more disappointments are likely ahead, especially in the mid-caps space," Jefferies said. For large-caps, the broking firm's earnings per share (EPS) estimates are 1-6 percent lower than consensus.

Several IT majors also gave a lower growth guidance for FY24, reflecting the rising headwinds for the sector. Adding to that, concerns that the banking crisis in the US, which accounts for the large chunk of clients for Indian IT companies, may be far from over also clouds growth expectations for the sector.

Tata Consultancy Services, the country’s largest IT services company, also said that its clients in North America deferred spending after the collapse of California-based Silicon Valley Bank sent shockwaves through the entire American financial system.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.