UiPath: AI Competition Increases

Summary

- UiPath's revenue growth has slowed down to 18.6% in 2022, falling short of the projected 41.2% due to increased competition in the RPA market and a decline in customer additions.

- The company faces challenges from large software vendors such as Microsoft, as well as new entrants in the RPA market, impacting its ability to grow at previous rates.

- PATH's valuation suggests a Hold rating with a target price of $20.10, reflecting a modest upside potential of 3.4%.

Funtap

In our previous analysis of UiPath Inc. (NYSE:PATH), we established its dominant position as the market leader in Robotic Process Automation (RPA), holding a significant 27.1% market share and demonstrating robust growth in its customer base. Despite notable enhancements to its platform, the company faced challenges in achieving profitability primarily due to substantial investments in R&D as well as SG&A expenses.

In this current assessment of UiPath, we will delve into the factors contributing to its year-on-year revenue growth of 18.6% in 2022, which fell considerably short of our projected figure of 41.2%. Additionally, its latest Q1 results which were released recently showed its revenues only growing by 18.2% YoY. Firstly, we examine the evolving competitive landscape within the RPA market and determine the potential impact on the company's outlook. In addition, we examine the additions to UiPath's customer base and ARPU growth to compare the difference with our previous forecast and identify the potential factors for its slowing growth.

Slowing Growth Amid Increased RPA Competition

UiPath Revenue Breakdown ('CY') ($'000) | 2018 | 2019 | 2020 | 2021 | 2022 | 4-year Average Growth Rate |

Licenses | 94,910 | 201,648 | 346,035 | 481,427 | 497,836 | |

Growth Rate % (YoY) | 112.5% | 71.6% | 39.1% | 3.4% | 56.7% | |

Maintenance and support | 47,287 | 119,612 | 232,542 | 369,867 | 508,823 | |

Growth Rate % (YoY) | 152.9% | 94.4% | 59.1% | 37.6% | 86.0% | |

Services and other | 6,268 | 14,896 | 29,066 | 40,958 | 51,922 | |

Growth Rate % (YoY) | 137.7% | 95.1% | 40.9% | 26.8% | 75.1% | |

Total | 148,465 | 336,156 | 607,643 | 892,252 | 1,058,581 | |

Growth Rate % (YoY) | 126.4% | 80.8% | 46.8% | 18.6% | 68.2% |

Source: UiPath, Khaveen Investments

Based on the table above, the company's growth rates across all of its segments are well below the previous year as well as the 4-year average growth. In 2022, the company's total revenue growth was only 18.6%, well below the previous year's growth (46.8%) and the average of 68.2%. Furthermore, in its latest earnings in Q1, the company's total revenue growth further slowed to 18.2% YoY. Thus, we will examine the change in the competitive landscape of the RPA market from our previous coverage to determine if it had an impact on the overall slowdown in the company's growth.

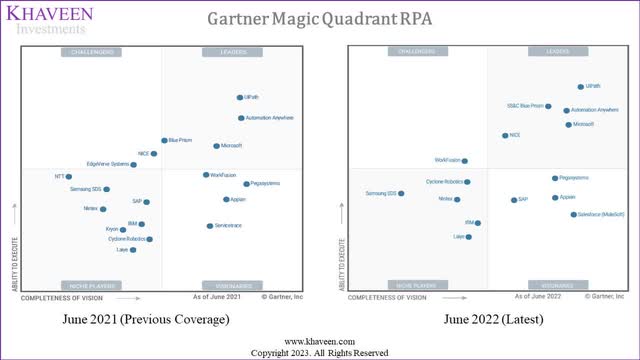

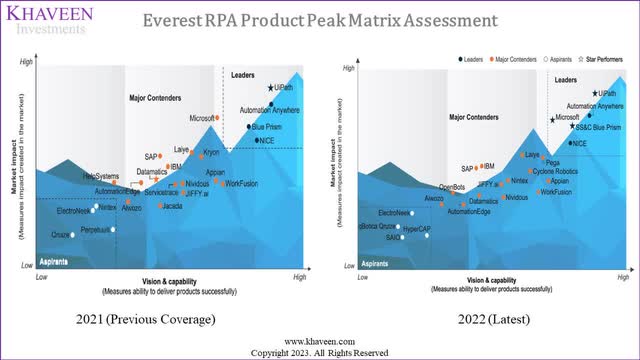

The figure on the left shows the Gartner Magic Quadrant for the RPA market as of June 2021 which was used in our previous coverage of UiPath. The figure to the right is the latest Gartner Magic Quadrant as of June 2022. Based on our observation of the two charts, the number of leaders has increased from 4 to 5, and at the same time, Blue Prism and Microsoft have evidently moved higher within the Leader quadrant.

Moreover, the figure to the left shows the Everest RPA Product Peak Matrix Assessment in 2021 which was used in our previous coverage of UiPath. The figure to the right is the latest RPA peak matrix assessment which was published in 2022. Similar to the Gartner Magic Quadrant above, the leaders increased from 4 to 5, with the 5 companies being the same as the ones in the Magic Quadrant. Moreover, the Star Performers within Leaders increased from 1 in 2021 (UiPath) to 3 in 2022 (UiPath, Microsoft and Blue Prism). Thus, this indicates increasing competition among the top companies in RPA including UiPath.

According to Polaris Market Research, the global RPA market was valued at $2,659 mln in 2022 and is expected to grow at a staggering rate of 37.9% till 2032. From the comparison above, it is indicated that large software vendors such as Nice and Microsoft are moving quickly to gain market share in the RPA market. According to VentureBeat, research from Gartner suggest that "mega-vendors are targeting their existing customer bases with aggressive offers and low entry price points". The average cost of implementation for Microsoft's RPA software (Power Automate) "can be 40-50% of the cost of UiPath" according to SphereGen. This is a real cause for concern as these large software vendors can achieve scale quickly and have most of the biggest companies in the world as their customers.

However, competition is not only coming from the large software vendors. According to Gartner, as of 2020, there were only 51 RPA vendors globally. According to G2.com, there are currently 152 RPA vendors globally. The RPA market's high growth rate is not only attracting large software vendors but also new companies.

Being one of the earliest RPA companies in the world, UiPath has benefitted from a first-mover advantage for several years. However, we believe the high growth rate of the RPA market (37.9%) due to the increased need for automation is attracting competition from various companies. In conclusion, we believe this increased competition is affecting UiPath's ability to grow its revenue at the high rate that it has been achieving in the past.

Positive Customer Additions but Slowing

In this section, we look at UiPath's customer additions, and compare them with our forecasts from our previous coverage, to determine if it had an impact on its slowing revenue growth.

UiPath Customers ('CY') | 2018 | 2019 | 2020 | 2021 | 2022 | 4-year Average |

Customers (Our 2021 coverage forecast) | 2,600 | 6,009 | 7,968 | 9,927 | 11,886 | |

Growth Rate % (YoY) | 131.1% | 32.6% | 24.6% | 19.7% | 52% | |

Customer Increase | 3,409 | 1,959 | 1,959 | 1,959 | 2322 | |

Customers (Actual) | 2,600 | 6,009 | 7,968 | 10,100 | 10,800 | |

Growth Rate % (YoY) | 131.1% | 32.6% | 26.8% | 6.9% | 49.4% | |

Customer Increase | 3,409 | 1,959 | 2,132 | 700 | 2,050 |

Source: UiPath, Khaveen Investments

In our previous coverage, we forecasted that customer additions would increase by 1,959 in 2021 and 2022, which was the rate of customer increase in 2020. Although customer additions were relatively in line with the actual in 2021, customer additions in 2022 were completely different from our forecasts, with actual additions being 700.

The 700 customers added in 2022 is well below the 2,132 customers added the previous year as well as the average of 2,050. According to management, "approximately 34% of the increase in total revenue was from new customers", which indicates that the increase of only 700 customers contributed to 34% of growth whereas the remaining 10,100 contributed to the remaining 66%. Therefore, the growth of the company in the past has been heavily dependent on acquiring new customers. Furthermore, in its latest earnings briefing, the company stated that its customers had grown to around 10,850 at the end of the quarter which represents a mere increase of 50 customers.

RPA Companies | Review (No. of reviews) | Product Capabilities (Out of 5) |

UiPath | 4.5 (2,005) | 4.6 |

Automation Anywhere | 4.5 (1,513) | 4.5 |

Blue Prism (OTCPK:BPRMF) | 4.3 (737) | 4.4 |

Workfusion | 4.3 (81) | 4.3 |

Nice (NICE) | 3.9 (50) | 4.0 |

Microsoft (MSFT) | 4.4 (134) | 4.3 |

SAP (SAP) | 4.3 (69) | 4.3 |

Appian (APPN) | 4.5 (105) | 4.5 |

IBM (IBM) | 4.4 (96) | 4.5 |

Source: Gartner, Khaveen Investments

Looking at reviews for RPA companies on Gartner Peer Insights, UiPath has the joint-highest rating with Automation Anywhere and Appian at 4.5, but it has the highest number of reviews amongst all companies with 2,005. Moreover, Gartner measures product performance by taking scalability, integration, customization and ease of deployment, administration, and maintenance. UiPath has the highest product performance rating by Gartner at 4.6. Thus, we believe this does not explain UiPath's decreasing rate of attracting new customers. However, we do believe as explained in the previous point, increased competition from larger software companies with cost-competitive solutions (such as Microsoft) and new entrants could be affecting UiPath.

UiPath Customer Forecast | 2021 | 2022 | 2023F | 2024F | 2025F | 2026F | 2027F |

Customers | 10,100 | 10,800 | 11,500 | 12,200 | 12,900 | 13,600 | 14,300 |

Growth Rate % (YoY) | 26.8% | 6.9% | 6.5% | 6.1% | 5.7% | 5.4% | 5.1% |

Customer Increase | 2,132 | 700 | 700 | 700 | 700 | 700 | 700 |

Source: UiPath, Khaveen Investments

For our updated customer projection, we conservatively forecasted the company's customer addition at 700 per year through 2027 based on its 2022 customer increase. We highlight the company's advantage of having the best product capabilities based on its top reviews on Gartner. Additionally, the company recently entered into a partnership with SAP "to jointly offer automation capabilities to customers". According to InfoClutch, SAP's customer base include over 86,500 companies, thus we believe this could provide an opportunity for UiPath to benefit. Still, we believe the company could be impacted by the price competition from large software RPA vendors.

In conclusion, UiPath's business model is heavily dependent on attracting new customers for growth and customer additions have had a sudden dip in 2022, contributing to weak revenue growth of 18.6% in 2022. We conservatively forecasted its customer increase for the next five years at 700 per year as we see UiPath's negatively affected by price competition from larger software vendors despite its product capability advantage.

Declining ARPU Growth Rate

UiPath ARPU ('CY') | 2018 | 2019 | 2020 | 2021 | 2022 |

ARPU ($ mln) (Our 2021 coverage forecast) | 0.057 | 0.056 | 0.076 | 0.093 | 0.109 |

Growth Rate % (YoY) | -2.0% | 36.3% | 17.9% | 17.9% | |

ARPU ($ mln) (Actual) | 0.057 | 0.056 | 0.076 | 0.088 | 0.098 |

Growth Rate % (YoY) | -2.0% | 36.3% | 15.8% | 11.0% |

Source: UiPath, Khaveen Investments

Based on the table above, the company's ARPU growth for 2021 and 2022 was below our forecast values. We forecasted 2021 ARPU to be $0.093 mln whereas the company's actual ARPU was $0.088 mln and the forecasted ARPU for 2022 was $0.109 mln but the actual ARPU was $0.098 mln.

We believe one of the factors UiPath failed to meet our previous ARPU forecast was the slowdown in its Annualized Renewal Run Rate (ARR) growth. The company defines ARR as the "annualized invoiced amounts per solution SKU from subscription licenses and maintenance and support obligations". The company's ARR grew strongly at 59.5% from 2020 to 2021, but only grew at 30.2% from 2021 to 2022, representing an almost 50% decrease in the growth rate. In addition, the growth rate of customers with more than $100,000 ARR also saw a decline, growing to 49% in 2021 and only 19.6% in 2022. Moreover, its ARPU growth rate decreased despite the increased adoption of new product offerings across the UiPath platform.

UiPath ARPU Forecast | 2021 | 2022 | 2023F | 2024F | 2025F | 2026F | 2027F |

ARPU ($ mln) | 0.088 | 0.098 | 0.108 | 0.117 | 0.127 | 0.136 | 0.144 |

Growth Rate % (YoY) | 15.8% | 11.0% | 10.0% | 9.0% | 8.0% | 7.0% | 6.0% |

Source: UiPath, Khaveen Investments

From its latest earnings briefing, the company guided for its ARR to be at $1.43 bln at the midpoint which is a growth rate of 19.1%, which would represent a steep drop compared to its 2022 growth of 30.2% for ARR. Therefore, we conservatively forecasted the company's ARPU growth based on its 2022 growth rate of 11% but tapered down by 1% for each year going forward.

Risk: Rise of Intelligence Automation

Although there has been rapid adoption of standalone RPA software, with advancements in technology, there is now the ability to integrate a variety of technologies with RPA to improve productivity. Their abilities include transforming unstructured data from various sources into structured data, finding inefficiencies within business processes, finding inefficiencies in the workflow of a specific individual and lastly coordination of various automated workflows. These technologies integrated with RPA have proven to be better compared to standalone RPA. As a result, there will be increased demand for automation but also increased competition from various companies providing these new technologies, which could capture some of the RPA market growth opportunities, that could result in UiPath's growth rate falling below the RPA market growth of 37.9%.

Verdict

UiPath Revenue Forecast ('CY') | 2021 | 2022 | 2023F | 2024F | 2025F | 2026F | 2027F |

Customers | 10,100 | 10,800 | 11,500 | 12,200 | 12,900 | 13,600 | 14,300 |

Growth Rate % (YoY) | 26.8% | 6.9% | 6.5% | 6.1% | 5.7% | 5.4% | 5.1% |

Customer Increase | 2,132 | 700 | 700 | 700 | 700 | 700 | 700 |

ARPU ($ mln) | 0.088 | 0.098 | 0.108 | 0.117 | 0.127 | 0.136 | 0.144 |

Growth Rate % (YoY) | 15.8% | 11.0% | 10.0% | 9.0% | 8.0% | 7.0% | 6.0% |

Total Revenues ($ mln) | 892 | 1,059 | 1,239 | 1,433 | 1,635 | 1,844 | 2,054 |

Growth Rate % (YoY) | 46.8% | 18.6% | 17.1% | 15.6% | 14.1% | 12.8% | 11.4% |

Source: Khaveen Investments

For our updated revenue forecasts through 2027, we multiplied our forecasts of the company's customer base from the second point above and ARPU from the third point. Overall, we forecasted the company's revenue growth at a 5-year forward average of 14.2% which is a stark contrast to its past 3-year average of 48.7%.

UiPath Valuation | 2023F |

Book Value ($ mln) | 1,545 |

P/B | 7.31x |

Equity Value ($ mln) | 11,290 |

Shares Outstanding ('mln') | 561.2 |

Price Target ($) | 20.1 |

Current Price ($) | 19.5 |

Upside | 3.4% |

Source: Khaveen Investments

Seeking Alpha, Khaveen Investments

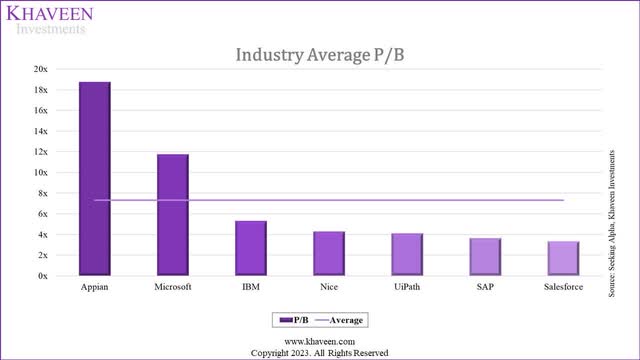

For the valuation of UiPath, we utilized a P/B valuation instead of P/E as the company is not profitable (negative net margins of -31% in 2022) and a P/S valuation as our revenue growth forecast was below 20% for the next five years, thus we do not see it as a high growth company. Additionally, we did not use DCF as the company has negative FCF margins of -27% in 2022.

We based the average P/B on seven RPA companies which are 7.31x. The comparable companies that were chosen are UiPath, Microsoft, Nice, SAP, IBM, Appian and Salesforce (CRM).

In summary, our analysis indicates a growing level of competition within the RPA market compared to our previous analysis. Notably, prominent software vendors, such as Microsoft, have made significant strides, and smaller RPA vendors have also entered the market and posing competitive threats to established player UiPath. The company experienced a substantial decline in customer acquisition growth, dropping from an increase of 2,132 in 2021 to only 700 in 2022. Thus, we adopt a conservative view of its customer addition outlook taking into account the intensified competition. Furthermore, the company's ARPU fell slightly below our initial projections which we believe is reflected by the company's slowing ARR growth rate. We forecasted a continued decline in the rate of ARPU growth underpinned by weak ARR guidance compared to its 2022 growth.

Based on our P/B valuation, we assign a Hold rating to the company, with a target price of $20.10. We believe that the current valuation accurately reflects the company's position in the market, offering a modest upside potential of 3.4%.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PATH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No information in this publication is intended as investment, tax, accounting, or legal advice, or as an offer/solicitation to sell or buy. Material provided in this publication is for educational purposes only, and was prepared from sources and data believed to be reliable, but we do not guarantee its accuracy or completeness.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.