Independence Contract Drilling Navigates Through Operational Challenges

Summary

- Independence Contract Drilling is focusing on rebalancing its rig portfolio by deploying more pad-optimal, 300-series super-spec rigs in the Permian region.

- The company's margin per day may decrease in Q2 due to rig relocations and cost inefficiencies associated with moving rigs between basins.

- Despite challenges, ICD stock appears undervalued compared to its peers, and investors can expect limited returns in the near term.

Otakeja

ICD Hangs On A Balance

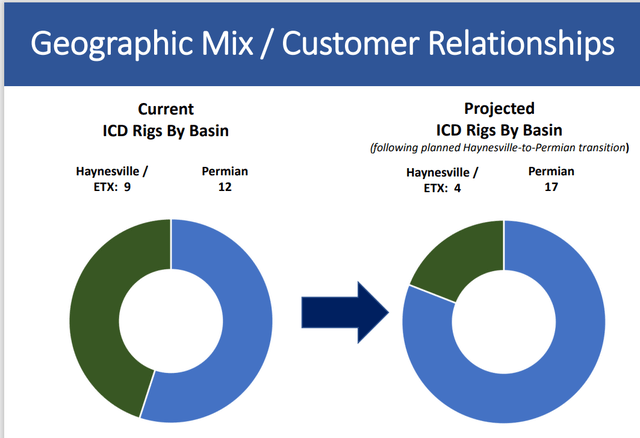

I discussed in my previous article how Independence Contract Drilling's (NYSE:ICD) management was focused on repricing and profit growth. In early 2023, ICD adopted the strategy of rebalancing the geographic mix for its rig portfolio. It is deploying more pad-optimal, 300-series super-spec rigs in the Permian, where drilling activities continue to grow following the relative stability in crude oil prices. Some additional rigs in the Permian come as replacements for the Haynesville rigs taken out following the decline in natural gas prices.

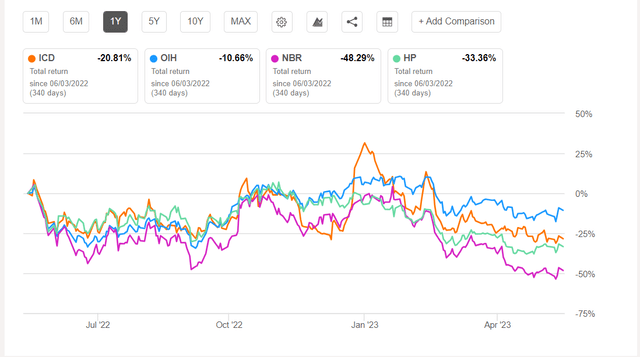

Between the rig relocations and the cost inefficiencies associated with moving rigs between basins, the rig margin per day may decrease in Q2. Due to the restrained capex plan, its free cash flow can remain stable, which can further help deleverage the balance sheet. The stock is relatively undervalued versus its peers. Given the various factors at play, investors might want to "hold" the stock for now.

ICD Relocates Rigs

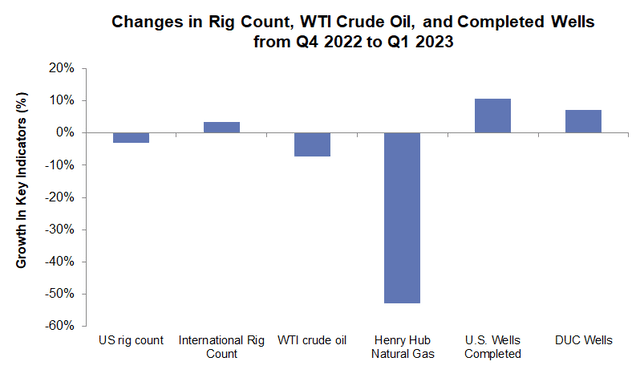

Led by energy prices' softness, the onshore rig count in the US has dropped since the start of the year. However, the changes have been uneven across the Basins. While the Permian added more rigs, some unconventional oil basins saw reductions during this period. The pad-optimal super spec rigs saw improved demand in the Permian. The Haynesville, in contrast, saw a rig count drop due to its natural-gas-heavy nature. Even in the Permian and Eagle Ford, many operators may shed lower-spec rigs and replace them with higher-specification AC rigs or relocated rigs from Haynesville.

The Market Outlook

Baker Hughes, EIA, and Seeking Alpha

The rig churns had an impact on ICD's performance. Although its margin per day remained robust in Q1, as I will discuss later, the management expects the margin to wobble in Q2 and Q3. While the rigs transition from the Haynesville to the Permian, costs will likely increase, denting the margin. ICD's management displayed confidence over Permian's growth in 2H 2023, although Haynesville will likely stay challenging for the rest of the year. In this context, investors might want to look at the impact of low natural gas prices on the Haynesville drilling rig market. Because natural gas prices fall has been spectacular in the past year, a drilling activity scale back in Haynesville led to the operating rig fall.

Given the market outlook, ICD did not add to the rig fleet, which reached 21 by the end of 2022. In early Q2 2023, it secured a contract for the 21st rig in the Permian. This super spec, pad-optimal rig features three by four mud pump to generator configuration. The company looks unlikely to increase the number of reactivated rigs anytime soon.

The Q2 Outlook

Regarding the demand for advanced rigs, the market for pad-optimal super-spec rigs remains strong. It has deferred further investments and will not make additional reactivations beyond the 21st rig. In Q2, the company expects margin per day to remain relatively unchanged compared to Q1. There would be cost inefficiencies given the number of rigs moving between basins. So, at the guidance mid-point, rig margin per day can decrease by 3% in Q2 versus Q1.

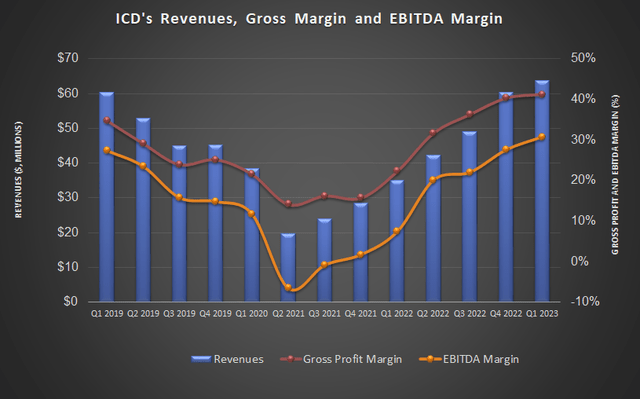

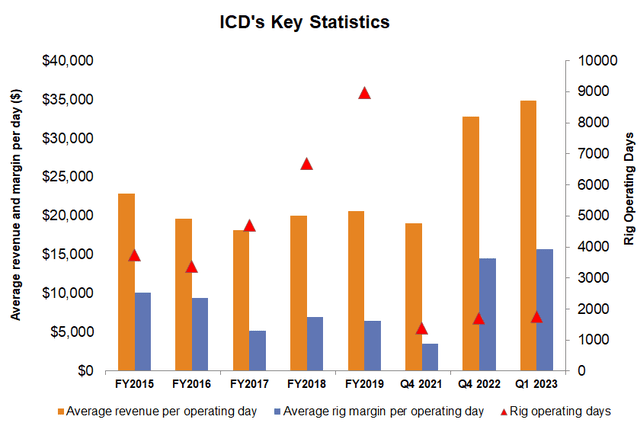

Analyzing The Q1 Drivers

From Q4 2022 to Q1 2023, the company's revenue per day increased by 6%, while the cost per day decreased by 5%. The average rig margin increased by 8% in Q1. The additional rigs would work in the Permian, where revenue per day would improve. It also estimates that the relocation costs could range between $3 million-$4 million.

Cash Flows And Liquidity

In Q1 2023, ICD's cash flow from operations turned positive compared to a mildly negative CFO a year ago after its revenues doubled over this period. Capex exceeded CFO. So, free cash flow (or FCF) turned negative in Q1. It spent the capex on maintenance and tubular purchases. During Q1, it improved its net working capital by $11.7 million. If the company stays on its rig relocation program that does not increase capex requirements or significantly adjust its rig operating, its cash flows will remain stable or improve if the margin improves.

As of March 31, ICD's debt-to-equity stood at 0.77x. This is lower than its peers' (NBR, HP, PTEN) average of 0.87x. Its liquidity was $22.1 million on March 31. The company's long-term goal is to reduce net debt to an adjusted EBITDA ratio of 1x-1.5x. In 2025, it would refinance its debt.

What Does The Relative Valuation Imply?

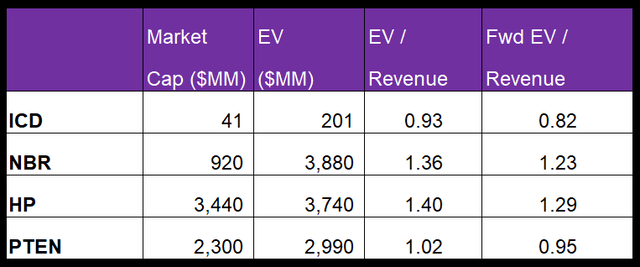

Author created and Seeking Alpha

ICD's EV/Revenue multiple (0.93x) contraction to the forward EV/Revenue (0.82x) is steeper than its peers' (NBR, HP, and PTEN), implying sharper revenue growth than its peers. This typically results in a higher EV/Revenue multiple. However, the stock's current multiple is lower than its peers' average (1.26x). So, the stock appears to be undervalued versus its peers at the current level.

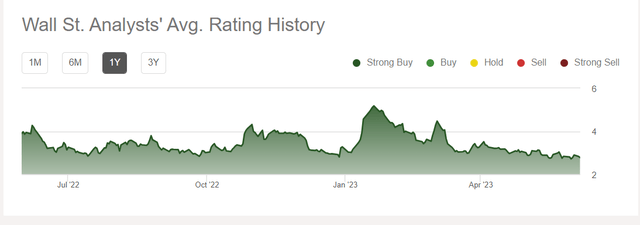

Target Price And Analyst Rating

During the past 90- days, two sell-street analysts rated ICD a "Buy" ("Strong Buy"). None rated it a "Hold" or "Sell." The consensus target price is $5.7, representing ~101% upside from the current price.

Current Risk Factors

ICD's Investor Presentation March 2023

Investors may also like to recall that ICD deployed ~50% of its rigs in Haynesville at the start of 2023. Following the natural gas price fall, it made a quick decision to redeploy some of them to the Permian to reach an effective utilization target of 21 operating rigs after the rebalancing exercise. It has already relocated two rigs., although they would not be operational before late May and mid-June.

So, at the end of Q1, the company had five rigs remaining in Haynesville. Among these, it secured re-contracts or signed extensions for two rigs. Its contract terms extend for the rest in Q3 and Q4 of 2023. However, if the situation demands, the company keeps its options open to move some of these to the West. If more Haynesville rigs are taken offline than added to the Permian, it can adversely affect the company's top line, margin, and stock price in the short term.

What's The Take On ICD?

In 2023, the market for pad-optimal super-spec rigs remains strong in the Permian, where drilling activities continue to grow. By Q1, ICD reactivated 21 rigs, while the average rig margin increased by 8% in Q1. These advanced rigs can expand the company's operating margin when the supply situation remains tight.

On the other hand, it relocates rigs from Haynesville following the steep fall of natural gas prices. It has deferred further investments and will not make additional reactivations beyond the current rig count in the near-to-medium term. On top of that, cost inefficiencies are also associated with moving rigs between basins. As a result of this sedate outlook, the VanEck Vectors Oil Services ETF (OIH) outperformed the stock in the past year. On a more positive note, ICD's cash flow from operations turned positive in Q1 2023. Due to the restrained capex plan, its free cash flow can remain stable, which can help deleverage the balance sheet further. Although it faces a few roadblocks, given the relative undervaluation, investors can expect limited returns from the stock in the near term.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.