Big Banks Have Massive Exposure: A Look At Canadian Banks

Summary

- During the U.S. Financial Crisis, Canadian banks were considered some of the strongest in the world.

- Since 2009, Canadian bank's business models have changed significantly.

- Today, Canadian banks have major issues.

- This idea was discussed in more depth with members of my private investing community, The Market Pinball Wizard. Learn More »

Walter Bibikow

As part of our ongoing series of articles on bank stability, we wanted to address Canadian banks in this missive. I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But, I must warn you. The substance of that analysis is not looking too good for the future of the larger banks in the United States. You can read about them here.

So, let's take a look at the Canadian banking environment. Canada did not have a banking crisis in 2008. In fact, during the Great Recession, Canadian banks, especially the so-called Big Six, were among the safest banks in the world. However, their business models have changed significantly since then. Yet, many retail depositors in both Canada and the U.S. still think that Canadian banks would be a safe haven in a major global crisis. In this article, we would like to highlight some of the issues we currently see at Canadian banks.

Exposure to capital markets and wealth management-related revenues have increased substantially

The revenue mix of Canadian banks has changed a lot since the Great Recession. If we look at Royal Bank of Canada (RY) aka RBC, which is the largest Canadian bank and is also viewed by many depositors as the safest bank in Canada, then its share of revenues from capital markets and wealth management increased from 37% in 2007 to 53% in 2022. Obviously, these revenues are very volatile and are very likely to be under significant pressure in a recessionary environment.

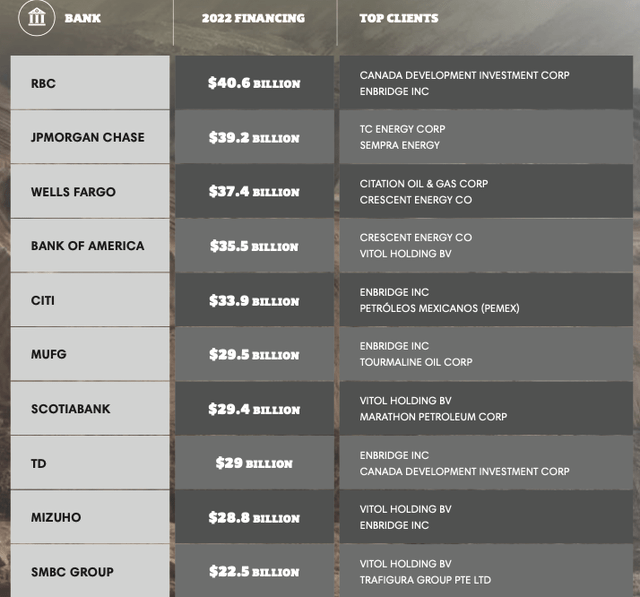

Rising financing for oil and gas and mining companies

According to the 2023 Fossil Fuel Finance Report, for the first time since 2019, when this report was published, RBC ranks #1 as the largest financier of fossil fuels. RBC provided fossil fuel companies $42.1B in 2022, an increase over its 2021 financing, making for a total of $253B since 2016. Notably, JPMorgan Chase (JPM) was ranked second with $39 billion; however, JPM’s total assets are $3.7 trillion, and RBC’s total assets are less than $1.5 trillion. The Bank of Nova Scotia (BNS) aka Scotiabank and The Toronto-Dominion Bank (TD), which are among the Big Six Canadian banks, are also on this list.

2023 Fossil Fuel Finance Report

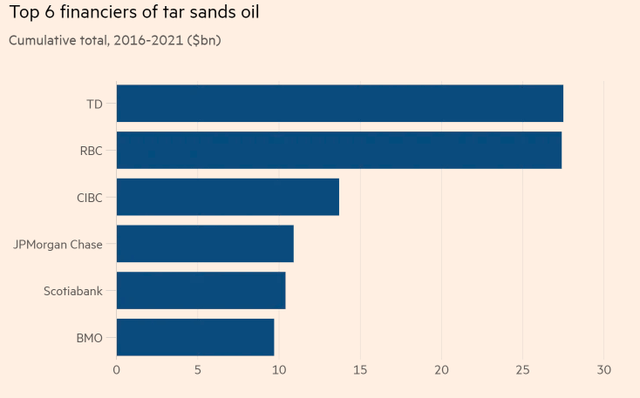

In addition, five of the six largest global financiers of the tar sands are Canadian banks.

Source: RAN, Financial Times.

The tar sands oil industry has already faced major issues during the 2014–2016 oil crisis. Obviously, these energy loans would be under severe pressure in a recessionary environment.

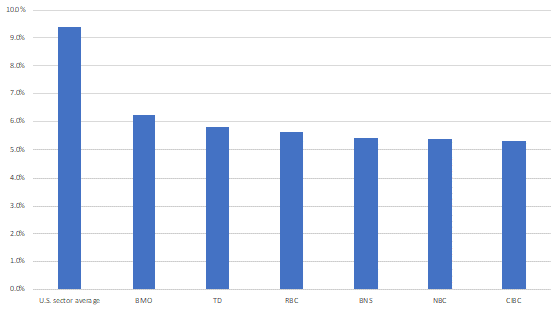

The leverage ratio is a concern

According to our estimates, the weighted-average leverage ratio of the Big Six Canadian banks was a tad above 5.5% as of the end of 2022. By comparison, the respective metric for the U.S. banks was more than 9%. We believe Canadian banks have low leverage ratios given that their business models have become more risky since 2008.

Company Data

Residential mortgages and high real estate prices In Canada

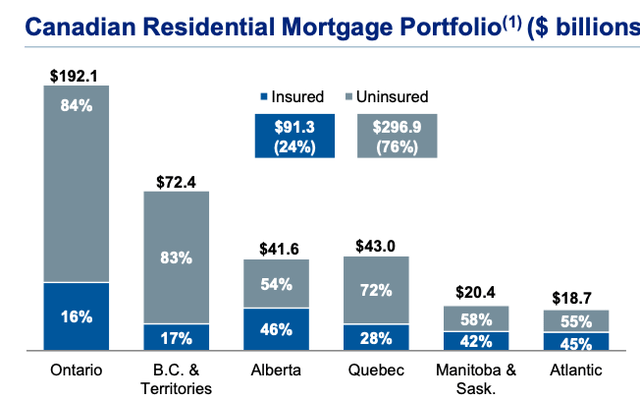

Many clients of Canadian banks view a mortgage insurance system in the country as a safety feature that would protect banks from the negative consequences of a potential real estate bubble. However, this system is mandatory only for mortgages with a down payment of less than 20%. If we look at RBC's mortgage book, 76% of its mortgage book is uninsured. More importantly, the highest shares of uninsured mortgages are in Ontario (83%), followed by British Columbia (82%), which saw the highest increases in real estate prices.

The Bottom Line

The Canadian banks were among the safest in the world during the 2008–2009 crisis, but their business models have changed significantly since then. There are 34 domestic banks in Canada, and it’s a quite small and oligopolistic market. At SaferBankingResearch.com, we found only two banks that meet our criteria. Those two banks are the best we could find in Canada, and they are the best choice for those Canadians who want to keep their money in their country. But those who have the opportunity to open an account at a U.S. or European bank should take a look at our Top banks to diversify their savings. The Big Six did not meet our standards.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money. You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And, if you are relying on the FDIC, I suggest you read our prior articles which outline why such reliance will not be as prudent as you may believe in the coming years.

It is time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. And, you can feel free to utilize the methodology we outline here.

Housekeeping Matters

This article, as well as Saferbankingresearch, was a combination of efforts between Avi Gilburt and Renaissance Research, which has been covering U.S., European, LatAm, and CEEMEA banking stocks for more than 15 years.

If you would like notifications as to when my new articles are published, please hit the button at the bottom of the page to "Follow" me.

Also, for those that are questioning why all comments (including mine) go through moderation, you can read here: Haters Are Gonna Hate - Until They Learn.

Lastly, I have asked the editors to close the comments section until I return from my travels on Monday.

THE #1 SERVICE FOR MARKET & METALS DIRECTION!

"A colleague said "no one saw this issue with the banks".. I just laughed and said "Avi from EWT was all over it."

"So happy to have found you Avi. Told you several times but you changed my life, and therefore my family's future."

"Avi is so nonchalant about all this. Meanwhile we are navigating the future while most all other market participants are whistling in the dark looking backwards."

CLICK HERE FOR A FREE TRIAL.

This article was written by

Avi is an accountant and a lawyer by training. His education background includes his graduating college with dual accounting and economics majors, and he then passed all four parts of the CPA exam at once right after he graduated college. He then earned his Juris Doctorate in an advanced two and a half year program at the St. John’s School of Law in New York, where he graduated cumlaude, and in the top 5% of his class. He then went onto the NYU School of Law for his masters of law in taxation (LL.M.).

Before retiring from his legal career, Avi was a partner and National Director at a major national firm. During his legal career, he spearheaded a number of acquisition transactions worth hundreds of millions to billions of dollars in value. So, clearly, Mr. Gilburt has a detailed understanding how businesses work and are valued.Yet, when it came to learning how to accurately analyze the financial markets, Avi had to unlearn everything he learned in economics in order to maintain on the correct side of the market the great majority of the time. In fact, once he came to the realization that economics and geopolitics fail to assist in understanding how the market works, it allowed him to view financial markets from a more accurate perspective.

For those interested in how Avi went from a successful lawyer and accountant to become the founder of Elliottwavetrader.net, his detailed story is linked here.Since Avi began providing his analysis to the public, he has made some spectacular market calls which has earned him the reputation of being one of the best technical analysts in the world.

As an example of some of his most notable astounding market calls, in July of 2011, he called for the USD to begin a multi-year rally from the 74 region to an ideal target of 103.53. In January of 2017, the DXY struck 103.82 and began a pullback expected by Avi.

As another example of one of his astounding calls, Avi called the top in the gold market during its parabolic phase in 2011, with an ideal target of $1,915. As we all know, gold hit a high of $1,921, and pulled back for over 4 years since that time. The night that gold hit its lows in December of 2015, Avi was telling his subscribers that he was on the phone with his broker buying a large order of physical gold, while he had been accumulating individual miner stocks that month, and had just opened the EWT Miners Portfolio to begin buying individual miners stocks due to his expectation of an impending low in the complex.One of his most shocking calls in the stock market was his call in 2015 for the S&P500 to rally from the 1800SPX region to the 2600SPX region, whereas it would coincide with a “global melt-up” in many other assets. Moreover, he was banging on the table in November of 2016 that we were about to enter the most powerful phase of the rally to 2600SPX, and he strongly noted that it did not matter who won the 2016 election in the US, despite many believing that the market would “crash” if Trump would win the election. This was indeed a testament to the accuracy of the Fibonacci Pinball method that Avi developed.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.