Post Holdings: Valuation Looks Cheap Based On Normalized Margins

Summary

- Post Holdings continues to recover and perform well, particularly in the Foodservice segment, which has seen strong volume growth and price inflation.

- I expect the Consumer Brands division to improve margins as supply chain disruptions and inflationary pressures subside, contributing to an overall margin recovery for the company.

- I believe the market currently undervalues POST as investors are not factoring in a reversal in margins.

fcafotodigital

Overview

Post Holdings (NYSE:POST) stock continues to receive a buy rating from me as the business continues to recover and perform as expected. Looking at the latest quarter, 1Q23, POST reported stronger-than-expected EBITDA, driven by strength in its Foodservice segment – which is the key segment that I have had high hopes for driving outperformance for the business. Importantly, management also increased their FY23 forecast to account for expected contributions from their newly acquired pet food business, as well as an underlying improvement in the business for the remainder of FY23. In terms of valuation, I believe POST is being mispriced today because investors are being conservative with their margin expectations, which I expect to revert back to historical levels eventually.

Foodservice growth recovery on momentum

POST has seen a significant uptick in the food-away-from-home sector as consumer behavior has returned to pre-pandemic patterns. I believe POST's efforts to increase distribution and respond to inflation and avian flu-related price increases are largely responsible for the uptick in business. Because of these strategic moves, the food service segment has experienced both strong volume growth and price inflation. This has led to POST's EBITDA in recent quarters consistently exceeding $100 million, which is significantly higher than management's estimated normalized EBITDA run rate of $85-95 million. Even more reassuring is the fact that operating margins have held steady at around 12.5%, which is in line with the segment's pre-COVID levels. I expect that the normalized foodservice business can maintain a higher EBITDA level, despite a possible decrease in margins as the incremental pricing benefits fade. This forecast assumes that recent price changes will continue to have an impact.

Consumer brands

Although the Food Service division is doing well, the Consumer Brands division was a drag on profit margin growth. In particular, the Consumer Brands division saw its margin decline due to the underutilization of fixed assets brought on by some plant maintenance. However, aside from this unusual circumstance, I anticipate margins to improve going forward as supply chain disruptions continue to be resolved and inflationary pressures subside. I'd like to refer the reader back to POST's operating history, where the Consumer Brands division was generating operating margins of 18% to 20%. Margin dilutive acquisitions, such as the recently acquired pet brand, which has a lower margin profile than this segment and the overall company, mean that it's possible that margins will never again reach pre-acquisition levels. POST acquired select pet brands from The J.M. Smucker Co. (SJM) that generated $1.4 billion net sales in the year ended April 30, 2022 and is expected to generate around $100 million of EBITDA in the next 12 months. This would imply a margin of around 7% pre-synergies, and a post synergy EBITDA margin of ($30 million synergies over 3 years, and $75 million immediate synergies) around 14%. That said, even after taking into account the margin-dilutive acquisitions, the new normalized margins should still be north of the 15% range (300 to 500bps dilution impact from dilutive acquisitions), which is an increase of 200bps from the recent levels of 12 to 14%.

Valuation

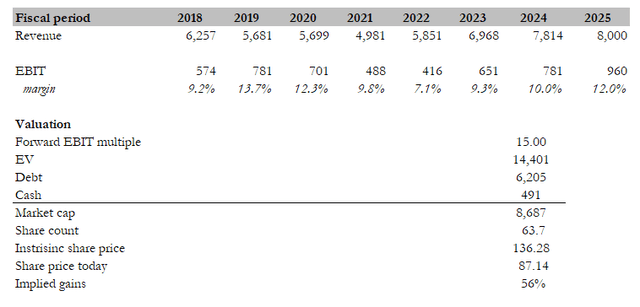

I believe the market is mispricing POST today because investors do not expect margins to recover to previous levels. This is where I differ from the crowd; I believe there are visible signs that POST can and will return to previous EBIT margin levels. To begin, the Food Service segment has already returned to pre-covid EBIT margin levels of 12.5%. Second, the Consumer Brands segment is already showing signs of margin recovery as a result of supply chain and inflationary pressures being relieved. As I previously stated, I believe the new normalized margin for the Consumer Brand segment will be at least 15%. When they are combined and the historical mix is applied, the margin is very likely to revert to previous levels. In my model, I assumed POST would recover margins to just 100 basis points below FY19 levels to account for the dilution in the acquired pet brands, and revenue would be in line with consensus estimates. And if we assume POST trades at 15x forward EBIT, as it did previously, we get an attractive 56% upside.

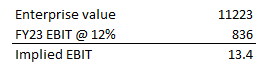

Another way to think about valuation is to assume POST's margin is at 12% today, this implies that the market is valuing POST at 13.4x EBIT. This does not make sense, in my opinion, as POST generally trades in line with its peer group that is trading at 16x forward EBIT.

Own calculation

Conclusion

I maintain a positive outlook on POST as the company continues to recover and meet expectations. The strong performance in the Foodservice segment, driven by the rebound in consumer behavior and strategic initiatives, has exceeded management's own EBITDA expectations. Management's increased forecast for FY23, considering contributions from the newly acquired pet food business and overall business improvement, further supports my positive stance. Although the Consumer Brands division experienced margin decline due to specific circumstances, I anticipate improvement as supply chain disruptions ease and inflationary pressures subside. Currently, the market undervalues POST, as the anticipated margin recovery is not fully priced in. Considering historical performance and comparable industry multiples, I see upside potential for POST, with a projected 56% increase.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.