Qualys: With Risks, It Is A Cheap Cloud Cybersecurity Trade

Summary

- Qualys, Inc., a cloud platform provider offering IT, security, and compliance solutions, is expected to hire more employees and continue investing in research and development.

- The company serves a wide range of clients, including blue-chip companies, and operates in a growing target market with a total addressable market expected to increase by 1.42x from 2023 to 2026.

- Despite risks from lack of innovation and reduced IT spending, Qualys' solid growth strategy, well-known clients, and strong financial position make it an attractive investment opportunity.

PM Images

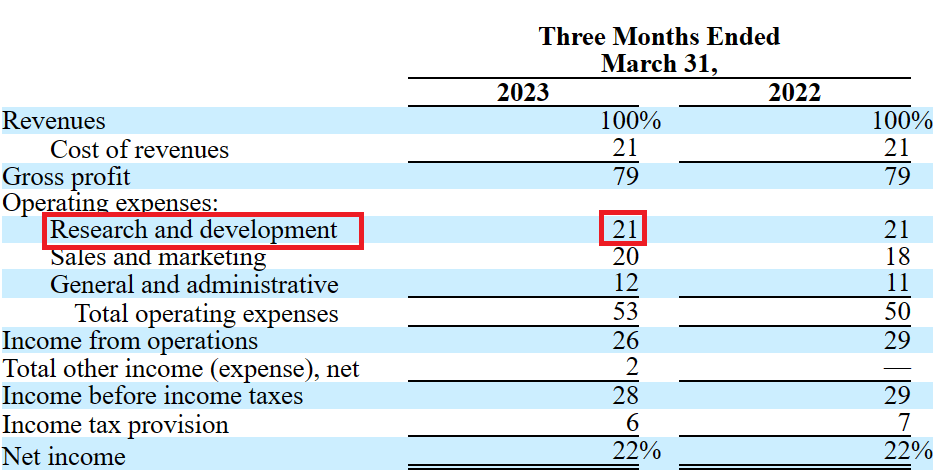

Even considering the current economic environment, Qualys, Inc. (NASDAQ:QLYS) noted in the last quarter that it expects to hire more. The company also continues to report quarterly R&D/net sales of 21%, which would, in my view, bring further innovation and more solutions in the coming years. Also, take into account that management, in recent presentations, noted that the business model will most likely enjoy growing economies of scale and beneficial conditions for partners. In sum, I do see risks from lack of innovation and less IT spending, however, QLYS could really trade at higher marks.

Qualys

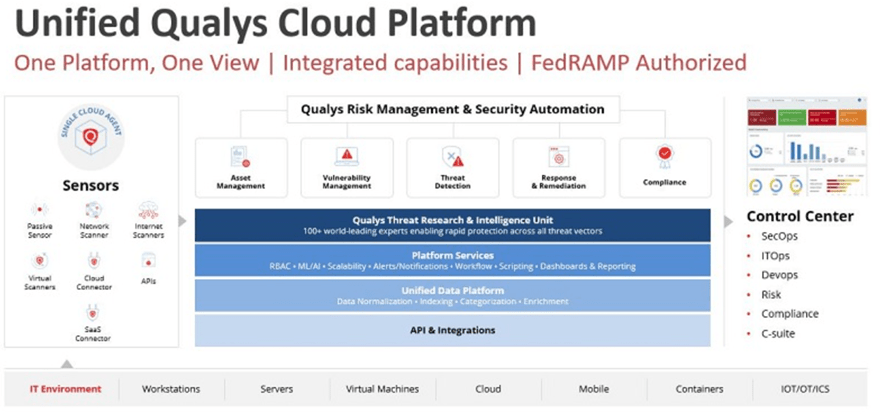

Qualys is a cloud platform provider offering IT, security, and compliance solutions. Its platform integrates various solutions that allow customers to manage and protect their IT assets in on-premises, cloud, and mobile environments, collect and analyze security data, identify vulnerabilities, implement remediation actions, and verify their effectiveness.

Source: Investor Presentation

These solutions address the challenges of complexity and risks in IT infrastructures, including the adoption of cloud computing and the geographic dispersion of assets. The platform is delivered via the cloud, making it easy to deploy globally and reducing costs compared to traditional software products. The company serves clients of various sizes, from large organizations to small businesses.

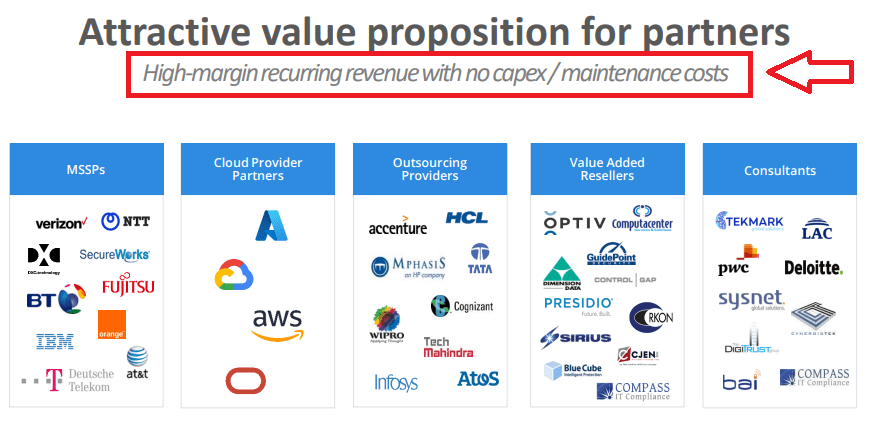

In addition, the company uses a network of channel partners, such as security consultancies and managed service providers, to reach more customers as well as to offer complementary solutions. Channel partners interact directly with potential customers, while the company sells subscriptions to partners, and provides direct access to solutions.

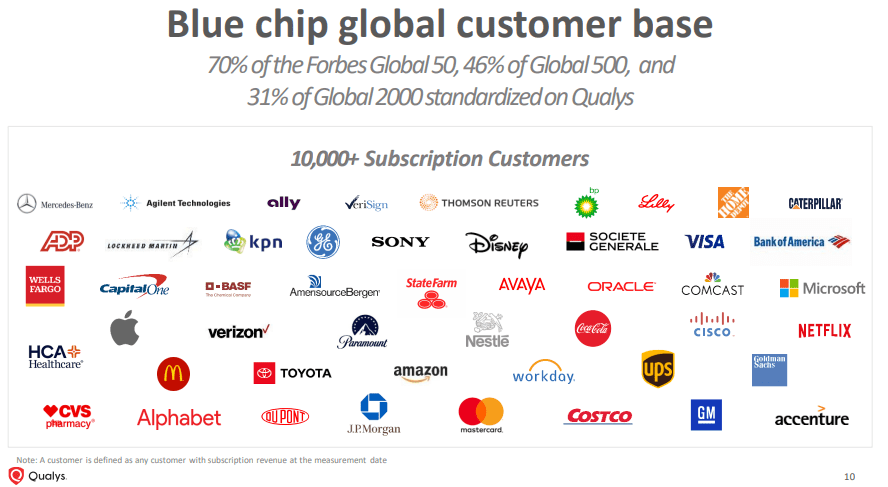

Qualys serves clients of various sizes, from large organizations to small businesses. With that, I believe that the most interesting from Qualys is that a significant number of blue chips have already subscribed to the software offered. With this type of customers working with Qualys, I believe that large and small clients will most likely be interested in trying some of the products offered.

Source: Investor Presentation

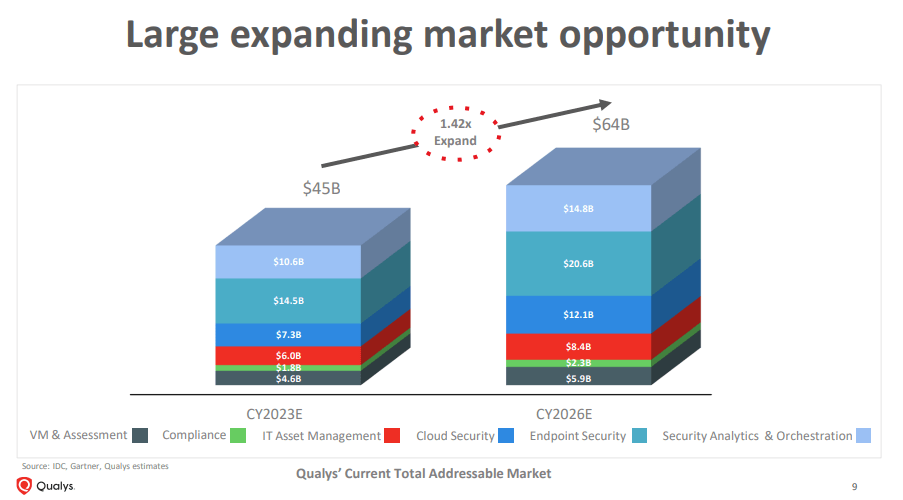

The other interesting feature about Qualys is the growing market opportunity. From 2023 to 2026, including VM, compliance, IT asset management, cloud security, endpoint security, and security analytics, the total addressable market, or TAM, is expected to multiply by close to 1.42x.

Source: Investor Presentation

Market Expectations Appear Quite Beneficial

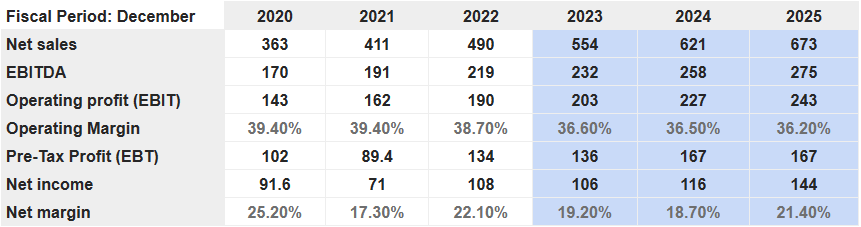

Expectations from financial analysts seem beneficial. I believe that investors may want to have a look at them. Expectations include net sales growth from 2023 to 2025, EBITDA growth, net income growth, and net margin growth.

2025 net sales would stand at $673 million with 2025 EBITDA of $275 million, 2025 operating profit close to $243 million, net income of $144 million, and net margin close to 21%.

Source: Marketscreener.com

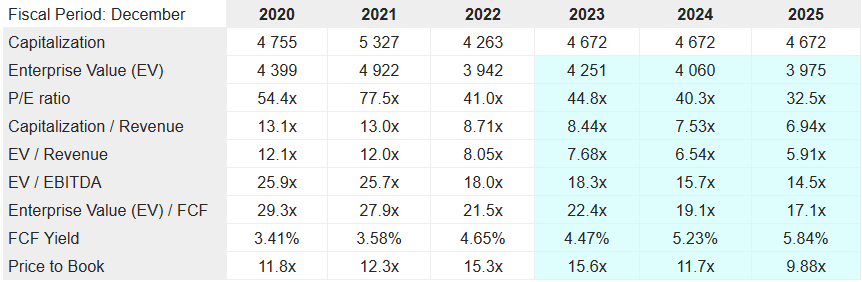

From 2023 and 2025, other financial advisors expect an Enterprise value/EBITDA close to 18x and 14x as well as an EV/FCF close to 22x and 17x. Finally, the price to book ratio would stand at around 15x and 9.8x.

Source: Marketscreener.com

Balance Sheet: No Debt And Stable Financial Position

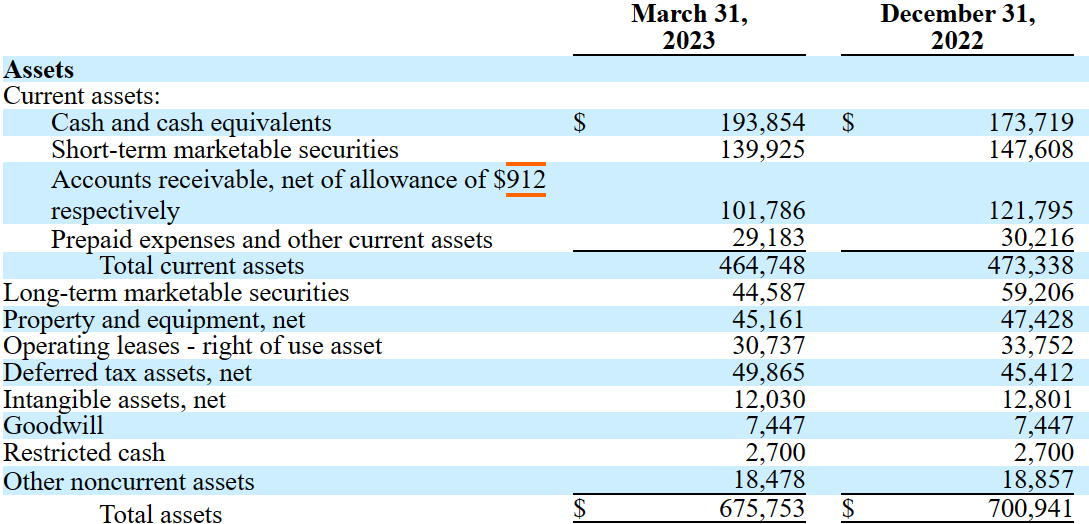

The most attractive thing about Qualys is its total cash in hand, the total amount of short-term marketable securities, and the total amount of current assets. Also, without debt, I believe that the company will be able to use its total amount of liquidity to finance the development of new software and marketing efforts.

As of March 31, 2023, the company reported cash and cash equivalents worth $193 million, short-term marketable securities close to $139 million, and accounts receivable of about $101 million. Also, with prepaid expenses and other current assets of about $29 million, total current assets stood at $464 million. The total amount of liabilities is lower than the total amount of current assets, so I believe that liquidity will not be an issue in the coming months.

With property and equipment worth $45 million, deferred tax assets of close to $49 million, intangible assets worth $12 million, and goodwill of $7 million, total assets stand at $675 million. The asset/liability ratio stands at more than 1x, so I believe that the balance sheet stands in a good position.

Source: 10-Q

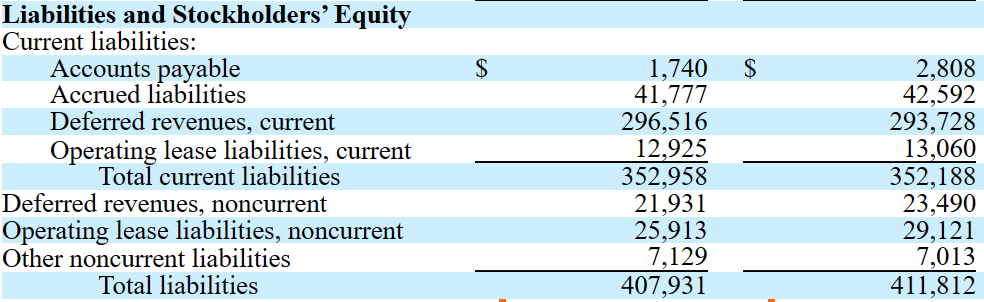

I am not really worried about the total amount of liabilities. Besides, it is quite beneficial that Qualys does not seem to report debt. Accounts payable stood at $1 million with accrued liabilities of about $41 million, deferred revenues worth $296 million, and total liabilities of $407 million.

Source: 10-Q

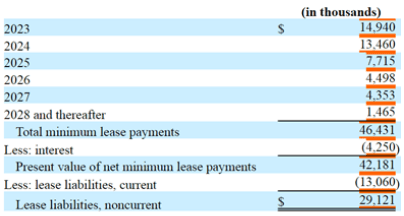

The company reports non-cancellable operating leases that include offices, computer equipment, and the facilities of its shared cloud platform. These leases have variable terms and maturities until 2028, so I would not be worried.

Source: 10-k

My DCF Model Implied A Valuation Of $159 Per Share

Under my financial model, I assumed that management would successfully continue to innovate and improve its cloud platform and solution set. I believe that sufficient investments in research and development, new security solutions, and capabilities will lead to better products. In my view, investors would do good by having a look at the impressive investments in R&D reported recently. In the last quarter, 21% of the total amount of sales was invested in research and development.

Source: 10-Q

I would also expect an increase in the number of solutions among the existing customer base, offering additional solutions and promoting adoption of existing solutions. In addition, driving new customer growth and expanding global reach by targeting key accounts could bring significant economies of scale. In this regard, I believe that it is worth noting that management believes that Qualys offers a scalable go-to-market model.

Source: Investor Presentation

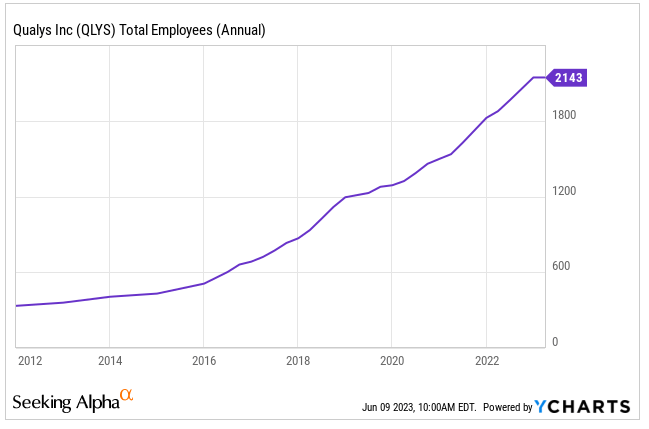

Under normal conditions, I believe that Qualys will continue to successfully hire new personnel, which would most likely accelerate the volume of operations, clients, and revenue growth. In this regard, I believe that one should have a look at the recent headcount growth and the intentions of management.

We expect to continue to expand our shared cloud platform infrastructures and hire additional employees to support our operations, which will increase the cost of revenues in absolute dollars. Source: 10-Q.

Source: Ycharts

Besides, I would say that further agreements with new partners and more communication efforts to sign new agreements will likely lead to net sales growth increases. Partners receive recurring revenue with no capex or maintenance costs required. With these conditions, the type of partners that Qualys already report is quite impressive.

Source: Investor Presentation

Finally, selective technology acquisitions to bolster the existing capabilities and add complementary assets and technologies that expand the existing offerings of cloud solutions could be expected. I know that Qualys did not report many acquisitions in the past. The goodwill is rather small. With that, if the industry becomes even more competitive, and shareholders require more revenue growth, inorganic growth could be an option. The balance sheet is well-prepared to finance acquisitions.

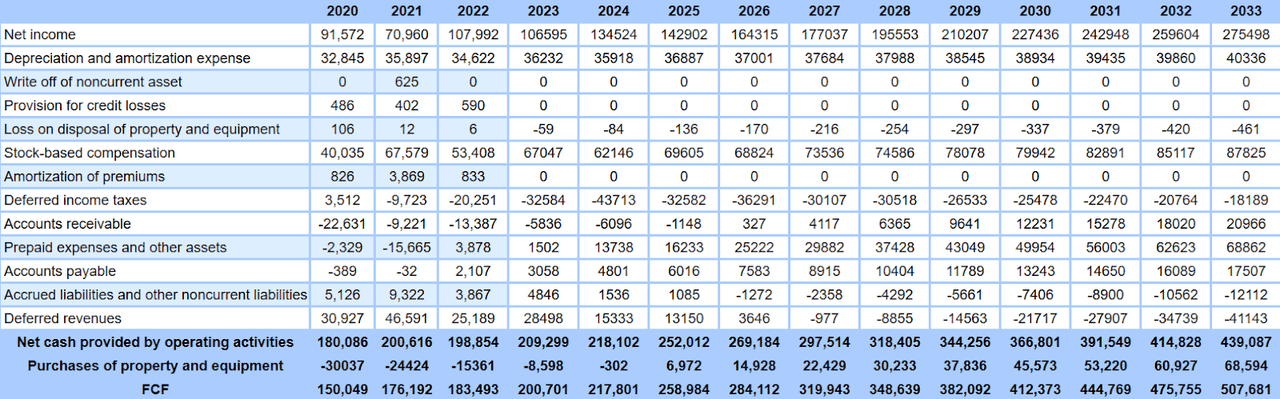

My financial model includes net income growth, depreciation and amortization expense growth, and stock-based compensation growth. Besides, I believe that accounts payable as well as account receivable will most likely increase. As a result, I expect increases in free cash flow ("FCF") as well as cash flow from operations.

I assumed that the cash flow statement in 2033 would include net income worth $275 million, 2033 depreciation and amortization expense close to $40 million, and 2033 stock-based compensation of $87 million.

Finally, with 2033 net cash provided by operating activities worth $439 million and purchases of property and equipment of close to $68 million, 2033 FCF would be $507 million.

If we assume an EV/FCF of 17x, the implied terminal 2033 FCF would be close to $8.630 billion. Now, with a WACC of 9%, the implied enterprise value would be around $5.547 billion. Adding cash and cash equivalents worth $193 million and short-term marketable securities close to $139 million, the implied equity would stand at close to $5.881 billion. Finally, the fair price would be close to $159 per share.

Stock Buyback Program May Accelerate The Demand For The Stock

I believe that the stock buyback program, which includes close to $187.9 million available, is worth consideration. In my view, if Qualys decides to repurchase its own stock again, stock demand could bring the stock price up.

As of March 31, 2023, approximately $187.9 million remained available under our share repurchase program. Shares will be repurchased from time to time on the open market in accordance with Rule 10b-18 of the Exchange Act of 1934, including pursuant to a pre-set trading plan adopted in accordance with Rule 10b5-1 under the Exchange Act. Source: 10-Q.

Risks

In my view, the most notable risk comes from rapid technological advancements and changing customer requirements that can create downward pressure on prices and gross margins. As a result, I believe that the FCF margins would decline, which may lead to lower stock declines.

Besides, intense competition and frequent introduction of new products and industry standards increase the need to improve existing solutions and develop new ones in a timely and cost-effective manner. If Qualys cannot cope with competition, or adapt to changes in the industry, I believe that we may see decreases in net sales growth. As a result, if investment analysts lower their expectations, I think that we may see a decrease in the valuation.

Finally, I believe that investors need to take into account that Qualys is significantly exposed to the economy in the United States. In the last quarterly report, management noted clearly that a deterioration of the macroeconomic perspective could lead to lower spending on IT security. Hence, even if the company offers new and innovative security systems, if clients decide that they cannot pay for them, I believe that Qualys may see revenue growth declines.

The uncertainty surrounding macroeconomic factors in the U.S. and globally characterized by the supply chain environment, inflationary pressure, rising interest rates, financial institution failures and associated uncertainty, labor shortages, significant volatility of global markets and geopolitical conflicts could have a material adverse effect on our long-term business and could lead to further economic disruption and expose us to greater risk as our current and potential customers may reduce or eliminate their overall spending on IT security. Source: 10-Q.

Large Competitors, Well-established, And With Many Resources

It seems to me that the company faces significant competition in the cloud IT, security, and compliance market. It competes with a wide range of established and emerging providers, including public and private companies. Some of the notable competitors are Broadcom (AVGO), CrowdStrike (CRWD), Palo Alto Networks (PANW), Rapid7 (RPD), and Tenable Holdings (TENB).

In addition, it competes with internal solutions developed by the organizations themselves. As they expand their cloud platform, I believe that the company may face additional competition in areas like web application scanning and firewalls. Key competitive factors include product functionality, breadth of offerings, delivery flexibility, ease of use, total cost of ownership, and scalability, customer support. Although the company considers itself competitive in these respects, its competitors have greater name recognition, established customer relationships, and broader resources.

My Opinion

Qualys, Inc. shows a solid growth strategy and well-known clients, and operates in a growing target market. With many analysts expecting significant sales growth and net income growth in the coming years, I believe that the stock could trade at higher valuations. Successful innovation driven by R&D/net sales of 21%, further hiring as promised in the last 10-Q, economies of scale, and more partnerships would most likely enhance future FCF. Yes, there are risks from lack of innovation and less expenditure in IT due to deterioration of macroeconomic conditions in the U.S., however, Qualys does look certainly cheap.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of QLYS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.