I Bought VICI And EPR Properties

Summary

- I own both VICI Properties and EPR Properties, two experiential property REITs with highly divergent risk profiles.

- EPR's portfolio faces headwinds from struggling tenants like Regal Theatres and AMC Entertainment, whilst VICI's growth has boomed on the back of acquisitions.

- Both REITs offer attractive dividends, but EPR's higher yield comes with increased risk due to tenant uncertainties.

LPETTET

VICI Properties (NYSE:VICI) and EPR Properties (NYSE:EPR) are two REIT pillars of my stock portfolio, with the experiential property owners forming two somewhat complementary ways to gain exposure to niche parts of the US commercial real estate market. I first covered EPR Properties at the outbreak of the pandemic, when many states issued broad stay-at-home orders that kept its tenants shut and wrecked its stock price. This was roughly the same story for VICI, whose total returns over the last year of 8.8% have since far outpaced EPR's loss of around 5.9%. Over the last three years, the total return differential is even more stark, with VICI up 88% versus a 16% gain for EPR.

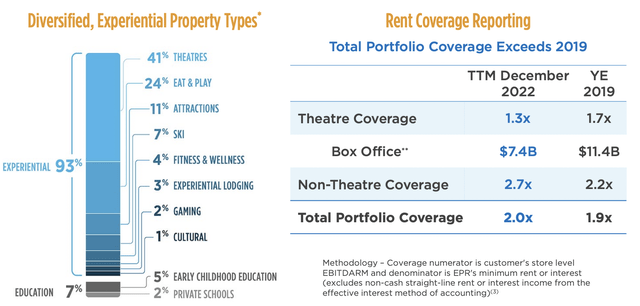

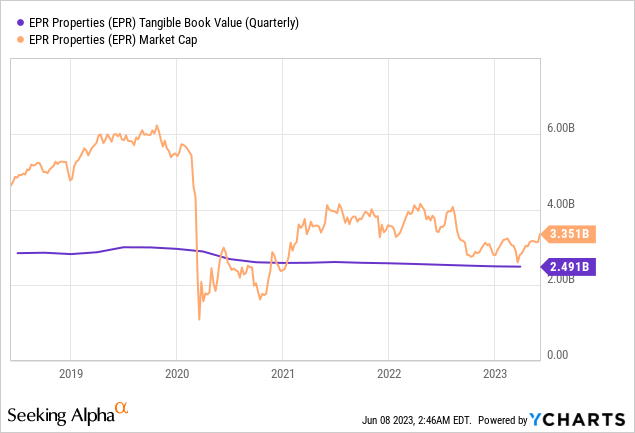

The reasons for the divergence are multifaceted and lay at the core of why these REITs both have a position in my portfolio. Firstly, EPR's experiential property portfolio is heavy on theatres, which formed 41% of annualized adjusted EBITDAre as of the end of its fiscal 2023 first quarter. The Kansas City, Missouri-based REIT, which currently trades on a $3.3 billion market cap, owns 363 locations with over 200 tenants as of the end of its first quarter. This included 172 theatre properties, 56 eat and play properties, 23 attraction properties, and 11 ski properties.

EPR Properties Fiscal 2023 First Quarter Presentation

Theatres have been bogged down by negative market sentiment around the post-pandemic movie-going zeitgeist. Like offices, theatres are seen to be a casualty of inherent behavior and lifestyle changes seen during the pandemic. Regal Theatres, the second-largest theatre chain in the US after AMC Entertainment (AMC) and a top-3 tenant of EPR Properties filed for Chapter 11 bankruptcy in September last year. Regal has essentially maintained rent payments throughout its bankruptcy, but the prospect of a resolution seeing steep rent cuts or a modest level of theatre closures has weighed on EPR's stock price.

Growth, Dividends, And FFO

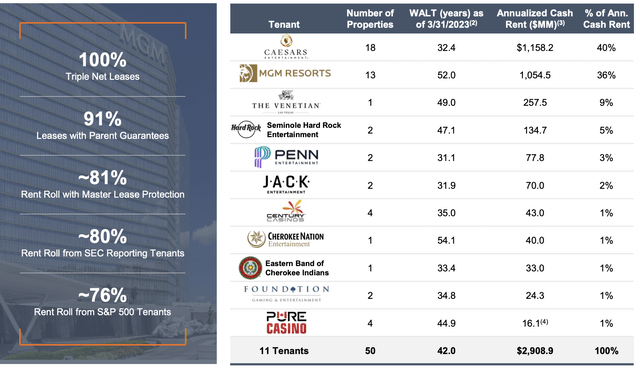

New York-based VICI Properties owns one of the largest portfolios of casino properties in the US. The REIT owns 50 gaming destinations and four championship golf courses. Its management has been aggressively acquisitive, recently buying four casinos in Canada for $164.7 million in cash in a sale-leaseback transaction with Century Casinos and at an implied acquisition capitalization rate of 7.8%. Critically, VICI owns a less risky property portfolio than EPR, with its tenants subject to triple-net master leases and with casinos not having the same pressures that EPR's portfolio has been subjected to. Both REITs have relatively recession-resistant portfolios, with VICI's management highlighting the economic resiliency of gaming. However, casinos are not fully immune to recessions, with a 2011 Oklahoma State and Purdue University paper flagging a generally negative relationship between the 2008 economic recession and Las Vegas casino revenues.

VICI Properties Fiscal 2023 First Quarter Presentation

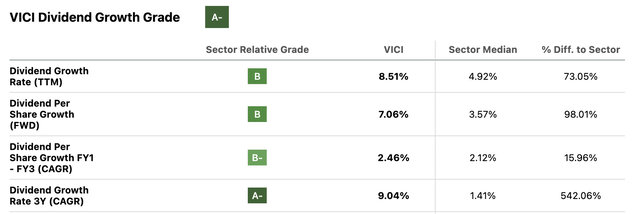

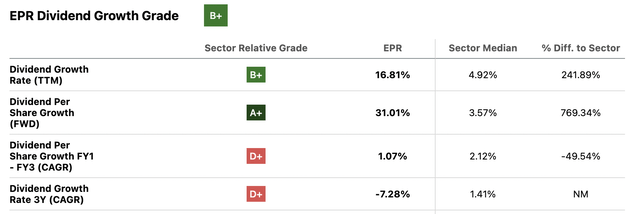

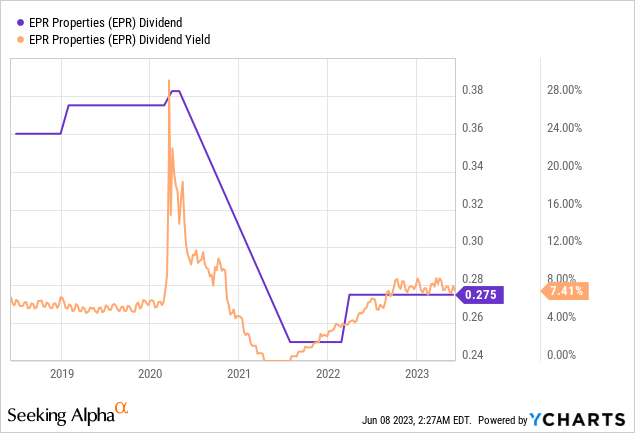

EPR's monthly dividend payouts are welcome in a quarterly dividend-heavy portfolio. The REIT last declared a monthly cash dividend of $0.275 per share, in line with its prior payout and for a 7.4% forward annualized yield. The dividend was reduced markedly during the pandemic and has yet to recover to its 2019 highs. Trailing 12-month dividend growth stands at 16.81% versus growth of 8.51% for VICI over the same time frame. Critically, both are outperforming their peer group's median growth rate of 4.92% over the same period.

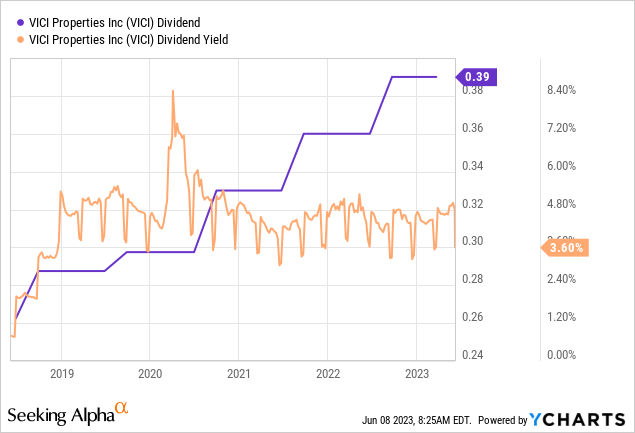

VICI last declared a quarterly cash dividend of $0.39 per share, in line with its prior payment and for a 4.7% forward annualized yield. EPR's yield is around 270 basis points greater than VICI's but this of course has to be contextualized against their respective property portfolios which have a divergent level of risk. VICI, which only went public in 2018, has built an incredibly shareholder-friendly dividend trendline with its quarterly payouts up from $0.2625 per share just after IPO to its current level.

EPR's yield currently sits slightly higher than the pre-pandemic level of around 6% and has been driven higher due to recent stock price weakness. The REIT's first quarter earnings saw revenue of $171.4 million, growth of 8.8% over its year-ago comp, and a beat by $20.78 million on consensus estimates. First quarter adjusted FFO per share of $1.30 beat consensus by $0.11 and was a growth of $0.14 from AFFO of $1.16 in the year-ago quarter. Critically, this meant EPR's payout ratio against the 3-month aggregate of its monthlies was 63.4%. EPR also has a number of preferreds like its Series E (NYSE:EPR.PE) that offer yields in excess of the commons.

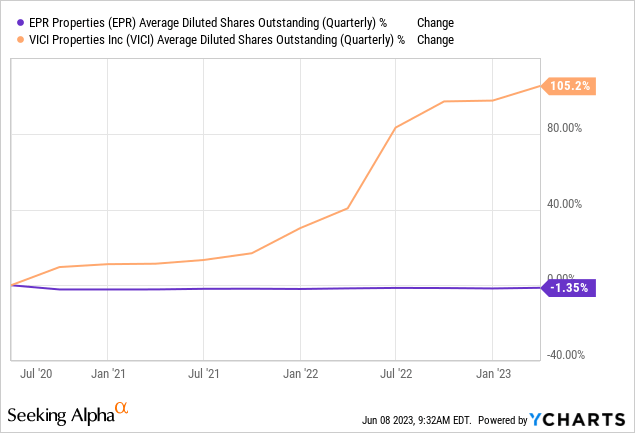

VICI's first quarter earnings saw revenue come in at $877.6 million, a growth of 110.6% over the year-ago quarter and a beat by $31.12 million on consensus estimates. Growth was boosted by a raft of acquisitions, with the REIT ending the quarter with a 50-property portfolio that's been further expanded by an additional four properties post-period end. Its first-quarter AFFO per share was $0.53, an increase of 18.6% year-over-year. AFFO attributable to common stockholders actually grew by 73% year-over-year to $528.6 million, but there was a corresponding 45.9% increase in weighted average shares outstanding from its year-ago comp. VICI's payout ratio at 73.5% was higher than EPR's with the casino owner targeting a 75% payout ratio.

Valuation And Discount To Book

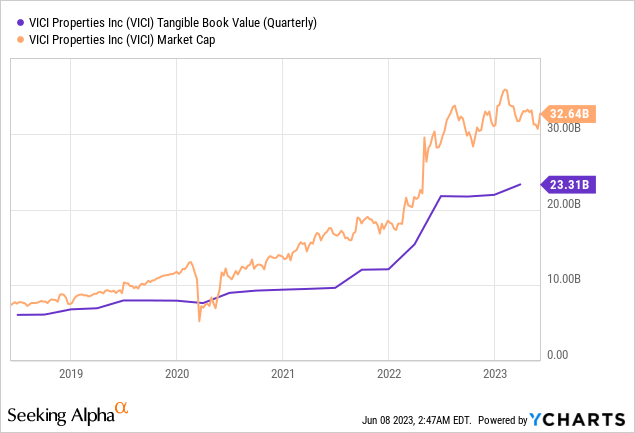

VICI's average diluted shares outstanding are up roughly 105% over the last three years, with the REIT issuing shares above its tangible book value to fund its property acquisitions. The REIT is currently swapping hands for a price to forward FFO multiple of 13.16x, higher than EPR's price to forward FFO multiple of 9.09x. EPR trades lower due to its tenant headwinds, but its market cap still sits above its tangible book value of $2.5 billion. This book value has also been trending lower over the last three years on the back of the pandemic's disruption.

VICI's tangible book value at $32.64 billion is far in excess of its current market cap of $23.3 billion, with the REIT only briefly trading at a discount during the pandemic. The premium to book has broadly widened over the last 12 months versus the preceding comparable period on the back of its acquisitions at healthy cap rates driving rapid growth. Hence, even though VICI is larger, the REIT has been growing quicker and currently possesses a stronger outlook for growth through 2023.

To be clear, VICI does not face the same tenant headwinds that EPR does but is more expensive. EPR's monthly payouts and higher yield make the REIT attractive, but this opens the specter of risk with a still uncertain future for two of its top three tenants. Critically, a potential AMC bankruptcy is what keeps EPR bulls from sleeping well at night, with the cinema operator holding total debt as of the end of the first quarter of $9.66 billion. A bankruptcy filing for AMC is a real possibility as the company still realized a $235 million net loss for its fiscal 2023 first quarter despite the number of theatrical releases being up 35% versus the year-ago period. I own both REITs but have held back on adding to EPR in recent months with the AMC and Regal headwinds yet to find a definitive end. Further, I'll rate both VICI and EPR as hold for now, with VICI's higher premium giving some reason for constraint with new purchases.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of EPR, VICI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.