Enbridge: Safety And Yield Combination

Summary

- There is a fear that rates will be cut to the bone in the next recession.

- That has led to some big pricing discrepancies within the preferred shares kingdom.

- Enbridge's 5 year reset preferred shares look particularly attractive today.

- Looking for option income ideas that focus on capital preservation? I offer this and much more at my exclusive investing ideas service, Conservative Income Portfolio. Learn More »

JHVEPhoto

One of the fascinating aspects of the preferred share market is that it gives you insight into investor outlook about interest rates. Different companies obviously have preferred shares priced at various points on the credit spread. That is hardly new information. We are talking about the pricing of fixed and resetting preferred shares from the same company. There, there is no credit spread or differential company specific risk. We are just bathing in the interest rate waters. Today we go over one of our favorite holdings, the preferred shares of Enbridge Inc. (NYSE:ENB). We look at the fixed rate and resetting ones and tell you why you are getting paid to take some interest rate risk.

Q1-2023 Results

Enbridge delivered yet another predictable and solid quarter and exceeded analyst expectations for adjusted funds from operations. The company got some help from a weaker Canadian dollar relative to the US and volumes came in above expectations. If there was some weakness here, it was in the renewable energy segment where pricing was a bit lower than expected. Overall numbers were good and ENB continues growing its AFFO while keeping debt levels very well controlled. One additional positive was the Mainline Settlement which was announced in early May. This removes a layer of uncertainty around Enbridge.

Enbridge Inc. says it has reached a deal with shippers for tolling on its Mainline pipeline system, which moves over three million barrels a day of crude oil and liquids from Western Canada.

The announcement Thursday is a major milestone for the Calgary-based pipeline company, which has been negotiating with oil shippers on a new tolling agreement ever since its proposal to fill Canada's largest oil pipeline network through long-term contracts was rejected by the Canada Energy Regulator in November 2021.

Source: CBC

The Fixed Rate Preferred Shares

While the common shares have their own appeal and we certainly don't want to dissuade anyone from investigating that option, we think Enbridge's preferred shares offer a lot of for the conservative investor. We start off here with a fixed rate Canadian dollar preferred offering that sets a baseline of what yield one can get with no additional interest rate risk.

Enbridge Inc. PFD SER A 5.50 (TSX:TSX:ENB.PRA:CA)

ENB.PRA:CA is a fixed rate, preferred share from Enbridge with a 5.5% coupon on par. At $21.70 CAD, the stock is near the bottom of its 3 decade long trading range.

TMX

The yield is a bit less for our tastes here and the stripped number of 6.37% does not offer enough juice. This one might make sense for the hard-core deflation outlook and if you think we are going back to ZIRP (zero interest rate policy) soon. As we have mentioned previously, ENB.PRA is expensive on a relative basis to what we consider as superior preferred shares. Brookfield Renewable Partners L.P. 5.50% PFD (TSX:BEP.PRR:CA) is one that comes to mind as a comparative. BEP.PRR:CA is also a fixed rate, perpetual, non-resetting offering. This one comes from Brookfield Renewable Partners L.P. (BEP) (BEPC). Both have identical BBB- ratings and BEP.PRR:CA currently yields 7.42%, a whole percentage point higher than ENB.PRA. If you wanted a fixed rate preferred share in the Canadian market, you would definitely want to investigate that one.

The Resetting Rate Preferred Shares-Canadian Dollar Edition

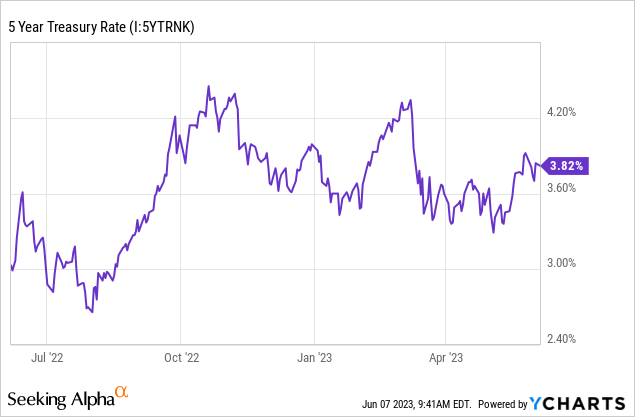

Enbridge has a legion of resetting preferred shares (unlike the lonely fixed rate one) and the nearest one coming for a reset is Enbridge Inc. PREF SHS SR H (TSX:ENB.PRH:CA). These shares will have their dividend rate reset as of September 1, 2023 and the announcement on the actual rate used will be in August. The reset calculation will be at Government of Canada (GOC) 5 year yield plus 2.12%. Based on the current GOC-5 yield of 3.52% we are looking at a 5.64% yield on par. That works to about 8.60% on the current price of $16.40 CAD.

So right there is a fascinating piece of information. Investors fear a lot of interest rate cuts down the line. They are indifferent to locking in 8.6% for 5 years versus 6.37% forever. For ENB.PRH to average a 6.37% yield over the long run (even ignoring the first 5 year advantage), GOC-5 would have to average 2.058%. Can it happen? Of course. But that is a huge handicap/hurdle for the fixed rate shares.

One related fact about how much investors hate interest rate uncertainty can be seen in the pricing of the neighboring Enbridge Inc. PREF SHS SR F (ENB.PRF:CA). These were reset from June 1, 2023 at a yield on par of 5.538%.

At the current price, the yield works to 7.76%. So we are ready to take 7.76% fixed for 5 years versus gamble on what would likely be an 8.6% lock in 60 days.

The Resetting Rate Preferred Shares-US Dollar Edition

Enbridge Inc. CUM RED PF S L (TSX:ENB.PFU:CA) is one of the rare US Dollar denominated preferred share offering from the company. These were reset recently.

Enbridge Inc. announced today that it does not intend to exercise its right to redeem its currently outstanding Cumulative Redeemable Preference Shares, Series L (Series L Shares) on September 1, 2022.

The new annual dividend rate applicable to the Series L Shares for the five-year period commencing on September 1, 2022 to, but excluding, September 1, 2027 will be 5.85790 percent, being equal to the five-year United States Government treasury bond yield of 2.70790 percent determined as of today plus 3.15 percent in accordance with the terms of the Series L Shares.

Source: Enbridge

The dividend rate is fixed for the next five years at 5.85790% on par value of $25.00. That works to 7.57% on the current price. This one also comes with a low hurdle rate for the dividend to be at this rate or higher in the future. Note that the 5 Year Treasury yield at the time of the reset was 2.70790%. We are over 110 basis points higher.

Taxation

The dividends qualify for the dividend tax credit in Canada and generally investors will prefer having these in regular (non-RRSP or TFSA) accounts. For US Citizens, the dividend is treated as a qualified dividend, but there will be 15% tax withheld for which you receive a tax credit. That tax withholding can be avoided by using tax deferred accounts.

Verdict

Enbridge reset preferreds offer a solid yield with extraordinary spreads relative to their history. We see these low risk quality income plays. The fixed rate ENB.PRA:CA preferred shares are quite expensive relatively and reflect the high levels of interest rate uncertainty.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Are you looking for Real Yields which reduce portfolio volatility? Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Give us a try and as a bonus check out our Fixed Income Portfolios.

Explore our method & why options may be right for your retirement goals.

This article was written by

Conservative Income Portfolio is designed for investors who want reliable income with the lowest volatility.

High Valuations have distorted the investing landscape and investors are poised for exceptionally low forward returns. Using cash secured puts and covered calls to harvest income off value income stocks is the best way forward. We "lock-in" high yields when volatility is high and capture multiple years of dividends in advance to reach the goal of producing 7-9% yields with the lowest volatility.

Preferred Stock Trader is Comanager of Conservative Income Portfolio and shares research and resources with author. He manages our fixed income side looking for opportunistic investments with 12% plus potential returns.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

We are long several ENB and BEP preferred shares listed on the TSX.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.