A New Playbook For Portfolio Diversification

Summary

- Bonds have bounced back as a source of income, but the degree of ballast and stability that they’re able to provide in portfolios remains in question.

- Continued inflation uncertainty may require a new playbook for portfolio diversification than what was needed in recent decades.

- Alternative diversifiers like the BlackRock Systematic Multi-Strategy Fund can complement traditional bonds by providing an added source of diversification and return in portfolios.

tadamichi

Transitioning into the post-COVID investment environment shifts the foundations of portfolio construction that investors relied on in recent decades. On full display in 2022, inflation and recession risk punished both bonds and stocks together to historic declines. Now, market dynamics appear to have shifted in favor of traditional asset classes. The idea that 'bonds are back' to their long-held role in portfolios has become the dominant market view for most investors.

Bonds have certainly bounced back in their ability to generate income, but if uncertainty in the inflation outlook persists, the degree of ballast and stability that they can provide remains in question. The idea that 'bonds are back' misses important nuances to the current economic and policy backdrop that may require a new playbook for portfolio diversification.

Bonds are back(?)

Low volatility, reliable ballast, and high income - these were hallmarks of the "old" fixed income that made bonds a trusted source of diversification and return in portfolios. The 'bonds are back' narrative, however, should recognize that to truly be "back," all three of these characteristics need to return. Yet, only one has: income. Yes, there is now an alternative and investors can finally access attractive yield in fixed income. But the idea of fixed income being the "insurance that pays for itself" with consistent yield AND reliable ballast has yet to be fully restored.

The low volatility of bonds - typically around 3-4% annually - is part of what has historically made them effective risk reducers in portfolios.1 But since mid-2022, the volatility of bond returns has more than doubled historic averages. That reflects the high level of uncertainty surrounding the path of inflation, monetary policy, and the outlook for bonds.

This uncertainty is also reflected in the degree of ballast that bonds have been able to provide in 2023. Bond ballast returned briefly during the March bank panic and again in April/May associated with debt ceiling concerns. Over a trailing quarterly basis, the stock-bond correlation is roughly zero, falling from the significantly positive readings in 2022 - underscoring the on-again, off-again ability of bonds to provide diversification against equity risk.2 So, can bonds return to their role as low volatility, reliable source of ballast? They may, but only if inflation uncertainty goes away with inflation returning to its pre-COVID steady 2%-type levels.

Under one condition: disinflation

Inflation remains the most important piece of the outlook for bonds and the degree of ballast that they can provide in the event of a recession. In the decades leading up to COVID-19, we lived in a world where inflation was too low. This created a unique environment for monetary policy - Olivier Blanchard and Jordi Gali's "Divine Coincidence" where policymakers faced no tradeoff between stabilizing inflation and stabilizing output. For investors, interest rate cuts in response to an output decline would cause bond prices to move higher, helping to offset equity losses in portfolios. As a result, the persistently below-target inflation supported a reliably negative correlation between stocks and bonds (Figure 1).

Figure 1: Inflation impacts the degree of ballast that bonds can provide

Stock-bond correlation (S&P 500 Index to 10-yr Treasury) and Annual PCE over 2% target

Source: Stock Bond Correlation via BlackRock Investment Institute, as of 3/31/2023, Personal Consumption Expenditures ("PCE") via Federal Reserve Economic Data, Federal Reserve Bank of St. Louis, as of 2/28/2023. Stock/ bond correlation reflects trailing one-year correlation (252 business days, one calendar year).

When inflation is too high like it is today, in place of "divine coincidence" there is now a tradeoff for policy between the inflation and output goals. Restoring price stability constraints how accommodative central banks can be in response to a recession. If we reflect on the 1970s and 1980s - the previous period of high inflation - the US Federal Reserve ("Fed") made the error of cutting interest rates in response to economic pain before inflation was fully conquered. Today, policymakers continue to reiterate their intention to avoid making the same mistake. This makes them much more likely to embrace a recession than to cut interest rates in the presence of persistent inflation - or at a minimum means that they can cut rates much less in the face of a recession. And that means both a lower amount and less reliable degree of negative stock/bond correlation.

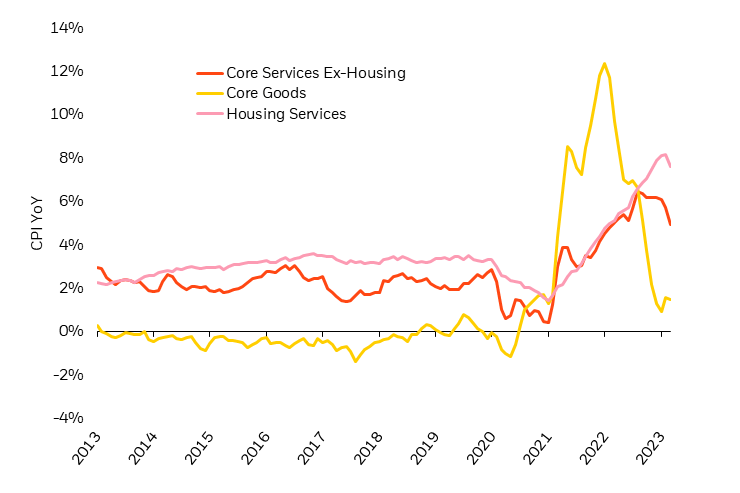

However, there's an evolving disconnect between the Fed's new operating model and what the market expects. The bond market wants to believe in the old operating model that once the Fed sees economic pain, they will quickly shift to cutting rates (and as soon as this year). The consensus view that inflation will rapidly fall to the 2% target supports this ability. The problem is that we (the Fed, the market, and professional economists) haven't been particularly good at forecasting inflation. Inflation has peaked and appears to be moderating, but will it return to the Fed's target as quickly as markets expect? This is less clear. Figure 2 illustrates that services inflation remains sticky and isn't normalizing at a pace that's consistent with market expectations. At the same time, the disinflationary impulse of the goods sector appears to be fading as price pressures have started to rebound.

Figure 2: Bond markets may be overly optimistic on the speed of inflation normalizing

Consumer Price Index ("CPI") separated into core services ex-housing, housing, and core goods inflation

Bloomberg, as of April 2023.

Core Services Ex-Housing represented by US Bloomberg BLS CPI Core Services Less Housing Index. Core Goods represented by US CPI Urban Consumers Commodities Less Food & Energy Index. Housing Services represented by US CPI Urban Consumers Shelter Index.

Higher yields, declining inflation, and the Fed's likely pause have made bonds more attractive in 2023. But the level of optimism priced into markets - implying a full pivot to rate cuts - poses risks to the outlook for bonds if those expectations are not realized. As long as inflation remains too high and uncertain, rate cuts are unlikely to occur. As a result, investors may want to consider additional ways to build portfolio resilience.

Diversification and returns with yield + defensive alpha3

Diversification is the most effective tool for navigating uncertainty and the difficult task of predicting inflation. Alternative diversifiers like the BlackRock Systematic Multi-Strategy Fund ("SMS") can complement traditional bonds by providing an added source of ballast that's less dependent on the inflation trajectory.

SMS combines fixed-income exposure with high-quality, defensive alpha. Because SMS invests in a diversified portfolio of fixed-income securities, the strategy benefits from higher yields just as much as traditional bonds do. The defensive alpha portion of the portfolio seeks to deliver an uncorrelated, consistent return stream that provides an alternative source of diversification.

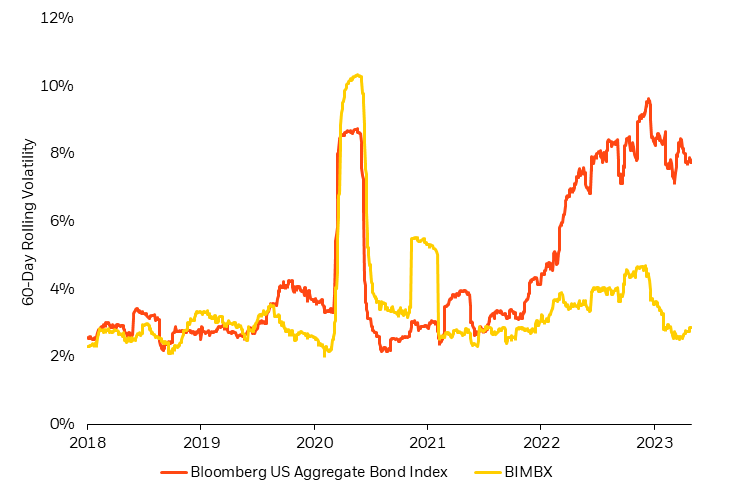

We discussed how inflation uncertainty is showing up in markets through increased interest rate volatility. So while bonds may be back (for the yield), that comes with substantially higher risk today than in recent decades. Figure 3 shows that throughout 2023, the volatility of SMS has remained in line with (and even below) the 3-4% level of volatility that bonds have historically provided. This is because SMS is able to take on less duration risk and instead rely on consistent, defensive alpha as a source of ballast. In the context of portfolio construction, this makes SMS complementary to traditional fixed-income exposures as investors look to diversify their diversifiers and build greater portfolio resiliency.

Figure 3: SMS has remained much less volatile than bonds over the last year

60-day rolling volatility of Bloomberg US Aggregate Bond Index vs. the Systematic Multi-Strategy Fund (BIMBX)

BlackRock, with data from Bloomberg, as of May 2023.

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. Standardized fund performance can be found here.

Conclusion

Yield is back, but the hallmark fixed-income traits of low volatility and ballast may be less reliable than in the past. As inflation uncertainty limits the degree of ballast that bonds can provide, investors may need a new playbook for portfolio diversification that includes bonds AND alternatives. This can be achieved by complementing traditional asset classes like stocks and bonds with alternative strategies like SMS. SMS offers access to fixed income and high-quality, defensive alpha - providing the added source of diversification that's needed in portfolios today.

1Bond volatility measured as the 60-day rolling volatility of the Bloomberg US Aggregate Bond Index.

2Trailing quarterly stock-bond correlation as of May 31, 2023.

3Alpha refers to the excess returns earned on an investment.

This post originally appeared on the iShares Market Insights.

This article was written by