A10 Networks Feels The Pinch Of Slowing Sales Cycles

Summary

- A10 Networks, Inc. reported its Q1 2023 financial results on May 4, 2023.

- The company provides a range of application delivery and security software for organizations worldwide.

- A10 Networks' security product demand is holding up, but other segments are seeing delayed purchasing decisions from clients and prospects.

- I'm on Hold for A10 Networks stock until we see evidence of a demand pickup across its offerings.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

Blue Planet Studio

A Quick Take On A10 Networks

A10 Networks, Inc. (NYSE:ATEN) reported its Q1 2023 financial results on May 4, 2023, beating revenue and matching EPS consensus estimates.

The firm provides an array of networking software products and related services worldwide.

While leadership is managing the company for a balance of growth and profitability and the firm’s security offerings will likely continue to be resilient, lengthening sales cycles will continue to pressure profitability and revenue growth in the near term.

Until the macroeconomic environment stabilizes and customer demand picks up, I’m on Hold for A10 Networks, Inc.

A10 Networks Overview

San Jose, California-based A10 Networks, Inc. was founded in 2004 to provide a growing list of networking software for a variety of use cases in application delivery, security and vertically optimized solutions.

The firm is headed by President and CEO Dhrupad Trivedi, who joined the firm in 2019 after serving as vice president at Belden and prior to that held management roles at JDS Uniphase.

The company’s primary offerings include the following:

Data Center and Cloud

Security

Application Analytics

Vertical solutions - Financial Services and Education.

A10 acquires customers through its direct sales and marketing efforts as well as through partner referrals.

A10’s Market & Competition

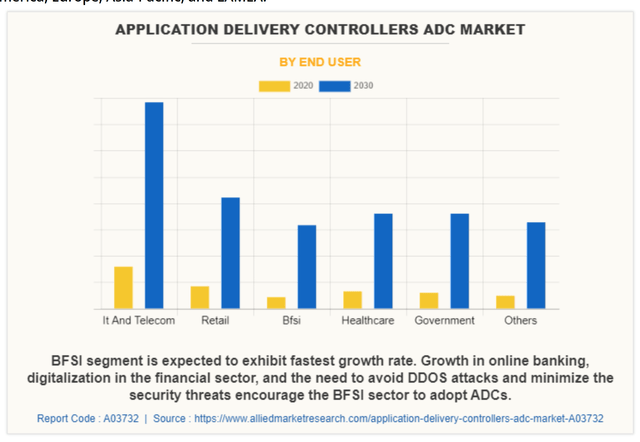

According to a 2022 market research report by Allied Market Research, the global market for application delivery controllers was estimated at $2.3 billion in 2020 and is forecast to reach $12.8 billion by 2030.

This represents a forecast CAGR (Compound Annual Growth Rate) of a very robust 19.1% from 2021 to 2030.

The main drivers for this expected growth are a growing need by organizations to maintain uninterrupted application services and improve end-user experience.

Also, coupled with security needs, the market is moving toward cloud delivery and hybrid cloud delivery models across all levels of the enterprise and in numerous verticals.

Below is a chart showing the application delivery controller market segment growth through 2030 by end-user type:

Application Delivery Controllers Market (Allied Market Research)

Major competitive or other industry participants include:

Citrix Systems

F5 Networks

Array Networks

Webscale

Dell

Barracuda Networks

Fortinet

Cisco Systems

KEMP Technologies.

A10’s Recent Financial Trends

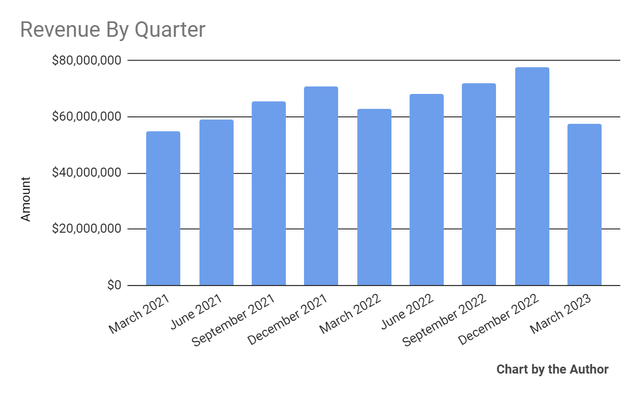

Total revenue by quarter fell in the most recent quarter, YoY:

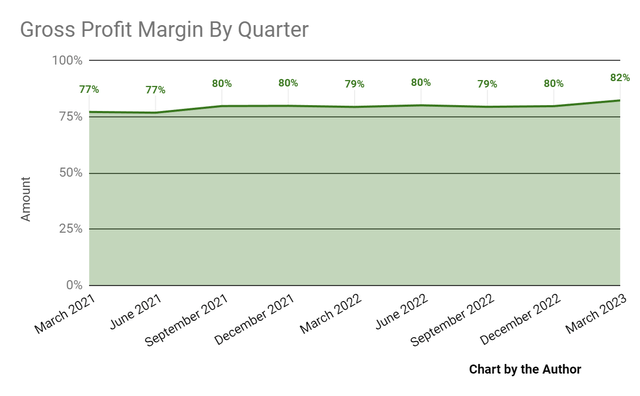

Gross profit margin by quarter rose in Q1 2023:

Gross Profit Margin (Seeking Alpha)

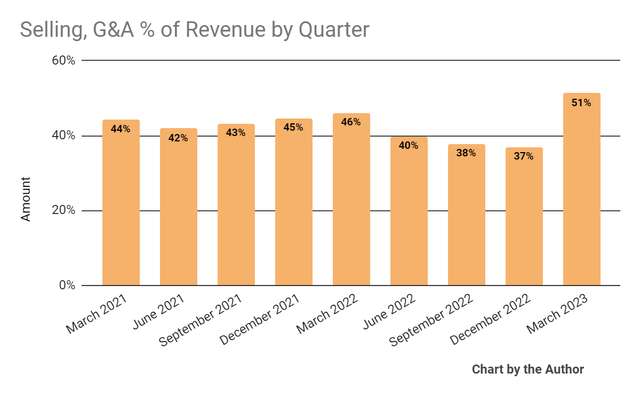

Selling, G&A expenses as a percentage of total revenue by quarter rose sharply in Q1 2023:

Selling, G&A % Of Revenue (Seeking Alpha)

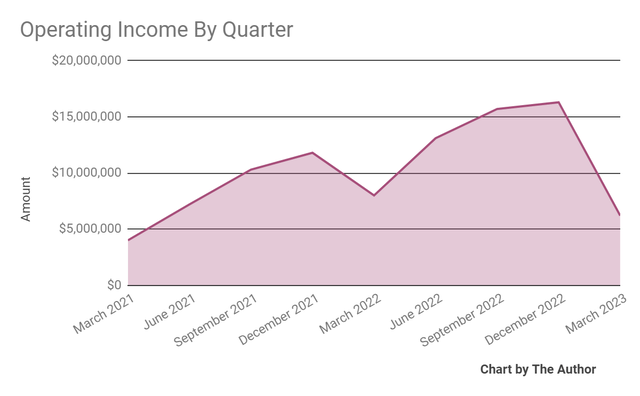

Operating income by quarter dropped substantially in Q1 2023:

Operating Income (Seeking Alpha)

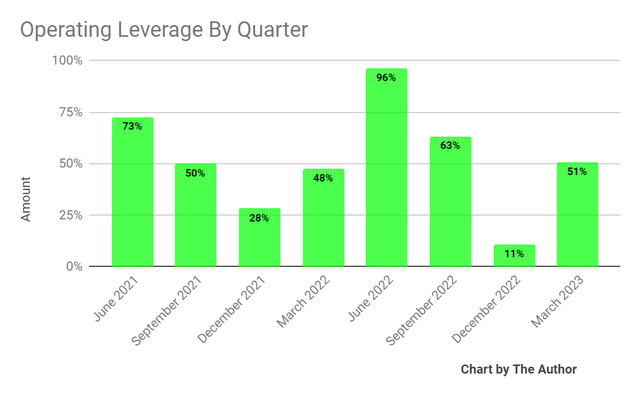

Operating leverage by quarter has generally remained positive in the past ten quarters:

Operating Leverage (Seeking Alpha)

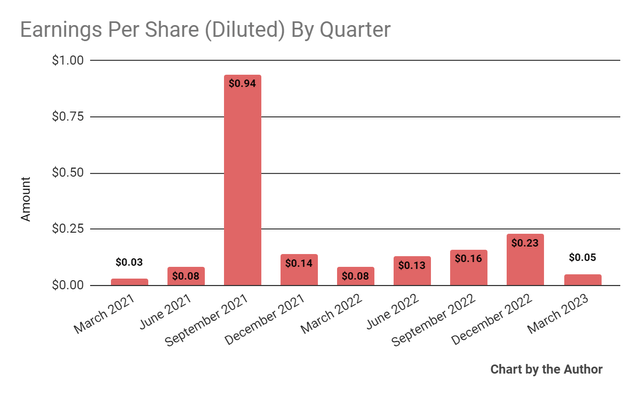

Earnings per share (Diluted) fell materially in Q1 2023:

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP.)

In the past 12 months, ATEN’s stock price has fallen 9.45% vs. that of Fortinet, Inc.’s (FTNT) rise of 14.78%, as the chart indicates below:

52-Week Stock Price Comparison (Seeking Alpha)

For the balance sheet, the firm ended the quarter with $144.5 million in cash, equivalents and short-term investments and no debt.

Over the trailing twelve months, free cash flow was $39.0 million, of which capital expenditures accounted for $10.3 million. The company paid $13.6 million in stock-based compensation in the last four quarters, similar in amount to previous quarters recently.

Valuation And Other Metrics For A10

Below is a table of relevant capitalization and valuation figures for the company:

Measure [TTM] | Amount |

Enterprise Value / Sales | 3.5 |

Enterprise Value / EBITDA | 16.2 |

Price / Sales | 4.0 |

Revenue Growth Rate | 6.8% |

Net Income Margin | 16.2% |

EBITDA % | 21.4% |

Net Debt To Annual EBITDA | -2.5 |

Market Capitalization | $1,080,000,000 |

Enterprise Value | $955,100,000 |

Operating Cash Flow | $49,350,000 |

Earnings Per Share (Fully Diluted) | $0.57 |

(Source - Seeking Alpha.)

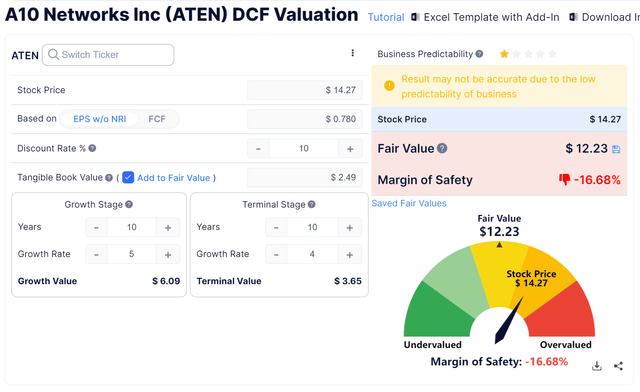

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

Discounted Cash Flow Calculation - ATEN (GuruFocus)

Assuming generous DCF parameters, the firm’s shares would be valued at approximately $12.23 versus the current price of $14.27, indicating they are potentially currently overvalued, with the given earnings, growth, and discount rate assumptions of the DCF.

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

A10’s most recent Rule of 40 calculation was 28.2% as of Q1 2023’s results, so the firm is in need of some improvement in this regard, per the table below:

Rule of 40 Performance | Calculation |

Recent Rev. Growth % | 6.8% |

EBITDA % | 21.4% |

Total | 28.2% |

(Source - Seeking Alpha.)

Commentary On A10 Networks

In its last earnings call (Source - Seeking Alpha), covering Q1 2023’s results, management highlighted the drop in revenue growth but its expectation that it will match its full-year non-GAAP earnings per share targets.

While customers are increasing their spending scrutiny, the firm’s security products are showing resilience as customers prioritize security spend.

Also, leadership is seeking to diversify the firm’s revenue streams, so it recently inked a partnership with Fastly to combine A10’s ADC solution with Fastly’s web application firewall solution.

Total revenue for Q1 2023 fell by 8.0% year-over-year, while gross profit margin improved by 2.9 percentage points.

Selling, G&A expenses as a percentage of revenue increased 5.2 percentage points year-over-year, a negative development and operating income dropped by a substantial 22.5% year-over-year.

Looking ahead, management did not provide specific guidance for full-year 2023; rather it said it expects "double-digit growth in 2023 full-year non-GAAP EPS."

The company's financial position is strong, with plenty of cash, no debt and $39 million in free cash flow in the past four quarters.

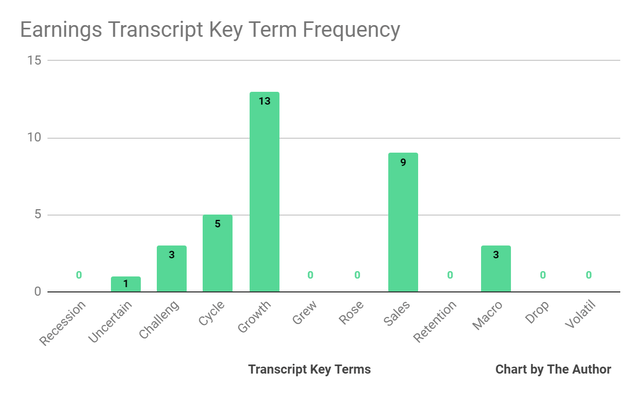

From management’s most recent earnings call, I prepared a chart showing the frequency of key terms mentioned (or not) in the call, as shown below:

Earnings Transcript Key Terms Frequency (Seeking Alpha)

I’m most interested in the frequency of potentially negative terms, so management or analyst questions cited "Uncertain" once, "Challeng[es][ing]" three times, and "Macro" three times.

The negative terms refer to the current challenging macro-driven market conditions forcing management to implement a series of cost-cutting measures.

Regarding valuation, compared to competitor Radware Ltd. (RDWR), the table below shows the two firm’s various valuation metrics:

Metric [TTM] | Radware | A10 Networks | Variance |

Enterprise Value / Sales | 1.8 | 3.5 | 89.6% |

Enterprise Value / EBITDA | NM | 16.2 | --% |

Revenue Growth Rate | -1.6% | 6.8% | --% |

Net Income Margin | -2.4% | 16.2% | --% |

Operating Cash Flow | $41,360,000 | $49,350,000 | 19.3% |

(Source - Seeking Alpha.)

In the past twelve months, the firm's EV/EBITDA valuation multiple has varied materially and dropped a net percentage of 30.0%, as the chart from Seeking Alpha shows below:

EV/EBITDA Multiple History (Seeking Alpha)

The primary risk to the company’s outlook is the slowing pace of prospect and customer purchasing decisions due to macroeconomic concerns and waning demand.

While leadership is managing the company for a balance of growth and profitability and the firm’s security offerings will likely continue to be resilient, lengthening sales cycles will continue to pressure profitability and revenue growth in the near term.

Until the macroeconomic environment stabilizes and customer demand picks up, I’m on Hold for A10 Networks, Inc.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.