Gatos Silver's Bi-Quarterly Earnings Reviewed

Summary

- Gatos Silver, Inc.'s latest financial results are stunning, conveying solid core operations, stemming from high throughputs.

- Credible sources suggest Silver is set to receive long-term support. However, the futures market implies that a short-term price retracement is possible.

- Gatos' exploration ventures and tailings endeavors are exciting prospects.

- Despite the stock's tailwinds, a 30% year-over-year surge places Gatos in overvalued territory. Thus, we urge our readers to invest with caution.

- Looking for a portfolio of ideas like this one? Members of The Factor Investing Hub get exclusive access to our subscriber-only portfolios. Learn More »

bagi1998

In an agglomerative event, Gatos Silver, Inc. (NYSE:GATO) released its Q4 and Q1 earnings results on Wednesday morning. The company realized substantial progress during most of its last two operating quarters, as its results excelled given the current metals price environment.

Gatos Silver's latest financial results are certainly worth cheering about. However, the question beckons: What is in store for Gatos Silver for the rest of 2023?

Let's delve into a deeper discussion to find out.

Quarterly Earnings Debunked

Headline

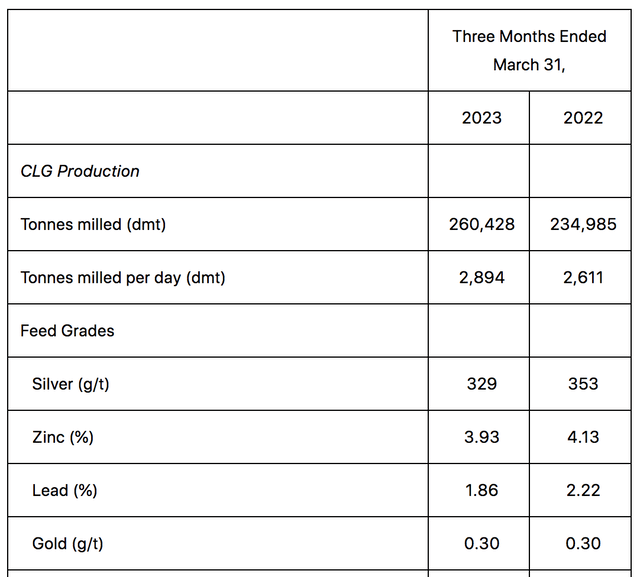

Starting with Gatos Silver's Q4 2022 results, the company reported cash from operations of $39.1 million, adding up to a 12% increase. Fundamentally, Gatos Silver's improved results stemmed from it achieving 36%, 22%, and 10% higher silver, zinc, and lead output. Therefore, it is encouraging to see that Gatos' core earnings are up and that it did not merely benefit from commodity inflation.

Although Gatos' Q4 results were mentioned, discussing the firm's Q1 2023 results is the foundation of this article. During Q1, Gatos Silver reported $44.5 million in cash from operations, 6% higher than the previous year. Furthermore, Gatos achieved 2% higher silver and zinc production in Q1 (quarter-over-quarter); however, lead receded by 8%.

A Deeper Dive

During the company's first quarter, it experienced lower overall feed grades; however, record throughput was achieved. In the quarters ahead, it is anticipated that Gatos will realize its production guidance to eclipse its full-year target. However, we urge readers to remain coy about the fact that materials prices are volatile and that positive production will not necessarily lead to higher revenues. Nevertheless, there is no indication that Gatos has any structural concerns.

Furthermore, the company trimmed its exploration spending in Q1 to $1.6 million. Many might see this as a slow-down in expansion; however, the reason for the decline is due to accounting reasons more than operating reasons. For instance, the firm capitalized expenses relating to its South-East Deeps zone.

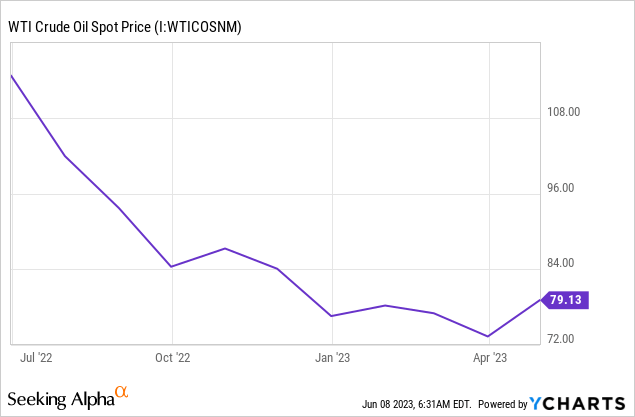

Regarding all-in-sustaining costs, Gatos could see an inflection point arise in the coming quarters. The firm's production costs rose by 4% in the previous quarter, primarily due to sector-wide inflation and volatility in the FX markets. In our view, the prior is transient while the latter is non-core; therefore, input costs might taper significantly toward the back end of the year, given lower broad-based salary pressures and softer fuel prices.

Lastly, a final noteworthy feature of Gatos Silver's Q4/Q1 is the completion of its third dam raise tailing facility. Tailings is a high-margin business and adds additional cost synergies to the firm. Moreover, the completion allows for additional capitalization of expenses.

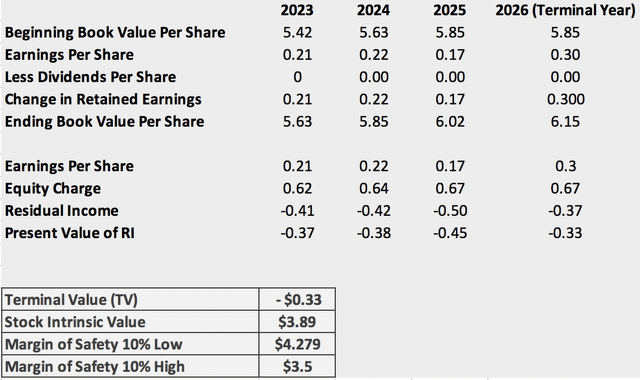

Residual Income Valuation

A residual income model was selected to value the stock seeing as it does not pay a dividend, and given that investors usually emphasize book value when assessing a resource stock's prospects.

Model Output

The input variables and relevant sources are explained later in the article. However, a preliminary assessment of the stock's intrinsic value suggests that it is currently overvalued in the marketplace. Even when factoring in a 10% margin of safety, Gatos' fair value sits below the $4.5 handle, which is where its stock currently trades at.

Model Inputs

The following inputs were used to complete the multistage residual income model.

- A baseline book value per share was determined by dividing the company's current stock price by its price-to-book ratio.

- Seeking Alpha's databank provided the necessary earnings-per-share forecasts.

- The equity charged is based on the stock's CAPM, which was calculated as follows: risk-free rate + (market risk premium) x Beta = 3.44% + (3.32%) x 2.4 = 11.408%.

U.S. Market Risk Premiums (marketriskpremia.com)

- Important side note: The residual income model provides no guarantees; it is merely an indicator. For more information on how the input variables were used to determine a fair value, visit the link provided earlier in this subsection.

Prices Discussed

Gatos Silver's core operations are intact. However, smaller scale silver producers are susceptible to non-core factors such as commodity prices. Thus, an outlook on prices is paramount when determining the stock's prospects.

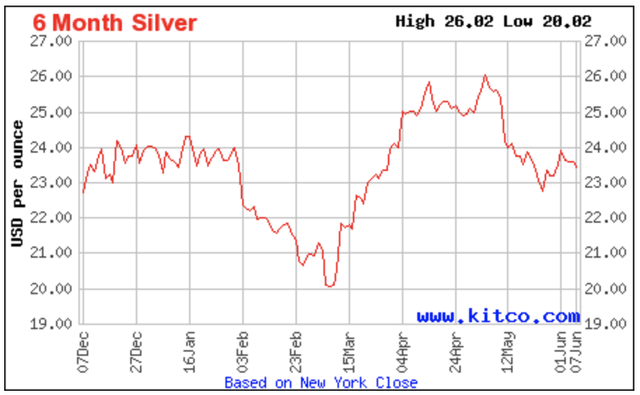

Silver Futures, June 23 (Investing.com)

By juxtaposing the year-to-date performance and futures of silver, it can be argued that the commodity has overshot amid a broad-based precious metals surge during a rising interest rate environment in the United States.

Although futures contracts imply that an overshoot toward the downside is likely in the succeeding quarters, a longer-term vantage point conveys that silver prices will receive plentiful support in the coming years due to both supply and demand-side factors. For instance, sources such as mining.com, the Silver Institute, and BullionVault state that Silver's demand as an industrial metal and renewable source (for solar panels) will by far outpace the rate of production increases, subsequently adding significant tailwinds to the commodity.

In essence, Gatos Silver's primary revenue channel might receive significant support in the coming years amid price tailwinds. Therefore, the company could surpass previous years' results merely due to non-core events.

Final Word

Based on various input variables, Gatos Silver's stock is juxtaposed for the time being. The company's latest financial results are robust, providing substance to a bullish scenario. Moreover, factors such as silver price support and exploration endeavors also provide noteworthy tailwinds. However, Gatos Silver, Inc. stock has surged by more than 30% year-over-year and is deemed overvalued by our residual income mode; as such, the stock's current price provides a poor entry point.

Given our analysis, we have decided to assign a Hold Rating to Gatos Silver, Inc. stock.

Looking for structured portfolio ideas? Members of The Factor Investing Hub receive access to advanced asset pricing models. Learn More >>>

This article was written by

Quantitative Fund & Research Firm with a Qualitative Overlay.

Coverage: Global Equities, Fixed Income, ETFs, and REITs.

Methods: Factor Analysis, Fundamental, Valuation, Street Gossip, and Common Sense.

Our work on Seeking Alpha consists of independent research and not financial advice.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.