Eos Energy: A Solid Bet On Energy Storage When Profitable

Summary

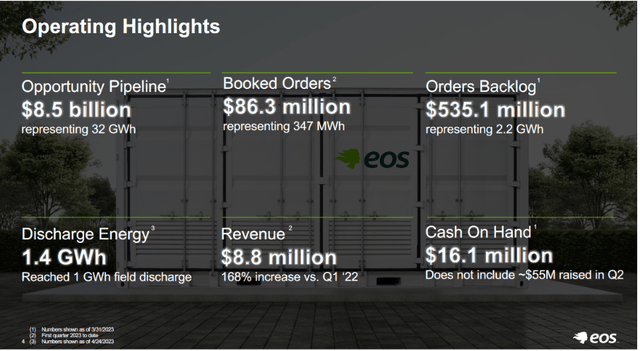

- Eos Energy Enterprises has seen a 168% increase in revenue, reaching $8.8 million, due to increased demand in the energy storage industry and efficient production.

- EOSE has a backlog of over $500 million in orders and aims to reach between $600 and $800 million by 2023, but the company is not yet profitable.

- The zinc battery product, Znyth, offers scalability, efficiency, and sustainability, making EOSE a potential long-term growth opportunity in the energy storage market.

PhonlamaiPhoto

Investment Rundown

Eos Energy Enterprises Inc (NASDAQ:EOSE) has had a solid start to the year with a massive 168% increase in the top line of the company, reaching $8.8 million in revenues in Q1 2023. The vast increase can be contributed to the increased demand the energy storage industry is seeing, but also because of EOSE managing to increase production all while also booking more orders. With over $500 million in backlog orders, the future seems bright for the company, now the challenge comes with improving margins to create a positive bottom line for the company. Because of the lack of positive EPS, I can’t rate EOSE stock a buy, but I do see the potential of the company and the market that they are in and think they do, however, deserve a hold rating.

Company Overview

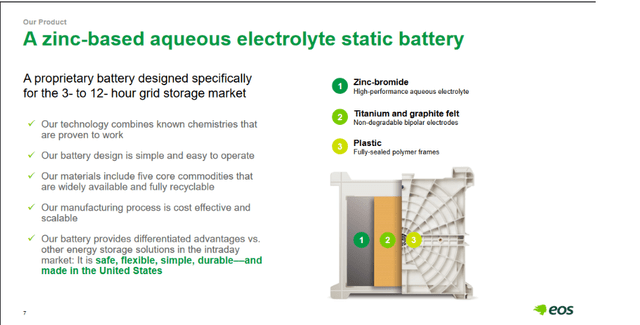

EOSE is responsible for creating the Znyth, a zinc battery that was meant to overcome some of the challenges the more traditional lithium-ion batteries had. The zinc battery is highly scalable and efficient, but above all also sustainable, which fits into the current narrative of converting our energy reliance to more renewable sources.

Company Product (Investor Presentation)

The company is seeing demand strength and is striving to grow its order backlog quickly. The company is hoping to reach between $600 - $800 million in backlog orders which they seem to be well on their way to achieving in 2023, as in the first quarter alone they added $86 million reaching above $500 million now in total orders. Some of the benefits seen with the zinc apart from the ones mentioned are the long lifespan of their product, expected to be over 20+ years, and that HVAC isn't necessary for the battery storage units either.

Markets They Are In

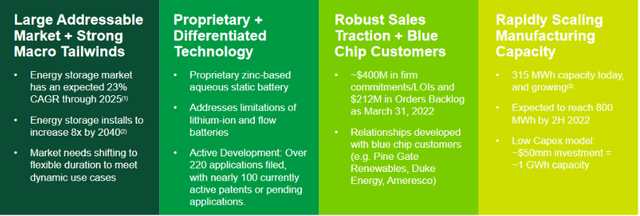

The energy storage market is expected to see a solid growth of demand as we aim to utilize the output we have as much as possible and not let any go to waste. In a report by Grand View Research they see the US market growing 12.4% between the years 2022 and 2030.

Company Market (Investor Presentation)

The scalability of the product that EOSE offers seems to be bringing them an edge against the competition as they are scaling their business. So far they seem very capable of capturing and even outperforming the market they are in when just looking at the top line of the company and the YoY growth they saw in the last quarter.

Operating Highlights (Q1 Report)

Much of the driving force being the industry growth is the more widespread use of renewable energy and the aim to reduce electricity costs. But also with the aim to upgrade existing infrastructure, the appeal of energy storage is very strong as it will ultimately help reduce costs and create and more efficient system. With companies like EOSE which haven't yet achieved a solid bottom line, one of the main things you need to look at is the growth of the orders for the company. With EOSE they see themselves being fully automated with their manufacturing line by the start of 2024, which would be a 1.25 GWh capacity. With the opportunity pipeline the company notes, they see it reaching $8.5 billion or 32 GWh. With the capacity expected at the beginning of 2024, that would mean about EOSE has a $332 million capacity. Which would be a massive increase from the current revenues the company is generating.

Risks

The main risk with EOSE is that they simply aren’t profitable yet, and it’s difficult to really set a date for when that will happen. Sometimes it's better to stay on the sidelines with capital until the company actually proves itself able to make a profit. With EOSE that is the case I see, which equates to the hold rating for them.

Share Price History (Seeking Alpha)

Without a profitable bottom line, it's very hard to decipher the value that shareholders could potentially extract from the company. Given that the company doesn't generate any FCF they need to dilute shares in order to raise capital. This of course hurts investors a fair bit and between 2021 and the last report the shares have increased by nearly 34%. During that time the share price plummeted as a result of an overvaluation needing to be adjusted but also because of the risks associated with the company. Going forward it will be important to keep an eye on the order backlog the company has and whether or not they seem able to achieve the $600 - $800 million target of backlog orders. If there is a negative trend starting to appear there, I think the hold rating would instead turn into a sell rating as the risks would be too high.

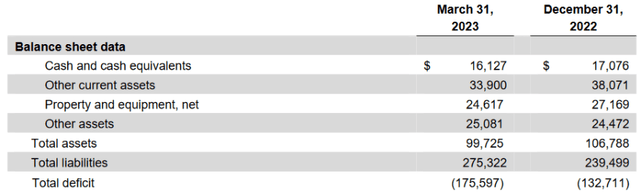

Financials

Looking at the financials of the company they aren’t that impressive. Without a profit for the company, they face the difficult task of improving the state of the financials. I don’t think we will see any meaningful steps toward paying off debt until there is an improvement in the margins for the company.

Balance Sheet (Earnings Report)

The cash position for the company has diminished on a QoQ basis, but this isn't really that important. The way the company raises capital is by diluting shares, and if there is an increase in the cash, I think it will be clear where from they got it. Looking at the liabilities of the company, they did increase an alarming amount, sitting nearly at $300 million now, almost as much as the company's market cap. Going into the coming quarters I don’t want to see another increase in the liabilities for the company, but I do fear the balance sheet will be decreasing in quality until the company in Q1 of 2024 gets production finished. It should be mentioned as well that the company did manage to raise an additional $55 million for Q2 of 2023. With $71 million in cash, the company has the cash to cover operating expenses for the next 3 quarters if you use the numbers for 2022. Here the operating expenses amounted to nearly $80 million. This is another factor that causes me to have a concern about an investment, without a strong enough cash position to cover expenses for at least a few years any missteps could be incredibly damaging.

Industry Comparison

Comparing EOSE to another energy storage company like Fluence Energy Inc (FLNC) which is a little more establishes and generates far more revenues than EOSE, over $1.1 billion in 2022 alone. They offer perhaps a better investment opportunity for those eager to get exposure to the industry. But just like EOSE, FLNC is also diluting shares to raise capital and they are yet to establish a solid bottom line and had a negative EBITDA of $225 million in 2022. But where FLNC wins out a little is the negative net debt they have, which brings a little less risk to the table compared to EOSE.

In terms of better play, I think that EOSE could provide more growth in the long term if they achieve their backlog targets and gets production up and running by Q1 in 2024. But for now, it's very difficult to say who will be the winners in this industry and who won't be.

Final Words

Eos Energy Enterprises Inc offers an exciting opportunity to get exposure to the energy storage market. They have ambitious goals and are currently well on their way to achieving them as the revenues grew 168% YoY as of the last report. They also managed to increase their order backlog a fair bit and I am not worried they won't see demand. The zinc battery seems superior to many products on the market currently and that will give EOSE an edge. But without a profitable bottom line, I can't make an investment case for them right now, but with the outlook of the industry as I am certain in the long run a profit can be made from investing in EOSE. But some of the rules I keep with an investment is a positive net margin, and for now, EOSE will instead be a hold.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.