Meituan: Strong Q1 But Not Out Of The Woods Yet

Summary

- Meituan outperformed expectations in Q1.

- Food delivery was the key P&L driver, while in-store, hotel & travel also contributed positively.

- Underwriting a sustained margin recovery seems presumptuous, however, given the prospect of more competition ahead.

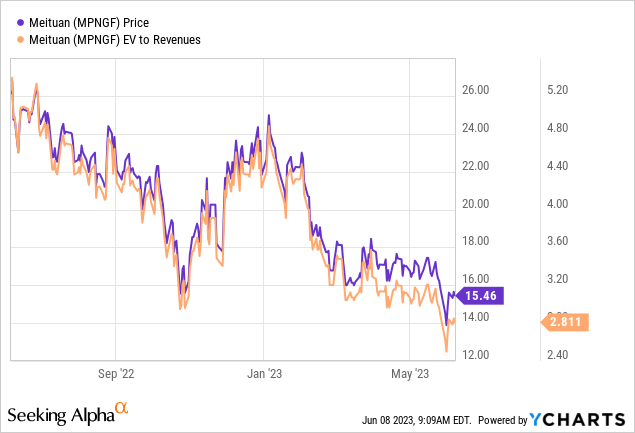

- The stock has likely priced in some of the negatives following this year’s de-rating, but at >70x earnings, there isn’t much margin for error.

KotoriK

Meituan (OTCPK:MPNGF) came out with a strong set of results in Q1, highlighting that its status as the top transaction platform in mainland China remains intact. The key highlight was the strength in the core commerce business, where operating profit doubled to RMB9.5bn (implied 22% margin), led by better-than-expected unit economics at the food delivery business. This was largely down to volume growth post-reopening, which more than offset margin headwinds from marketing and user incentives to support merchants getting back to business as usual.

While the improved Q1 profitability of the food delivery business is a major positive to achieving its long-term unit economics target, competitive pressures remain a major overhang. Guidance numbers calling for higher operating and marketing costs confirms this view, as Meituan will continue to allocate incremental spending for share gains. The second-order impact shouldn’t be underestimated either – competitors on both sides of its core business (i.e., food delivery and in-store, hotel & travel) like ByteDance (BDNCE)/Douyin (valuation pegged at >$200m per last funding round) have deep pockets and will respond in kind. At >70x P/E and ~3x EV/Revenue, this name isn’t cheap either, and further margin disappointments could significantly de-rate the name.

Volume-Driven Q1 Improvement in Food Delivery, but Sustainability is a Concern

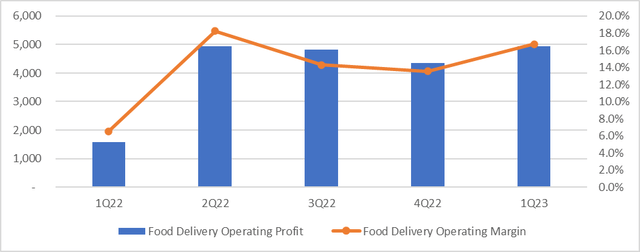

Food delivery led to Meituan’s positive Q1 surprise, with order volumes up +13% YoY on the back of a reopening-driven impetus in Mainland China. Management deserves credit for its marketing and user incentive strategies which better positioned the company to capture the consumption-led economic rebound. In addition to transaction volumes, active merchants and transacting users on the food delivery platform were also up for the quarter, driving overall revenue growth of +23% YoY (outpacing underlying volumes). The strong top-line drove operating leverage benefits as well, with the unit rider cost coming down YoY and driving an expansion of the segment adjusted operating margin to 16.7% (well above prior guidance).

JP Research

Q2 looks set for more volume strength – per management, the food delivery recovery has continued since March, with order volume growth at >20% YoY amid the continued consumption-led recovery in China. Meituan’s continued support of merchants’ online operations and new store openings have also been paying off, fueling management optimism on the achievability of its 100m/day transaction target over the mid to long term. The catch is that user acquisition remains expensive – to achieve its Q2 numbers, management will ramp up its discount-led marketing efforts via events such as ‘Shen Qiang Shou’ (i.e., a livestreaming/short video format for selling discounted quality products) and ‘Shen Quan Jie’ (i.e., a livestreaming/short video format for deep discounts and flash sales). Also in the pipeline are coupon-led strategies to improve volumes, for instance, by allowing coupon stockpiling to incentivize usage during non-mealtimes. While positive for volumes, the focus on discounting could hinder unit economics in the coming quarters, particularly if competitors deploy similar strategies. A slowing post-reopening tailwind toward the back half of the year could slow Meituan’s operating leverage gains as well. And with management also holding off on full-year margin guidance, I would be cautious about underwriting a sustained post-Q1 profitability inflection in food delivery.

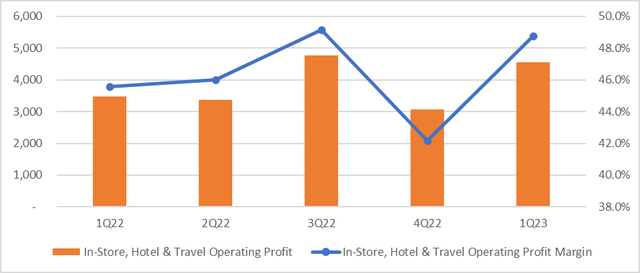

Ex-Delivery Business Also Strong but Reliance on Subsidies is a Concern

The other major contributor to its core commerce business, in-store, hotel & travel, also saw a strong >50% YoY acceleration in Q1 on higher gross transaction value (GTV) and hotel room nights, helped by seasonal Lunar New Year tailwinds. Per management, the momentum has extended into April as well, supported by a strong post-reopening Labor Day holiday performance, and is now on track to hit RMB150bn of transaction value. While Meituan has a clear scale advantage over key competitor Douyin here, competition is stiff, with management citing a ramp-up in subsidies (i.e., merchant and consumer incentives) from March to counter the competitive threat. Also concerning was the weakness in subscription services and the unfavorable mix shift (higher GTV contribution from lower-margin hotel & travel), which led to revenue growth lagging GTV this time around. With various marketing strategies also in the pipeline next quarter (mainly incentives), expect slower net revenue growth vs. GTV in Q2 as the company ramps up user acquisition and retention efforts to maintain its leadership.

JP Research

On the margin side, the company still reaped the benefits of operating leverage (~49% sub-segment margin in Q1), though management guidance for increased subsidies likely entails margin pressure ahead. While favorable growth tailwinds from higher inbound tourism post-reopening should help the sub-segment somewhat, the second-order impact of Douyin responding with a step-up in competitive intensity remains the key concern for the long-term margin trajectory. While I do agree with management’s approach of maximizing market share over short-term profitability, I see more P&L and free cash flow downside than upside for in-store, hotel & travel going forward.

Strong Q1 but Not out of the Woods Yet

Meituan’s strong Q1 results may have reinforced investor optimism on its long-term prospects, but I wouldn’t count on sustained profitability just yet. While Meituan remains the leader in China’s transaction platform race, the level of subsidies and the spending required to maintain share doesn’t seem sustainable, in my view. Even for this quarter, which saw core operating profit hit an impressive RMB9.5bn (>20% margin) post-reopening, the company needed heavy marketing and user incentives to keep merchants on the platform. And as competition in the market heats up, I see more spending pressure ahead; hence, I would be cautious about underwriting the long-term RMB1/order adjusted EBIT target, particularly at the currently elevated valuation.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.