PULS: Staying In Cash Has Paid Off

Summary

- The PGIM Ultra Short Bond ETF is a suitable cash parking vehicle due to its short duration, granularity, and investment-grade quality of collateral.

- The fund has outperformed its competition in the past year, with a 30-day SEC yield close to 5%.

- PULS is a headache-free way for retail investors to take advantage of higher rates, as it is a mix of corporate bonds and ABS securities, providing a high level of granularity and diversification.

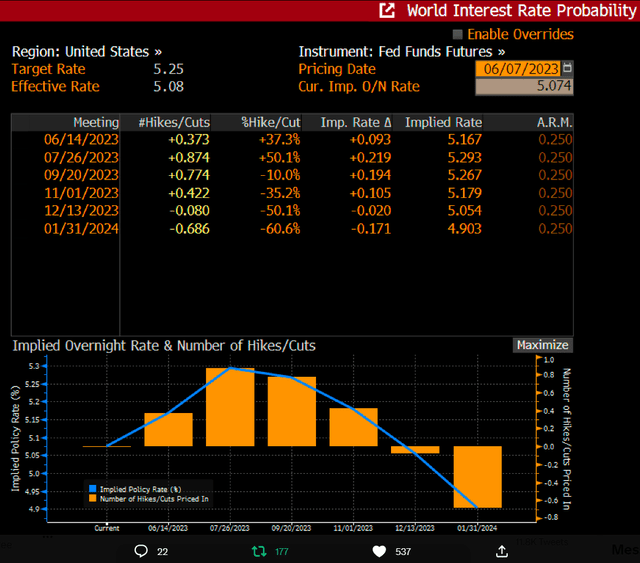

- We anticipate higher rates for longer at the current levels, although the market is now starting to price in a July rate hike as per the WIRP Bloomberg function.

PM Images

Thesis

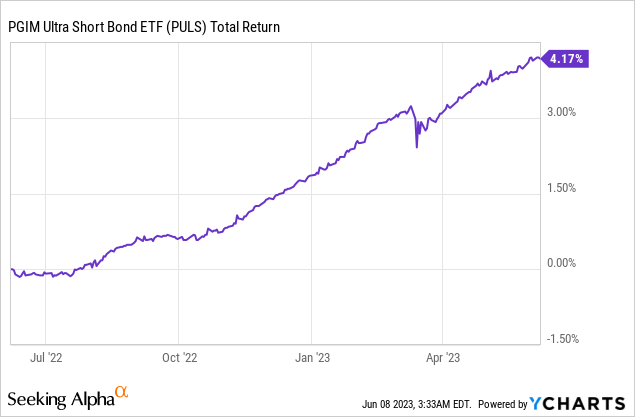

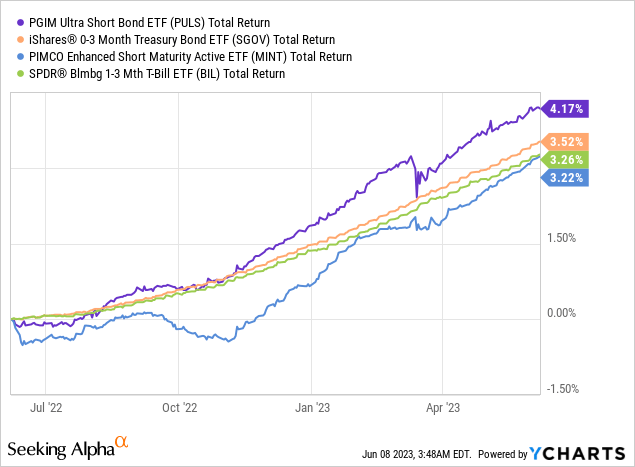

The PGIM Ultra Short Bond ETF (NYSEARCA:PULS) is a short-dated bond fund. The vehicle qualifies as a cash parking vehicle based on its build and duration. The fund holds a mixed portfolio of investment grade fixed income securities, tilted towards the best rated 'AAA' and 'AA' assets. The fund has an extraordinarily tight 0.75% standard deviation and has delivered in the past year:

With yields this high, there are a multitude of vehicles competing now for investor cash, some of which we have covered before:

- The iShares Treasury Floating Rate Bond ETF (TFLO) which we covered here

- The SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BIL) which we covered here

- The iShares® 0-3 Month Treasury Bond ETF (SGOV) which we covered here

A retail investor needs to be very careful with bank CDs, however. With the regional banking crisis still an issue in the background, many institutions are now offering very high yields on their CDs. Always keep in mind that you are insured for $250,000 only, with the rest at risk if the regulators do not end up saving the respective institution.

At the end of the day, as a retail investor, you want to be in an instrument that does not give you headaches. An asset backed fund like PULS is the best choice out there in our mind. Investors, depending on time horizon, can also purchase outright treasuries these days given the high yields. Buying treasuries outright does create a duration profile though, and you might be subject to mark to market fluctuations depending on the chosen tenor.

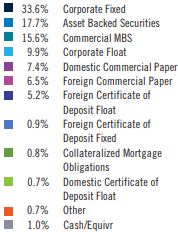

We like this fund because it is a mix of corporate bonds and ABS securities, thus introducing a very high level of granularity and diversification. One of the most important aspects with 'cash parking funds' is the ability of said fund to completely eliminate default risk, while achieving its stated goal of providing a high level of current income. One needs to look at concentration risk and sectoral risk in these instruments, and PULS measures up well in both those aspects.

Analytics

- AUM: $4.7 billion

- Sharpe Ratio: 0.82 (3Y)

- Std. Deviation: 0.75 (3Y)

- Yield: 4.94%

- Premium/Discount to NAV: N/A

- Z-Stat: N/A

- Leverage Ratio: 0%

- Composition: Fixed Income - Short-dated bonds

- Duration: below 0.5 yrs

- Expense Ratio: 0.15%

Holdings

The fund holds a mix of very high quality assets:

Sectors (Fund Fact Sheet)

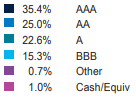

The largest bucket in the fund holdings is represented by corporate bonds, followed by ABS securities and CMBS bonds. All the securitizations will be the senior structures in the respective SPVs, as we can see from the ratings profiles:

Ratings (Fund Fact Sheet)

This fund is tilted towards the highest rated assets, with an overweight positioning in AAA and AA assets. This profile virtually eliminates credit risk from the structure.

Performance

The fund has had an outstanding performance in the past year:

We can see that on a total return basis, PULS has outperformed its competition. There is actually a 1% gap with the worst performing vehicle, namely the PIMCO Enhanced Short Maturity Active ETF (MINT).

Currently, the fund yields close to 5%, and we expect the 30-day SEC yield to settle around these levels absent any surprises from the Fed.

Where are short term rates going and impact on PULS?

This fund ultimately tracks short term rates, and its ultimate distribution level is dependent on what the Fed does next. We think we are in a higher for longer regime. While we do not see another hike in the future, the market is now starting to price one:

Using the WIRP function in Bloomberg, we can see that market participants are now pricing another 25 bps of hikes by the end of July. WIRP, or World Interest Rate Probabilities, is a function on Bloomberg terminals that calculates the implied probability of a rate hike at the next Fed meeting. It does this by using data from Fed Funds futures contracts. Fed funds futures are a type of financial derivative that is based on the federal funds rate, and are traded on the Chicago Mercantile Exchange.

This translates into higher yields for PULS for longer. Given the fund's very low duration, even another rate increase will probably not affect its total return profile. It will actually boost it long term. Conversely, if an investor purchases a longer dated treasury bond outright, the curve might move higher on the back of a rate hike, thus creating temporary mark to market losses.

Conclusion

PULS is a short-dated bond fund. The vehicle qualifies as a cash parking tool given its very short duration, granularity and investment grade quality of the collateral. The fund has outperformed (SGOV), (MINT) and (BIL) in the past year on a total return basis, and should continue to deliver. As of now the fund exhibits a 30-day SEC yield close to 5% (as per Morningstar) which will follow short term rates. We feel we are in a higher for longer rates regime, but we do not anticipate any further rate hikes. The market on the other hand is now starting to price in another 25 bps hike by the end of July, as implied by Fed Funds futures. PULS is a great tool which has done well, and represents a headache free method to take advantage of higher rates.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PULS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.