Comerica Bank Towering Above The Skyline, A Buying Potential

Summary

- Comerica Bank gets a Strong Buy Rating due to its undervaluation, strong capital ratio, competitive dividend yield, and revenue diversification.

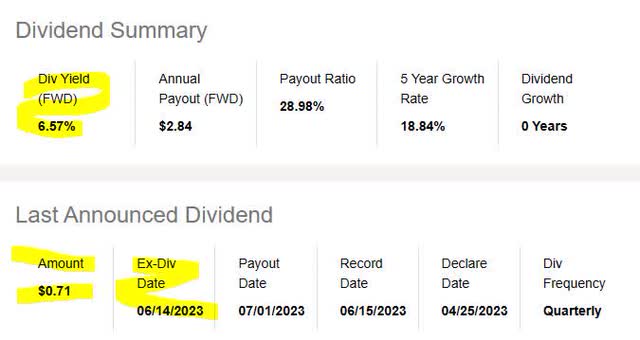

- Comerica Bank's current dividend yield is 6.57%, and the company has a well-diversified business model across traditional banking, insurance, equipment leasing/financing, and wealth advisory segments.

- Risks to the bullish outlook include potential nonperforming loans and deposit outflows, but these are being mitigated and managed responsibly by the company.

Comerica Bank Building - Dallas Art Wager

Summary

Some years ago, the first time I heard of Comerica (NYSE:CMA) was while starting a job in the tech sector in downtown Austin Texas, when I looked up at the office building where the job was and it happened to have the Comerica logo on it.

Turns out, this Dallas-based bank also had a major presence in Austin. Eventually, I learned it was present in many other places too and was a fast growing regional financial firm with roots in Detroit going back to 1849.

Fast forward to the summer of 2023, as some in the markets are still talking about the March crash of bank stocks, I am looking for buying opportunities for my readers!

Today, as the evidence below will show, I am giving this stock a Strong Buy Rating, believing that investors can get a Texas-sized value out of the current price. Its other positives are an attractive valuation, strong capital ratio, competitive dividend yield, and revenue diversification.

Ratings Methodology Used

In May 2023, I began an series of articles covering financial and tech stocks as an analyst for Seeking Alpha, with the goal of simplifying and condensing key data points using a systematic method, giving readers a holistic view of a stock in one place without them having to do all the research on their own. Your time as an investor is too valuable!

To rate a stock, here are the 5 questions I ask, and the scoring system used:

- Is the stock undervalued based on P/B ratio and P/E ratio? (10 points each)

- Is their revenue diversified enough across multiple segments? (20 points)

- Does their price chart present a valuable buying opportunity? (20 points)

- Is their dividend yield competitive among its sector? (20 points)

- Are they in a strong position in terms of capital / liquidity? (20 points)

After totaling the score, I assign a rating:

- 100 Points: Strong Buy

- 80 to 90 Points: Buy

- 30 to 70 Points: Hold

- 10 to 20 Points: Sell

- 0 Points: Strong Sell

Further, rather than being a markets generalist, I specialize in just the financial and tech sector specifically, giving you my insight into that space.

P/B ratio and P/E ratio show Undervaluation

To valuate this stock, I am using both the forward P/E ratio and the forward P/B ratio, which is provided by Seeking Alpha.

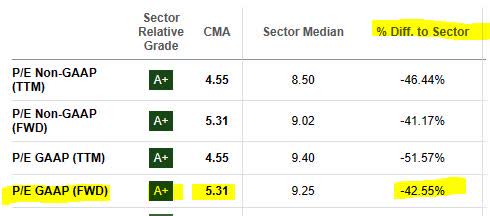

Comerica - P/E Ratio (Seeking Alpha)

From the above table, I am impressed by the A+ grade giving by Seeking Alpha, for this stock having a forward P/E of 5.31, over 42% lower than its sector median. To determine undervaluation or overvaluation, I will refer to is the S&P 500's median P/E ratio of 14.93 as of May 2023, according to Investopedia.

In this case, the stock appears undervalued, based on the P/E.

For the forward P/B, similarly impressive:

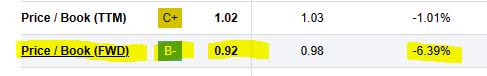

Comerica - P/B ratio (Seeking Alpha)

I see that Seeking Alpha gave it a B- here, as its P/B of 0.92 is over 6% lower than the sector median. The reference I will use the Corporate Finance Institute definition: a low ratio (less than 1) could indicate that the stock is undervalued (i.e. a bad investment), and a higher ratio (greater than 1) could mean the stock is overvalued.

In this case, based on the P/B, it is undervalued.

This opportunity was also recognized in a mid-May article by fellow Seeking Alpha analyst, The Asian Investor:

The financial crisis in March has led to aggressive, fear-driven valuation discounts for shares of community banks like Comerica.

With that said, one of the reasons I am still bullish on banks is for the value for the price you are now getting, while it continues to last of course.

A Balanced Revenue Diversification

Comerica Corp, according to its website, makes money from the following business subsidiaries: Comerica Bank, Comerica Insurance Services, Comerica Leasing Corp, and Comerica Securities Inc.

Besides traditional banking products like loans and cards, the overall company also deals in insurance, equipment leasing/financing, as well as having a broker/dealer business segment as well as a wealth advisory practice.

I will use publicly available data from the firm's Q1 2023 earnings results, for this discussion.

Below is a breakdown of their most recent Q1 income vs the prior quarters:

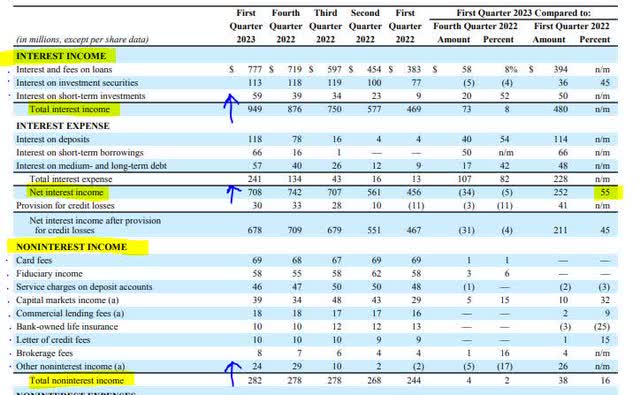

Comerica - Q1 results - by income (Comerica)

It is evident that both interest and non-interest income has shown YoY growth. What is also notable is the 55% YoY increase in NII, likely driven by a favorable rate environment for all banks.

Consider, for instance, what the Independent Community Bankers of America association had to say on this topic in a March 2022 article, when a trend of rate hikes was starting:

Generally, rate hikes are advantageous for community banks. Research suggests that community banks focus their asset base on higher-yielding loans that reprice faster than deposit rates when interest rates rise.

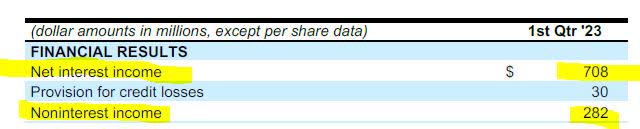

A closer look at their Q1 financials shows:

Comerica - Q1 results - interest vs non interest income (Comerica)

Together, interest and non-interest income were $990MM, with NII making up 71% of that bulk, and non-interest income 28%. Roughly, a 70/30 breakdown.

Because Comerica Bank is part of a larger parent company that is considered a financial services company, the company is more than just a community bank, I would say. Although it is not comparable to the scale of a Morgan Stanley (MS) or JPMorgan Chase (JPM), it is not trying to be those and should not need to, because it has found its market niche where it is.

It appears to me that, yes, it is well diversified across its revenue segments.

A Price Chart Showing a Steep Discount

Next, let's look at the current price chart for this stock on June 7th:

Comerica - Price Chart on June 7 (StreetSmart Edge trading platform)

This 2-year price chart tracking the period of December 2021 through early June 2023, with the 50-day SMA (dark blue line) crossing the 200-day SMA (dark red line) in May 2022, forming a so-called death cross, a known lagging indicator of a bearish price trend.

I like the stock at the $35 to $43 range while it remains well below its 200-day SMA and below or near the 50-day.

At these prices, I think, yes, it could be something a financial sector investor could consider adding to their portfolio of bank stocks. Particularly, if the portfolio already consists of some of the big banks, this stock could add some diversification within the same sector.

Consider that others, such as the CEO of Algebris Investments, also recognized the value price opportunity of banks back in late April. Here is what they had to say in a Financial Times article that month:

Banks now look to be well positioned to outperform, just as some in the market have deemed them - simplistically - to be uninvestable.

An Amazingly Competitive Dividend Yield

6.57%...

Yes, you read that correctly!

The current dividend yield for this stock is 6.57%, according to Seeking Alpha data.

Comerica - Dividend Yield (Seeking Alpha)

What's better, is that investors may be able to take advantage of the upcoming June 14th ex date.

The dividend growth has proven itself too with this stock... paying $0.68 in the same quarter a year ago and now up to $0.71.

For this firm with $85.6B in assets, that Wikipedia lists as 39th place in the top 100 banks in the US, how does it compare to some of its peers in the financial sector?

For this comparison, I will use Regions Financial (RF) as it is also geographically concentrated in the south. Its dividend yield is currently 4.37%.

Comparing to another bank regionally concentrated, KeyCorp (KEY), that bank's dividend yield is 7.72%

Just out of curiosity, the dividend yield for America's top bank JPMorgan Chase is currently 2.87%.

So, it appears that, yes, Comerica has a very competitive dividend yield but some of these other regionalized banks also present value to a dividend-income investor, if part of the portfolio strategy is maximizing yield.

Consider that even back in January, Seeking Alpha analyst Gen Alpha recognized the dividend play and commented:

Income investors get paid a healthy dividend yield while waiting for the stock price to revert to its mean valuation.

Standing on a Stable Financial Foundation

From the firm's Q1 results, they have grown their CET1 ratio from 9.93% the same quarter a year go to 10.09% this time. Typically, banking standards require large banks to have a minimum CET1 of 4.5%.

Also, importantly to note, was the following commentary from the Q1 press release:

Total liquidity capacity totaled $41.7 billion at March 31, 2023 and consisted of the Federal Reserve Discount Window and the new Federal Reserve Bank Term Funding Program (BTFP), both of which are not being utilized, as well as FHLB remaining capacity and cash.

If you are a bank sector investor, you may already know this, but worth mentioning anyway. In the event that a large bank does run into liquidity issues there are various tools like borrowing from the Fed discount window, the BTFP, the FHLB, or overnight interbank loans between banks, at current overnight lending rates.

This is a unique feature of this sector, which is not readily available to others, like the tech sector.

For instance, a tech company would not borrow from the Fed discount window but via the commercial money markets at prevailing rates.

I mention this because when you get past the market panic triggered by the spring failures of a handful of regional banks, which were unfortunate and isolated incidents, brought under control quickly... you can see that systemically there are plenty of financially healthy banks remaining and worth considering.

Risks to my Outlook

The risks to my bullish outlook for this stock, being that a major part of Comerica's business is traditional banking, is that a large percentage of its loan book becomes unperforming, or a large amount of depositors pull funds out of the bank, causing additional liquidity pressure.

These are some of the risks inherent in this sector.

However, the good news from Comerica's Q1 release is that nonperforming assets decreased $23 million to $221 million, or 0.40% of total loans and foreclosed property, compared to 0.46% in fourth quarter 2022.

CEO Curtis Farmer remarked:

Credit quality in the first quarter remained excellent with $2 million in net recoveries and criticized loans (including nonperforming loans) at 3% of total loans, still well below historical averages.

On the issue of deposit outflows he also struck a positive tone:

Relative to pre-pandemic, we have a higher level of deposits, a better loan to deposit ratio and a lower percentage of uninsured deposits. Our business model was tested, and we emerged in a better position for long-term success.

So, I believe the known risks are being mitigated and managed responsibly, and from a forward-looking view to the rest of 2023 it seems that this firm is holding steady.

Conclusion

As the Comerica Tower continues to overshadow the downtown Dallas skyline, so too do the positives overshadow some of the negatives mentioned, and I reiterate my Strong Buy Rating on this stock, as it scored a 100% in my rating.

Positives include attractive price point and valuation, competitive dividend within its sector, diversified business model, and strong capital ratios and liquidity. This is offset by some of the known risks of this type of business which include deposit outflows and unperforming loans, which can be mitigated by proper risk management as well as the various liquidity tools already mentioned.

As the first "regional" financial stock I am rating, I look forward to keeping an eye on this one, particularly since the current rate environment ought to continue to work in its favor as we go through the first halfway point of 2023, a period of quite the turbulence in this sector.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.