Hello Group: Plenty More Upside On The Cards Post Q1 Earnings

Summary

- Hello Group Inc. stock is expected to rise due to its improving fundamentals, strong cash position, and low valuation.

- The company's Tantan app reported positive profitability for the first time in Q1, and management aims to increase ARPU while reducing acquisition costs.

- MOMO generated $1.18 in free cash flow per share over the past four quarters, resulting in a trailing free-cash-flow multiple of 7.92, indicating strong potential for growth.

hxyume/E+ via Getty Images

Intro

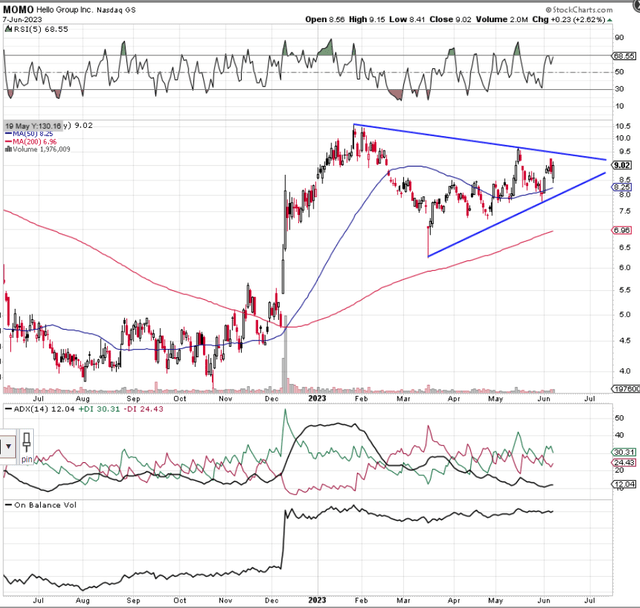

We wrote about Hello Group Inc. (NASDAQ:MOMO) back in December of last year post the announcement of the company's convincing third-quarter earnings beat, when we witnessed both margin & live-streaming growth in the quarter. This resulted in us initiating a fresh "Buy" rating on the stock, as we believed Momo's fundamentals were finally changing for the better. As we can see from Momo's technical chart below, shares rallied hard on that Q3 report in that shares have returned just under 8% over the past 6 months or so. In fact, if we were to include the bumper $0.72 annual dividend which was paid to shareholders of record last month (May 2023), the return would actually be above 16% which is well over 30% if we indeed annualize the payment.

The thing is though that we still maintain this stock is going much higher for a number of reasons. First, as we see below, we seem to have a coil playing itself out (symmetrical triangle) which more often than not plays itself out as a continuation pattern (bullish). The great thing about these patterns is that due to the converging nature of both trendlines, the market sooner rather than later will have to make a firm decision on the near-term direction of this stock. Furthermore, Momo's 200-day moving average continues to move northward having lost none of its momentum since it turned up post the above-mentioned Q3 earnings beat in December of last year.

Momo Symmetrical Triangle (Stockcharts.com)

Hello Group recently announced their Q1 earnings numbers, where the company once more announced an earnings beat (GAAP earnings of $0.28 per share) on higher-than-expected revenues ($395.95 million) also. Monthly active users on both the Momo app as well as the Tantan app grew sequentially, which is key. Investors should not be looking at rolling 12-month quarterly comparisons due to the ramifications of the Pandemic but instead focus on sequential quarterly trends which continue to be encouraging.

Tantan Potential

Standalone apps continue their upward trajectory, which means volatility with respect to sales from the mature Momo app can continue to be compensated somewhat. Tantan reported positive profitability (Operating income) for the first time at the book level in its history in Q1. This bodes well for the remainder of the year, where the goal is to break even in this segment for fiscal 2023. The sustained turnaround of Tantan continues to improve the income statement, as we see with the company's margins overall. Hello Group's operating margin came in at 15.48% in Q1, which again shows how the company is becoming more profitable despite its sales growth curve in recent times. (Trailing operating profit margin average of 13.83%.)

Management is focused on increasing ARPU in Tantan whilst also taking acquisition costs out of the segment on the front end. So, management believes the double tailwind of user growth & APRU growth (which definitely has not been exploited yet) will drive the top line forward towards the end of the year.

Hello Group's Strong Cash Position

However, making things happen, whether this be new initiatives to drive user numbers higher or significantly increasing marketing costs to drive market share, here we see the Hello Group is not found wanting from a financial standpoint. Take the dividend, for example, which cost close to $136 million last month. This sizable payout only made up 8.6% of the company's Cash & St balance ($1.58 billion).

Then, from a valuation standpoint, Hello Group generated $1.18 in free cash flow per share over the past four quarters. If we divide Hello Groups' present share price of approximately $9.35 per share by free cash flow per share of $1.18, we get a trailing free cash-flow multiple of 7.92. Free cash flow is the most important metric in investing (As it fuels sustained growth), so buying it as cheaply as possible is always a priority. This ratio informs us of how much it costs Hello Group to generate $1 of free cash flow. Suffice it to say, 7.92 is a steal, as it clearly demonstrates the firepower management has at its disposal to keep moving forward aggressively with its spending initiatives.

Conclusion

Therefore, to sum up, we are maintaining our "Buy" rating in Hello Group, as profitability is now beginning to gain traction as we see with the company's rising margins in Q1. Furthermore, Hello Group Inc. is cash-rich, and shares continue to trade with an ultra-low valuation. Let's see how Q2 fares out. We look forward to continued coverage.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MOMO over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.