Occidental Petroleum: Berkshire Buys More At A Higher P/E (Rating Downgrade)

Summary

- This is an update to an earlier article I published in Oct 2022 on Occidental Petroleum.

- In that article, I argued for a bullish thesis and suggested a backdoor to buy Occidental through Berkshire at large discounts.

- This update is triggered by two changes. First, the outlook of Occidental has changed and caused its valuation to increase dramatically.

- Second, the valuation of Berkshire has also expanded substantially since then. As such, the advantage of owning it through Berkshire has diminished.

- These factors combined led me to downgrade the stock from buy to hold.

- Looking for a portfolio of ideas like this one? Members of Envision Early Retirement get exclusive access to our subscriber-only portfolios. Learn More »

SCI_InDy

Thesis

This is an update to an earlier article I published in Oct 2022 on Occidental Petroleum (NYSE:OXY). In that article, I rated the stock as a BUY based on several factors:

- Its debt reduction has led to more flexibility in capital allocation (for example, to invest in growth CAPEX).

- There is a strong forecast for earnings and cash flow.

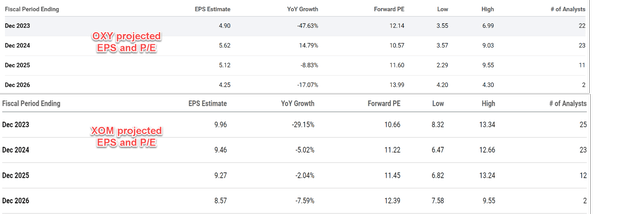

- And very attractive valuation (about 7x FW P/E at that time, see the next chart below).

- And finally, OXY investors could benefit from a potential arbitrage opportunity if BRK decides to pursue an acquisition of the entire business.

Furthermore, I then went a step further and suggested a backdoor to buy OXY shares through Berkshire Hathaway (BRK.B).

This update is triggered by two key changes since then. First, OXY's outlook has changed substantially and now its FW P/E has increased to 12.4x as seen. Second, the valuation of BRK has also expanded (from about 18x back then to the current 20.5x). And the combined result of these changes is that the potential return of owning OXY, either directly or indirectly through BRK, has diminished. Due to these changes, this article downgrades my rating from BUY to HOLD. And in the rest of the article, I will elaborate on these changes.

BRK kept adding OXY - at increasing multiples though

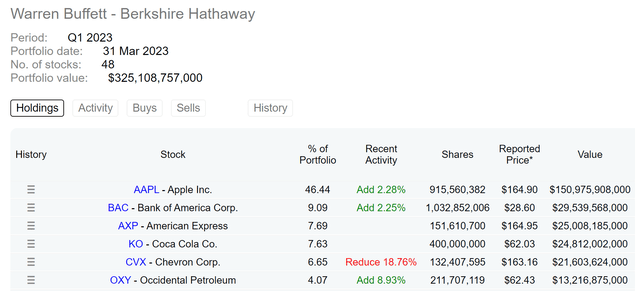

At the time of my original article, BRK already owned a good chunk of OXY shares. To wit, BRK owned 158.5 M shares at that time (or more than 20% of the total outstanding shares), making OXY the 7th largest position in its portfolio.

Since then, BRK has kept adding OXY, although at less attractive valuation multiples as seen from the chart above. Berkshire Hathaway's March disclosure (see the chart below) showed a sizable increase of 8.93%, making OXY the 6th largest position in its equity portfolio. A more recent disclosure showed that BRK purchase an additional 3.46M OXY shares during May 16-18, 2023. All told, BRK holds 217.3M OXY shares, translating into about 24.4% of all OXY outstanding shares.

Despite the increased stake, Buffett commented that he has no intention to acquire OXY. At the time of my original writing, it was deemed a likely scenario that BRK would take over the entire business and OXY investors could benefit from a potential arbitrage opportunity. Buffett's comments have essentially ruled out such arbitrage opportunities in my mind.

And next, I will explain there is not too much to arbitrage anyway with the changed outlook and expanded P/E ratios.

OXY: not that attractive anymore

With the above changes, the potential return of owning OXY has diminished either via direct ownership or indirect ownership through BRK.

First, if you want to own OXY shares directly, I see better alternatives such as Exxon Mobil or Chevron (CVX). With its updated outlook, OXY is now priced at 12.1x FY1 P/E. As seen, it is higher than XOM's 10.6x FY1 P/E. Looking further out, OXY is priced at a similar or slightly higher P/E multiple than XOM, which is difficult to justify in my view given XOM's larger scale, more integrated business, and also a stronger balance sheet.

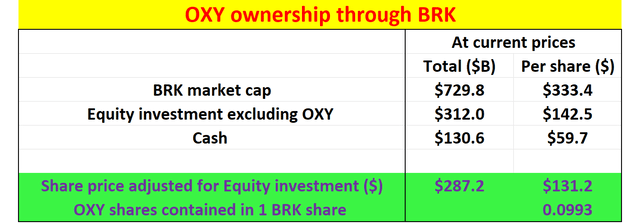

Buying OXY indirectly through BRK is no longer attractive either due to the expanded valuation of both stocks. The table below shows my analysis of the indirect ownership cost through BRK. This analysis is performed based on the following assumption:

A) BRK's market cap and stock prices as of this writing (based on B-equivalent shares). BRK's current market cap stands at $729 B (or $333 per share).

B) Out of the $729B market cap, $312B is in its equity portfolio excluding OXY (based on the first chart taken from dataroma.com).

C) A cash position of $130.6 billion according to SA's most recent data.

So if we want to only own OXY shares via BRK, we could hypothetically buy BRK shares and then immediately liquidate the cash position and all other stock holdings except OXY. This way, we would have effectively purchased all the OXY shares plus BRK's operating segments for a total amount of $287.2B (A-B-C), or $131.2 per share.

Source: Author based on Seeking Alpha data.

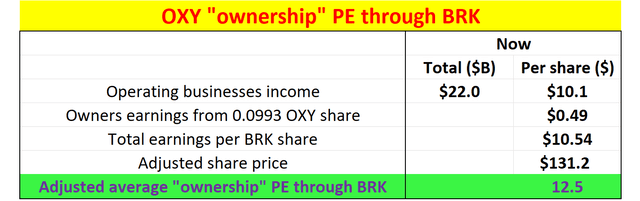

Now, let's examine the "ownership" valuations for OXY in this case. We will essentially own A) all the operating income of BRK and B) a fraction of the earnings of OXY via the shares owned by BRK. My analyses for both parts are shown in the table below. In this table, I assumed $21.9 billion of operating earnings for BRK's various operating units, translating into about $10.1 per share. And via each BRK share, we also own 0.0993 OXY shares. OXY's forecast EPS is $4.9. Therefore, the OXY shares would contribute additional earnings of $0.49 to each BRK share. Hence, the total earnings we've purchased their way per BRK share would be $10.54.

Thus, the bottom line is that, at the adjusted share price of $131.2 (adjusted for cash and other stock holdings), the ownership P/E of OXY would be 12.5x. This is not that different from (actually a bit higher than) the 12.1x FY1 P/E mentioned above via direct ownership. To provide a contrast, when I published my original thesis, the "ownership" P/E was only 8.5x due to the lower valuation multiples of both BRK and OXY at that time.

Source: Author based on Seeking Alpha data.

Risks and final thoughts

OXY's earnings are sensitive to commodity prices, which pose both upside and downside risks. For example, its earnings during Q1 this year dialed in at $1.09, about ½ of last year's EPS of $2.12 due mainly to oil and gas prices. Besides such sensitivities, I also want to point out a few risks specific to the method I used in my above "ownership" P/E analysis:

- There is uncertainty in BRK's equity portfolio. The value of BRK's equity portfolio fluctuates with the overall market. And given the size of the portfolio, the fluctuations could lead to uncertainties.

- Part of BRK's cash position is its insurance float, which cannot be entirely liquidated. This will also affect the valuation analysis depending on which portion you consider as "cash" and which portion as "float".

To conclude, the purpose of this update article is to downgrade an earlier rating on OXY from BUY to HOLD. The downgrade is triggered by two new developments: changes in OXY's outlook and the expanded valuation of BRK shares. The combination of these changes has diminished the return potential of OXY, either purchased directly or indirectly through BRK.

Join Envision Early Retirement to navigate such a turbulent market.

- Receive our best ideas, actionable and unambiguous, across multiple assets.

- Access our real-money portfolios, trade alerts, and transparent performance reporting.

- Use our proprietary allocation strategies to isolate and control risks.

We have helped our members beat S&P 500 with LOWER drawdowns despite the extreme volatilities in both the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too. You do not need to pay for the costly lessons from the market itself.

This article was written by

** Disclosure** I am associated with Envision Research

I am an economist by training, with a focus on financial economics. After I completed my PhD, I have been professionally working as a quantitative modeler, with a focus on the mortgage market, commercial market, and the banking industry for more than a decade. And at the same time, I have been managing several investment accounts for my family for the past 15 years, going through two market crashes and an incredible long bull market in between.

My writing interests are mostly asset allocation and ETFs, particularly those related to the overall market, bonds, banking and financial sectors, and housing markets. I have been a long time SA reader, and am excited to become a more active participator in this wonderful community!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of OXY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.