Lumen Investor Day Presentation Details Financial Turnaround Plans

Summary

- Lumen Technology has presented a turnaround plan, aiming to invest in growing markets and reduce costs through technology updates and process automation.

- LUMN expects revenue and earnings headwinds until the end of 2024, with growth starting in 2025 and continuing through 2027.

- Lumen plans to invest almost all its revenue growth into capital expenditures and expects free cash flow to grow to $300 to $500 million by 2027.

piranka

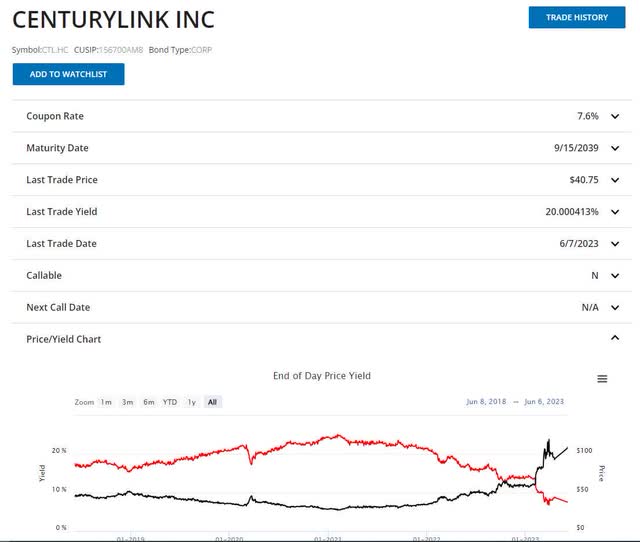

Lumen Technology’s (NYSE:LUMN) shares and bonds have been in distress over the past year. Share prices have fallen more than 80% to $2.50 per share. The company’s debt offerings have also seen big price drops. Lumen’s bonds maturing in 2039 continue to hover around 40 cents on the dollar, yielding 20% to maturity. On Monday, Lumen presented a turnaround plan as part of its Investor Day. The company provided some specific action steps it will be taking, along with financial guidance for the years 2023 through 2027.

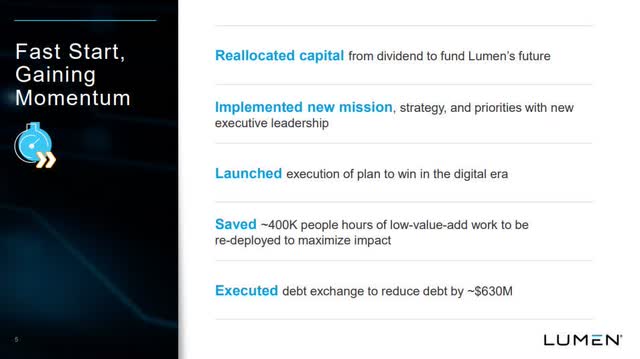

Lumen’s management team is new and the company’s share price has been dogged by missed estimates, broken promises, and dividend cuts by prior management. With the new team in place, Lumen has already taken decisive action to facilitate its operational turnaround. First, the company eliminated its dividend to preserve cash towards capital expenditures and investments in growth. Next, they enhanced productivity by reassigning work within their labor force. Finally, they initiated a debt exchange offer, which reduced debt by $630 million. After analyzing the market, the company launched a plan to change the business towards meeting future needs.

Lumen Investor Day Presentation

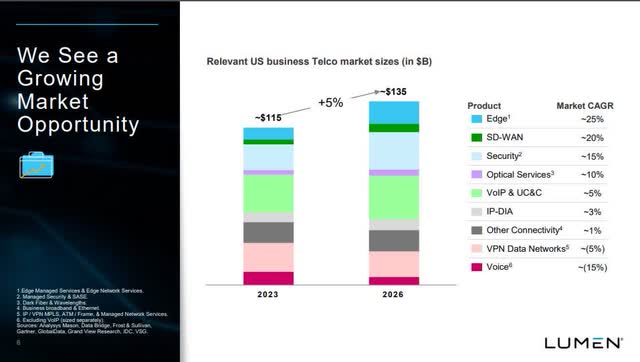

Lumen believes the telecom categories it occupies are going to experience a cumulative 5% annual increase in growth between now and 2026, growing their markets from $115 to $135 billion. Within those spaces, Lumen sees Edge, which is a managed services network, and security being the two big growth spaces. The company also sees voice and VPN declining over this period. Lumen wants to position itself to meet the demands of the growing market segments it already has a presence in.

Lumen Investor Day Presentation

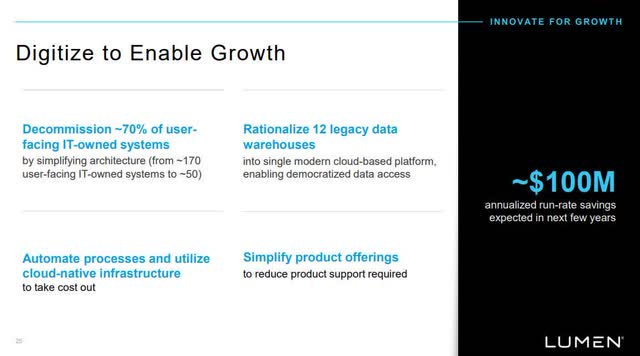

Lumen is not only wanting to invest in growing markets, but it is taking steps internally to reduce costs. First, the company is updating its systems with new technology. This will allow Lumen to consolidate 12 legacy data warehouses into a single modern cloud-based platform and consolidate the number of user-facing IT owned systems from 170 to around 50. This simplification combined with automation of processes is estimated to achieve $100 million in annual savings in the next few years.

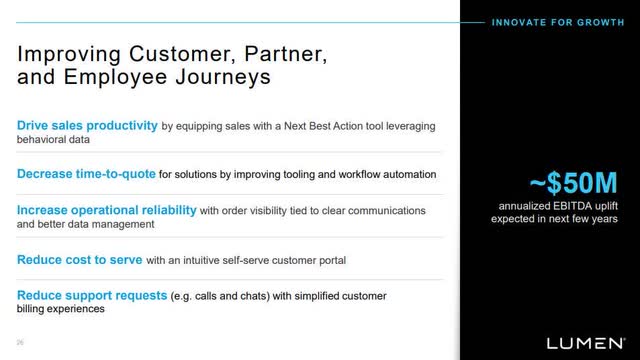

Lumen Investor Day Presentation

Additionally, Lumen is expecting to see $50 million in annual EBITDA enhancements over the next few years by becoming more productive with its customers. Through improvements in sales productivity and reduced times to quote and support requests, Lumen is set to streamline the end user experience with its business side.

Lumen Investor Day Presentation

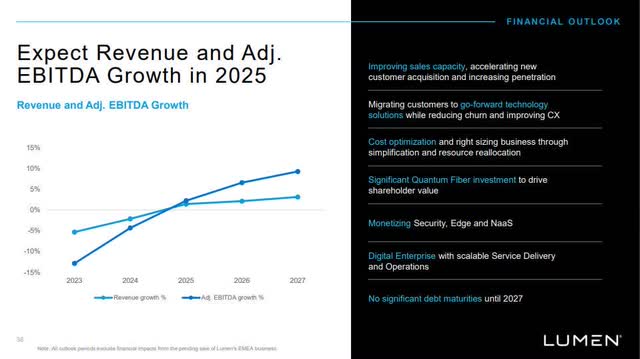

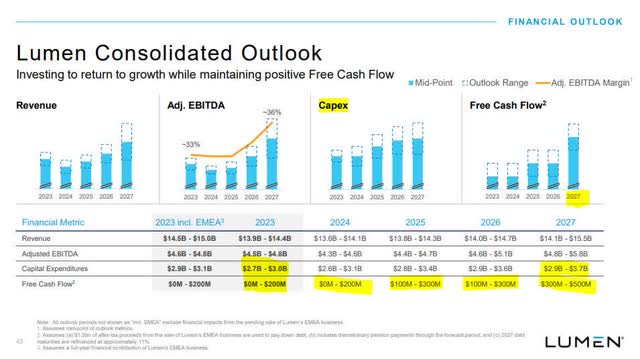

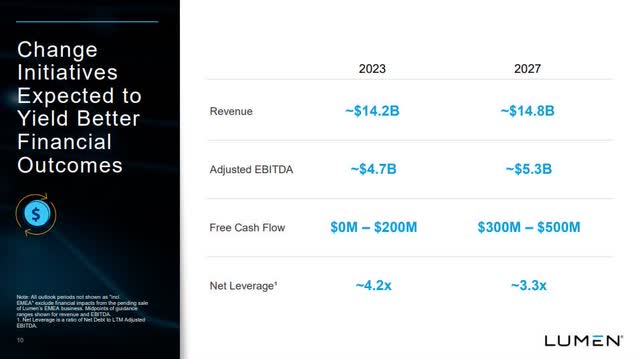

Towards the end of the presentation, Lumen’s CFO communicated specific financial targets for the company’s transition. These are helpful checkpoints to ensure bondholders that the business will remain solvent and support a responsible level of leverage. Based on the timelines of Lumen’s operational transformation, the company is expecting revenue and earnings headwinds through the end of 2024. From there, revenue and earnings will both start to grow in 2025 and continue their expansions through 2027.

Lumen Investor Day Presentation

Drilling down to specific numbers, Lumen’s CFO shared that the company is planning to invest almost all its revenue growth into capital expenditures, as it works to capitalize on those growing markets. Despite the need to invest capital into growth opportunities, Lumen is expecting free cash flow to remain at previously guided $0 to $200 million in 2023, remain unchanged in 2024, and grow to $300 to $500 million by 2027. Ultimately, Lumen expects to grow revenue and EBITDA by $600 million and free cash flow by $300 million by 2027.

Lumen Investor Day Presentation Lumen Investor Day Presentation

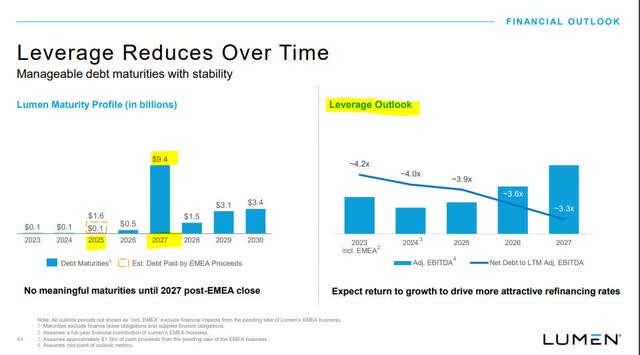

By growing earnings and free cash flow, Lumen expects to have favorable financing terms when it addresses its 2027 maturing debt. The upcoming EMEA transaction is expected to fund the 2025 maturities and free cash flow should be sufficient to cover the 2023, 2024, and 2026 debt maturities. But investors should expect Lumen to refinance its entire 2027 maturity based on the free cash flow projections provided.

Lumen Investor Day Presentation

Over the next several quarters, I will be comparing Lumen’s results with the multi-year guidance provided in the Investor Day presentation. Lumen’s CCC credit rating makes acquiring new financing more difficult. The company will need to generate free cash flow or use cash on hand to continue to fund its transformation until it produces better financial results. Based on the presentation, I find Lumen’s strategy and financial projections to be very reasonable, therefore I will continue to hold onto my shares and 2039 maturing bonds.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LUMN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I own Lumen bonds maturing in 2039.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.