Build Better Returns With Boise

Summary

- Boise Cascade Company has seen a 118% total shareholder return over the last five years, driven by strong fundamentals and dividend payouts.

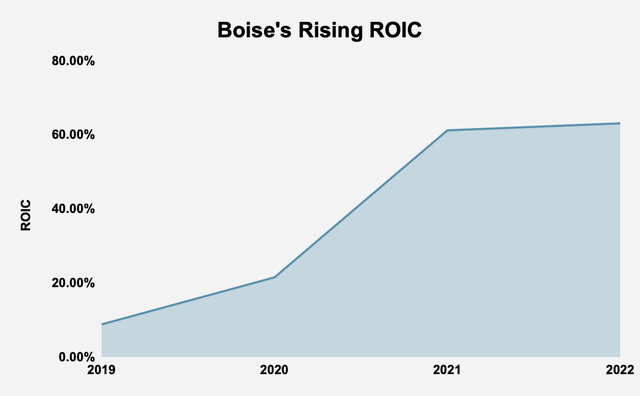

- The firm's long-term incentive plan aligns management incentives with shareholder interests, resulting in a rise in return on invested capital from 8.8% to 46.9% in the last five years.

- With a low price-earnings multiple, high gross profitability, and a free cash flow yield of over 33%, Boise Cascade is an attractive investment for long-term investors.

Michael M. Santiago

Boise Cascade Company (NYSE:BCC) has excelled as a producer of engineered wood products [EWP] and plywood, and as a wholesale distributor of building products. The firm’s fundamentals have driven a 118% total shareholder return [TSR] over the last five years. Dividend payouts have been important to that TSR story, with the firm generating 118% of its market cap in free cash flow [FCF] over the last five years. With the firm’s long-term incentive plan (LTIP) tying executive compensation to returns on invested capital [ROIC], agent-principal conflicts have been eased, and ROIC has risen from 8.8% to 46.9% in the last five years. These trends are supportable, given that evidence shows that construction prices drive housing prices, suggesting that Boise can pass on higher prices to consumers. Finally, with the firm trading at a low multiple, a gross profitability of 0.48, and an FCF yield of more than 33%, BCC stock is very attractive for long-term investors.

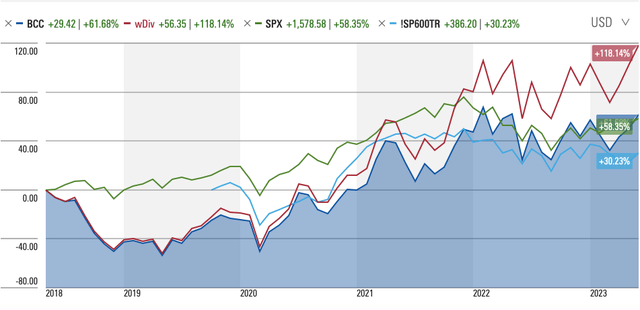

Boise Has Been a Stock Market Winner

In the last five years, Boise’s share price has risen by nearly 62% compared to an over 58% increase for the S&P 500 (SPX) and a more than 30% increase for the S&P SmallCap 600 (!SP600TR). The company’s stock market excellence is brought into even sharper relief when we take dividends into account, with the firm enjoying a TSR of over 118%. In the trailing twelve months [TTM], Boise’s share price has suffered, and is down over 7%, while the S&P 500 is up by almost 4% and the S&P SmallCap 600 is down over 3%. Dividends continue to be a weapon that the firm has been able to deploy with good effect, and the firm’s TSR over the TTM period is a more respectable, although still disappointing -1%.

Source: Morningstar

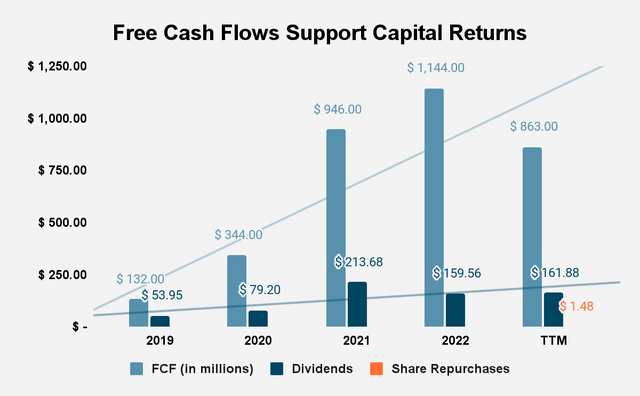

Free Cash Flow Generation Supports Capital Returns

A large measure of the company’s performance has been driven by its ability to consistently deliver dividends to its shareholders. It is, therefore, apt to begin our analysis by asking if dividend payments are supportable and if the firm has any space to increase dividends. Dividends are paid out from FCF, and the space the firm has to increase dividends, and, indeed, share repurchases, is determined by the spread between free cash flows and returns to shareholders. In the last five years, the firm has grown FCF from $132 million in 2019 to $863 million in the TTM period, compounding at 45.6% a year. In that period, the firm generated a total of $3.43 billion in FCF, or 112% of its market cap. The firm used FCF to grow dividend payments from $53.95 million in 2019 to $161.88 million in the TTM period, compounding at 24.58%. The firm paid out a total of $668.27 million in dividends. The firm used just $1.48 million throughout that period, and spent in 1Q23, for share repurchases. This shows that the firm has ample room to grow capital returns to shareholders.

Source: Boise Cascade Company Filings and Author

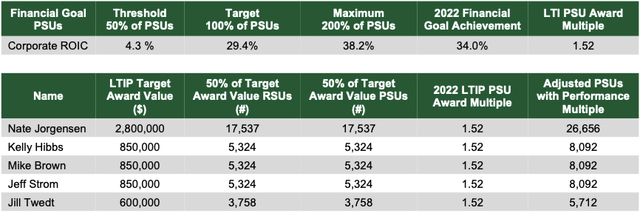

Management Incentives are Aligned to Shareholder Interests

According to the firm’s 2023 Proxy Statement, ROIC was chosen as the LTIP metric, in order to align management incentives with those of shareholders.

Source: Boise Cascade Company 2023 Proxy Statement

This is important because agent-principal conflicts are rife in businesses, and incentives often motivate managers to act against the long-term interests of shareholders. What shareholders want is a management that deploy capital in the way that creates the most value for them. By judging and paying management according to ROIC, shareholders ensure that everyone’s interests are the same. In the end, research shows that long-term firm value is driven by ROIC.

The 2023 Proxy Statement indicates that,

“If ROIC is below the threshold as shown above, no PSUs are earned. At threshold performance, 50% of the target PSUs are earned, and at maximum performance, 200% of the target PSUs are earned. The compensation committee approved a payout scale such that when results fall between the threshold and maximum reference points, linear interpolation is used to determine the actual PSUs to be awarded.”

This alignment has clearly worked. Management has grown ROIC from 8.8% in 2019 to 46.9% in the TTM period.

Source: Author Calculations

The Housing Boom Is Stronger Than You Think

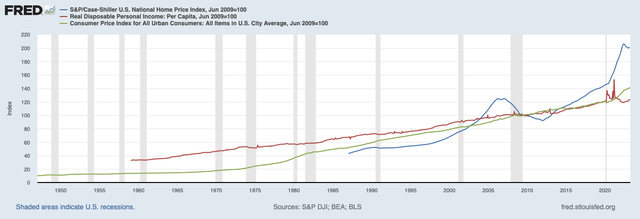

Much has been made about the tapering off of house prices, with the S&P/Case-Shiller U.S. National Home Price Index seeing a decline since May 2022, although there are some signs of recovering post since the start of the year, with much of the country experiencing growth, despite the traditional growth areas of the West experiencing house price declines. The narrative is simple: prices have to come down because millennials cannot afford new homes, and more crucially, with rising interest rates, steady increases are not possible. These conditions mean that construction must, inevitably, slow down, and with it, demand for EWP, plywood and building products. However, this narrative ignores several key factors. Most importantly, there has been a fundamental shift since the beginning of 2013, where national house price indices, such as the S&P/Case-Shiller U.S. National Home Price Index, have grown faster than growth in per capita real disposable personal income and inflation. Since the Jan. 2012 trough, the S&P/Case-Shiller U.S. National Home Price Index has risen 118%, compared to 33% for disposable incomes, and 18% for the CPI.

Source: FRED

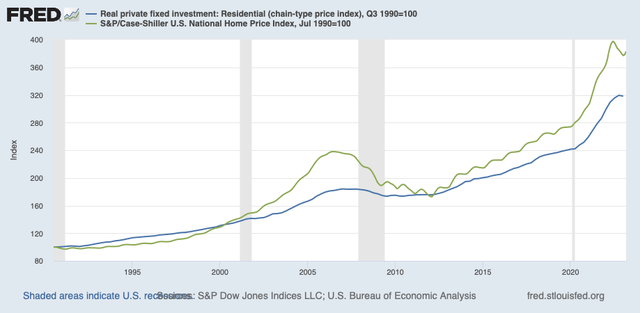

Put simply, house prices are not determined by disposable incomes and inflation. What we actually see is that construction prices (from land acquisition to building construction) drive the housing market. Since 1990, the S&P/Case-Shiller U.S. National Home Price Index has compounded at 4% a year, compared to 3.6% for the cost of residential properties. In simpler terms, this indicates that rising construction costs can indeed be passed onto buyers and that this has occurred for decades.

Source: FRED

Consequently, fears that Boise Cascade cannot pass on higher prices to consumers are grossly misplaced. History suggests otherwise.

Valuation

Boise Cascade has a price-earnings multiple of 4.71 compared to 18.68 for the S&P SmallCap 600, and 24.8 for the S&P 500. The firm also has a gross profitability of 0.48, which is greater than the 0.33 threshold for attractiveness that Robert Novy-Marx’ research uncovered. Importantly, the firm has an FCF yield (FCF/enterprise value) of 33.58%, which is far in excess of the FCF yield of 2.56% the 2,000 largest firms in the United States, as calculated by New Constructs. What we see is a firm with attractive profitability, trading at low P/E multiples, and with a very attractive price for its FCF.

Conclusion

Over the last five years, Boise has handily beaten its benchmarks in terms of share price appreciation and TSR. Given the importance of dividends in driving TSR, it’s important to note that the firm’s FCF generation provides ample support for future capital returns. Indeed, with 118% of its market cap generated in FCF over the last five years, the firm’s role as a cash machine cannot be understated.

The company’s LTIP aligns shareholder and management interests, by tying pay to ROIC, a key measure of capital allocation excellence. The results are clear, with ROIC rising from 8.8% in 2019 to 46.9% in the TTM period.

Crucially, while investors have worried about the firm’s ability to pass on rising costs to consumers, history indicates that construction prices drive house prices, showing that price increases can indeed be passed on. That tells us that the firm’s position in the value chain is stronger than investors appreciate.

With the firm trading at a low multiple, attractive profitability, and an FCF yield of over 33%, Boise is a very attractive long-term investment.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.