Farmer Bros. Brews Up A Great Deal

Summary

- I intend to increase my bullish position in Farmer Bros. Co. as I view the upcoming deal with TreeHouse Foods as beneficial for the business.

- The deal will allow Farmer Bros. to focus on higher margin activity and reduce debt, improving the balance sheet and income statement.

- Despite a recent spike in price, the valuation remains reasonable, making it a good time to buy more shares.

Filmstax/E+ via Getty Images

What a difference a day makes. Back on April 25, I published an article announcing that I was taking a small bullish position in Farmer Bros. Co. (NASDAQ:FARM). Right on cue, the shares continued their march lower. They spiked yesterday in price, and so I'm now up 12.5% against a gain of 4.8% for the S&P 500. The company has reported earnings since, and those demand review. Additionally, I want to decide whether or not it makes sense to buy more, hold, or take my profits on this name. I'll make that determination by looking at the latest financials and comparing them to the valuation. Of course, I'll also need to add the impact of the deal that was announced yesterday.

Welcome to the "thesis statement" portion of the article, where I offer you the gist of my thinking in a relatively short paragraph, so you can get in, read what I think, and then get out again before my writing induces a combination of boredom and anger. You're welcome. I'll be buying a few more shares this morning for a few reasons. I think the upcoming deal is a great one for the business because it'll allow them to focus on higher-margin activity. Additionally, reducing ~$100 million of debt will do wonders not just for the balance sheet, but for the income statement, which saw interest expenses up a massive 75% over the past three quarters. Getting rid of that drag will be an enormous boon, obviously. Additionally, in spite of yesterday's spike in price, the valuation remains reasonable. The shares will probably drop in price after yesterday's enormous move higher, but I'm comfortable buying and forgetting for a while here. That strategy has worked out reasonably well so far, and I expect it to continue to do so.

But First, Let Me Get On My Soapbox

To refresh your collective memories in case you don't feel up to the task of going back and reading my prior work, I decided to buy this stock for two reasons. First, I mused that at some point this stock would start to trade on the balance sheet, which I considered to be in relatively better shape than the income statement, in spite of the recent uptick in debt. Second, the valuation was very compelling. I'll drone on about this at length later, but I think there's an overarching lesson to be learned here, beyond the Farmer Brothers story. You cannot predict the future, obviously. What you can do is review the past and understand that companies that have been in the "dog house" can, on occasion, post positive surprises. So the people who argued against my investment thesis here in April by pointing out the well-known problems were missing the point. It's not about what's known today. It's the expectations today versus a potential reality. If the former is too pessimistic relative to the latter, then the stock is a good buy, no matter how much (well publicized) "hair" is on the company. People might be interested in this deal, because we like to focus on the minutiae. Even more important than that is the lesson to be drawn here about expectations versus future reality.

The Deal

If you're reading this, you likely already know about the recently announced deal with TreeHouse Foods, but people like repetition sometimes, so let me go through the salient points for your enjoyment and edification. Farmer Brothers has entered into an agreement with TreeHouse Foods to sell the direct ship business for $100 million. The transaction includes the Northlake, Texas facility. The company is going to use the proceeds to pay down existing debt.

Additionally, the deal will allow the company to focus on the (higher margin) direct store delivery business. After the deal, the company expects to generate about $350 million in sales and expects margins to improve substantially. The market seems to agree that this is a good move, given that the stock was up about 70% yesterday.

Financial Snapshot

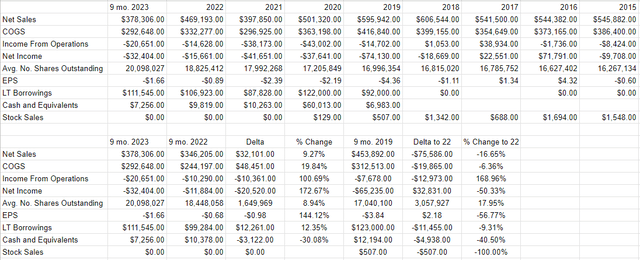

Of the most recent financial results, I'd say that the company did what it could. Revenue for the most recent financial period was up about 9.25% relative to the same period in 2022. Additionally, the company did a reasonably good job of containing those expenses that were containable, namely G&A which was down about $3.9 million, or 11.3%. The problem is that the $32 million uptick in sales was dwarfed by the $48.5 million uptick in COGS over the same time period. This is one of the reasons that net income for the most recent nine months is down by about $20.5 million. Another reason net income is down dramatically relates to the uptick in the interest expense. For the first three quarters of last year, the company spent a total of $7.1 million on interest. This year that figure was about $12.4 million, a 75% uptick. In my view, this is one of the reasons why the market reacted favourably to yesterday's announcement.

Apart from the strategic benefits of higher levels of focus, much of the interest expense will go away if $100 million of the currently outstanding $111.5 million of borrowings is paid down. Ceteris paribus, fully $12 million would flow directly to the bottom line, excluding the elimination of costs associated with the sale of a less profitable part of the business. This transaction would give the company a much more clear path toward consistent profitability in my view.

So, I would suggest that the most recent financial performance doesn't offer much of a clue about the future, as the elimination of so much debt would obviously transform the business in a fundamental way. I'd be very happy to buy more of it if the valuation seems reasonable after yesterday's price spike.

Farmer Brothers Financials (Farmer Brothers investor relations)

The Stock

As I suggested above, I consider the stock and the company to be very different things. The company roasts coffee and sells it, along with tea and other allied products in the United States. The stock is a piece of virtual paper that gets traded around in a market that is often capricious. The stock price moves around at a much faster rate than does the company, and is driven by a host of factors, only some of which relate to the underlying business. For instance, someone may decide that the demand for coffee will wane as the population ages, and that will take the stock down. Some may fret that interest rates will stay elevated for some time, and the company is powerless to do anything to mitigate that problem. Additionally, the stock may be affected by changes in the appetite for "stocks" as an asset class. Either way, I think it's plain that the stock moves around at a faster clip than does the company itself. In my experience, the only way to trade stocks profitably is to spot discrepancies between expectations and reality. If the assumptions embedded in the stock price are too rosy, you avoid or sell. If the assumptions are too dour, you buy. I really hate to remind you about my success here, but this is the approach I took with Farmer Bros. and it seems to have worked out pretty well so far.

Another way of writing "too pessimistic" is "cheap." I like to buy stocks when they're cheap, because they have a great chance of beating expectations (there's that word again). I measure the cheapness of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I look at ratios, and I want to see a company trading at a discount to both the overall market and its own history.

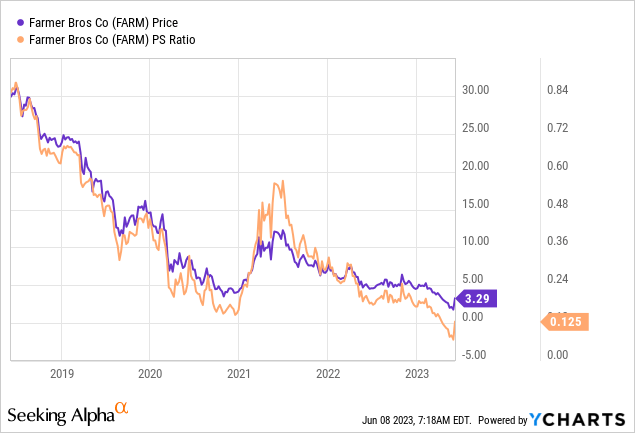

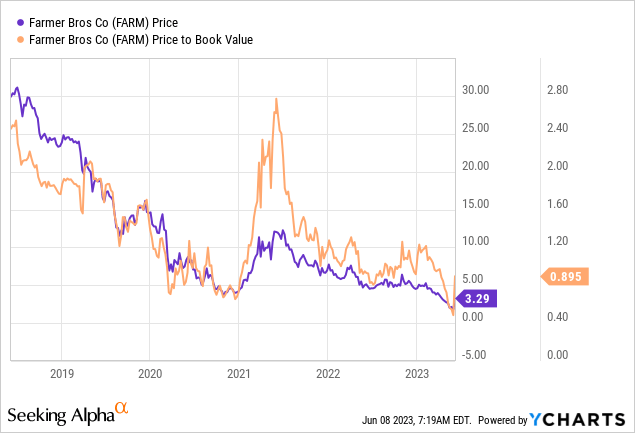

When I last reviewed Farmer Bros. I became intrigued because the market was paying only 11 cents for $1 of sales, which was a record low. Additionally, the price to book ratio was near a record low of about 0.73. Fast-forward to the post price spike and here's the current lay of the land. In spite of the uptick in stock price, the price to sales valuation has barely budged and is now about 0.125. The price to book ratio is up about 22%, but I'm willing to accept that given that the upcoming deal should strengthen the balance sheet considerably. All in all, I think the shares remain reasonably priced in spite of yesterday's jump.

I've been droning on about this for much of this article, so why stop now? I like to trade based on discrepancies between current expectations and price. In order to do this, I use the stock price itself as a source of information. I'm able to do this by relying on the work found in Penman's "Accounting for Value" and Mauboussin and Rappaport's "Expectations Investing." Both of these works assume that you can infer what the market is "thinking" about the future based on the current price. The last time I took a look at Farmer Bros., the market was assuming a growth rate of about 3%, which I considered to be optimistic but not egregiously so. Today, that expectation has come down to about 3.25%, which is still reasonable in my view.

I expect that the shares will take a breather at this point, but because the valuation is still reasonable, and because there's a much clearer path to profitability, I will be buying a few more shares this morning. The shares may continue to languish, but I think the company will be transformed for the better, and I'm willing to wait for more good news. This approach has worked in the past, and I have confidence that it'll work in the future, too.

Readers should bear in mind that FARM is a microcap stock and there are inherent risks with such a small company. Microcaps tend to be more volatile and investors should take this into account before investing.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of FARM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I'll be adding a few thousand shares this morning.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.