DIVO: This Fund Is Likely To Underperform If There Is A Recession

Summary

- The Amplify CWP Enhanced Dividend Income ETF, DIVO, may underperform benchmarks and other dividend funds in an economic slowdown due to its overweight in cyclical sectors.

- DIVO has a 5.21% yield and has experienced solid dividend growth of 7% over the last five years, making it appealing to income-focused investors.

- The fund's options strategy could generate more income if the economy slows and markets become more volatile, but it may not be well-positioned for a prolonged economic slowdown.

Torsten Asmus

The investing environment continues to change. While Covid and then inflation have created significant challenges for investors over the last several years, and there are now increasing signs of an economic slowdown. Even though most investors are focused on the long-term, capital allocation strategies still often have to evolve as market condition change.

One investment fund that is not likely well-positioned for a recession is the Amplify CWP Enhanced Dividend Income ETF (NYSEARCA:DIVO).

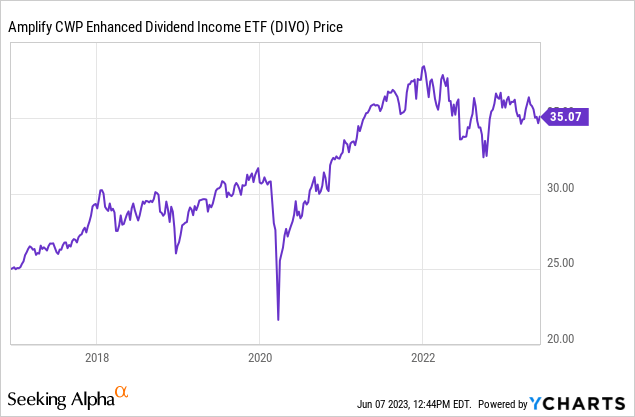

DIVO has performed reasonably well over the last 10 years, the fund's total returns have increased by 98% over that time. Still, the S&P 500 is up 218% during this time frame.

I last wrote about DIVO in February of this year, when I rated the fund a buy primarily because of the ETF's appealing allocation in an inflationary environment. Today I rate this fund a hold. This ETF is likely to underperform the benchmarks and many other dividend funds if the economy slows significantly, which looks increasingly likely, since this fund is overweight to several more cyclical sectors. DIVO ETF also only sells covered calls against 20% of the exchange traded fund's holding, the increased income from higher levels of volatility if the economy should only be minimal.

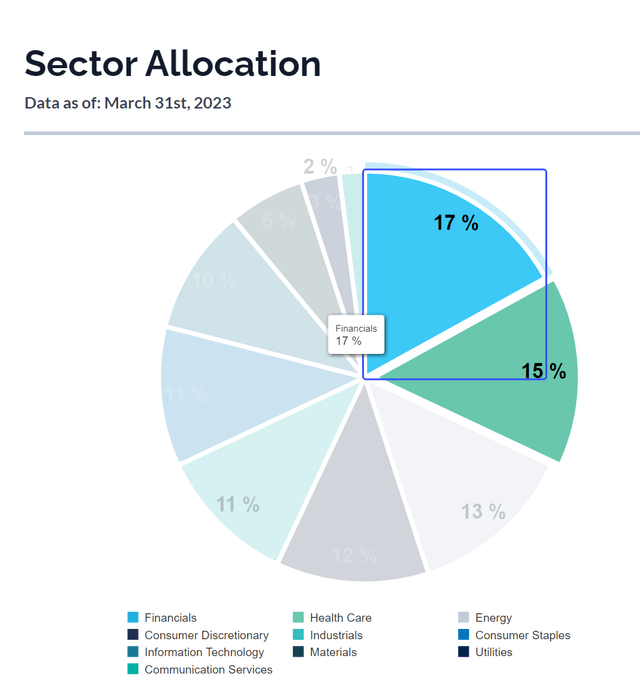

DIVO's holdings are 17.79% health care, 17.43% financials, 11.42% energy, 13.19% consumer defensives, 11.33% industrials, 9.5% consumer cyclical, 2.24% basic materials, 11.56% technology, 3.49% utilities, and 2.32% communication. The five largest equity holdings of this fund are Microsoft (MSFT), the UnitedHealth Group (UNH), Visa (V), and Procter & Gamble (PG), and Chevron (CVX).

A Chart of DIVO's sector allocation (Amplify ETFs)

DIVO currently has 10% of the fund's cash reserved to use for the covered call strategy that the managers use to create additional income, and this ETF sells out-of-the money covered calls against nearly 20% of the exchange traded fund's holdings. The options are sold against individual stocks, not an index. This ETF guarantees to investors that allocations will always be at 80% invested in equities, and this exchange traded fund will also never invest more than 25% of the fund's assets to any one sector. The expense ratio of this fund is 0.55%, the yield is 5.21%, and the assets under management are $2.85 billion. DIVO pays out monthly distributions. The fund seeks to pay 2-3% a year from dividend payments and 2-4% a year from the options strategy the ETF uses. This is an actively managed fund.

There have been increasing signs of an extended economic slowdown in the US over the last several months, and a recession looks more likely now. The ISM survey showed manufacturing fell in the US in March to the lowest levels seen since May of 2020, housing prices are now falling in many markets nationwide for the first time in years, and the Federal Reserve has lowered the bank's forecast for GDP growth in the US in the back half of 2023. The Fed also remains committed to raising rates with current inflation levels of 4.9% well above Powell's stated target for price increases of 2%.

DIVO has more exposure to a softer economy and slowing growth than most funds for several reasons. First, this fund is overweight to several more cyclical sectors such as the financials, consumer cyclicals, and the industrials. Second, this fund is invested exclusively in large-cap stocks, so this ETF is also more exposed to even minor forex moves, and the dollar should strengthen significantly against most major currencies if there is a global recession.

Even slight forex moves have historically had a significant impact on large cap companies. The S&P 500, obviously an index of larger cap companies, has risen 3.7x more when the dollar has fallen over the last seven years, and S&P 500 earnings have risen by an additional 6% when the dollar has fallen against major currencies. DIVO seeks to track the MSCI USA Large Cap Index, which is designed to measure the performance of large-cap companies in the market. Other covered calls funds that use more aggressive strategies of selling options such as the Global X Russell 2000 Covered Call ETF (RYLD) and Global X NASDAQ 100 Covered Call ETF (QYLD) should also outperform DIVO if a recession occurs since the premiums in the call options these ETFs sell should rise significantly as markets likely become more volatile.

DIVO should still have some appeal to investors whose primary focus is income. This fund has had solid dividend growth over the last 5 years of 7%. The options strategy this ETF uses should also generate more income if the economy slows and markets become more volatile. Finally, there is still a chance the economy could avoid a recession, or that the Fed slows the current interest rate cycle sooner than expected.

The economic environment has changed dramatically over the last several years, and investing conditions remain fluid. Even though a recession looks increasingly likely today, Fed intervention or a slowing of the current rate cycle could still obviously potentially impact growth levels in the back half of the year significantly as well. While DIVO isn't likely going to be well positioned if there is a prolonged economic slowdown, some more aggressive income investors with a longer-term outlook not focused on total returns are still likely to find this fund appealing.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.