Latest Electric Vehicle, Battery And EV Metal Miner Trends - May 2023 (Updated)

Summary

- Q1 2023 global plugin electric car sales were up ~25% YoY, well below the 2022 growth rate of 55%. This is seasonal and due to a slowdown in China sales.

- Key May 2023 trends include - China EV sales slowdown to start to recover. Cheaper small electric car sales set to surge in 2023. China becomes a major EV exporter.

- Stationary energy storage set to double in 2023. Sodium-ion batteries are coming, but won't replace lithium-ion for most applications.

- EV battery metals prices to stabilize in Q2 2023, then H2 2023 will mostly depend on China EV sales. Other EV metals to remain depressed until EV sales surge again.

- I do much more than just articles at Trend Investing: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

VCG

Image: Tesla founder Elon Musk is directing the electric vehicle ("EV") boom. This article first appeared in Trend Investing on May 4, 2023, but has been updated for this article.

For a background, investors can read our past update articles:

- The Latest Electric Vehicle, Battery & EV Metal Miner Trends - February 2023

- The Latest Electric Vehicle, Battery & EV Metal Miner Trends - December 2022.

The top trends from the February 2023 article above were:

- EV price war and the arrival of very affordable compact electric cars - BYD Company Limited (OTCPK:BYDDF) and soon Tesla, Inc. (TSLA). Tesla to release their Generation 3 platform (compact vehicle) to focus on large scale production of cheaper cars + Master Plan 3.

- The Inflation Reduction Act - A huge burst in USA investment in the EV supply chain (mostly in the battery/cathode/anode manufacturing sector and less towards mining so far). IRA subsidies are helping consumers and manufacturers. Expect more U.S government grants and loans to support resource projects.

- The European Critical Raw Materials Act (due out end March 2023) to help build a European EV supply chain and to support European automakers.

- Auto companies are now moving to 'properly' secure battery supply and more importantly battery raw materials supply + localization of supply chain.

- Mergers and acquisitions in the lithium sector to continue in 2023 as lithium supply continues to struggle to catch surging demand. Lithium prices have dipped but should stabilize soon.

Q1, 2023 plugin global electric car sales

In the IEA EV Outlook 2023 report, they state:

Over 2.3 million electric cars were sold in the first quarter, about 25% more than in the same period last year. We currently expect to see 14 million in sales by the end of 2023, representing a 35% year-on-year increase with new purchases accelerating in the second half of this year. As a result, electric cars could account for 18% of total car sales across the full calendar year. National policies and incentives will help bolster sales, while a return to the exceptionally high oil prices seen last year could further motivate prospective buyers.

Trend Investing's forecast for 2023 global plugin electric car sales remains at 14.35m (17.5% market share) growing by 36% YoY. We think BYD and Tesla will remain at number 1 and 2 for global sales in 2023. The slow Q1 does skew risks towards the downside of our forecast; however the EV price wars and a surge in cheaper EVs (BYD Dolphin, BYD Seagull etc) could lead to a positive surprise in 2023.

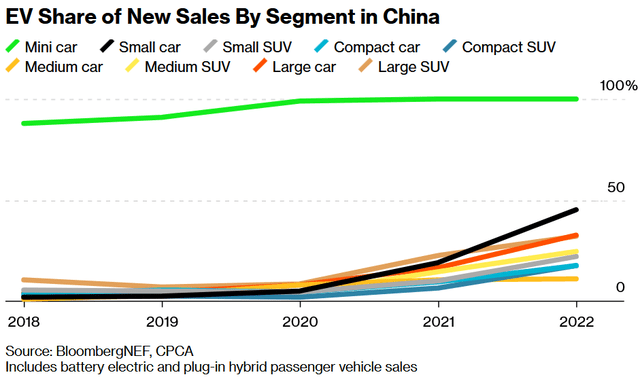

A tough global economy in 2023 is boosting electric car sales in the (previously ignored) budget small car segment (black line below) (source)

April 2023 global plugin electric car sales recovered strongly (updated for this article)

Note: As reported in EV company news for May 2023 global plugin electric car sales have started to recover after a poor January 2023. Also some great Tesla news with Model Y sales success.

Global plugin electric car sales were 928,000 in April 2023, up 70% on April 2022 sales. Global plugin electric car market share in April was 14%, and 13% YTD.

The biggest news item for the month was that Tesla Model Y became the best-selling car globally in Q1, 2023, of ALL types of cars (including internal combustion engine cars).

Latest trends and what to expect in 2023

1) Slower China sales in Q1 (post-subsidies ending) are slowing EV sales globally, but are now recovering. Rising interest rates in the West are a growing negative

Q1, 2023 global plugin sales were up ~25% YoY, well below the 2022 growth rate of 55%. This is seasonal and mostly due to a slowdown in China sales.

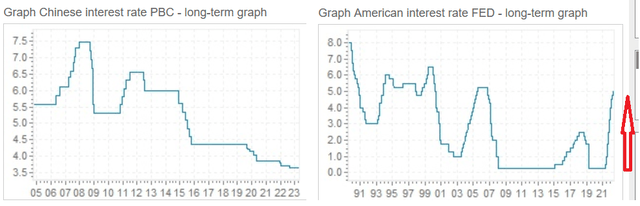

The good news is that China's economy is now recovering from Covid shutdowns and has not had any recent interest rate increases, unlike the USA, which has now had 10 rapid fire increases to a 16 year high.

China interest rates remain low while U.S rates shoot higher (source)

Given China still accounts for around 60% of global plugin electric car sales the low interest rate environment in China should be a positive in 2023.

Higher interest rates in the western world are a growing negative factor, but not yet too significant.

The IEA stated (page 10) in May 2023: "The number of available electric car models reached 500 in 2022, more than double the options available in 2018."

The IEA forecast global plugin electric car sales to reach 14 million in 2023.

Note: Trend Investing's forecast is similar at 14.35m in 2023.

The IEA forecasts global plugin electric car sales to reach 14 million in 2023 (source, p22)

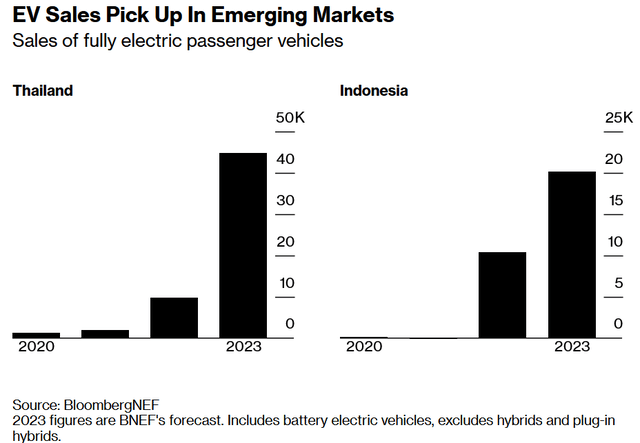

A small positive is the rise in EV sales in other regions of the world. Until 2022 China, Europe, and USA dominated EV sales. In 2023 this will remain the case; however EV sales are surging in many countries notably Australia (tripled YoY in 2023 YTD), India, Indonesia, Thailand and many other countries.

EV sales are starting to increase rapidly in emerging markets as cheaper priced EVs become available (source)

2) Cheaper small electric car sales set to surge in 2023. China becomes a major EV exporter. Tesla Compact car may be released soon

As Bloomberg reported on May 2, 2023 (paywalled):

BYD will accelerate bottom-up EV trend with under-$11,000 model. China has electrified both the low and high ends of its auto market. Budget models are now taking off in India, Indonesia and Thailand, as well.

Up until 2023 electric cars were really only for the rich, except within China where the Wulin Mini sold for around US$5,500. The big change in 2023 is China is now starting to export some of their very cheap electric cars to the world.

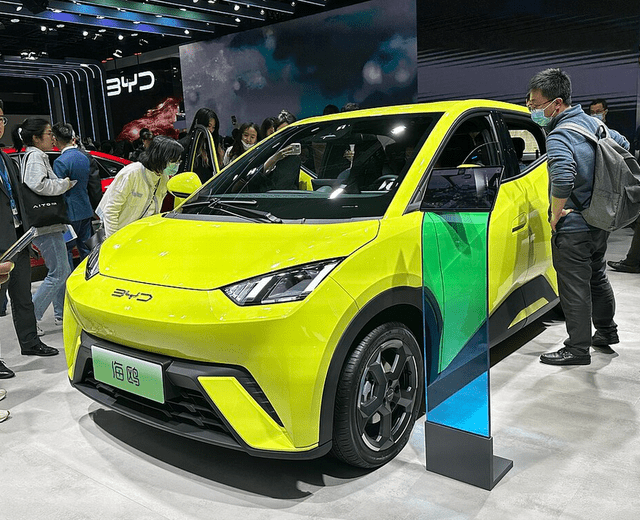

The BYD Dolphin has had remarkable sales the past several months and is now starting to be exported globally. A great small size 100% BEV that sells for around US$16,700 in China is a knockout deal for price sensitive buyers. Then next the BYD Seagul is on the way. A budget smaller 100% BEV that will sell from US$8,860 in China.

These two BYD cars are about to take the world by storm and prove once and for all how cheap and popular electric cars can be, in China and soon in the West.

On May 2, 2023 Bloomberg stated (regarding emerging markets):

These are fast-growing auto markets with price-sensitive buyers. That price sensitivity is often cited as a reason for why they’ll be much slower to adopt EVs. But price sensitivity cuts both ways. It acts as a deterrent before EVs hit price parity, and an accelerant afterward. With the BYD Seagull, we may approach that acceleration point in emerging economies sooner than many expected.

Note: Bold emphasis by the author.

The IEA reported in May 2023: "In 2022, 35% of exported electric cars came from China, compared with 25%."

BYD Dolphins sells from an incredibly low US$16,700 in China (source)

The new BYD Seagul is reported to be even cheaper ranging from US$8,860 to US$14,770 (source)

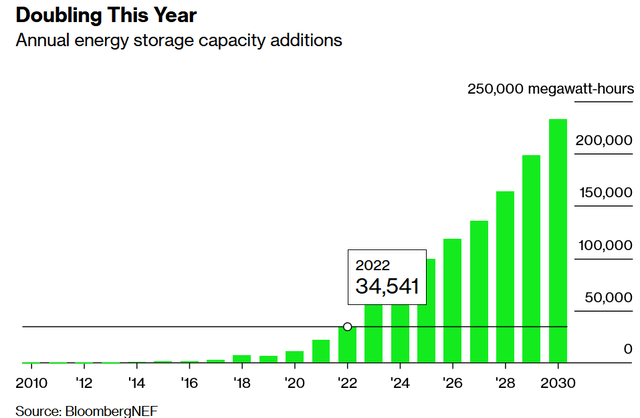

3) Stationary energy storage set to double in 2023

Perhaps the biggest story of 2023 will be the boom in stationary energy storage. Bloomberg forecasts the market to double in 2023 from ~34.5 GWh to over 68 GWh in 2023. The majority of this new production will be using lithium-ion batteries.

Tesla alone plans to scale two megapack factories (Lathrop & Shanghai) to a combined 80 GWh of production (10,000 megapacks pa each factory) in the next few years. That's well over double the world's total stationary storage production of 34.5 GWh in 2022.

Bloomberg forecasts rapid growth in global stationary energy storage and a doubling in 2023 (source) (Jan. 2023)

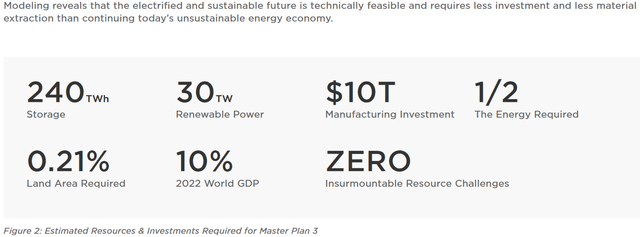

Looking out to a 100% renewable grid Tesla Master Plan 3 forecast that we will need an incredible 240 TWh of energy storage, with 112 TWh needed for electric transportation, and most of the rest for stationary energy storage to support solar and wind power. This means the energy storage trend can be even bigger than the EV trend. Wow!

Tesla Master Plan 3 estimates that 240 TWh of storage needed to move to a 100% renewable energy world (source)

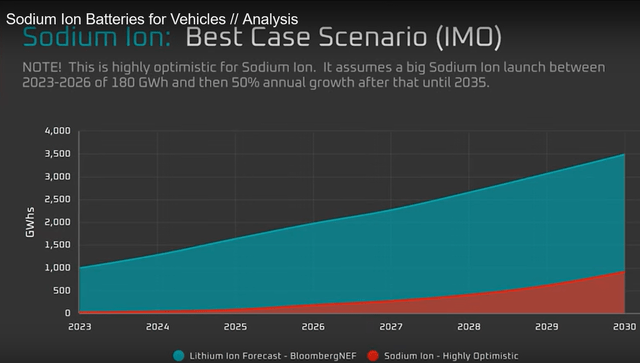

4) Sodium ion batteries are coming but won't replace lithium-ion for most applications. They will mostly be used for energy storage and lower end, low range, cheap electric cars (in emerging Asia)

A new trend in 2023 is the arrival of sodium-ion batteries being used in small, low range, cheap cars in China. We think this trend was probably over-hyped a bit by CATL and others seeking to crash the lithium price.

Yes sodium-ion batteries will take some market share from lithium-ion batteries, but it is likely to be only small in EVs, but possibly significant in energy storage where sodium-ion's worse volumetric density won't mater.

Best to read the recent Trend Investing full article of the sodium-ion battery trend here.

Forecast showing sodium-ion gaining some share of the EV battery market, but well below lithium-ion (source)

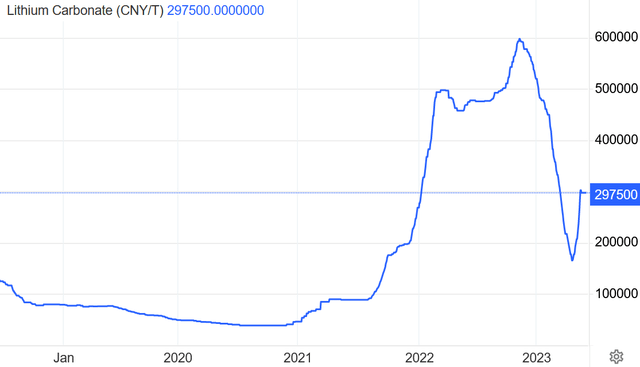

5) EV battery metals prices to stabilize in Q2, 2023, then H2 2023 will mostly depend on China EV sales.Other EV metals to remain depressed until EV sales surge again

Mostly due to the China Q1, 2023 EV sales slowdown and inventory clean out, we saw all EV metal prices fall. China lithium spot carbonate prices fell the most, but this is not representative of the full market and merely a forward price indicator of where prices may head.

China lithium spot carbonate prices now look to have stabilized above CNY 175,000/t in early May, similar to Ganfeng Lithium's forecast they would stabilize in may above CNY 150,000/t.

Trend Investing's view is that spot prices will start to stabilize closer to China spot prices and contract prices will fall in 2023 towards, but not as low as, current spot prices. At these prices most lithium producers will still be very profitable, just not nearly as profitable as we saw in late 2022 at the price peak.

On May 3 Seeking Alpha reported:

Albemarle cuts full-year earnings outlook on falling lithium prices....."We see strong sales volume growth for the rest of the year but have modified our guidance to reflect softening lithium market pricing," CEO Kent Masters said.

China lithium spot carbonate prices now look to have stabilized above CNY 175,000, now at CNY 297,500 (source)

The long term picture remains very strong for EV metals. The IEA stated in May 2023 (page 11):

The increase in demand for electric vehicles is driving demand for batteries and related critical minerals. Automotive lithium-ion (Li-ion) battery demand increased by about 65% to 550 GWh in 2022, from about 330 GWh in 2021, primarily as a result of growth in electric passenger car sales. In 2022, about 60% of lithium, 30% of cobalt and 10% of nickel demand was for EV batteries. Only five years prior, these shares were around 15%, 10% and 2%.

Note: Trend Investing's forecast many years ago for 2022 was 66% of lithium, 33% of cobalt and 11% of nickel demand to be used in EV batteries.

Further reading

- EV Sales Expected to Grow in 2023 Despite a Slow Start in Q1, Now Fueled by Tesla-Led Price Wars

- Auto OEMs are heading to Indonesia to secure nickel for their EV batteries, but what about North America & Australia?

- Chile plans to nationalize its vast lithium industry

- Tesla Master Plan 3 Breakdown And Investment Opportunities

- Exclusive: A Look At The Sodium-Ion Battery Trend And The Leading Manufacturers

- April 2023 - USD 25000 ‘Tesla Model 2’ or ‘Model Q’ proposed in 6 designs [Update]

- May 2023 - IEA global EV outlook 2023 (executive summary)

- May 2023 - IEA global EV outlook 2023 (full 142 page report)

- April 2023 - Global electric car sales' 'explosive growth' – in numbers

- Stationary Energy Storage Is Set For Insane Growth - How To Invest Into This Boom

Two key quotes from the IEA global EV outlook 2023 full report (source p14, 15)

The release of the Tesla compact car has potential to be a game changer for the EV industry (images just a made up render) (source)

Topelectricsuv

Conclusion

Q1 2023 saw a sharp slowdown in global plugin electric car sales. This was a part seasonal affect and part China sales slowdown (notably in Jan. 2023). Sales growth for Q1 was still solid at 25%, but well below the 55% growth in 2022.

This resulted in an EV price war, a push towards cheaper smaller electric cars out of China, and a significant hit to the EV metals - Lithium, cobalt, nickel, graphite and neodymium prices all fell in Q1 2023.

Q2 2023 is looking like becoming a quarter where we see some stabilization of the price falls. We have already seen a strong bounce higher in China spot lithium carbonate prices.

H2 2023 is hard to know just yet and will depend mostly on China EV sales. If they pick up and we head to 14.3m sales or above in 2023, then EV metal prices should do better in H2 2023. If global plugin electric car sales languish below 36% YoY growth, we will likely see EV metal prices also remain under pressure.

Our top 5 EV, battery, and EV metal miner trends from May 2023 are:

- Slower China sales in Q1 (post-subsidies ending) are slowing EV sales globally, but are now recovering. Rising interest rates in the West are a growing negative.

- Cheaper small electric car sales set to surge in 2023. China becomes a major EV exporter. Tesla Compact car to be released soon.

- Stationary energy storage set to double in 2023.

- Sodium ion batteries are coming but won't replace lithium-ion for most applications. They will mostly be used for energy storage and lower end, low range, cheap electric cars (in emerging Asia)

- EV battery metals prices to stabilize in Q2, 2023, then H2 2023 will mostly depend on China EV sales. Lithium contract prices to fall following spot prices fall. Other EV metals to remain depressed until EV sales surge again.

As usual all comments are welcome.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Trend Investing

Trend Investing subscribers benefit from early access to articles and exclusive articles on investing ideas and the latest trends (especially in the EV and EV metals sector). Plus CEO interviews, chat room access with other professional investors. Read "The Trend Investing Difference", or sign up here.

Trend Investing articles:

This article was written by

The Trend Investing group includes qualified financial personnel with a Graduate Diploma in Applied Finance and Investment (similar to CFA) and well over 20 years of professional experience in financial markets. Trend Investing searches the globe for great investments with a focus on "trend investing" themes. Some focus trends include electric vehicles and the lithium/cobalt/graphite/nickel/copper/vanadium miners, battery and plastics recycling, the online data boom, 5G, IoTs, AI, cloud computing, renewable energy, energy storage etc. Trend Investing was recently selected as the leading expert consultancy for a U.S government project on the EV supply chain and to the Board of Directors of the Critical Minerals Institute.

Trend Investing hosts an Investing Group service called Trend Investing for professional and sophisticated investors. The service is information only and does not offer advice or recommendations - see Seeking Alpha's Terms of use .

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA, BYD CO [HK:1211] either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is for ‘information purposes only’ and should not be considered as any type of advice or recommendation. Readers should "Do Your Own Research" ("DYOR") and all decisions are your own. See also Seeking Alpha Terms of Use of which all site users have agreed to follow. https://about.seekingalpha.com/terms

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.